In this material we will learn how to calculate the mineral extraction tax, determine the tax base of the tax, consider the tax rate for different regions and discuss regulations. We will also answer the most common questions.

Mineral extraction tax (MET) is a payment to the country's treasury transferred for the exploitation of minerals and subsoil for commercial gain. The mineral extraction tax is an indirect tax, since the amount for its payment is transferred to the budget of the region in whose territory the developed lands are located.

LLCs and individual entrepreneurs who have expressed a desire to engage in this type of activity undergo state registration at the Federal Tax Service as future payers of mineral extraction tax. After the license is received, the individual entrepreneur must register with the Federal Tax Service at the location of the area being processed.

Legal and regulatory framework for mineral extraction tax

The main regulatory normative act is Chapter 26 of the Tax Code of the Russian Federation, which received legal force on July 24, 2002 in accordance with the provisions of Federal Law No. 104.

The process of collecting and calculating mineral extraction tax is also regulated by:

- Art. 336 of the Tax Code of the Russian Federation , which lists the categories of mined minerals.

- Art. 334 of the Tax Code of the Russian Federation , which lists those citizens and organizations obligated to pay the specified tax.

- In Art. 335 of the Tax Code of the Russian Federation provides instructions regarding the registration of subsoil users depending on the location of the subsoil plot provided to them for use.

- In Art. 337 of the Tax Code of the Russian Federation provides a definition of extracted minerals.

The legal framework also includes:

- Letter of the Ministry of Finance dated May 31, 2012 No. 03-06-05-01/66.

- Federal Law No. 204 of November 29, 2012.

Calculation methods and example

Calculation of the mineral extraction tax based on the amount of minerals extracted is limited: for gas, coal, oil; in other cases, the tax base will be cost based. The quantity is determined directly or indirectly.

The direct method is used where it is possible to rely on the readings of measuring instruments that take into account quantitative production. To these must be added the actual losses during production. Actual losses are determined by the difference between the calculated production indicator and the actual one.

The indirect method is calculated based on the PI content in the mining product. Mineral raw materials themselves are taken into account using instruments. The calculation methodology is fixed in the LNA. It cannot be changed during the entire production period if the technological characteristics of production do not change. How to calculate the mineral extraction tax by quantity is stated in Art. 338, 339 NK.

The value of PI is determined to calculate the tax at sales prices, with or without subsidies. Subsidies appear in the calculations of the miners who actually receive them. These methods are applied if the miner had a sale in the reporting month.

Another calculation method. It applies if there were no sales in the reporting month. Methods for determining value are characterized by Art. 340 Tax Code of the Russian Federation:

- The cost of mined PI = the number of mined PI*the cost of a unit of PI production.

- Cost of a unit of production PI = revenue / sales volume or Cost of a unit of extracted PI = estimated cost / volume of production.

The estimated value of PI is calculated according to NU data, using the same methodology as the income tax base. Direct and indirect costs are taken into account.

An example (conditional) of cost calculation. The company extracts construction sand. It has no subsidies. In the past period she had realization. The organization pays VAT to the budget. Production for the period amounted to 50,000 tons, of which sales - 35,000 tons. Sales price - 300 rubles/t. The cost of delivering sand is 150,000 rubles.

Calculation:

- 300 / 1.2 = 250 rub./t - selling price excluding VAT.

- 35,000 * 250 = 8,750,000 rub.

- 8750000 – 150000 = 8600000 rub. — revenue.

- 8600000 / 35000 = 245.71 rubles. — the cost of one mined ton.

- 245.71 * 50000 = 12285500 rub. — mineral extraction tax base.

- 12285500 * 5.5% = 675702.50 rub. — Mineral extraction tax.

Note: the rate of 5.5% is established by art. 342 paragraphs 2 paragraphs. 4.

