Who must submit reports on Form 6-NDFL

Tax legislation in part 6-NDFL, the instructions for filling out, establish that it must be formed by tax agents in relation to the amounts of accrued income to individuals.

This category includes companies and entrepreneurs that attract hired labor under labor and civil contracts. Persons who act as a source of income in relation to transactions with securities, other financial market instruments, etc. must also transfer 6-NDFL.

The obligation to submit 6-NDFL instructions for filling out applies both to business entities within the country and to foreign companies, representative offices, and separate divisions that operate on the territory of our state.

The report must also be submitted to notaries, lawyers, and doctors conducting private practices with the involvement of individuals for whom they act as a source of income.

Attention! The obligation to submit 6 personal income taxes also applies to individuals who have agreements with other individuals, as a result of which the latter receive income.

Section 1

In Section 1 of 6-NDFL for the 2nd quarter of 2021, “Generalized Indicators,” you need to summarize data on the total amount of accrued income from January 1 to June 30, 2021, tax deductions and the total amount of accrued and withheld personal income tax.

Section 1 is filled in with a cumulative total

The first section of 6-NDFL is filled out with a cumulative total: for the first quarter, half a year, nine months and 2021 (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). In general indicators, include income (deductions, tax amounts) for transactions performed during the reporting period - half a year. That is, section 1 should reflect indicators for the period from January 1 to June 30 inclusive.

Let us explain in the table which lines of generalized values are in section 1 of the 6-NDFL calculation for the six months:

| Section 1: Meaning of Strings | |

| Line | Meaning |

| 10 | Personal income tax rate (for each rate, fill out section 1). |

| 20 | The amount of accrued income from January 1 to June 30, 2021. |

| 25 | Income in the form of dividends from January to March 2021 inclusive. |

| 30 | Amount of tax deductions in the 1st quarter of 2021. |

| 40 | The amount of calculated personal income tax from January 1 to June 30, 2021. To determine the value of this indicator, add up the personal income tax amounts accrued from the income of all employees. |

| 45 | The amount of calculated personal income tax on dividends on an accrual basis from January 1 to June 30, 2021. |

| 50 | The amount of fixed advance payments that are offset against personal income tax on the income of foreigners working under patents. This amount should not exceed the total amount of calculated personal income tax (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/3852). |

| 60 | Total number of individuals who received income in the reporting period (January-June) |

| 70 | The amount of personal income tax withheld in the first half of 2021 |

| 80 | The amount of personal income tax not withheld by the tax agent. This refers to amounts that a company or individual entrepreneur should have withheld until the first half of 2021, but for some reason did not do so. |

| 90 | The amount of personal income tax returned in the first half of 2021 (under Article 231 of the Tax Code of the Russian Federation). |

Should I submit zero 6-personal income tax?

There is no need to submit a blank report to the Federal Tax Service In accordance with 6-NDFL, instructions for filling out are not necessary:

- When in the reporting period under review, even if there were employees, they were not accrued and paid income.

- If the individual entrepreneur or organization does not have hired employees.

- During the reporting period, the business entity did not carry out activities.

This point is mentioned in several explanatory letters prepared by the tax authorities. However, in such situations, it is advisable to still send explanatory letters to the Federal Tax Service, which justify the reason for the failure to submit the report.

For companies where the manager is the only employee, it is necessary to submit reports in the prescribed form. If you ignore this point, then administrative measures may be applied to the organization.

A company is exempt from filing 6NDFL only if no payments were accrued or made to the director.

6-NDFL instructions for filling out establishes that zero reporting on this form exists. It needs to include:

- Title page.

- Section 1, where all indicators are 0.

- Section 2 - you can not complete it at all, or you can cross out all the provided columns.

If there were no payments

If during the period from January 1 to June 30, 2021, an organization or individual entrepreneur did not accrue or pay any income to individuals, did not withhold or transfer personal income tax to the budget, then there is no need to submit a 6-personal income tax calculation for the six months. This is explained by the fact that in such a situation, an organization or individual entrepreneur is not considered a tax agent. However, we note that an organization (or entrepreneur) has the right to submit a zero calculation to the Federal Tax Service. “Nulevka”, in essence, simply confirms that there is no information to be included in the reporting.

