Typically, an invoice and delivery note serve different purposes, but contain almost identical data. To reduce document flow, a document was created that combines a delivery note and an invoice - a universal transfer document (UTD). In what cases can such a document be used? Is there for it ? Let's talk about the features of using a delivery note and an invoice in one document - UPD.

Also see:

- How to fill out the UPD correctly

- What is the difference between an invoice and an UTD?

Functions of the invoice

A consignment note in the TORG-12 form is used when selling inventory items. However, since 2013, the requirement to use only unified forms of documents has been abolished . Organizations are allowed to create their own document forms (with rare exceptions). The main condition is the presence of mandatory details in such a document and its consolidation in the company’s accounting policy.

The consignment note is classified as a primary accounting document, on the basis of which records are made about the facts of economic activity in the accounting accounts.

The list of mandatory details for primary accounting is enshrined in Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ.

Here is a list of attributes that a document must contain in order to be considered a full-fledged primary document (in our case, an invoice):

As a rule, when implementing inventory materials in practice, they still use TORG-12, since this form is familiar and understandable.

The form of the unified form TORG-12 can be downloaded for free from our website using the link:

FORM TORG-12

What to do?

To submit

The documents must correctly indicate the name of the seller or buyer, their details and data about goods, products or services, as well as write their cost. The issued documents are signed by officials and sealed. Then they are transferred to the counterparty at the time of sale of goods and materials or provision of services, or until the actual implementation or completion of work.

Registration

It is necessary to register primary documents in registration journals and primary documentation books. This responsibility is imposed on the accounting department, because according to the Accounting Rules, all documents must be registered on the day they are issued.

Responsibility for the correct entry of data into certain primary documents rests either with the chief accountants or with the responsible persons who, according to the job description, are required to fill out these documents.

Invoice Functions

An invoice has a function that is different from the TORG-12 function.

An invoice is issued by each organization that applies a common taxation system for each of its shipments. This shows that VAT is included in the sale price. The buyer who receives the invoice claims a VAT deduction based on it. Without a properly executed invoice, it is impossible . Therefore, keeping track of the presence of all required details in the invoice is vital.

The rules for filling out an invoice govern 2 documents:

From these documents we can conclude what attributes must be present in the invoice so that a deduction can be obtained from it:

As can be seen from the diagrams, many items in the delivery note and in the invoice are the same.

Content

The invoice contains the following items:

- The date the invoice was issued and the document number.

- Full information about the supplier, including his bank details.

- Buyer information.

- Name, as well as quantity, unit price and cost of inventory items sold or services provided.

- The total cost, as well as the amount of VAT, if any.

- Signatures of responsible persons.

The invoice must contain the following items:

- Number in order.

- Date of discharge.

- Details of the taxpayer himself, as well as the buyer.

- Shipper's details.

- Payment document number in case of receiving advance payments from your counterparty.

- The name of the various goods or services supplied by the seller.

- Unit of measurement.

- Unit price excluding tax.

- The total cost of goods or work or services.

- Tax rate.

- The cost of the entire quantity of products or services, including taxes.

- Signatures of officials.

The bill of lading contains the following items:

- Serial number.

- Date of discharge.

- Name, as well as details of the buyer or seller.

- The name of the product, its quantity, and the total cost.

- The basis for the TN extract indicating the contract number and the date of its signing.

- Signatures of responsible persons.

UPD functions

Obviously, in the delivery note and invoice, many items are the same. But it is impossible to draw up just one transaction document, since they perform completely different functions.

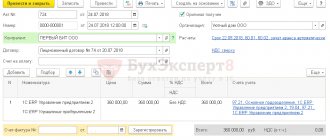

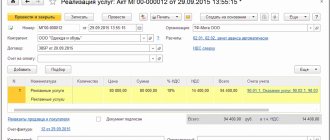

In order to reduce document flow, a universal transfer document – UPD – was introduced. He combined the invoice and delivery note into one document. That is, one document can be used to ship/receive goods and other materials. values, and also deduct VAT.

Similar rules apply for UPD: the recommended form can be modified in accordance with the needs of the enterprise, but it is necessary to ensure the presence of mandatory details .

Mandatory attributes of the UPD are a set of mandatory details of the invoice and invoice. But there are also unique details that are unique to UPD.

The UPD form is developed on the basis of the invoice form. In fact, the invoice form is part of the UTD form.

UPD and you can get acquainted with samples of filling it out in our article “What correct samples of filling out UPD look like: examples.”

What is the difference between an invoice and a delivery note in 2020?

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST JSC. Students who successfully complete the program are issued certificates of the established form.