Mineral extraction tax rates

The amount of ad valorem interest rates charged from subsoil users is established by clause 2 of Art. 342 Tax Code of the Russian Federation:

- when extracting potassium salts, its size will be 3.8%;

- when extracting peat, apatite and other ores, the rate will be 4%;

- when mining standard ores of ferrous metals, the rate will be 4.8%, and its size must be multiplied by the corresponding coefficient (Kpodz);

- when extracting radioactive raw materials, salts, thermal waters, bauxites, etc., the rate will be 5.5%;

- when extracting mining non-metallic raw materials, concentrates , etc., the rate will be 6%;

- when extracting raw materials with impurities of precious metals – 6,5%;

- when extracting thermal waters and mud – 7,5%;

- When mining rare metals and stones, the rate will be 8%.

Certain categories are subject to specific rates:

- for 1 ton of gas condensate, a rate of 42 rubles is charged , which must be multiplied by the base value of a unit of standard fuel and by a coefficient established depending on the complexity of production, as well as by a correction factor, the amount of which is specified in Article 343.4 of the Tax Code of the Russian Federation. Changes also came into force on January 1, 2019, according to which the amount received should also be increased by the product of the Kman indicator specified in paragraph 7 of Article 342.5 of the Tax Code of the Russian Federation and a coefficient characterizing the amount of gas condensate produced, in respect of which Kman cannot be applied , and equal to 0.75;

- oil - 919 rubles (from January 1, 2017) per 1 ton . The resulting amount should also be multiplied by the Dm indicator, which characterizes the features of the mining process.

Unfinished production

On the last day of the month, the organization may have a volume of minerals for which the full technological cycle has not been completed. Do not take into account the number of such minerals when calculating the mineral extraction tax. They must be included in the calculation of the tax base in the period in which the technological production cycle is completely completed. The only exceptions are cases when minerals obtained before the completion of the technological cycle are sold or used by the organization for its own needs. This procedure is provided for in paragraph 8 of Article 339 of the Tax Code of the Russian Federation.

When determining the duration of the production technological cycle, not the entire complex of technological operations (processes) to obtain the final product of field development is taken into account, but only those operations that relate to the extraction (extraction) of mineral resources (clause 3 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 18, 2007 No. 64).

Methods for calculating mineral extraction tax

The tax amount can be calculated in one of the following ways:

- The first method can be used to calculate the mineral extraction tax for the extraction of most minerals . It is calculated as the total amount of raw materials extracted from the subsoil, and the current rates are taken from the corresponding article of the Tax Code of the Russian Federation.

- The second method of calculation is used in gas production . In this case, the total volume of extracted raw materials and specific rates determined by the Tax Code of the Russian Federation are taken into account.

- The third method is used when calculating the mineral extraction tax on precious metals . The tax base depends on the cost of selling finished raw materials or nuggets that were mined locally.

- The fourth method was created for calculating the mineral extraction tax during oil production . The base is determined in tons, and the rate is adjusted by the coefficients established by the Tax Code of the Russian Federation.

The formula by which the mineral extraction tax is calculated looks like this:

Mineral extraction tax = NB * NS , where NB means the tax base calculated for the reporting period, and NS is the interest rate established by the Tax Code of the Russian Federation.

How to calculate mineral extraction tax

The size of the mineral extraction tax can be calculated according to special rules. rates, preferential or ad valorem. Formulas for calculating mineral extraction tax depend on the method of calculating the tax amount.

- The formula for calculating the tax based on the amount of minerals that were extracted during the month of work:

MET = CT x C , where:

CT – quantity calculated in tons,

C – tax rate.

The rate ranges from 11 to 553 rubles , depending on what kind of mineral we are talking about, and is expressed in rubles/t. A preferential rate of 0% may apply.

- Formula for calculating the mineral extraction tax based on the price of mineral resources:

MET = SI x C , where

SI – cost of the obtained mineral,

C – rate.

The range of rates is from 0 to 8% , depending on the type of minerals.

