Kontur.Accounting - 14 days free!

Personnel records and employee reports, salaries, benefits, travel allowances and deductions in a convenient accounting web service

Try it

The expenses that employers bear when paying their employees the benefits provided for by Russian legislation are covered from the Social Insurance Fund. To reimburse costs, organizations submit an interim report to the Fund to the Social Insurance Fund. We will consider below the principles of filling out and the procedure for submitting this report.

Certificate of calculation in the Social Insurance Fund: sample 2021

Insurers under compulsory social insurance in case of temporary disability and in connection with maternity pay benefits both at their own expense (the first 3 days of the employee’s illness) and at the expense of the Social Insurance Fund (in other cases).

Of course, if they are not in the regions participating in the pilot project. Insureds reduce their social insurance payments by the amount of benefits paid (clauses 1, 2, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ, clause 2 of Article 431 of the Tax Code of the Russian Federation).

If social insurance costs exceed accrued contributions, policyholders can apply to the Social Insurance Fund for reimbursement (clause 3, article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ, clause 9, article 431 of the Tax Code of the Russian Federation).

How to make an application

According to the recommendations of representatives of Social Insurance, an application to the Social Insurance Fund contains the required details:

- name and address of the location of the policyholder;

- policyholder registration number;

- the amount of funds claimed for reimbursement.

The procedure for completing the form is fixed in letter No. 02-09-11/04-03-27029 of the Federal Social Insurance Fund of the Russian Federation dated December 7, 2016.

Help-calculation in the Social Insurance Fund 2021

Calculation certificate to the Social Insurance Fund (sample)

In order for the Social Insurance Fund to make a decision on allocating funds to the policyholder for the payment of insurance coverage, it is necessary, based on the results of the quarter or any month of 2021, to submit to the territorial body of the Social Insurance Fund a set of documents that should contain (Order of the Ministry of Health and Social Development dated 04.12.2009 No. 951n):

- written statement from the policyholder;

- reference-calculation;

- breakdown of expenses at the expense of the Social Insurance Fund for each type of benefit;

- copies of documents confirming expenses.

The form of the Calculation Certificate is given in Appendix 1 to the Application for the allocation of the necessary funds for the payment of insurance coverage (FSS Letter dated December 7, 2016 No. 02-09-11/04-03-27029).

The calculation certificate for compensation from the Social Insurance Fund in 2021 in Excel format can be downloaded from the link below:

certificate of calculation in the Social Insurance Fund 2021: download (free)

Title page

The title page is filled out by the policyholder, except for the subsection “To be filled out by an employee of the territorial body of the Fund.”

Attention! If the policyholder is registered in the SBIS system, then almost all fields of the title page are filled in automatically.

“Adjustment number” field is filled in as follows: if the calculation is primary, then “000” is indicated, if it is a corrective calculation, then the adjustment number “001”, “002”, etc. is indicated.

“Reporting period (code)” field is filled in in accordance with the codes given in the directory. In this case, the first two digits are the code of the reporting period (for example, if the calculation is made for the first quarter, then the code “03” is selected, for the half year “06”, etc.), and the last two digits indicate the number of requests from the policyholder for the allocation of funds for payment of insurance compensation (one appeal - 01, etc.).

“Calendar year” field automatically indicates the year for the reporting period for which the calculation is presented.

Attention! The “Cessation of activities” field is filled in only if the organization’s activities are terminated due to liquidation or termination of activities as an individual entrepreneur.

Field “Full name of the organization, separate division/full name” individual entrepreneur, individual" is filled in automatically in accordance with the name (full name) specified in the policyholder's registration card. When filling out this field, the full (without abbreviations) name of the organization (separate division) is reflected, corresponding to that indicated in the constituent documents or the last name, first name, patronymic (if any) of the individual entrepreneur.

The fields “TIN” , “KPP” and “OGRN (OGRNIP)” are filled in automatically from the client’s registration card in the program.