However, you need to be careful: if in the first half of the year there was at least one payment (for example, to a contractor), then the tax agent is required to submit quarterly 6-NDFL calculations for the entire 2021.

6-NDFL due dates in 2017-2018

The rules of tax law determine that this report is prepared quarterly, so its reporting periods are: the first quarter, the first half of the year, for nine months, and a year.

According to the 6-NDFL report, the deadlines for submission in 2021 remained the same as in the previous period. This form must be sent to the tax office no later than the final day of the month following the reporting one, and for the total for the year - before the first of April of the year following the reporting one. If the due date falls on a weekend or holiday, then the final date is the date of the next working day.

6-NDFL in 2021 due date, table:

| Tax reporting period | Final due date |

| For 2021 | 03.04.2018 |

| For the 1st quarter 2021 | 02.05.2017 |

| For the 1st half. 2021 | 31.07.2017 |

| In 9 months 2021 | 31.10.2017 |

| For 2021 | 02.04.2018 |

The dates for filing 6 personal income taxes in 2021 will be as follows, table:

| Tax reporting period | Final due date |

| For 2021 | 03.04.2018 |

| For the 1st quarter 2021 | 03.05.2018 |

| For the 1st half. 2021 | 31.07.2018 |

| In 9 months 2021 | 31.10.2018 |

| For 2021 | 01.04.2019 |

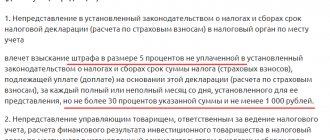

Sanctions for violations

For violations of the deadline and form for filing 6-NDFL, tax and administrative liability is provided. All sanctions are collected in the following table.

Table 1. Possible sanctions for violating the procedure and deadline for filing 6-NDFL

| Violation | Sanction | Regulatory Standard |

| Form not submitted | 1 thousand rubles for each month (full and part-time) | clause 1.2 art. 126 Tax Code of the Russian Federation |

| The calculation was not received by the Federal Tax Service within 10 days after the deadline for submission | Blocking the current account | clause 3.2 art. 76 Tax Code of the Russian Federation |

| Error in calculation (if identified by the tax authority before the agent corrected it) | 500 rubles | Art. 126.1 Tax Code of the Russian Federation |

| Failure to comply with the form (submission on paper instead of sending via TKS)* | 200 rubles | Art. 119.1 Tax Code of the Russian Federation |

| Submission deadline violation | 300-500 rubles per official | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation |

* Note. Tax agents submitting calculations in respect of 25 or more insured persons must submit it electronically using the TKS. Everyone else can choose the form at their discretion.

Company officials are held administratively liable. For example, a fine for late filing of 6-NDFL will be imposed on the chief accountant if his job description states that he is responsible for the timely filing of reports.

Where are the reports submitted?

6-NDFL instructions for filling out should be submitted by subjects:

- Legal entities - send reports in format 6 personal income tax to their location.

- Branches and representative offices at their location. The exception is large taxpayers, who have the right to choose to send a report to the location of the head office or a separate division.

- Entrepreneurs submit reports at the place of registration, that is, at their registration.

- Notaries, lawyers, citizens - at their place of residence.

Reporting methods

The law establishes the following methods of reporting:

- Submission of the 6-NDFL report on paper - the inspector is given two copies of the report, after which he checks it and puts an acceptance mark on one of them and transfers it to the representative of the tax agent. This method is available only for a business entity if it has no more than 25 employees.

- The 6-NDFL form is submitted via an electronic communication channel. To do this, you must have an electronic digital signature (EDS), an agreement with a special communications operator, and a specialized program.

Rules for filling out reports

When filling out the report, you must follow some rules:

- Tax amounts are always indicated only in whole numbers, without kopecks. If the tax has a fractional part greater than 50 kopecks, then an increase of 1 ruble occurs, if less, it is discarded.