The program was developed jointly with Sberbank-AST JSC. Students who successfully complete the program are issued certificates of the established form.

See also the resolution of the Federal Antimonopoly Service of the East Siberian District dated 05.

UPD and SSF

Invoice is an NU document. It confirms the release of goods to the buyer, the provision of services to him, the performance of work on operations subject to VAT, and is not used anywhere else. SChF details contain information:

- about the subject of the transaction;

- about his country of origin;

- about the amount;

- on the quantitative characteristics of a business transaction;

- about the tax rate;

- about excise tax;

- about the relevant group of goods;

- allowing taxpayers to be identified.

The information contained in the SSF is used for VAT calculations and control of these transactions. When registering the release of goods, an accounting document is attached to the SChF: delivery note, delivery and acceptance certificate, etc.

The Universal Transfer Document (UDD) is a form created on the basis of the SSF. All information from the SSF is reflected in the UPD. For convenience, the “invoice area” is highlighted with a dark outline. In addition, the UPD contains information on the issue of goods and materials (act, bill of lading, partially - TTN, document on issue of materials f. M-11, etc.), i.e. information when the shipment was made, which official took responsibility for it and signed it, and on the basis of which agreement the shipment was made.

Who can use UPD

The use of UPD is voluntary . To complete transactions, a company can use any acceptable forms: a set of invoice + invoice or only UPD. Moreover, some clients can be issued an invoice and invoice, while others can receive an UTD. It is better to specify what set of documents the transaction will be closed in the agreement with the counterparty.

As already mentioned, the invoice is issued by VAT payer organizations. That is, those who use OSNO.

Can a company issue a UPD in a special regime? Yes maybe . But in this case, the UPD will only play the role of a primary accounting system. To indicate the status of the UTD - only primary or invoice - invoice - there is a special requisite in the UTD form.

Special regime officers should not be afraid to prescribe UPD. If the “status” detail is set correctly, the UTD is not equivalent to an invoice and does not entail consequences in the form of mandatory payment of VAT to the budget.

For a sample of a single document “invoice and delivery note” for simplifiers, as well as filling out specific UPD details, see the article “What does status mean in UPD.”

Instructions for filling

In order to fill out the account correctly you need:

- In the “Recipient” line, indicate the name of the seller or contractor.

- In the line “Recipient's bank” enter the bank details of the organization that sells goods and materials or provides services.

- The empty line indicates the invoice number and the date of its preparation.

- In the line “Goods (works, services)” the name of these types is entered.

- The lines “Quantity”, “Unit of Measurement”, “Price” and “Amount” indicate the quantity of goods or services, their price and total cost.

- Under the total cost, VAT is indicated, if any, as well as the total cost.

- At the end of the document, information about the manager and chief accountant is placed.

To fill out an invoice you need:

- In the first line, indicate the date the document was compiled and its serial number.

- In lines 2,3,4 and 6, indicate the details of the seller, buyer, consignee or consignor.

- Line 5 contains the number of the payment document according to which the advance was received.

- Line 7 indicates the name of the payment currency.

The tabular part of this document is filled out as follows:

- The first column indicates the name of the goods.

- In gr. 2,3,4 indicate the unit of measurement, quantity and price.

- In gr. 6 information about excise duty is entered. 4. In gr. 7 and 8 indicate the tax rate and the tax itself in rubles and kopecks without rounding.

- In gr. 5 and 9 – total cost with and without VAT.

- In gr. 10 and 11 enter information about imported goods.

- The invoice is signed by the director and chief accountant, or other officials authorized to draw up this document. The document is completed either by hand or using a computer. But you can partially fill it out in a computer program, and partially add it by hand.

Important! According to Russian legislation, a document such as an invoice can be sent over the Internet, but only in a special program with an electronic signature of a manager or official.

In addition, all invoices issued or received are recorded in special accounting journals. If transactions are subject to VAT, the documents are displayed in the sales and purchases books.

We present information about what a delivery note and an invoice are, as well as how to combine them in one document.

To fill out a delivery note you must:

- In the line “Consignor” you must indicate the name, location, as well as bank details of the organization itself, which is engaged in shipping the goods to the customers themselves.

- In the lines “OKPO” or “Type of activity according to OKDP” information about the seller of goods and materials is recorded.

- In the “Consignee” line, you must indicate all the buyer’s details, including his name, location, and bank information.

- In the lines of the TN form “Supplier” or “Buyer” information similar to that indicated in the lines “Consignor” or “Consignee” is recorded.

- In the “Bases” line, enter the number of the signed agreement and the date of its preparation.

- If the supplier does not deliver his own goods himself, but engages a third-party organization, then the line “Billing note” is filled in.