In the “OKVED Code” , select the code of the main type of activity of the policyholder in accordance with the all-Russian classifier of types of economic activity. These codes are determined by organizations and individual entrepreneurs independently and are contained in extracts from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs.

In the “Budget organization”

The policyholder's attribute is selected in accordance with the source of financing:

- 1 - federal budget;

- 2 - budget of a constituent entity of the Russian Federation;

- 3 - municipal budget;

- 4 - mixed financing.

Attention! The attribute in this field is indicated only by policyholders who are budgetary organizations.

When filling out the “Contact telephone number” , the policyholder’s telephone number specified during registration is reflected.

In the “Registration Address” , organizations indicate their legal address, and individual entrepreneurs (individuals) indicate their registered address at the place of residence.

The field “Average number of employees” indicates the average number of employees.

The corresponding fields indicate the number of working disabled people and workers employed in hazardous industries.

Attention! All headcount indicators are indicated as of the reporting date, i.e. on the last day of the reporting period for which the calculation is submitted.

When filling out the field “Calculation is presented on ____ page.” The number of pages on which the calculation is compiled is indicated.

The field “with supporting documents or their copies on ___ sheets” reflects the number of sheets of supporting documents and (or) their copies (if any). Such documents may be: the original (or a certified copy) of a power of attorney confirming the authority of the policyholder’s representative (if the calculation is submitted by a representative of the insurance premium payer), etc.

In the section of the title page “I confirm the accuracy and completeness of the information specified in this calculation:” the following is indicated:

1 - if the document is submitted by the policyholder,

2 - if the document is presented by a representative of the policyholder;

3 – if the document is presented by the legal successor.

Next, indicate the last name, first name, patronymic of the head of the organization, individual entrepreneur (individual) or representative of the policyholder.

In the “Document confirming the authority of the representative” , the type of document confirming the authority of the signatory is indicated (for example, a power of attorney, its number and date).

How to fill out a Certificate of Calculation in the Social Insurance Fund

Certificate - calculation submitted when applying for the allocation of funds for the payment of insurance coverage, includes the following indicators for the reporting period:

- the amount of the insurer's debt (FSS) for insurance premiums at the beginning and end of the reporting (calculation) period;

- the amount of accrued insurance premiums, including for the last three months;

- the amount of additional accrued insurance premiums;

- the amount of expenses not accepted for offset;

- the amount of funds received from the territorial bodies of the Social Insurance Fund to reimburse expenses incurred;

- the amount of returned (credited) overpaid (collected) insurance premiums;

- the amount of funds spent for the purposes of compulsory social insurance, including for the last three months;

- the amount of insurance premiums paid, including for the last three months;

- the amount of the insured's debt written off.

There is nothing new in filling out the Calculation Certificate for the policyholder. Similar data were previously presented in Table 1 of Section I of the 4-FSS form, which has been lost since 2021.

The example of a certificate of calculation in the Social Insurance Fund that we provided is still relevant in 2019.

Important information about deadlines

There is no deadline for filing a refund claim. The policyholder has the right to apply for any reporting period if there are documented grounds. There are no restrictions on the number of applications for FSS reimbursement for two years or more. The policyholder is not limited in terms of terms.

The fund will consider the appeal within 10 calendar days and refund the funds. But only on condition that the policyholder has provided the entire package of necessary documents.

IMPORTANT!

The review period will be extended if Foundation controllers request additional information. Or, upon request, a desk or field inspection will be scheduled. The money will be refunded only after the inspections are completed.

Help calculation for FSS reimbursement: sample filling

Document year: 2019

Document type: Help

Download formats: DOC, EXCEL, PDF

An accounting statement for reimbursement of the Social Insurance Fund (sample of filling), which we will consider in the article, is submitted to social insurance as part of other documents. The documentation package is used by the organization to reimburse the funds spent on benefits.

Read the article to the end - on the page you can download a free sample certificate with a calculation to the Social Insurance Fund, which will be needed for submission in 2021.