How to calculate the mineral extraction tax for oil

To pay the mineral extraction tax on oil production, it must be:

- stabilized,

- isolated,

- dehydrated.

For the purpose of calculating the tax for oil, a special mineral extraction tax rate (RUB/t) has been approved, but its value must be adjusted by several types of coefficients determined by the mineral extraction tax payer himself.:

- Kc (depends on changes in the cost of oil in the world);

- Kv (means the degree of depletion of the areas where mining is carried out);

- Kz (an indicator of the volume of reserves in a certain area where production is taking place);

- Kd (characterizes the degree of complexity of mining work in a certain territory);

- Kdv (means the degree of depletion of carbon raw materials).

Formula for calculating Kc:

Kc = (C – 15) x P: 261 , where:

C ($/barrel) is the average global oil price for the month (Urals oil is used for calculation);

P – averaged ratio $/rub.

How to calculate the mineral extraction tax for sand

The tax base for the mineral extraction tax on sand is calculated on a general basis, and its value is calculated as follows:

- at the estimated cost (for cases where the sand was not intended to be sold);

- calculation of income upon sale at a price approved by the miner for the entire tax period, without taking into account subsidies, VAT, excise taxes and costs of supplying sand to the buyer (for cases where government subsidies were received);

- calculating income from the sale of sand at the company price without VAT, excise taxes, and delivery costs to the buyer (if there was no government subsidy).

The tax rate in this case is 5.5%.

And if an individual entrepreneur extracts commonly used sand for his own personal purposes, no tax is paid at all.

How to calculate the mineral extraction tax for coal

The production of coal is also subject to mineral extraction tax at a fixed rate (RUB/t).

Its value may vary depending on what kind of coal is mined:

- brown,

- coking,

- anthracite,

- coal.

It is also possible to adjust the rate by one of the deflator coefficients (at the request of the mineral extraction tax payer):

- depending on the type of coal mined and approved quarterly by the federal government;

- previously used.

You can organize the accounting of costs associated with labor protection when calculating income tax or mineral extraction tax.

The value of the coefficient can be set at the discretion of the payer, but should not exceed 0.3.

How to calculate the mineral extraction tax for gas

Gas is subject to tax at a fixed rate (RUB/cubic meter). It must be corrected by the coefficients Tg (meaning the cost of delivering gas to the place of further processing), Eut (units of standard fuel). Sometimes Kc is also used - a coefficient indicating the degree of difficulty of obtaining gas.

Ktd coefficient

Ktd is a coefficient used to characterize mineral extraction territories (Article 342.3 of the Tax Code of the Russian Federation). Its use is justified by the provisions of paragraphs. 1 clause 1 art. 28.5 of the Tax Code of the Russian Federation in relation to participants in regional investment projects who have the status of residents of territories that are advancing socio-economic development.

The size of this coefficient is equal to zero until the moment when a participant in a regional investment project begins to apply the tax rate on the organization’s profit (in accordance with the norms described in paragraph 1.5 of Article 284 of the Tax Code of the Russian Federation).

Over the course of 120 reporting periods, starting from the moment the corporate income tax rate is applied for a project participant, the CTD is set at the following values:

- during the first 24 periods – 0.

- from 25 to 48 period inclusive – 0,2.

- from 49 to 72 period – 0,4.

- from 73 to 96 period – 0,6.

- starting from the 97th period and all subsequent – 1.

Answers to common questions

Question No. 1: What deadlines are approved for transferring the mineral extraction tax amount to the budget?

Answer: The tax must be paid based on the results of the tax period (for mineral extraction tax this is a month) no later than the 25th day of the month that follows the previous period.

Question No. 2: What documents prove that the company has the right to apply a 0% rate for mineral extraction tax?

Answer: You must present the state registration to the Federal Tax Service. statistical reporting (form 6-gr), which will indicate data on changes in oil reserves and some valuable gases, as well as the qualitative characteristics of minerals. This procedure for granting the right to a preferential rate was approved by the Ministry of Finance in its Letter dated September 7, 2006 N 03-07-01-02/48.