- Income and expenses that were received in foreign currency are indicated on the basis of the exchange rate determined by the Central Bank on the dates of receipt and expenditure;

- If an error is made, then you cannot use a tool like “Stroke” or similar ones to correct it. You need to fill out this sheet again;

- The report is printed on only one side of the sheet. Double-sided printing is not permitted;

- If the report is stapled, then this must be done carefully in the very corner of the document, without damaging the sheets.

- If a digital value is written in a column, then the numbers must be entered starting from the leftmost cell. All remaining blanks must be crossed out at the end;

- If filling out the report by hand on a blank form, then this must be done with a pen with black, purple or blue ink.

You might be interested in:

Information on the average number of employees: sample filling, form

6-NDFL instructions for filling out

Let's look at the 6-NDFL example of filling out so that you know how to correctly fill out the declaration.

Sample of filling out the title page

First, you need to enter the TIN and KPP codes on the sheet. If the report is submitted by an entrepreneur, then he does not have a checkpoint code - in this case, the field must be completely crossed out. Then the sheet number is recorded in the general report stack. Usually this is 001.

Next you need to go to the field with the report number. If the form is submitted for the first time for this reporting period, then “000” is entered in the field, otherwise - the correction number in order.

In the “Submission period” field, enter the code corresponding to the period for which the report is submitted. It can be:

- 21 - rented out in the first quarter;

- 31 - rented out in six months;

- 33 - rented out in nine months;

- 34 – annual report is submitted.

The next field contains the number of the year for which the document is being compiled.

The next step is to record the Federal Tax Service code, as well as the location of the taxpayer. Here can be values:

- 120 - rented at the place of residence of the entrepreneur;

- 212 - for rent upon finding a company.

The full name of the company or full name is written in the large field without abbreviation. entrepreneur. If individual entrepreneur data is entered, then each part is written on a new line. All cells that are left blank must be crossed out.

The next step is to indicate the OKTMO code and phone number.

Nearby there are columns in which you need to enter the total number of sheets in the report, as well as how many documents are included as attachments.

At the bottom of the title page, information is written on the left:

- If the report is submitted personally by the taxpayer, put “1”. Next, indicate the full name of the director.

- If submitted by a representative, then put “1”, and information about the issued power of attorney is written in the empty field. A copy of the power of attorney is attached to the reporting.

Attention! If the form is filled out by an entrepreneur, then put dashes in the full name field, since this data is already indicated above.

Sample filling Section No. 1

bukhproffi

Important! This section contains information on a cumulative basis from the beginning of the current year to the end of the reporting period.

The page indicates the amount of income accrued since the beginning of the year for all employees, as well as the determined and withheld tax. If an employee had tax withheld at several rates at once during the year, then for each of them you need to draw up a separate sheet with section 1.

Attention! In a situation where several sheets with section 1 are compiled, the totals for lines 060-090 are entered only on the first one, and on all others they must be left blank.

6-NDFL instructions for filling out section 1:

- 010 - the rate at which the tax was withheld;

- 020 - the total amount of income that is taxed at the specified rate since the beginning of the year;

- 025 - the amount of dividend income from the beginning of the specified year;

- 030 - the amount of tax deductions provided to employees since the beginning of the year;

- 040 - the amount of tax, which is calculated at the specified rate from the beginning of the year;

- 045 - the amount of tax calculated on dividends from the beginning of the year;

- 050 - the amount of the transferred advance fixed tax payment;

- 060 - the total number of employees who for the current period have income taxed at the specified rate;

- 070 - total tax amount since the beginning of the year;

- 080 - the amount of income for which it was not possible to withhold tax;

- 090 - amount of taxes returned back.

Sample filling Section No. 2

This section contains amounts that relate only to the current period. You must enter the dates here:

- When the employee received income;

- When the tax was withheld from him;

- When it was listed.

Also, for each group of dates the amount of income and the amount of tax are recorded.