When to submit 4-FSS

The deadline for submitting 4-FSS depends on the form of submission. There are two deadlines for submitting calculations: the 20th and 25th of the month following the reporting month. If the form is submitted on paper, then it must be submitted to the Social Insurance Fund by the 20th, if electronically - by the 25th. If the reporting deadline falls on a weekend or holiday, the period is extended to the next working day.

However, in 2021, coronavirus made its own adjustments to the reporting periods. In this regard, 4-FSS for the 1st quarter had to be submitted before May 15. The remaining deadlines for submitting the form are as follows: for half a year – July 20/27, for 9 months – October 20/26, for 2021 – January 20/25, 2021.

The principle of reimbursement of funds from the Social Insurance Fund

Legal entities and existing individual entrepreneurs in 2019, as in previous years, are allowed to reimburse part of the money from the Social Insurance Fund. You can also offset them against future payments. This is possible if the condition is met: the organization’s money spent on benefit payments must exceed payments recalculated to the Social Insurance Fund.

Only certain types of payments are reimbursed:

- Reimbursement to employees for sick leave.

- Compensation paid one-time at the birth of a child. This includes benefits for registering mothers with a clinic (in the early stages); payments for child care if his age does not exceed one and a half years; actually, maternity benefits; and one-time compensation for birth.

- Social payment for funeral. For this calculation, a sample standard certificate in the Social Insurance Fund 2021 is used (you can download such a paper for free).

By the way! Sick leave covers only expenses from the fourth day of incapacity for work.

As for the need to apply to the Social Insurance Fund. Companies (legal entities and entrepreneurs) have two options:

- If a legal entity or private individual entrepreneur reimbursed employees less than the amount they contributed to the Social Insurance Fund, then there is no need to contact the latter for reimbursement. Then, in the future, you can reduce the amount of social security payments;

- if the company paid more money to employees for compensation than it paid contributions to the Social Security Fund, the latter can be contacted with a statement.

In this case, the company may request compensation or offset of money against the following transfers to the Social Insurance Fund. The refund amount is calculated in the calculation sample; the filling in 2021 has not changed much compared to previous years.

What it is

In the event of temporary disability, a person receives payment of insurance funds accrued for a certain period when the citizen was unable to carry out his work activity. Payment of benefits by the organization is carried out at its own expense during the first three days, after which this obligation is assumed by the Social Insurance Fund.

Using compulsory social insurance contributions in the event of temporary disability or the birth of a child, the Social Insurance Fund reimburses benefits for:

- on sick leave;

- in connection with the birth of a child. Most often these are cash payments for pregnancy, childbirth or child care until the age of 1.5 years;

- for burial.

Payment of funeral and childbirth benefits is entirely the responsibility of the Social Insurance Fund. Payment of sick leave benefits can be carried out either entirely at the expense of the Social Insurance Fund or partially at the expense of the company. A lot also depends on the case of disability and the organization’s individual approach to such payments.

Where to apply for reimbursement of benefits?

The refund chain consists of three participants:

- the policyholder. This is a separate company or individual entrepreneur who reports on insurance premiums;

- social insurance fund. Abbreviated as (FSS);

- tax service (FTS).

The company submits a package of documentation to the Social Insurance Fund (this includes a sample certificate for calculating compensation, an application, and certifying papers). An example of filling out the paper is freely available on the Internet. The latter reviews the received papers and makes a decision: to reimburse or not. The company and the territorial Federal Tax Service are notified of the decision. In this case, the answer must be given within three days. If the decision is favorable, the company returns the money due.

If the company received a refund, they reflect the amount in the tax report. If she is refused, she will have to pay extra to the Federal Tax Service.

Important! The money is returned within ten days. Exceptions are cases when an incomplete package is presented, there are errors or inaccuracies. Then a special inspection is ordered.

Responsibility for failure to issue a certificate

Employees of the authorized body have the right not to provide citizens with a certificate on the grounds established by current legislation. Thus, they do not issue the form to the applicant’s representatives without a power of attorney certified by a notary.

Another reason for refusal is an incomplete package. To obtain the form you need:

- an application drawn up by a citizen according to the approved form;

- Russian passport.