Changes in the procedure for calculating mineral extraction tax regarding losses during oil production

In relation to oil extracted from those subsoil areas in respect of which the tax on additional income from the extraction of hydrocarbons (AIT) was in effect throughout the reporting period, the mineral extraction tax rate is established by the legislation of the Russian Federation at the level of 1 ruble per 1 ton of extracted raw materials , however, the amount received must be multiplied by a coefficient characterizing the level of oil taxation, the amounts of which are determined in Article 342.6 of the Tax Code of the Russian Federation.

Also, in accordance with the explanations of the Ministry of Finance dated May 17 and 24, 2021, taxation in terms of regulatory losses of extracted raw materials should be carried out at a zero rate.

Common mistakes

Mistake No. 1: A mining company operates on different plots of land located in different regions of the Russian Federation. The company pays the mineral extraction tax in full for work at both sites at the place of registration of the enterprise.

Comment : The amount of mineral extraction tax is calculated at the end of each month for all types of extracted minerals, and the amount of tax is transferred to the location of the land on which the work is being carried out. The place of extraction of minerals is the territory of the region of the Russian Federation, that is, the tax is paid to the budget of the subject in proportion to the amount of minerals extracted.

Error No. 2: An enterprise that extracts minerals from the waste of its mining industry does not pay the mineral extraction tax and does not provide any documents to the Federal Tax Service.

Comment: In order not to transfer the mineral extraction tax to the budget in such a situation, it is necessary to prove the payment of this tax on the main extraction of minerals. But if a license is required to obtain minerals from production losses, the mineral extraction tax will have to be paid.

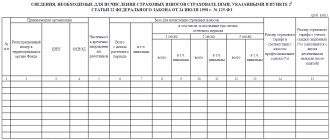

Direct and indirect costs

The estimated cost is determined taking into account:

- Direct expenses. They refer to all expenses for wages, the use of funds for production, and the amount of insurance premiums.

- Indirect costs. These are funds spent on repairing equipment, developing natural resources, eliminating fixed assets that are being taken out of service, mothballing and re-mothballing production facilities, and others.

To obtain data on the indicator, it is necessary to select from the total amount of expenses the part that corresponds to the extraction of a certain substance.

What changes are expected

The mineral extraction tax in 2021 is included in the program of the new tax regime. The government plans to introduce a profit tax (added income tax) for oil companies, which will come into force on January 1, 2019. Currently, the objects of taxation include oil and gas, for which oil companies pay mineral extraction tax.

Before calculating oil royalties, they take into account how much oil prices have changed in the world, whether reserves and production volumes have been depleted.

The approval of the new tax regime has already been carried out by the Government, but the size of the new tax rate has not yet been provided.

Changes in the mineral extraction tax on oil will apply to fields located in Eastern and Western Siberia, some fields in western Siberia that have already been depleted, as well as those fields that benefit from a reduction in export duties.

The Energy Minister claims that this tax will only affect new projects that are being developed by Russian oil companies.

The Ministry of Finance is convinced that if the tax burden on the oil industry is increased, this could negatively affect the rate of mineral extraction in traditional areas.

Composition of the declaration and its completion

In addition to the title page, the mineral extraction tax declaration has 7 more sections. Common to all report filers is the title and Section 1, which reflects the amount of tax payable. Otherwise, you only need to fill out those sections for which there are indicators. Accordingly, if there are no indicators for section a , then it does not need . The following table provides information about which types of activities require completion of each section of the report.