The formation in the lines must be entered as follows:

- 100 - the date when income was received from line 130 is recorded;

- 110 - the date when tax was withheld from this income;

- 120 - the date when the tax was transferred;

- 130 - amount of income for this date;

- 140 - the amount of tax that was withheld from the amount on the date recorded in line 110.

bukhproffi

Important! If on the same day employees received several types of income, which have different days with which taxes were withheld or sent, then each such income must be shown on a separate line. Otherwise, a merger can be performed.

One of the nuances of filling out the report is compliance with the actual deadlines for receiving income and withholding. So, if income was received in the last month of one reporting period, and the tax was transferred in the first month of the next, then in the first declaration it is shown only in Section 1, and in the second - only in Section 2.

You might be interested in:

Reporting to statistics: list of forms and deadlines for submission in 2018

Title page

When compiling 6-NDFL for the 4th quarter of 2021, at the top of the title page you need to note the TIN, KPP and the abbreviated name of the organization (if there is no abbreviation, the full name). If you need to submit a settlement in relation to individuals who received payments from a separate division, then fill in the “separate” checkpoint. Individual entrepreneurs, lawyers and notaries only need to indicate their TIN.

In the line “Adjustment number” of the year o, if the annual calculation for 2017 is submitted for the first time. If an updated calculation is submitted, then the corresponding adjustment number (“001”, “002”, etc.) is reflected.

In the line “Submission period (code)”, enter 34 - this means that you are submitting the annual 6-NDFL for 2021. In the “Tax period (year)” column, mark the year for which the annual calculation is submitted, namely 2021.

Indicate the code of the department of the Federal Tax Service to which the reporting is sent and the code in the line “At location (accounting).” This code will show why you are submitting 6-NDFL here. Most tax agents reflect the following codes:

- 212 – when submitting a settlement at the place of registration of the organization;

- 213 – when submitting the calculation at the place of registration of the organization as the largest taxpayer;

- 220 – when submitting a settlement at the location of a separate division of a Russian organization;

- 120 – at the place of residence of the individual entrepreneur;

- 320 – at the place of business of the entrepreneur on UTII or the patent taxation system.

In the line “I confirm the accuracy and completeness of the information specified in this calculation”, indicate:

- 1 – if the 6-NDFL calculation is signed by the tax agent himself or his legal representative (for example, an individual entrepreneur or the head of an organization). You also need to indicate the last name, first name, patronymic of the tax agent (his legal representative);

- 2 – if the 6-NDFL calculation is signed by a representative by proxy. In this case, you must indicate the last name, first name, patronymic of the person or the name of the representative organization.

Frequently asked questions when filling out the form

The procedure for reflecting compensation upon dismissal

The procedure for reflecting compensation upon dismissal in the report is similar to the reflection of salary calculations, however, these payments must be shown on different lines.

The procedure for filling out section 2 is as follows:

- The date of issuance of compensation is entered in lines 100 and 110;

- In line 120 - the next day of work;

- Lines 130 and 140 show the amount of compensation and withheld tax.

How to reflect bonuses

When reflecting a premium, it is necessary to focus on the order by which it was established. The final day of the month when such an order was issued is the day on which the income was received.

Section 2 is formatted as follows:

- Line 100 records the final day of the month when the order was drawn up;

- Line 110 - date of issue of the bonus to the employee;

- Line 120 is the date the tax was sent (usually the day after payment).

- Lines 130 and 140 - the amount of the premium and the tax withheld from it.

The procedure for recording sick leave

The document reflects only those sick leave for which personal income tax must be calculated. Otherwise, the control ratios in Section 1 will not converge. Maternity benefits are not included in the report!

Section 2 should be formatted as follows:

- The date of sending sick leave is recorded in lines 100 and 110;

- Line 120 shows the final day of the month when the payment was made. If the last day falls on a weekend, then the next next working day is entered.

- In line 130 - the amount of sick leave along with tax;

- Line 140 shows the tax amount.

How to reflect vacation pay in 6-NDFL

Vacation payments must be included in the report in the month in which they were issued to the employee. If vacation pay was accrued but not issued, then it is not included in the document.