If employees refuse to provide a document without legal grounds, they may be held financially or administratively liable.

List of documents for FSS reimbursement

To inform social insurance of your intention to reimburse part of the funds, organizations or individual entrepreneurs need to collect a package of papers for this. It includes:

- application on behalf of the organization;

- accounting certificate (certificate-calculation);

- breakdown of expenses that were allocated for employee benefits.

All samples are taken from the same letter from the Federal Tax Service.

Additionally, they may request documents that were the basis for payment of benefits. We need copies of them.

If the person was on sick leave, the company attaches copies of temporary disability sheets. The same form for reimbursement under a certificate of calculation to the Social Insurance Fund in 2021 will be needed if payments for maternity and childbirth are transferred (a sample of filling is in the example).

For other insurance payments, the following may be suitable:

Preparation of a calculation certificate for submission to the Social Insurance Fund

Preparation of the necessary package of documents for submission to the FSS of the Russian Federation is carried out in the 1C accounting application, accounting is carried out in the subsection “Application and certificate-calculation for the FSS”.

- Open the report to fill out an application and a calculation certificate from the “Salaries and Personnel” menu (Salaries - Reports).

- In the “Period” column, enter the start and end dates of the period for reimbursement of benefits (the beginning of the period coincides with the beginning of the year).

- The “Organization” line will be filled in automatically. If there are several organizations, you should choose the one that sends a request to the Social Insurance Fund to allocate funds for social security.

- The “Settings” menu is intended for entering the data required to fill out an application form in the 1C Accounting 8.3 program (Fig. 1). The same data - the position of the head of the contribution control body, the company's personal account number in the Federal Treasury, etc. - can subsequently be entered manually.

Clicking the “Close and Generate” button starts the formation of the documents described below.

Application for requesting funds for social security (Fig. 2)

The application will automatically include the following information:

- information about the policyholder (address, registration data in the Social Insurance Fund) - filled in by the program based on the “Organizations” document. To add the missing information, open the “Organizations” document (Main > Settings);

- amount of insurance compensation. It cannot exceed the amount specified in the calculation certificate and detailing of expenses;

- bank details of the organization (filled in by the 1C accounting program based on the document “Organizations”);

- information about the manager and chief accountant (filled in on the basis of the “Organizations” document).

Information missing in the generated application form can be entered manually.

The calculation certificate attached to the application for requesting funds for insurance coverage (Fig. 3) is formed as follows:

- lines 1 and 11 indicate, respectively, the debt owed by the policyholder or the local body of the Fund;

- in lines 2 – 5 the amount of accrued social insurance contributions from the beginning of the billing period is entered. Contributions are calculated in the section of the program dedicated to payroll. In addition, the forms “Contribution accounting operation” and “Recalculation of insurance premiums” can be used (see the menu of the “Salaries and Personnel” section);

- line 6 contains data on additionally accrued contributions, entered on the basis of the “Contribution Verification Report” tables, which can be called up from the “Insurance Premiums” section, “Salaries and Personnel” menu;

- line 7 is intended for insurance expenses not accepted for offset. The amount is entered using the “Operation” document (see Settlements with funds for insurance contributions);

- The 8th line contains data on the amounts transferred to the company’s account by the Social Insurance Fund in order to replenish the funds spent. These amounts are entered into the certificate form using the “Receipt to Current Account” table, which can be accessed from the “Bank and Cash Desk” menu;

- The 9th line is intended to indicate manually the amounts of overpaid contributions that were offset by the Fund or returned to the organization’s account;

- Lines 12 – 15 contain data on the amounts spent since the beginning of the billing period for the needs of compulsory social insurance in cases of temporary disability and maternity. The amount indicated in line 12 should be identical to the figures in control line 15 (column 4) in the table containing the breakdown of expenses (see Fig. 4). The corresponding benefit amounts are entered using the document “Contribution Accounting Transaction” (menu “Salaries and Personnel”);

- lines 16-19 contain the amounts of contributions that were transferred to the Social Insurance Fund account. In 1C Accounting 8.3, accounting and entering numerical values into these lines is carried out using the table “Write-offs from the current account” in the “Bank and cash desk” section;

- line 20 corresponds to the amount of debt written off: the numerical value is entered into the line manually;

- line 21 shows the insured’s debt as of the end of the billing period, and line 10 shows, respectively, the debt of the local Social Insurance Fund.