Table 1. Required sections of the mineral extraction tax declaration depending on the activity

| Section number | When filled/what is reflected |

| Title page | Fill out everything |

| Section 1 | Fill everything out. The amount of tax payable to the budget is reflected |

| Section 2 | When producing dehydrated, desalted and stabilized oil, with the exception of production at a new offshore hydrocarbon field |

| Section 3 | When producing gas, flammable natural gas and gas condensate, with the exception of production at a new offshore hydrocarbon field |

| Section 4 | When extracting hydrocarbons from a new offshore hydrocarbon field |

| Section 5 | Data serving as the basis for calculating and paying tax, with the exception of hydrocarbon raw materials (except associated gas) and coal |

| Section 6 | Determining the cost of a unit of extracted minerals based on the estimated cost |

| Section 7 | When mining coal in a subsoil area |

The mineral extraction tax declaration form and the procedure for filling it out (hereinafter referred to as the Procedure) were approved by order of the Federal Tax Service of Russia dated May 14, 2015 No. ММВ-7-3/197.

Filling out the title page

At the top of the title page, the taxpayer indicates:

- TIN . If the number consists of 10 characters, zeros are entered in the first two cells.

- Checkpoint . Only organizations can fill this out. It is necessary to indicate the checkpoint assigned to the organization of the Federal Tax Service at the place of filing the declaration.

- Correction number. If the declaration is submitted for the reporting month for the first time, “0—” is entered. When submitting an updated declaration, the adjustment number “1—”, “2—” and so on is entered.

- Tax period (code). You need to take the code from Appendix No. 1 to the Order. If the company has not undergone reorganization and has not been liquidated, then the code corresponds to the serial number of the month for which the report is submitted. That is, 01 is January, 02 is February, and so on.

- Reporting year . The year to which the reporting month belongs is indicated.

- Provided to the tax authority ( code ) . It is necessary to indicate the code of the tax authority to which the declaration is sent. The code can be taken from the Tax Registration Certificate.

- By location ( registration ) ( code ) . The code is entered in accordance with Appendix No. 1 to the Procedure. Companies that have not been reorganized and do not belong to the category of the largest indicate code 214, individual entrepreneurs - 120.

- Taxpayer . The name of the organization is indicated in full, including its legal form (as indicated in the constituent documents). The last name, first name and patronymic of the individual entrepreneur are indicated line by line.

- Code of the type of economic activity according to OKVED.

- Line for reorganized companies. The organization form code from Appendix No. 1 to the Procedure is indicated, as well as the TIN and KPP of the reorganized or liquidated company.

- Contact phone number. A valid contact number must be provided.

- A string to indicate the number of pages. It is indicated how many pages the declaration is submitted on, as well as the number of pages of copies of supporting documents (if any).

Basic information about the taxpayer and the report is indicated here.

The lower part of the title page is intended to confirm the data given in the report . It states:

- Code depending on who confirms the data:

- 1 - if the taxpayer signs personally;

- 2 - if the signature is put by his representative.

- Last name, first name and patronymic line by line. Filled out depending on who will sign the declaration. This could be: Individual entrepreneur. There is no need to re-enter his full name.

- Director of the organization. You must indicate his full name.

- The taxpayer's representative is an individual. His full name is indicated.

- The taxpayer's representative is a legal entity. The full name of the employee who is authorized to sign the declaration is indicated. In this case, the following lines indicate the name of the representative organization.

If the declaration is signed by a representative, in the bottom two lines you must indicate the details of the document that confirms his authority .

The section is completed in relation to the person who signs the declaration

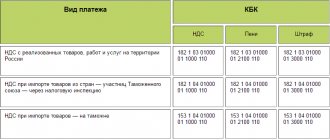

Completing Section 1

The section contains the results of calculations that are made in the remaining sections of the declaration. It consists of blocks, each of which has only 3 lines:

- Line 010 . It reflects the budget classification code according to which the tax is credited to the budget.

- Line 020 . The code of the municipality in whose territory funds are mobilized is reflected. You can obtain OKTMO from the Federal Tax Service at the place of registration. If the code consists of 8 characters, dashes should be placed in the last three cells.