In section 1, line 020 records all amounts of vacation pay that were issued this month along with personal income tax. In lines 040 and 070 - the tax amount.

Section 2 should be formatted as follows:

- In lines 100 and 110, the date of sending vacation pay is recorded;

- Line 120 shows the final day of the month when the payment was made. If the last day falls on a weekend, then the next working day is entered.

- In line 130 - the amount of vacation pay along with tax;

- Line 140 shows the tax amount.

All vacation pay paid on the same day can be combined into one entry.

bukhproffi

Important! If vacation pay is paid in the last month of the quarter, and the final day of the month (the day the tax is sent) falls on a weekend, then such payments must be included in the document in the next quarter.

How to take into account the salary issued next month

The organization is obliged to pay wages in two parts - an advance and the remaining part. The advance is issued in the same month for which it is accrued. Since the Tax Code does not recognize it as income (unless it is paid on the last day of the month), there is no need to show it in the report.

The amount of earnings is deposited according to the date of issue. This should be reflected as follows:

- The final day of the month for which the salary is calculated is entered in line 100;

- In line 110 - the date of payment of wages and withdrawal of taxes;

- In line 120 - the next business day when the tax is transferred.

- In line 130 - the full amount of the salary, taking into account the advance;

- Line 140 shows the tax amount.

How to take into account salaries issued in the same month

Since the Labor Code determines that the organization does not have the right to delay the payment of wages, and payment in advance does not violate the established rights of employees, it is allowed to issue the entire salary in the month of accrual. This is especially true at the end of the year, when some companies try to pay employees before the New Year holidays.

This output is reflected as follows:

- Line 100 records the ending day of the month;

- In line 110 - the day of payment of wages;

- In line 120 - the next working day (personal income tax payment);

- In lines 130 and 140 - the amounts of salary and tax.

Checking reports by the tax service

Tax inspectors check 6-NDFL calculations received from taxpayers in the following ways:

- on the basis of a desk audit - a mandatory procedure carried out by the tax authorities;

- by means of reconciliation with completed payments to the budget;

- in relation to 2-personal income tax.

Features of the desk audit are as follows:

- the check starts only after individual entrepreneurs or commercial organizations have submitted the 6-NDFL report;

- The duration of the inspection cannot be more than 3 months.

Desk audit is one of the types of tax control of the 6-NDFL declaration

Step-by-step actions of a tax officer:

- Verifies general information about the organization presented in the report form (whether the address, TIN, responsible person and other parameters are correct).

- The 6-NDFL report is filled out with a cumulative total, and therefore, when studying the data in the first and second sections, the inspector makes sure that later data is not less. If a discrepancy is found, the calculation was performed incorrectly.

- Verifies control ratios. With their help, the inspector identifies the compliance of the report with the information available at the Federal Tax Service.

- Recalculates some parameters in order to identify possible arithmetic errors made by the accountant when filling out form 6-NDFL.

- After submitting the annual report, the tax inspector again verifies the control ratios.

Tax authorities carefully check submitted returns for errors made by tax agents

When any errors are discovered during the audit, the taxpayer is notified of them. A request for explanations on existing issues or for data correction is sent to his address.

Control ratios used by tax authorities during audits:

- The date of submission of the calculation, recorded by the tax authority on the title page, is tracked. It must not be later established by law;

- the value in line 020 must be greater than or equal to the value in line 030;

- the value in line 040 must be greater than or equal to the value in line 050;

- the following equality must be observed: line 040 = line 010 * (line 020 - line 030).

When reconciling Form 6-NDFL with completed payments to the budget, the calculation data is compared with the KRSB (settlement card with the budget) for a specific taxpayer:

- first check: personal income tax paid since the beginning of the year according to the CRSB is greater than or equal to the difference between lines 070 and 090;

- second check: the tax payment date according to the KRSB is earlier or coincides with the data in line 120.

The annual report is checked using reconciliation with 2-NDFL. Based on the results of the audit, the amount that taxpayers paid to employees for their work activities must be correlated with the data reflected in the income certificates of individuals.