Unified certificate form

For information on accrued wages for the previous two years, a unified form for a certificate of average wages is provided, which is approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. Let's look at how to fill out certificate 182n; you can download the form for free below.

IMPORTANT!

Until July 2, 2013, for information about wages, a different form was used - certificate 4n. Therefore, if an employee provided information on average earnings for 2011, 2012 and 2013 on such a form, then there is no reason not to accept the information. During these periods, the form in Form No. 4n is considered valid. The employer also has the right to provide similar information for the specified periods in a free-form salary certificate (sample below).

Help calculation for FSS reimbursement: sample filling

Document year: 2019

Document type: Help

Download formats: DOC, EXCEL, PDF

An accounting statement for reimbursement of the Social Insurance Fund (sample of filling), which we will consider in the article, is submitted to social insurance as part of other documents. The documentation package is used by the organization to reimburse the funds spent on benefits.

Read the article to the end - on the page you can download a free sample certificate with a calculation to the Social Insurance Fund, which will be needed for submission in 2021.

The principle of reimbursement of funds from the Social Insurance Fund

Legal entities and existing individual entrepreneurs in 2019, as in previous years, are allowed to reimburse part of the money from the Social Insurance Fund. You can also offset them against future payments. This is possible if the condition is met: the organization’s money spent on benefit payments must exceed payments recalculated to the Social Insurance Fund.

Only certain types of payments are reimbursed:

- Reimbursement to employees for sick leave.

- Compensation paid one-time at the birth of a child. This includes benefits for registering mothers with a clinic (in the early stages); payments for child care if his age does not exceed one and a half years; actually, maternity benefits; and one-time compensation for birth.

- Social payment for funeral. For this calculation, a sample standard certificate in the Social Insurance Fund 2021 is used (you can download such a paper for free).

By the way! Sick leave covers only expenses from the fourth day of incapacity for work.

As for the need to apply to the Social Insurance Fund. Companies (legal entities and entrepreneurs) have two options:

- If a legal entity or private individual entrepreneur reimbursed employees less than the amount they contributed to the Social Insurance Fund, then there is no need to contact the latter for reimbursement. Then, in the future, you can reduce the amount of social security payments;

- if the company paid more money to employees for compensation than it paid contributions to the Social Security Fund, the latter can be contacted with a statement.

In this case, the company may request compensation or offset of money against the following transfers to the Social Insurance Fund. The refund amount is calculated in the calculation sample; the filling in 2021 has not changed much compared to previous years.

What documents are needed

The following list of documents that must be provided has been approved at the legislative level:

- application for the allocation of funds to compensate for insurance coverage;

- a calculation that contains complete information about all funds allocated to the budget and paid to employees as benefits;

- copies of documents that prove the need to send funds for social security.

The following are evidence of the need to provide benefits:

- sick leave certificates, which will indicate the fact of temporary loss of ability to work due to illness, pregnancy or childbirth;

- other documents confirming the birth of the child. They are necessary to receive one-time benefits after childbirth, as well as for child care;

- documents from the place of employment of the second parent, which will confirm the lack of payment of child care benefits;

- death certificates upon receipt of funds for funeral;

- documents on registration in the early stages of pregnancy. Required to receive benefits when applying for up to 12 weeks.

In some situations, FSS authorities may request additional documents.

The need to include additional information in the documentation package should be clarified in advance. It is worth noting that for each missing document a fine of 200 rubles can be issued.

Any document must be drawn up in accordance with the established standards. The calculation certificate is submitted to the Social Insurance Fund to receive funds paid for insurance premiums.