- The “Product” line provides a detailed description of the product.

- The line “Unit of measurement” must indicate the name of the unit of measurement itself.

- In the “Quantity” line, enter the quantity of the product being sold.

- In the lines “Price”, “Amount without VAT”, “VAT”, “Amount with VAT” the required amounts are indicated accordingly.

- At the end, the data of those officials who issued the goods, as well as those who, according to the power of attorney, accepted the goods and materials, are indicated.

- All entries at the end are sealed with the signatures and seals of the seller and buyer of the goods and materials.

Resolving controversial issues

This last point may be of utmost importance for organizations. The presence of such a document allows you to resolve most controversial issues without bringing the matter to court. For example, tracking cargo by waybill number may be necessary if the cargo is lost.

If a trial does take place, then the invoice allows you to prove the case and substantiate the claims. Despite the abundance of information and the undoubted importance of the bill of lading, its completion does not require specialized knowledge, and this is what explains the ubiquity of this document.

Typically, each organization has template documents for goods and other invoices that contain unchanged information, such as details. If a company has clients with whom it works on an ongoing basis, then a template is developed specifically for each of them. In this case, issuing the relevant documents is further simplified.

Who's tracking?

The consignment note is also of interest to inspection authorities, for example the tax service, which carries out mandatory inspections. In this case, an incorrectly executed invoice can have far-reaching, but sad consequences. Also, the presence of a consignment note can be checked during the transportation of goods, for example, traffic police inspectors will definitely check the trucks along the route, and accordingly, they need to show the consignment note for the transported goods. Naturally, the information reflected in the document must correspond to what is in the truck. The situation is approximately the same with transportation by other modes of transport. Without a consignment note, the goods simply will not be loaded into transport. There are quite a large number of varieties of such documents. Each type of consignment note has its own characteristics when drawing up, we advise you to familiarize yourself with them in advance. For example, there are special types of waybills used when transporting livestock products.

Online magazine for accountants

It was necessary to make changes to the invoice form due to the entry into force of Federal Law No. 56-FZ dated 04/03/2020, which expanded the scope of information that must be indicated in the invoice issued for the sale of goods (work, services), transfer of property right

From July 1, 2021, a new invoice form will come into effect. Also, from this date, a new invoice format becomes mandatory, necessary for the exchange of documents in electronic form. What exactly has changed? What does the new invoice form look like as of July 1, 2021? Did the changes affect adjustment invoices? We will tell you about all the important amendments related to VAT refunds and provide a completed sample of the new invoice form.

What types of waybills are there?

Several main names and categories of invoices have been developed and implemented into permanent operation. The papers differ in the presented form. The main form legally established by standards has an individual classification number 1‑T. The document was developed as part of the implementation of a state regulatory project and was officially approved by the relevant statistics committee back in 1997. The number of the adopted resolution is 78. The document is used for handling most goods. Additionally, current names and profile forms of the TTN are provided, the main task of which is to carry out full-fledged registration of operations necessary in the transport sector as part of the acceptance, as well as warehouse dispatch of various types of food products with a strict indication of the main names, taking into account the origin and characteristics of transportation, depending on the regulated distance . Traditional forms had previously been officially approved by a special resolution of the border authorities.

In 2011, government authorities made an official decision to apply a new TTN update in their work. The introduction into the activities of specialized companies and carriers is regulated by the key Rules for the implementation of cargo transportation using automotive equipment. The corresponding resolution was legalized and fully approved by the Government. The text of the profile document notes strict agreement on the fact of a comprehensive conclusion of a bilateral agreement in cases of delivery of cargo of different types. A special feature of the document was the removal of special fields with marks for write-off or capitalization of profile products. TTN of the regulated standard of 1997 and 2011 are used by companies today equally.

Purposes of providing each document

An invoice is issued to the buyer to confirm the task completed by the contractor (seller). In addition, this action provides for the following opportunity on the part of the customer - to demand, on the basis of the submitted document, a deduction of VAT, which is included in the amount of the purchased product or service and is indicated in the appropriate column.

The consignment note is provided to formalize the transfer of ownership of the goods from the supplier to the buyer and to record material assets. The issuance of this document does not serve any other purpose.

How to work with documents: contracts, invoices, acts, invoices

A primary document is an accounting document drawn up at the time of business transactions and which serves as evidence of their completion.

The list of primary documents accompanying a particular transaction varies depending on the characteristics of each specific transaction. It is accepted that the package of documents accompanying the transaction is prepared by the supplier (executor).

Agreement

Regulates the emerging rights and obligations of the parties to the transaction.