Bidding is one of the effective forms of concluding transactions, which guarantees maximum transparency and maximum benefit for both parties. This applies to both organizers and participants. In some cases, an agreement can only be concluded through participation in the procurement procedure through bidding, for example, if we are talking about buyers: municipal unitary enterprises, government agencies, state corporations.

Modern trading is conducted in a convenient electronic form on online electronic platforms. There is no need to leave the office to track trades and their results. The company's accountant first of all faces the question of how to take into account the amounts that ensure participation in an electronic trading procedure: an auction or competition.

What is the procedure to take part in an electronic auction held under Law No. 44-FZ?

On the basis of what documents is a bank guarantee reflected in accounting?

According to accounting standards, all transactions reflected in the accounts must be supported by documents. It does not matter whether balance sheet accounts are involved or off-balance sheet accounts.

Based on the norms of Ch. 23 of the Civil Code of the Russian Federation, the principal and the guarantor are not required to draw up a bank guarantee in a separate agreement. However, bankers do not trust the oral form of agreements and describe the nuances of relations with the principal in a separate document - an agreement on the issuance of a bank guarantee.

Such an agreement usually contains all the necessary data for which the beneficiary can make entries in his accounting (guarantee amount, validity period, etc.).

The guarantee can also be issued in electronic form. It is drawn up in the form of an electronic document, which has the same legal force as its paper counterpart. Documents are signed with an electronic signature, which gives the electronic document legal force. If necessary, a paper version of the electronic guarantee can be requested from the bank.

“Not every bank can act as a guarantor to the tax office” will introduce you to the tax nuances of accounting for a bank guarantee .

We will describe below how a bank guarantee is reflected in accounting.

We study documents and legal grounds

There are three parties involved in the transaction: the supplier, the customer and the bank. Their actions are regulated by the following standards:

- Supplier and customer - Chapter 23 of the Civil Code of the Russian Federation (paragraph 6, Article 168, 169, 374–379, Article 429 of the Civil Code of the Russian Federation), the law on the federal contract system (Article 44, 96 44-FZ).

- Credit organization - Federal Law on Banks No. 395-1 of December 2, 1990 (clause 8, part 1, article 5 of Federal Law No. 395-1).

There are discrepancies in the standards. The provision for the provision of a guarantee should be included only in cases where there is initially reason to believe that the supplier will not fulfill the obligation (determination of the RF Armed Forces in case No. 305-ES16-14210 of January 30, 2017). In government procurement, a different rule applies: the condition for providing a bank guarantee must always be included, it is mandatory (Article 96 44-FZ). Customers include a requirement for warranty obligations in the procurement documentation (descriptive part, draft contract, notice) or an invitation to participate in closed procedures (Part 1 of Article 96 44-FZ). The form of security is specified in Part 3 of Art. 96 44-FZ.

IMPORTANT!

The conditions for issuance, requirements for the formation and procedure for maintaining a register of bank guarantees are prescribed in Art. 45 44-FZ. The Contractor has the right to provide a guarantee from the bank to secure applications for participation in auctions and competitions (Parts 3, 4, Article 44 44-FZ). Insurance is sent not only in the form of an official document from a credit institution, but also in the form of funds transferred to the customer’s current (personal) account.

Guarantee obligations will be needed to secure contracts for the purchase of fixed assets and inventories, the issuance of loans, advances and loans, guarantees for the reimbursement of advances. And these are not all possible situations. The order of reflection in accounting directly depends on the basis on which the guarantee document was issued. The issuance and use of the guarantee is recorded not only by the customer-beneficiary, but also by the supplier-principal.

The fact of receipt/issuance of a bank guarantee in the records of the principal and beneficiary

To account for the cost of the bank guarantee, the beneficiary has an off-balance sheet account 008 “Securities for obligations and payments received.” The received collateral is written off off-balance sheet as the debt is repaid. The beneficiary must keep analytical records for each security received.

There are two positions regarding the reflection of a bank guarantee by the principal in accounting:

Position 1: the principal does not reflect the bank guarantee in his accounting.

Supporters of this position explain their point of view by the fact that the principal of the bank guarantee:

- receives not for himself, but for the beneficiary (his creditor);

- does not issue a guarantee (it is issued by the bank).

Consequently, there are no grounds for the principal to use off-balance sheet accounts 008 “Securities for obligations and payments received” and 009 “Securities for obligations and payments issued” to account for the bank guarantee.

Position 2: the principal needs to reflect the bank guarantee on the balance sheet.

This approach allows:

- take into account the fact of a change of creditor if the principal fails to fulfill an obligation (when the guarantor becomes a creditor instead of a beneficiary);

- reflect additional sanctions established by agreement with the guarantor (for example, special penalties for late fulfillment of obligations to the guarantor).

The accuracy of the assessment by external users of the financial statements of the state of the principal's accounts payable depends on how reliable the information about the bank guarantee reflected on the off-balance sheet accounts is. Reflection of a bank guarantee in the accounting of the principal is of particular importance if the transaction is large and subject to disclosure in the financial statements.

You will find the criteria for a major transaction with explanations in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

In accordance with paragraph 1 of Art. 96 of Law No. 44-FZ in the notice of procurement, procurement documentation, draft contract, invitation to participate in the selection of a supplier (contractor, performer) in a closed way, the customer must establish a requirement to ensure the execution of the contract, with the exception of certain cases. What are the methods of this provision? In what order is security for the performance of a contract provided and how are these transactions reflected in accounting? Can the customer withhold the amount of security previously provided by the contractor against the unreturned advance payment under the contract? You will find answers to these and other questions in the article.

According to clauses 4, 5 of Art. 96 of Law No. 44-FZ, a contract is concluded only after the procurement participant with whom the contract is concluded provides security for the execution of the contract. If a participant fails to provide security within the period specified for concluding the contract, such participant is considered to have evaded concluding the contract.

Cases in which contract enforcement is not necessary

Despite the customer’s obligation to establish in the contract documentation requirements for ensuring the execution of the contract, clause 2 of Art. 96 of Law No. 44-FZ describes certain cases in which the customer has the right not to do this. For example, procurement cases:

1) by conducting a request for quotations, if the initial (maximum) price of the contract (hereinafter referred to as NMCC) does not exceed 500,000 rubles;

2) by conducting a request for quotation, if legal acts do not provide for the customer’s obligation to establish a requirement to ensure the execution of the contract, in particular:

- when concluding a contract for the supply of sports equipment and equipment, sports equipment necessary for the preparation of sports teams of the Russian Federation in Olympic and Paralympic sports, as well as for the participation of sports teams of the Russian Federation in the Olympic and Paralympic Games;

- when a federal executive body concludes, in accordance with the rules established by the Government of the Russian Federation, a contract with a foreign organization for the treatment of a citizen of the Russian Federation outside the territory of the Russian Federation;

- when purchasing medications that are necessary to prescribe to a patient for medical reasons (individual intolerance, for health reasons) by decision of the medical commission, which is recorded in the patient’s medical documents and the journal of the medical commission;

3) from a single supplier (contractor, performer), in particular:

- when purchasing goods, work or services that fall within the scope of activities of natural monopoly entities, as well as central depository services;

- when purchasing goods, work or services for an amount not exceeding 100,000 rubles;

- when providing services for water supply, sewerage, heat supply, gas supply (except for services for the sale of liquefied gas), for connection (attachment) to engineering support networks;

- when concluding a contract for the provision of services related to sending an employee on a business trip;

- when concluding an energy supply agreement or an electricity purchase and sale agreement with a guaranteeing supplier of electric energy;

- when renting a non-residential building, structure, structure, non-residential premises to meet federal needs, the needs of a constituent entity of the Russian Federation, municipal needs.

In addition to the cases listed in paragraph 2 of Art. 96 of Law No. 44-FZ, in 2015 the customer also has the right not to establish requirements for ensuring the execution of the contract in situations provided for by Decree of the Government of the Russian Federation of March 6, 2015 No. 199, which includes cases:

- holding competitions, electronic auctions, requests for proposals, if procurement participants are only small businesses and socially oriented non-profit organizations;

- when the draft contract contains a provision for banking support of the contract;

- when the draft contract contains a condition on the transfer of advance payments to the supplier (contractor, performer) to an account opened by a territorial body of the Federal Treasury or a financial body of a constituent entity of the Russian Federation, a municipal entity in the institutions of the Central Bank of the Russian Federation;

- when the draft contract involves the payment of advance payments in the amount of no more than 15% of the contract price when purchasing to meet federal needs or in another amount established by the highest executive bodies of state power of the constituent entities of the Russian Federation, local administrations, as well as settlement by the customer with the supplier (contractor, performer) with payment in the amount of no more than 70% of the price of each delivery of goods (stage of work, provision of services) to meet federal needs or in another amount established by the highest executive bodies of state power of the constituent entities of the Russian Federation, local administrations, and full payment is made only after the customer has accepted all goods supplied under the contract, work performed, services provided and full fulfillment by the supplier (contractor, performer) of other obligations stipulated by the contract (except for warranty obligations);

- when the procurement participant is a budgetary or autonomous institution and they are offered a contract price reduced by no more than 25% of the NMCC.

Methods of securing a contract

The execution of the contract can be ensured:

- provision of a bank guarantee issued by the bank and meeting the requirements of Art. 45 of Law No. 44-FZ;

- by depositing funds into the account specified by the customer, which, in accordance with the legislation of the Russian Federation, accounts for transactions with funds received by the customer.

The method of ensuring the execution of the contract is determined independently by the procurement participant with whom the contract is concluded (clause 3 of Article 96 of Law No. 44-FZ).

The Ministry of Economic Development in Letter No. D28i-1893 dated September 19, 2014 clarifies that the execution of the contract can be ensured by one of the above methods: by providing a bank guarantee or by depositing funds. At the same time, the possibility of providing several bank guarantees and their combination with the provision of funds is not provided for by Law No. 44-FZ. In addition, the provisions of this law do not provide for the possibility of a third party to provide security for the execution of a contract instead of the procurement participant with whom the contract is concluded.

The funds contributed as security for the execution of the contract must be returned by the customer to the supplier (contractor, performer) who performed such a contract. The return period is a mandatory condition included in the contract (clause 27, article 34 of Law No. 44-FZ). Since the main condition for the execution of a contract is the fulfillment of all obligations under it, the return of security by the customer is carried out, as a rule, after signing certificates of completed work upon the fulfillment of obligations by the supplier (contractor, performer).

A bank guarantee is understood as a written obligation of the bank (guarantor) (which it gives at the request of the procurement participant) to pay the customer, based on the terms of the said obligation, a sum of money upon submission by the customer of a written request for its payment (Article 368 of the Civil Code of the Russian Federation).

As we noted above, a bank guarantee issued by a bank to a procurement participant for the purpose of ensuring the execution of a contract must comply with the provisions of Art. 45 of Law No. 44-FZ, that is, it must:

- issued by a bank included in the list of banks that meet the requirements for accepting bank guarantees for tax purposes;

- be irrevocable;

- be included in the register of bank guarantees;

- contain:

- the amount of the bank guarantee payable by the guarantor to the customer in specified cases;

- obligations of the procurement participant, the proper fulfillment of which is ensured by a bank guarantee;

- the bank's obligation to pay the customer a penalty in the amount of 0.1% of the amount payable for each day of delay;

- the condition according to which the fulfillment of obligations under the bank guarantee is the actual receipt of funds into the account in which, according to the legislation of the Russian Federation, transactions with funds received by the customer are taken into account;

- the validity period of the bank guarantee, which must exceed the validity period of the contract by at least one month;

- a suspensive condition providing for the conclusion of an agreement for the provision of a bank guarantee for the obligations of the procurement participant arising from the contract at its conclusion, in the event of a bank guarantee being provided as security for the execution of the contract;

- a list of documents determined by the Government of the Russian Federation that the customer submits to the bank simultaneously with the requirement to pay the amount of money under the bank guarantee. Currently, such a list is approved by Decree of the Government of the Russian Federation dated November 8, 2013 No. 1005 “On bank guarantees used for the purposes of the Federal Law “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” (hereinafter referred to as Resolution No. 1005 ). The same resolution established additional requirements for a bank guarantee.

Collateral amount

In accordance with paragraph 6 of Art. 96 of Law No. 44-FZ, the amount of security for the execution of a contract must be:

- from 5 to 30% of the NMTsK specified in the notice of purchase;

- from 10 to 30% of the NMCC, if the NMCC exceeds 50 million rubles. The amount of security must be no less than the amount of the advance (if the contract requires payment of an advance);

- the amount of the advance, if the advance exceeds 30% of the NMCC.

During the execution of the contract, the supplier (contractor, performer) has the right to provide the customer with security for the performance of the contract, reduced by the amount of fulfilled obligations stipulated by the contract, in exchange for the previously provided security for the performance of the contract, and the method of securing the performance of the contract may be changed (clause 7 of Article 96 of Law No. 44‑FZ).

Accounting

Let's consider the rules for reflecting in accounting the amounts provided by procurement participants as security for the execution of the contract.

The amount of funds contributed by the procurement participant. As we noted above, on the basis of Art. 96 of Law No. 44-FZ, funds provided by procurement participants as security for participation in the execution of the contract are credited to the account specified by the customer in the procurement documentation and which, in accordance with the legislation of the Russian Federation, accounts for transactions with funds received by the customer. When the supplier (performer) fulfills the obligations stipulated by the contract, the funds contributed as security for the execution of the contract must be returned to the procurement participant with whom the contract was concluded. In other words, the said funds are at the customer’s disposal temporarily.

Funds that, upon the occurrence of certain conditions, are subject to return to the owner, refer to funds at the temporary disposal of the customer (institution) (Letter of the Ministry of Finance of the Russian Federation dated October 8, 2014 No. 02‑07‑07/50609). According to section V of Instructions 65n, transactions leading to an increase (decrease) in funds and not related to the income (expenses) of institutions, including the receipt (disposal) of funds at the temporary disposal of an autonomous (budgetary) institution, are reflected using Article 510 “Receipts to accounts budgets" (Article 610 "Disposal from budget accounts") of KOSGU.

Thus, funds received as security for the execution of a contract are accounted for in accounting as funds received for temporary disposal, indicating in the 19th – 23rd digits the account number of code 3 “Funds in temporary disposal” (clause 21 of the Instructions No. 157n).

In accordance with paragraph 267 of the said instructions, account 304 01 000 “Settlements for funds received at temporary disposal” is intended to account for amounts received at the temporary disposal of the institution and upon the occurrence of certain conditions subject to return. Accounting for transactions on this account is kept in the journal of transactions with non-cash funds (clause 269 of Instruction No. 157n).

The Letter of the Ministry of Finance of the Russian Federation dated June 27, 2014 No. 02‑07‑07/31342 clarifies that funds received as security for the execution of a contract cannot be accounted for in off-balance sheet account 10 “Security for the fulfillment of obligations.”

The sports school (budgetary institution) established a requirement in the procurement documentation to ensure the execution of the contract. As such security, the contractor with whom it is planned to conclude a contract transferred funds in the amount of 200,000 rubles to the customer’s account. After completing the work and signing the relevant act, the customer returned the security amount to the contractor.

In the accounting records of a budgetary institution, transactions will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The funds received as security for the execution of the contract have been transferred to the personal account of the institution | 3 201 11 510 | 3 304 01 730 | 200 000 |

| The funds received as security for the execution of the contract were returned to the contractor | 3 304 01 830 | 3 201 11 610 | 200 000 |

The amount of the bank guarantee provided. Bank guarantees provided to secure participation in a competition (closed auction), as well as to secure the execution of a contract, by virtue of clause 351 of Instruction 157n, are subject to accounting in off-balance sheet account 10 “Security for the fulfillment of obligations.”

According to Letter of the Ministry of Finance of the Russian Federation dated June 27, 2014 No. 02-07-07/31342, security for an obligation in the form of a bank guarantee is reflected in this account on the date of provision of this guarantee. The disposal of a bank guarantee from accounting on off-balance sheet account 10 (reflected in the account with a minus sign) is reflected by the date of termination of the obligation to secure the said guarantee (the date of fulfillment by the supplier (performer) of the obligations secured by the guarantee, or the date of fulfillment by the bank of the customer’s demands for payment of a sum of money in connection with the violation by the supplier (performer) of the obligation to secure which the guarantee was issued).

The autonomous sports institution (customer) has established in the procurement documentation a requirement to ensure the execution of the contract. The supplier with whom it is planned to conclude a contract has chosen to provide a bank guarantee as security. The amount of the bank guarantee is RUB 170,000. The contract period is two months. The bank guarantee was issued by the supplier's bank for three months.

In the accounting records of an autonomous institution, the amount of the bank guarantee will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The amount of the bank guarantee accepted by the customer as security for the execution of the contract has been received | 10 | – | 170 000 |

| The amount of the bank guarantee was written off as of the date the supplier fulfilled the contractual obligations to secure which such a guarantee was issued | – | 10 | 170 000 |

Withholding the security amount against the unreturned advance. Ensuring the execution of a contract in its meaning is a guarantee of the fulfillment by the supplier (performer) of obligations under the contract. In addition, the specified security guarantees the customer the return of the previously transferred advance, for example, in the event of termination of the contract.

The question arises: can the customer withhold the amount of security provided by the supplier (performer) against the unreturned advance payment?

Explanations on this matter are given in the Letter of the Ministry of Finance of the Russian Federation dated December 25, 2014 No. 02-02-04/67438 and the Federal Treasury No. 42-7.4-05/5.1-805 “On the use of contract performance security provided by the supplier (contractor, performer) in connection with failure to fulfill obligations related to the return of the advance payment" (hereinafter referred to as the Letter dated December 25, 2014). It states that if, upon termination of the contract, the contractor (supplier) violates the obligations to return the advance payment, to secure the fulfillment of which funds or a bank guarantee are provided, the said security may be retained by the customer under the terms of the contract or a demand for payment of funds is sent in relation to the specified security according to the Civil Code of the Russian Federation.

If the customer under the contract is a budgetary (autonomous) institution, the amounts of the retained collateral are subject to transfer to the appropriate account in which transactions with the institution’s funds are recorded and from which the obligations under the contract were paid (advance transfer), and used to fulfill the obligation with clarification of the financial plan. economic activity of a state (municipal) institution. In this case, the amounts of retained collateral received:

- during the financial year in which the obligations under the contract were paid - are recorded in the corresponding personal account of the state (municipal) institution as a restoration of cash expenses;

- after the end of the financial year, if the source of financial support under the contract was a subsidy for financial support for the fulfillment of a state (municipal) task, they are taken into account in the personal account of a budgetary (autonomous) institution and are reflected in the plan of financial and economic activities of the institution as amounts of receivables from previous years that arose in connection with the violation of obligations related to the execution of the contract, under Article 130 “Income from the provision of paid services (work)” of the KOSGU.

If the customer under the contract is the recipient of budget funds, the amounts of the withheld security are subject to transfer to the budget revenue of the public legal entity to meet the needs of which the state (municipal) contract was concluded. These revenues are reflected according to the income code 000 1 1300 130 “Revenue from compensation of state expenses” using the corresponding codes of subarticles, elements and subtypes of budget income provided for by Instructions No. 65n.

In addition, the Letter dated December 25, 2014 contains the correspondence of invoices regarding the withholding of the amount of the provided security against the unreturned advance. Let's look at how to use it using an example.

A budgetary institution of physical culture and sports (customer), using a subsidy for the implementation of a state task, entered into a contract for the installation of electricity meters in the amount of 110,000 rubles. The contractor transferred funds in the amount of the advance payment (40,000 rubles) to the customer’s account as security for the execution of the contract. The contract was then terminated. Due to the fact that the contractor did not return the amount of the transferred advance, the amount of the received security was withheld against him.

These transactions will be reflected in the accounting of a budgetary institution as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Funds have been credited to the institution’s personal account as security for the execution of the contract | 3 201 11 510 | 3 304 01 730 | 40 000 |

| Advance paid to the contractor | 4 206 26 560 | 4 201 11 610 | 40 000 |

| A demand was made to the contractor for the return of the advance upon termination of a previously concluded contract | 4 209 30 560 | 4 206 26 660 | 40 000 |

| The advance was withheld from the cash deposit (deposit) provided to secure the execution of the contract in the amount of satisfaction of the pledge holder's claim | 3 304 01 830 | 3 304 06 730 | 40 000 |

| Accounts receivable were reduced in the amount of amounts withheld from the amounts of the cash deposit (deposit) provided to secure the execution of the contract | 4 304 06 830 | 4 209 30 660 | 40 000 |

| The withheld amount of security for the execution of the contract was transferred to account for the unreturned advance from the account intended for accounting for funds in temporary disposal to the personal account | 3 304 06 830 | 3 201 11 610 | 40 000 |

| 4 201 11 510 | 4 304 06 730 |

When presenting demands to the contractor for the return of the advance upon termination of a previously concluded contract, the customer also has the right to present an additional demand for the payment of interest for the use of someone else’s funds. This operation will be reflected in the accounting records as a debit to account 2,209 40,560 and a credit to account 2,401 10,140.

Summarizing the above, we note the following main points:

- except in certain cases, establishing in the contract documentation a requirement that the procurement participant with whom it is planned to conclude a contract provide security for the execution of the contract is the responsibility of the customer;

- the contract is concluded only after the procurement participant provides security for the performance of the contract;

- execution of the contract can be ensured by providing a bank guarantee or depositing funds into the account specified by the customer;

- funds received as security for the execution of the contract are accounted for in accounting on account 3,304,01,000 as funds received for temporary disposal;

the amount of the provided bank guarantee is subject to reflection in off-balance sheet account 10.

=============================================================================

For questions about setting up accounting and tax accounting, preparing and submitting reports to the Federal Tax Service, extra-budgetary funds and statistical bodies, restoring accounting records and accounting support, please contact us:

Consulting website: YOUR ACCOUNTANT E-mail: YOUR ACCOUNTANT Phone: +7 909 509 1448 Fax: +7 495 943 1448

Entries in the accounting of the beneficiary and the principal in case of failure to fulfill the obligation

The principal does not always manage to fulfill his obligations to the beneficiary in a timely manner. In this case, the beneficiary may demand in writing from the guarantor payment of the amount not received under the agreement.

After receiving documents from the beneficiary and considering his request for compliance with the terms of the issued guarantee, the guarantor makes a decision to pay the principal’s debt (Articles 374-375 of the Civil Code of the Russian Federation).

After the claim is accepted by the guarantor, the beneficiary makes the following entries in the accounting records:

The bank informs the principal:

- about termination of the warranty;

- the need to reimburse the amount paid by the bank to the beneficiary under the guarantee.

Having received a notification from the bank, the principal reflects the bank's recourse claims in his accounting. We will show you with an example what transactions are used to pay for a bank guarantee.

Greenwich LLC issued a bank guarantee for a period of 1 month, but during this period it failed to pay the seller Corrida LLC the amount of 12,378,533 rubles stipulated in the purchase and sale agreement. The bank, which paid off this obligation for Greenwich LLC, demanded that it reimburse the amount paid.

Two entries will appear in the principal’s accounting:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 60 | 76 | 12 378 533 | The bank's recourse claim was recognized |

| 76 | 51 | 12 378 533 | The obligation to the bank has been repaid |

Is it possible to avoid the need to make a contract security posting?

Issue a bank guarantee, because this financial and credit instrument not only saves money and time, but also significantly simplifies the mechanism for providing security for both applications and the fulfillment of contractual obligations.

We offer you:

- shortened processing time for applications – only 1 hour;

- more than 50 partner banks that are ready to provide you with a guarantee;

- the most favorable conditions and low rates;

- various amounts for which a certificate can be issued;

- comfortable and competent service;

- the work of exclusively qualified specialists;

- the opportunity to learn all the intricacies of participating in tenders at our courses, seminars and training sessions;

- eliminate the need to make entries to secure the contract.

Your personal manager will tell you even more about your capabilities!

Do you urgently need money to secure an application or secure a contract?

Submit your application and you will have the money tomorrow!

Send a request

Example of transactions with a beneficiary: receipt and write-off of a guarantee

Let's look at an example that helps the beneficiary navigate the main entries in accounting.

Trading LLC purchased a batch of goods worth RUB 1,693,461. on deferred payment terms. The seller PJSC Delivery requested a bank guarantee as security for the payment obligation.

Postings to the beneficiary (PJSC "Supply") after receipt of the guarantee and delivery of the goods:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 008 | — | 1 693 461 | The received bank guarantee is reflected on the balance sheet |

| 62 | 90 | 1 693 461 | The goods were shipped to the buyer LLC Trading |

The buyer did not pay for the goods within the period specified in the contract. PJSC "Supply" sent a written message to the bank about the need to pay the principal's debt under the bank guarantee, attaching the necessary documents.

After reviewing the documents and checking them, the bank transferred the money under the guarantee. The following entries were made in the accounting of PJSC Supply:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 51 | 76 | 1 693 461 | Received money from the bank under a guarantee |

| 76 | 62 | 1 693 461 | The debt of Trading LLC has been repaid |

| — | 008 | 1 693 461 | Payment security written off from off-balance sheet accounting |

If the buyer repaid the debt for the goods on time, there would be significantly fewer accounting entries in the beneficiary's accounting. Everything would be limited to reflecting and writing off the received collateral in an off-balance sheet account.

Methods of securing a contract

The execution of the contract can be ensured:

- provision of a bank guarantee issued by the bank and meeting the requirements of Art. 45 of Law No. 44-FZ;

- by depositing funds into the account specified by the customer, which, in accordance with the legislation of the Russian Federation, accounts for transactions with funds received by the customer.

The method of ensuring the execution of the contract is determined independently by the procurement participant with whom the contract is concluded (clause 3 of Article 96 of Law No. 44-FZ).

The Ministry of Economic Development in Letter No. D28i-1893 dated September 19, 2014 clarifies that the execution of the contract can be ensured by one of the above methods: by providing a bank guarantee or by depositing funds. At the same time, the possibility of providing several bank guarantees and their combination with the provision of funds is not provided for by Law No. 44-FZ. In addition, the provisions of this law do not provide for the possibility of a third party to provide security for the execution of a contract instead of the procurement participant with whom the contract is concluded.

The funds contributed as security for the execution of the contract must be returned by the customer to the supplier (contractor, performer) who performed such a contract. The return period is a mandatory condition included in the contract (clause 27, article 34 of Law No. 44-FZ). Since the main condition for the execution of a contract is the fulfillment of all obligations under it, the return of security by the customer is carried out, as a rule, after signing certificates of completed work upon the fulfillment of obligations by the supplier (contractor, performer).

A bank guarantee is understood as a written obligation of the bank (guarantor) (which it gives at the request of the procurement participant) to pay the customer, based on the terms of the said obligation, a sum of money upon submission by the customer of a written request for its payment (Article 368 of the Civil Code of the Russian Federation).

As we noted above, a bank guarantee issued by a bank to a procurement participant for the purpose of ensuring the execution of a contract must comply with the provisions of Art. 45 of Law No. 44-FZ, that is, it must:

- issued by a bank included in the list of banks that meet the requirements for accepting bank guarantees for tax purposes;

- be irrevocable;

- be included in the register of bank guarantees;

- contain:

- the amount of the bank guarantee payable by the guarantor to the customer in specified cases;

- obligations of the procurement participant, the proper fulfillment of which is ensured by a bank guarantee;

- the bank's obligation to pay the customer a penalty in the amount of 0.1% of the amount payable for each day of delay;

- the condition according to which the fulfillment of obligations under the bank guarantee is the actual receipt of funds into the account in which, according to the legislation of the Russian Federation, transactions with funds received by the customer are taken into account;

- the validity period of the bank guarantee, which must exceed the validity period of the contract by at least one month;

- a suspensive condition providing for the conclusion of an agreement for the provision of a bank guarantee for the obligations of the procurement participant arising from the contract at its conclusion, in the event of a bank guarantee being provided as security for the execution of the contract;

- a list of documents determined by the Government of the Russian Federation that the customer submits to the bank simultaneously with the requirement to pay the amount of money under the bank guarantee. Currently, such a list is approved by Decree of the Government of the Russian Federation dated November 8, 2013 No. 1005 “On bank guarantees used for the purposes of the Federal Law “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” (hereinafter referred to as Resolution No. 1005 ). The same resolution established additional requirements for a bank guarantee.

What affects the accounting treatment of payment of a fee for issuing a guarantee?

Issuing a guarantee is a paid service. The credit institution's fee for issuing a guarantee can be set in different ways:

- in a fixed amount;

- as a percentage of the guarantee amount;

- in a different way.

In addition, the guarantor may establish additional conditions for paying the commission for issuing a bank guarantee. He may require the principal to pay the commission in one lump sum in full or in installments during the validity period of the guarantee.

All this affects not only the accounting procedure for this type of expense, but also requires the principal to additionally elaborate his accounting policy (we will talk about this in subsequent sections).

Find out what to consider when drawing up your accounting policies in 2021 in this publication .

Next, we will talk about the nuances of accounting for the commission for issuing a bank guarantee and the entries used to reflect this type of expense.

advokat-martov.ru

Home » For entrepreneurs » KBK ensuring the execution of a contract in 2021 KBK ensuring the execution of a contract in 2021 Return to Contract execution 2021 Merchants, organizations, to transfer funds to various authorities use not only standard details, such as the organization’s current account, personal account and etc., but also use specialized codes—KBK. This applies to those classification codes that are routinely used by employers and taxpayers to pay contributions, fines, and penalties. In addition to the main KBK codes, which can be downloaded and checked in the directory, there are codes for certain types of services and works.

We recommend reading: Returning interior doors to the seller

Such codes are used not only by taxpayers, but by individuals who are neither policyholders nor taxpayers.

These include KBK 00000000000000000510. The account description specifies that it is intended to account for: property received by an institution for use that is not the subject of a lease (treasury property and other property received free of charge as a contribution of the owner (founder); property, which, by decision of the owner (founder), is used by the institution (authority) when performing the functions (powers) assigned to it, without securing the right of operational management; property received for free use due to the obligation to provide (receive) it, arising in accordance with the law; objects for which capital investments have been formed, but the right to operational management has not been obtained.

Two types of entries to reflect the commission on a bank guarantee when purchasing property

The supplier of expensive equipment or the seller of the building may make it a mandatory condition when concluding an agreement with the buyer that there is a bank guarantee. In the buyer's accounting, the guarantor's remuneration will be recognized as an expense. However, the accounting for this expense will be different depending on the moment at which it was made: before the purchased property is registered or after it. In each case, a different set of accounting entries is applied to reflect the commission for issuing a bank guarantee.

- The guarantor's remuneration was paid before the acquired property was reflected in the accounting accounts.

What entries are used to record a bank guarantee from the principal in such a situation? The amount of remuneration to the guarantor is included in the cost of the acquired asset, since this expense is directly related to its acquisition (clause 6 of PBU 5/01 “Accounting for inventories”, clause 8 of PBU 6/01 “Accounting for fixed assets”).

For such a case, the following set of transactions is used:

The specified accounting scheme reflects the transactions for payment of the bank guarantee and for its reflection in accounts payable until the transfer of money by the principal.

PJSC "Modern Technologies" plans to purchase an office building worth RUB 150,364,199. from Real Estate+ LLC. As security for obligations, the buyer provided the seller with a bank guarantee.

Warranty conditions:

- remuneration to the bank (4% of the transaction amount) - 6,014,568 rubles. (RUB 150,364,199 × 4%);

- Warranty period - 1 month;

- The procedure for paying the commission is the entire amount at a time.

PJSC Modern Technologies paid the commission and purchased the property from the seller. The following entries were made in accounting:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 76 | 51 | 6 014 568 | Commission transferred to the guarantor bank |

| 08 | 76 | 6 014 568 | The amount of remuneration to the guarantor is included in the cost of the building |

| 08 | 60 | 150 364 199 | The cost of the building is reflected in non-current assets |

| 01 | 08 | 156 378 767 (150 364 199 + 6 014 568) | The building is included in the principal's fixed assets |

We talk about the nuances of tax accounting for a bank guarantee in this article.

- The guarantee is issued after the value of the asset has been generated.

Here, accounting standards do not allow the amount of the guarantor's remuneration to be taken into account in the initial cost of the asset. Once the accounting value of the property has been formed, it is not allowed to change it.

In such a situation, other expenses are recognized and postings are made:

The situation is dangerous if the remuneration to the guarantor, paid before the initial cost of the asset is formed, is taken into account as part of other expenses. This will cause a distortion in the amount of property tax, which is calculated according to accounting data. Considering that from 2021 the value of movable property is excluded from the tax base, the unlawful write-off of remuneration to the guarantor as part of other expenses will distort the property tax base if the buyer purchased real estate.

Cases in which contract enforcement is not necessary

Despite the customer’s obligation to establish in the contract documentation requirements for ensuring the execution of the contract, clause 2 of Art. 96 of Law No. 44-FZ describes certain cases in which the customer has the right not to do this. For example, procurement cases:

1) by conducting a request for quotations, if the initial (maximum) price of the contract (hereinafter referred to as NMCC) does not exceed 500,000 rubles;

2) by conducting a request for quotation, if legal acts do not provide for the customer’s obligation to establish a requirement to ensure the execution of the contract, in particular:

- when concluding a contract for the supply of sports equipment and equipment, sports equipment necessary for the preparation of sports teams of the Russian Federation in Olympic and Paralympic sports, as well as for the participation of sports teams of the Russian Federation in the Olympic and Paralympic Games;

- when a federal executive body concludes, in accordance with the rules established by the Government of the Russian Federation, a contract with a foreign organization for the treatment of a citizen of the Russian Federation outside the territory of the Russian Federation;

- when purchasing medications that are necessary to prescribe to a patient for medical reasons (individual intolerance, for health reasons) by decision of the medical commission, which is recorded in the patient’s medical documents and the journal of the medical commission;

3) from a single supplier (contractor, performer), in particular:

- when purchasing goods, work or services that fall within the scope of activities of natural monopoly entities, as well as central depository services;

- when purchasing goods, work or services for an amount not exceeding 100,000 rubles;

- when providing services for water supply, sewerage, heat supply, gas supply (except for services for the sale of liquefied gas), for connection (attachment) to engineering support networks;

- when concluding a contract for the provision of services related to sending an employee on a business trip;

- when concluding an energy supply agreement or an electricity purchase and sale agreement with a guaranteeing supplier of electric energy;

- when renting a non-residential building, structure, structure, non-residential premises to meet federal needs, the needs of a constituent entity of the Russian Federation, municipal needs.

In addition to the cases listed in paragraph 2 of Art. 96 of Law No. 44-FZ, in 2015 the customer also has the right not to establish requirements for ensuring the execution of the contract in situations provided for by Decree of the Government of the Russian Federation of March 6, 2015 No. 199, which includes cases:

- holding competitions, electronic auctions, requests for proposals, if procurement participants are only small businesses and socially oriented non-profit organizations;

- when the draft contract contains a provision for banking support of the contract;

- when the draft contract contains a condition on the transfer of advance payments to the supplier (contractor, performer) to an account opened by a territorial body of the Federal Treasury or a financial body of a constituent entity of the Russian Federation, a municipal entity in the institutions of the Central Bank of the Russian Federation;

- when the draft contract involves the payment of advance payments in the amount of no more than 15% of the contract price when purchasing to meet federal needs or in another amount established by the highest executive bodies of state power of the constituent entities of the Russian Federation, local administrations, as well as settlement by the customer with the supplier (contractor, performer) with payment in the amount of no more than 70% of the price of each delivery of goods (stage of work, provision of services) to meet federal needs or in another amount established by the highest executive bodies of state power of the constituent entities of the Russian Federation, local administrations, and full payment is made only after the customer has accepted all goods supplied under the contract, work performed, services provided and full fulfillment by the supplier (contractor, performer) of other obligations stipulated by the contract (except for warranty obligations);

- when the procurement participant is a budgetary or autonomous institution and they are offered a contract price reduced by no more than 25% of the NMCC.

Features of accounting policies and entries when reflecting remuneration to the guarantor under a loan agreement

The borrower may incur expenses for paying remuneration to the guarantor when issuing a guarantee is one of the conditions for receiving borrowed funds. In such circumstances, it is necessary to take into account the norms of PBU 15/2008 “Accounting for expenses on loans and credits”:

- according to clause 7, borrowing costs are classified as other expenses;

- According to clause 8, it is allowed to recognize additional expenses on loans evenly as part of other expenses during the period of validity of the loan agreement.

How the borrower will write off additional expenses on loans, he must indicate in his accounting policy:

What postings are used in accounting in this case, see the figure below:

Whatever method of recording loan costs in the form of remuneration to the guarantor the borrower chooses, the accounting accounts used will be the same.

Participation in trading transactions

It’s good that today the law stipulates payment for the execution of a contract for a maximum of 30 days. Previously, enterprises could generally wait six months or more for payment for work performed or delivery of a contract. An advance payment system for a state-owned enterprise is very rare. And how can a small business operate in such conditions? Take out a loan? Who will cover the interest costs?

At first glance, the fee for participation in the auction is negligible - only 2 thousand rubles (from August 2021). Yes, it is really small if contracts are concluded for hundreds of thousands, millions or even billions of rubles. But if you go to the procurement website and filter out open auctions with prices up to 10,000 rubles, you will find quite a lot of such applications. This is mainly the purchase of medicines for small medical institutions. The life and death of rural residents depends on the provision of medicines, and if the necessary medicines are not purchased on time, patients will have to buy them with their own money. In this case, waiting for the hospital to finally purchase drugs is unacceptable. But these are mostly elderly people with a small pension. Why is this happening? Why didn’t anyone warn the competition commissions of medical institutions that hardly anyone would apply for auctions worth 2 or 3 or even 10 thousand rubles. Unless only those who are not aware that if they win, they can be charged a decent amount for this auction. After all, sometimes the fee for winning exceeds the cost of the trades themselves, not to mention the profit. Tell me, is it possible to attract small businesses to participate in bidding in this way?

Bank guarantee under a government contract: what type of expense and how to take it into account?

If a bank guarantee is required to fulfill obligations under a government contract (or government order), the amount of remuneration to the guarantor can be taken into account as:

- expenses for ordinary activities; or

- other expenses.

Whether the guarantor's remuneration is taken into account at one time or gradually depends on the type of company's obligations secured by the guarantee:

The correspondence of accounts for accounting for remuneration to the guarantor is similar to those described above:

The materials on our website will introduce you to the nuances of concluding and executing government contracts:

- “Concluding a contract without limits on budgetary obligations”;

- “Is it legal to pay UTII when selling goods under state and municipal contracts?”.

Electronic trading and its support

Civil Code of the Russian Federation, in particular Art. 447-1, allows you to conclude a purchase and sale agreement, a lease agreement, a contract agreement, and the provision of services at auction. Bidding with the participation of government organizations and municipal unitary enterprises is regulated by Federal Law No. 44 of 04/05/2013 and a number of other regulations.