Despite the fact that there is no single form for filling out the document, a citizen must adhere to generally accepted standards for filling out official documents. If there is inaccurate information, errors or omissions, the document will not be accepted, which will entail a lot of time.

As before, the employer has the right to reimburse the costs of social insurance for the company’s employees. However, the composition of documents sent to the Social Insurance Fund has changed significantly. Previously, social security payments were presented in the well-known 4-FSS form. Now it has been replaced by a certificate from the FSS. The article will tell you about the procedure for filling out a new report and will present a sample of a calculation certificate to the Social Insurance Fund.

In what cases is an accounting certificate used?

An accounting statement is used when an organization intends to refund funds or offset amounts against future payments. Then, along with the rest of the papers, a calculation certificate is made. Its form was approved by an explanatory letter from the Social Insurance Fund dated December 7, 2021.

Until January 1, 2021, a special form 4-FSS was used. In general, the volume and type of paper have not changed dramatically.

We will consider how to fill out a calculation certificate in more detail in the following sections. It will also be possible to download the official sample and example of filling out the paper (blank and completed template).

Form

The previously used form 4-FSS was replaced with a new reporting form, which serves as a calculation certificate. These changes are related to the new procedure for reporting on insurance premiums.

In 2021, administration is carried out by tax authorities, which excludes the possibility of receiving reports on transfers of funds to the budget for the Social Insurance Fund. In this regard, it became necessary to create a new document that would reflect all information regarding contributions.

When filling out the certificate, you must take into account that the Social Insurance Fund may send an official request to the tax office to confirm the authenticity of all specified data.

At the same time, a single document form is not fixed at the legislative level. In this regard, the preparation and completion of the certificate is carried out independently. To eliminate the possibility of refusal to accept a document, you should be guided by Order of the Ministry of Labor 585.

Where to apply for reimbursement of benefits?

The refund chain consists of three participants:

- the policyholder. This is a separate company or individual entrepreneur who reports on insurance premiums;

- social insurance fund. Abbreviated as (FSS);

- tax service (FTS).

The company submits a package of documentation to the Social Insurance Fund (this includes a sample certificate for calculating compensation, an application, and certifying papers). An example of filling out the paper is freely available on the Internet. The latter reviews the received papers and makes a decision: to reimburse or not. The company and the territorial Federal Tax Service are notified of the decision. In this case, the answer must be given within three days. If the decision is favorable, the company returns the money due.

If the company received a refund, they reflect the amount in the tax report. If she is refused, she will have to pay extra to the Federal Tax Service.

Important! The money is returned within ten days. Exceptions are cases when an incomplete package is presented, there are errors or inaccuracies. Then a special inspection is ordered.

When to issue certificate 182n

The employer must issue a document in two cases:

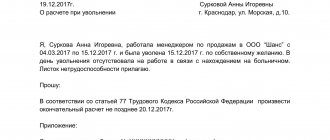

- Upon dismissal, on the day of termination of work. If this is not possible, you need to notify the former employee that he must come to the office and pick up the certificate. Upon receipt of the employee’s written consent, the document should be sent to him by mail (clause 2 of the procedure for issuing certificate 182n).

- After dismissal, upon written request from the employee. The issuance period is no later than three working days from the day the application was submitted (Article of the Labor Code of the Russian Federation).

Keep personnel records and prepare all personnel reports for free in the “Kontur.Personnel” service

List of documents for FSS reimbursement

To inform social insurance of your intention to reimburse part of the funds, organizations or individual entrepreneurs need to collect a package of papers for this. It includes:

- application on behalf of the organization;

- accounting certificate (certificate-calculation);

- breakdown of expenses that were allocated for employee benefits.

All samples are taken from the same letter from the Federal Tax Service.

Additionally, they may request documents that were the basis for payment of benefits. We need copies of them.

If the person was on sick leave, the company attaches copies of temporary disability sheets. The same form for reimbursement under a certificate of calculation to the Social Insurance Fund in 2021 will be needed if payments for maternity and childbirth are transferred (a sample of filling is in the example).

For other insurance payments, the following may be suitable: