Budget classification code for 2014

Home / Directory / Budget classification code / Budget classification code for 2014

Budget classification codes are digital designations of various groups of income and expenses. The full list of current KBK 2014 is given below.

Simplified taxation system (STS)

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Tax levied on taxpayers who have chosen income as an object of taxation | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied on taxpayers who have chosen income as the object of taxation (for tax periods expiring before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| A tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expiring before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax credited to the budgets of the constituent entities of the Russian Federation | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of urban districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

VAT

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| VAT on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| VAT on goods imported into Russia (payment administrator – Federal Tax Service of Russia) | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Patent tax system

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of urban districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Personal income tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens registered as: – entrepreneurs; – private notaries; – other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax in the form of fixed advance payments on income received by non-residents employed by citizens on the basis of a patent in accordance with Article 227.1 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

Income tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Income tax credited to the federal budget | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Profit tax credited to the budgets of constituent entities of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on the profits of organizations when implementing production sharing agreements concluded before the entry into force of the Federal Law “On Production Sharing Agreements” and not providing for special tax rates for crediting the specified tax to the federal budget and the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on the income of foreign organizations not related to activities in the Russian Federation through a permanent establishment, with the exception of income received in the form of dividends and interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

UTII

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Single tax on imputed income for certain types of activities | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Organizational property tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Property tax of organizations on property not included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Tax on property of organizations included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Property tax for individuals

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property tax for individuals, levied at rates applicable to taxable objects located within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property tax for individuals, levied at rates applied to taxable objects located within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

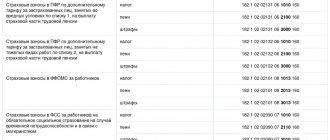

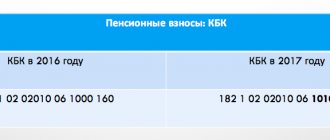

Pension contributions

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Additional insurance contributions for the funded part of the labor pension and employer contributions in favor of insured persons paying additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation to pay the insurance part of the labor pension | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013) | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension (for billing periods expired before January 1, 2010) | 392 1 0900 160 | 392 1 0900 160 | 392 1 0900 160 |

| Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2010) | 392 1 0900 160 | 392 1 0900 160 | 392 1 0900 160 |

Contributions to compulsory social insurance

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases | 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

| Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity | 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

Contributions for compulsory health insurance

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Insurance premiums for compulsory health insurance of the working population, credited to the Federal Compulsory Medical Insurance Fund | 392 1 0211 160 | 392 1 0211 160 | 392 1 0211 160 |

| Insurance premiums for compulsory health insurance of the working population, previously enrolled in the TFOMS (for billing periods before 2012) | 392 1 0212 160 | 392 1 0212 160 | 392 1 0212 160 |

Property tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Real estate tax levied on real estate located within the boundaries of the cities of Veliky Novgorod and Tver | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Excise taxes

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on ethyl alcohol from non-food raw materials produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcohol-containing products produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on tobacco products produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on motor gasoline produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on straight-run gasoline produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines produced in Russia (in terms of repayment of debt from previous years accrued before January 1, 2003) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on passenger cars and motorcycles produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on diesel fuel produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on motor oils for diesel and (or) carburetor (injection) engines produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on wines, fruit wines, sparkling wines (champagnes), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on beer produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for beer, wines, fruit wines, sparkling wines (champagnes), wine drinks produced without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for wines) when sold by producers, with the exception of sales to excise warehouses, in terms of amounts calculated for 2003 | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for wines) when sold by producers to excise warehouses in terms of amounts calculated for 2003 | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for wines) when sold from excise warehouses in terms of amounts calculated for 2003 | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on natural gas | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Excise taxes on oil and stable gas condensate | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Excise taxes on jewelry | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

Excise taxes (imported)

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on ethyl alcohol from non-food raw materials imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on alcohol-containing products imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on tobacco products imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on motor gasoline imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on passenger cars and motorcycles imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on diesel fuel imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on motor oils for diesel and (or) carburetor (injection) engines imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on wines, fruit wines, sparkling wines (champagnes), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on beer imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent, including drinks made on the basis of beer, produced with the addition of ethyl alcohol (except for beer, natural wines, including champagne, sparkling, carbonated, fizzy, natural drinks with volume fraction of ethyl alcohol no more than 6 percent of the volume of finished products made from wine materials produced without the addition of ethyl alcohol) imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate), imported into the territory of Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on straight-run gasoline imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on household heating fuel produced from diesel fractions of direct distillation and (or) secondary origin, boiling in the temperature range from 280 to 360 degrees Celsius, imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

Land tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Land tax levied at a rate of 0.3 percent and applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 0.3 percent and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 0.3 percent and applied to tax objects located within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 0.3 percent and applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to tax objects located within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in the territories of intra-city municipalities of federal cities of Moscow and St. Petersburg | 182 1 0900 110 | 182 1 09 04051 03 2000 110 | 182 1 0900 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in the territories of urban districts | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in inter-settlement territories | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in the territories of settlements | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

Transport tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Transport tax for organizations | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Transport tax for individuals | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Gambling tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Gambling tax | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Fauna and biological resources

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Fee for the use of fauna objects | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 11 |

Water tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments)* | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Water tax | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

MET

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Combustible natural gas from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Extraction tax for common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of mineral resources on the continental shelf of Russia, in the exclusive economic zone of the Russian Federation, when extracting mineral resources from the subsoil outside the territory of Russia | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mining tax on natural diamonds | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

Unified agricultural tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Unified agricultural tax | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Unified agricultural tax (for tax periods expired before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Government duty

Income from the provision of paid services and compensation of state costs

| Payment Description | KBK for payment transfer |

| Fee for providing information contained in the Unified State Register of Taxpayers | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs | 182 1 1300 130 |

| Fee for providing information on registered rights to real estate and transactions with it, issuing copies of contracts and other documents expressing the content of unilateral transactions made in simple written form | 182 1 1300 130 |

Fines, sanctions, payments for damages

| Payment Description | KBK for payment transfer |

| Monetary penalties (fines) for violation of laws on taxes and fees | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) | 392 1 1600 140 |

| Monetary penalties (fines) imposed by the Pension Fund of the Russian Federation and its territorial bodies in accordance with Articles 48 - 51 of the Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical funds insurance" | 392 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | 182 1 1600 140 (to the Federal Tax Service of Russia) 188 1 1600 140 (to the Ministry of Internal Affairs of the Russian Federation) |

| Monetary penalties (fines) for administrative offenses in the field of state regulation of the production and turnover of ethyl alcohol, alcohol, alcohol-containing and tobacco products | 141 1 1600 140 (to Rospotrebnadzor) 160 1 1600 140 (to Rosalkogolregulirovanie) 188 1 1600 140 (to the Ministry of Internal Affairs of the Russian Federation) |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 (to the Federal Tax Service of Russia) |

| Monetary penalties (fines) for violation of the legislation on state registration of legal entities and individual entrepreneurs, provided for in Article 14.25 of the Code of the Russian Federation on Administrative Offenses | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on administrative offenses provided for in Article 20.25 of the Code of the Russian Federation on Administrative Offenses | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of the constituent entities of the Russian Federation | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of city districts | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of municipal districts | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of settlements | 182 1 1600 140 |

| Other gratuitous receipts to the federal budget | 182 2 0700 180 |

Who pays and when

According to Art. 143 of the Tax Code of the Russian Federation, taxpayers for this type of fee are legal entities and individual entrepreneurs, but it is believed that ultimately it is paid by the buyer. The fact is that value added tax is indirect. With its help, the state seeks to receive part of the premium that the manufacturer or seller sets on the price of the product at each stage of production or sales. The tax is calculated by the manufacturer and the seller, but it is included in the cost of the product; in addition, the entrepreneur deducts the input VAT already paid when purchasing goods for production. Thus, the buyer is the source of the collection, but in the legislative act - in the Tax Code - individuals are not mentioned as VAT payers; they do not calculate or transfer it.

This financial commitment is of great importance for the budget and not only in terms of revenue. The state, by introducing a value added tax, ensures the contribution of funds to the budget earlier than the final sale of products, which increases the efficiency of the obligation and its collection.

IMPORTANT!

From 01/01/2019, VAT has been increased from 18% to 20%.

Self-calculation of penalties

Perhaps you are faced with the problem of calculating and paying penalties, and you need to correctly calculate the amount. Let's use the following scheme:

- We determine the amount of the penalty. This is an indicator of the amount owed.

- We determine the days overdue from debt repayment.

- We look at the Central Bank refinancing rate. This indicator is indicated on the Central Bank website.

- We calculate using the formula - P = Week * St.

Ref. / 300 - Pr ,

- P – the amount to be paid for the penalty itself;

- Art. ref. — refinancing rate in effect at the time the penalty is issued;

- Pr - number of overdue days.

You can also use a calculator to calculate penalties or obtain data on the accrual of penalties from regulatory authorities.