Bidding in the form of an auction assumes that the highest bidder will win, and bidding begins with the initial minimum price specified in the advertisement. Auction participants gradually increase the price of the lot until a winner is identified. The auction, organized as a competition, is won by the participant who offers the best conditions. The advertisement indicates the maximum possible price. The competition is held with the participation of a competition commission formed in advance. Participants in the competition present individual projects to the commission, and the most economical and creative one is selected.

The application participating in the auction must be secured. The security amount for the auction organizer is a guarantee of participation in them. The amount of the amount is determined by the organizer.

Competitions and auctions are provided (according to the text of Federal Law No. 44, Article 44):

- bank guarantee;

- in cash.

When trading on an electronic platform, the participant’s personal account and the funds on it are blocked. As part of government procurement, according to Federal Law No. 44, special accounts are opened not on an electronic platform, but in a bank. The list of banks is determined by Government Decree No. 1451-r dated 07/13/18.

The return of the security amount occurs in the following cases:

- based on the results of the competition or auction, the participant is not recognized as the winner;

- the auction was canceled on the initiative of the controlling authority or the organizer;

- the participant decided not to participate in them, or was withdrawn from the auction, or turned out to be the only supplier, for example, during a government procurement.

If the participant is recognized as the winner of the auction, but refuses to enter into the contract that was the subject of the auction, the security payment will not be returned.

Results

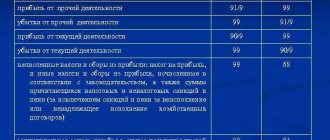

When reflecting a bank guarantee, the beneficiary and the principal use accounting entries using balance sheet and off-balance sheet accounts. The fact of receipt and write-off of the guarantee is recorded on the balance sheet. And when reflecting the costs of paying the commission for its issuance, the correspondence of accounts 51 “Current accounts” and 76 “Settlements with various debtors and creditors” is used. The costs of paying remuneration to the bank for issuing a guarantee are reflected in the accounts depending on the type of asset for the acquisition of which it was issued. If the initial cost of the asset has not been formed and the commission is paid, its amount increases the initial cost. In other cases, the commission is taken into account as another expense and is reflected in accounting in account 91.2 “Other expenses”.

Sources: Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting in government institutions

In the program “1C: Public Institution Accounting 8”, edition 2, the transfer of the deposit by the procurement participant is formalized by a settlement and payment document - Application for cash expenses (abbreviated). You will first need to set up postings in standard transactions.

When posting the document, the necessary accounting records will be generated.

The return of the deposit (deposit, security) to the personal account of the procurement participant is reflected in the “Cash Receipt” documents. Because The documents do not contain a corresponding standard operation; it must first be created.

Since the return of the deposit (deposit, security) is the restoration of previously incurred expenses of the institution, in the standard transaction being created for the document “Cash Receipt”, you should select account 17.01 as an off-balance sheet debit account, indicating the CPS of the payment purpose is the same as when transferring the deposit (deposit , collateral) to the customer, payment destination KEC - 510 “Receipt to budget accounts.” As a credit account – 210.05.

The created standard transaction should be selected on the “Accounting transaction” tab. When posting the document, the necessary accounting records will be generated.

In the program “1C: Public Institution Accounting 8”, edition 1, the transfer of the deposit by the procurement participant is formalized by settlement and payment documents (Application for cash expenses) with the operation Other transfers.

In the document, as an off-balance sheet loan account, you should select account 18.01 “Disposal of funds from institution accounts”, KEK for the purpose of payment - 610 “Disposal from budget accounts”.

As a debit account – 210.05 “Settlements with other debtors”.

Since this transaction is new, it is not included in the list of valid accounts. To select account 210.05, you should disable the restriction by clicking the “Correct accounts” button - all EPSBU accounts will be available for selection.

The return of the deposit (deposit, security) to the personal account of the procurement participant is reflected in the documents “Cash receipts” with the operation Other receipts.

Maslennikova Victoria,

Consultant

Tel.

A bank guarantee and accounting in the accounting departments of government institutions are carried out differently. When funds are received into a current account, they are accounted for according to KFO 3, since they are received at temporary disposal and are required to be transferred to budget revenues. Accounting entries for these transactions depend on the powers delegated to a particular government institution to administer budget funds.

Postings for accounting in a government institution are reflected in the table.

| Operation | Debit | Credit | Notes |

| Funds for the BG were received in accordance with the established procedure | KIF 3,201 11,510 | GKBK 3 304 01 730 | For PBS, RBS, GRBS and budget revenue administrators |

| BG funds transferred to the budget | GKBK 3 304 01 830 | KIF 3,201 11,610 | |

| Accrued profit from receipt of funds to the budget | KDB 1 209 40 560 | KDB 1 401 10 140 | For budget administrators |

| Calculations by the administrator of budget revenues are reflected | KDB 1 304 04 140 | KDB 1 209 40 660 | For limited administrators only |

| The amount of the budget is credited to the budget | KDB 1 210 02 140 | KDB 1 209 40 660 | Only for administrators with full privileges |

The institution paid for participation in the auction through an employee

Attention: On November 16, 2021, changes were made to the Instructions for the Unified Chart of Accounts No. 157n. And now settlements for collateral must be reflected on account 0.210.05.000 “Settlements with other debtors”. However, it is not necessary to apply this account until the end of 2021. Balances can be transferred to it on the last day of the reporting year - December 31.

For reference: starting from 2021, KOSGU codes are no longer used to detail payments. Now they are needed only for accounting and reporting. But this concerns the expenses of the institution. And regarding the IFDS, payments continue to be reflected according to KOSGU codes (clause 8.1 of the Requirements approved by Order of the Ministry of Finance of Russia dated July 28, 2021 No. 81n).