- Line 030 . The amount subject to payment to the budget in the form of a tax for minerals extracted from the subsoil, in respect of which payment is made according to the OKTMO specified in line 020, is reflected.

Section 1 of the mineral extraction tax declaration is filled out by all filers.

The procedure for calculating the amount in line 030 depends on the code of the type of mineral extracted . This code, in turn, is taken from Appendix No. 2 to the Procedure and is entered in line 010 of sections 2-5 of the declaration, as well as in column 1 of subsection 7.1.

For example, the fossil “Petroleum, dehydrated, desalted and stabilized” corresponds to code 03100. In this case, the taxpayer fills out Section 2 of the declaration. In this case, line 030 of Section 1 will indicate the sum of the values in Line 150 of all completed Sections 2 for the corresponding OKTMO.

What is taxed and not taxed

Like any other tax, the mineral extraction tax is regulated by the Tax Code of the Russian Federation, namely its part 2, Chapter 26. Article 336 defines a specific list of objects subject to taxation.

This includes:

- Minerals mined from a specific plot of land granted to a person for use.

- Minerals extracted from mining waste.

- PI extracted in territory under the jurisdiction of the Russian Federation or leased by it from other states on the basis of an international treaty.

The same article describes those objects that cannot relate to individual entrepreneurs subject to taxation:

- Mineral resources recognized as commonly occurring, groundwater that is not listed on the state balance sheet. These resources are produced and consumed by the user for personal purposes.

- Minerals, paleontological specimens and other geological finds that can be defined as collectible.

- Finds that were obtained during the formation, use or reconstruction of objects that have cultural, sanitary, aesthetic, scientific or other social and public value.

- Minerals that were extracted from mining waste, if they were taxed in accordance with the generally established procedure.

- Drainage groundwater.

- Coal bed methane gas.

How coal taxation works

A specific rate applies to it. This means that you need to pay for coal in rubles per ton. Rates are set for each type of coal every three months. At the same time, they take into account how coal prices have changed in the territory of the Russian Federation during this period.

Deflator coefficients used earlier are also used. They are identified and published publicly.

The legislation in Article 343.1 of the Tax Code provides for the possibility of reducing the tax if there are expenses that will provide safe conditions for all workers.

The business owner can take this into account when calculating the tax amount or indicate the amount as a tax deduction. He must also independently calculate the amount of the deduction.

Responsibility

For late submission of a declaration, the entity may be fined in accordance with Article 119 of the Tax Code. The fine will be 5% of the tax amount for each month of delay (full and incomplete), but not less than 1 thousand rubles and not more than 30% of the amount. In addition, the current account may be blocked .

If you fail to pay the tax or are late, a fine may be imposed under Article 122 of the Tax Code of the Russian Federation. Its size is 20-40% of the tax amount . You will also have to pay a penalty in the amount of 1/300 of the refinancing rate for each day of delay.

Deadlines and reporting procedures

The mineral extraction tax declaration is submitted monthly no later than the last day of the month following the reporting month. That is, the declaration for April is submitted until the end of May, for May - until the end of June, and so on. If the last day of the month falls on a weekend, the deadline is moved to the next business day.

The report must be submitted from the month when the organization actually began extracting minerals. That is, if a license has been obtained, registration as a mineral extraction tax payer has been made, but production has not begun, then there is no need to submit a declaration. However, if production was started and then suspended, there is no reporting exemption.

Attention! If an organization has suspended mineral extraction, a mineral extraction tax declaration must still be submitted.

The declaration is submitted at the location of the organization or the place of residence of the individual entrepreneur. In this case, it does not matter that the subject is registered as a mineral extraction tax payer with another tax office - the report must be submitted to “your” Federal Tax Service.

The presentation format depends on the size of the taxpayer. If the average number of employees for the previous year is more than 100 people, then you only need to report electronically using the TKS. Other entities may choose electronic or paper format at their discretion. In the latter case, you can submit documents in person, through an authorized representative or by mail.