When independently calculating penalties, the taxpayer must take into account the next day, that is, the day of seizure.

The correct calculation of penalties can be considered using an example.

Let's say a certain organization Vympel LLC filed a tax return. It indicated the amount that was not paid to the tax authority on time. As a result, a penalty was charged:

| VAT amount | VAT paid | Arrears | Payment deadline | Number of days | Calculation | Sum |

| 840,200 | 500,260 | 840,200- 500,260 = 339, | .01.2016 | 12 | 339, rub. * 11% / 300 * 12 days | 1,495 |

| 880,730 | 319,400 | 880,730- 319,400 = 481,33 | .02.2016 | 14 | 481.33 * 11% / 300 * 14 days | 2,47 |

| 720,610 | 649,80 | 720,61- 649,8 = ,81 | .03.2016 | 19 | .81 rub. * 11% / 300 * 19 days | 0,49 |

As a result, the amount of the penalty amounted to 4.461 rubles; we sum up all the columns (1.495+2.476+0.49)

The day the penalty is paid is considered the day the document is processed and funds are credited to the account of the organization that assigned these penalties.

The tax authority will collect penalties corresponding to the unpaid VAT tax unconditionally. For this purpose, government services, such as the bailiff department, will be involved.

In tax inspectorates, programs for calculating penalties are set to automatic mode. To keep abreast of all calculations, you need to constantly take certificates and statements in order to pay the accrued amounts on time.

Reducing penalties

Sometimes situations arise when the taxpayer is unable to pay the tax and penalties on it. Judicial practice shows that it is impossible to change or remove penalties, since this type of tax is not a tax charge. Tax authorities can write off “bad” debts, but the taxpayer will have to pay penalties in any case. It is possible to highlight which articles of offenses are exempt from liability:

- Committing a tax offense.

- Inability to pay due to bankruptcy.

). Therefore, if you transfer some tax (contribution) to the budget already in 2021, you need to indicate the new BCC in the payment slip (if it has changed). For example, you need to pay contributions to the Pension Fund for December in January, transferring them to the new KBK.

Accordingly, if you plan to transfer contributions before January 1, then in the payment order indicate the BCC in force in 2015. If you will make payments after this date, then the new BCC will be indicated.

Changed BCCs are highlighted in red.

KBK VAT 2016-2017

In 2013, the Ministry of Finance of Russia, by order dated July 1, 2013 No. 65n, approved the VAT Code for 2014 (see also Information from the Federal Tax Service of Russia “Classification Codes for Budget Income of the Russian Federation Administered by the Federal Tax Service in 2014,” order of the Federal Customs Service of Russia dated February 17, 2014 No. 231). The same KBK VAT codes continue to be valid when transferring taxes for 2016-2017.

So, the current BCCs in 2021 for VAT transfers:

- 182 1 0300 110 - KBK VAT 2021 for transferring to the budget tax on goods sold, work, services, transferred property rights in the territory of the Russian Federation, advances received, as well as for payment of VAT by a tax agent.

- 182 1 0400 110 - BCC for VAT in 2021 for transferring to the budget the tax payable when importing goods into the territory of the Russian Federation from the countries of the Customs Union. This BCC VAT for legal entities in 2016-2017 is also required to fill out a tax return when importing goods (work, services) from countries participating in the Customs Union.

- 153 1 0400 110 - KBK VAT tax 2021 for transferring to the budget the tax payable when importing goods into the territory of the Russian Federation from countries that are not members of the Customs Union.

- 182 1 0300 110 — KBK VAT for payment of penalties on domestic transactions in 2021; 182 1 0300 110 - for fines.

- 182 1 0400 110 — KBK VAT for payment of penalties in 2021 on transactions for the import of goods from Belarus and Kazakhstan; 182 1 04 01000 01 3000 110 - for fines.

- 153 1 0400 110 — KBK VAT for payment of penalties in 2021 on goods imported into Russia during the administration of the Federal Customs Service; 153 1 0400 110 - for fines.

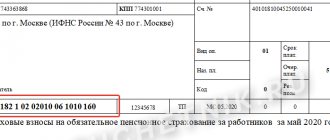

How to fill out a payment form

Budget classification codes are indicated in field 104; they are the same for the entire country. When filling out the payment form, it is necessary to take into account that the details are indicated by the tax office to which the payer is assigned in accordance with his location. The registration rules are specified in Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, as amended.

When filling out, you must also correctly indicate:

- payer status (check in the article > “What is the payer status in a payment order and how to fill it out”);

- payment amount (integer);

- quarter for which payment is made (in the form “KV.01.2019”).