The provision of subsoil to legal companies is formalized by a special state permit (license), confirming the right of its owner to use a certain territory for a specific purpose during a specified time period. For the exploitation of a plot of territory, mandatory transfers of funds to the state budget are provided, paid upon receipt of permission to carry out specified types of activities on the subsoil plot (Federal Law No. 2395, 02/21/1992).

Payments for subsoil use

Everything about these payments can be found out from the Law of the Russian Federation dated February 21, 1992 No. 2395-I (hereinafter referred to as the Subsoil Law).

Subsoil users can be both Russian individual entrepreneurs and legal entities, and foreign citizens (Article 9 of the Subsoil Law).

The subsoil includes caves, minerals - in a word, everything that is underground. Payments are charged for the use of these resources and for work associated with them.

You should pay regular payments (Article 43 of the Subsoil Law) if your organization has received exclusive rights:

- to search and evaluate mineral deposits;

- mineral exploration;

- geological study and assessment of the suitability of subsoil areas for the construction and operation of structures not related to mining;

- construction and operation of underground structures not related to mining, except for shallow engineering structures (up to 5 meters) used for their intended purpose.

Regular payments are collected separately for each type of work carried out in the Russian Federation, on the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation.

Regular payments for subsoil use are not charged for:

- use of subsoil for regional geological study;

- use of subsoil for the formation of specially protected geological objects that have scientific, cultural, aesthetic, sanitary, health and other purposes;

- exploration of mineral resources in deposits that have been put into commercial operation, within the boundaries of a mining allotment granted to the subsoil user for the extraction of mineral resources;

- exploration of mineral resources within the boundaries of a mining allotment granted to the subsoil user for the extraction of this mineral resource;

- use of subsoil for the development of technology for geological exploration and extraction of hard-to-recover minerals;

- use of subsoil for the development of technology for the study, exploration and extraction of minerals under a combined license for the use of subsoil.

Subsoil is provided for use on the basis of a special license or production sharing agreement. You must pay regularly, starting from the date of state registration of the license or from the date of entry into force of the production sharing agreement.

Responsibility for violation of legal norms

If a company uses subsoil in the absence of state permission, then a fine may be applied to the culprit, and the company will also be obliged to compensate for the loss caused (Article 7 of the Code of Administrative Offenses of the Russian Federation).

The amount of loss from unauthorized use of the territory is calculated according to the mineral extraction tax (mineral extraction tax) rates.

Tax authorities have no grounds for holding violators of payments for the use of state subsoil plots accountable due to the non-tax nature of regular payments.

When establishing cases of violation of the current legislation, the Federal Tax Service sends a request for revocation or suspension of the permit providing for the possibility of using subsoil to the Service for Supervision in the Sphere of Natural Resources (ROSPRIRODNADZOR), the Subsoil Use Agency (ROSNEDRA).

Calculation procedure

The payment depends on various factors, including the type of work, the type of mineral, the size of the site, the degree of risk, etc.

RPN = S × C / 4, where:

- RPN - regular payment due for the quarter,

- S—taxable base,

- C is the regular payment rate.

The taxable base depends on the type and stage of work carried out by the subsoil user. Thus, when searching and evaluating deposits, this is the area of the licensed subsoil plot, reduced by the area of the returned part of the plot and the area of the territories of discovered deposits. When exploring deposits, this is the area of the licensed subsoil plot in which mineral reserves are established and taken into account by the State Reserves Balance, with the exception of the area of mining allotments. During the construction and operation of underground structures not related to mining, the amount of minerals to be stored specified in the design documentation for the construction and operation of the underground structure.

The amount of regular payments is calculated in the calculation of regular payments in full rubles, taking into account rounding rules.

Control of payments for subsoil

The regularity and accuracy of depositing funds is administered through government enforcement measures. As such, termination of the right and revocation of the license to use subsoil, as well as the imposition of a fine, are used. In this way, the regulatory function characteristic of payments is manifested, through which participants in economic relations strive to strictly comply with the requirements of the law and the conditions for collecting fees for carrying out certain activities on land plots.

Violation of such requirements will result in a sanction. This is due to the protection of mineral resources that are the property of the state, which grants the right to exploit the land for profit. Negative impact measures are aimed at confiscating plots illegally transferred to entrepreneurs in order to protect public interests when transferring objects to private use.

Payments for the use of land do not fall under the category of taxes or excise taxes. Their legal nature is close to lease payments provided for the use of natural resources subject to the rules on preventing damage to the environment. The fee for the use of subsoil does not have a compensatory function, since it is provided for by a fee for negative impact on the environment.

In essence, such payments provide compensation to the state for the use of natural sources, as the owner of the subsoil.

In conclusion, we can say about the specifics of such payments. Among the shortcomings of legal regulation, one can highlight the lack of clear regulations for the procedure for establishing payments, the lack of definitions and its content. There is also the presence of a huge number of standards at the level of the Government of the Russian Federation and subordinate legislation - from the Ministry of Natural Resources of the Russian Federation. Because of this, in practice, problems arise with calculating payments in the absence of economically proven justification; the coefficients and indicators established at different levels for determining the base vary. Acts of different legal force come into conflict. As a result, streamlining, systematization of regulations, and harmonization of tax provisions are required due to the different legal nature of these concepts.

Author of the article

Payment rates

The law on subsoil provides minimum and maximum rates. The exact rate is determined by federal authorities and constituent entities of the Russian Federation.

The rate also depends on the purpose of using the obtained subsoil (Article 43 of the Subsoil Law).

For example, when using subsoil to search for precious metals, the minimum rate is set at 90 rubles per square meter of land. If the goal is exploration of precious metals, the minimum rate will be 3,000 rubles per square meter of land.

Payers and payments

The subsoil use payment system provides for transfers:

- periodic (regular);

- one-time (when adjusting the boundaries of the exploited land territory and other measures and procedures defined in the text of the license);

- type of auction fee (with the participation of a company in a competition for obtaining a permit (license) for subsoil use).

Regular payments for the use of land are classified as non-tax transfers of a mandatory nature, paid for obtaining the opportunity to be present for permitted purposes in a certain territory. The Federal Tax Service of the Russian Federation controls the correctness and accuracy of the calculation, the amount of payment received into the budget and the timeliness of its payment.

Payment is made by companies and entrepreneurs (residents and non-residents of the Russian Federation), recognized as users of subsoil (in accordance with the permits issued to them and the executed production sharing agreement), including those who have rights to:

- exploration and prospecting activities, as well as assessment of mineral deposits in the allocated territory;

- study and assessment of sites from the point of view of their suitability for construction work, operation of buildings not related to the process of obtaining minerals;

- operation of underground buildings that are not associated with the process of obtaining minerals, except for buildings of shallow depth (no more than 5 meters), and construction work.

There is no regular payment for:

- Exploitation of the subsurface territory for:

- procedures for their geological study;

- creation of objects protected by the state, cultural, scientific or other purposes.

- Mineral exploration:

- in areas with deposits that are already being used for industrial development;

- within the boundaries of the mountain allotment area intended for their extraction.

Procedure for paying regular payments and submitting reports

The payment is calculated for the year and is paid in equal installments of ¼ quarterly.

Payments for subsoil use must be made by the last day of the month following the reporting quarter. If the day falls on a weekend, the deadline is transferred to the next working day. Thus, you need to pay a payment for the use of subsoil in 2021:

for the first quarter - until April 30 inclusive;

for the 2nd quarter - until August 2 inclusive;

for the third quarter - until November 1 inclusive;

for the fourth quarter - until January 31, 2022 inclusive.

The calculation (declaration) must be submitted within the same deadlines as provided for payment.

There are no benefits for this type of non-tax payment.

Type and frequency of payment

Payments for the exploitation of subsoil are made in monetary terms and are subject to direction to the budget (territorial, federal) in accordance with the budgetary legislation of the Russian Federation. According to Federal Law No. 349 (December 2, 2013), the share of payment sent to the budget of a state subject is 60%, to the federal budget - 40% of the contribution for subsoil use.

Users of plots submit calculations of the amount payable to the Federal Tax Service and executive authorities involved in the field of natural resources. The deadline for transferring the calculation is one month after the last quarter, but not later than the last day of the month.

The payment procedure takes place at the location of the subsoil territory that has been transferred for use. The deadline for the transfer coincides with the deadline for submitting the payment calculation: no later than the last day of the month after the last quarter.

For your information! For untimely submission of the calculation, the consumer may be subject to punishment in the form of a fine, but for violation of the deadline provided for payment of the regular payment for subsoil use, penalties are not charged (Letter of the Federal Tax Service of the Russian Federation No. SD-4-3/1152, 06/28/2016). This type of transfer is not a tax or fee, therefore the provision of Article 75 of the Tax Code of the Russian Federation regarding the collection of penalties cannot be applied.

Example of filling out a calculation

Fossil LLC is engaged in the extraction of precious metals. Activities are carried out in accordance with NT license No. 2657981 dated 01/01/2019. The company mines platinum in Nizhny Tagil. The rate is set at 405 rubles per square meter. The taxable area of the land is 240 square meters.

The annual payment is 97,200 rubles (240 x 405).

The quarterly payment is 24,300 rubles (97,200: 4). This amount must be indicated in line 030 of section 1 of the calculation.

Submit your tax returns on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Who's counting

Who exactly calculates regular payments depends on the category of subsoil user. That is, it depends on whether the organization operates on the basis of a license or on the basis of a production sharing agreement.

For organizations that have signed a production sharing agreement, the amount of regular payments is calculated by Rosnedra. The agency will establish the annual payment amount in the agreement. The organization divides it into four equal parts and transfers them to the budget quarterly.

License holders calculate the amount of payment themselves. It depends on the annual rate and the taxable object (size of the subsoil plot).

This follows from paragraphs 2 and 3 of Article 43 of the Law of February 21, 1992 No. 2395-1 and subparagraph 5.3.12 of the Regulations approved by Decree of the Government of the Russian Federation of June 17, 2004 No. 293.

How to prepare and submit reports?

Most reports can be generated independently, using, for example, the official program “Nature User Module”. The current version is available on the Rosprirodnadzor website. Many reports are accepted there through your personal account.

For those who do not have the time or opportunity to understand the intricacies of environmental legislation, we offer a full support service: we will prepare and submit all environmental reports for you. Detailed information is here.

Responsibility

If the reporting was not submitted on time or not submitted, this may result in penalties and become a reason for an unscheduled inspection of your organization. Responsibility is determined by the Administrative Code of the Russian Federation.

Fines vary:

- For individual entrepreneurs – up to 50 thousand rubles.

- For organizations – up to 250 thousand rubles.

- For responsible persons – up to 30 thousand rubles.

Penalties are determined by the Code of the Russian Federation on Administrative Offenses (see Chapter 8 of the Administrative Code).

How to calculate

The general maximum and minimum rates are prescribed in Law No. 2395-1 of February 21, 1992. The specific annual rate for each subsoil user operating on the basis of a license is established by Rosnedra, which is stated in this permit document. The department will set it per 1 sq. km of subsoil area per year separately for each type of work.

The size of the subsoil plot area taken into account for the regular payment depends on the stage of work carried out by the subsoil user.

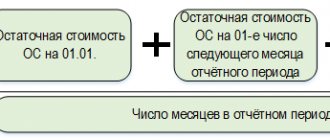

If an organization conducts exploration of deposits, calculate the taxable area of the subsoil plot as follows:

At the stage of searching and assessing mineral deposits, make calculations using the formula:

Determine the amount of regular payment that needs to be transferred for the quarter as follows:

If the license was suspended during the quarter, still calculate the payment amount in the same way. Suspension of a license does not mean termination of the right to use subsoil, and therefore there is no reason to stop making regular payments or reduce their amount. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 14, 2013 No. 03-06-05-01/42730 and the Federal Tax Service of Russia dated March 25, 2014 No. GD-4-3/5368.

This follows from paragraph 6 of Article 12, paragraphs 2 and 4 of Article 43 of the Law of February 21, 1992 No. 2395-1, paragraph 6.7 of the Procedure approved by order of the Ministry of Taxes of Russia of February 11, 2004 No. BG-3-21/98, and subclause 5.3.12 of the Regulations approved by Decree of the Government of the Russian Federation of June 17, 2004 No. 293.

Situation: how to calculate the regular payment for the quarter in the middle of which the organization received a license or its validity expired?

Regular payment

Payments for the use of wildlife objects

Payers of this type of fee automatically become those citizens who have received permission or a license to use wildlife objects. Typically this involves hunting activities. Only those persons who have the right to use this type of resource have the right to obtain permission. The basis for the permit is hunting on a designated hunting ground, in a specially protected natural area or in a publicly accessible hunting ground.

The formula for calculating the fee for the use of wildlife objects is as follows:

Fee amount = Rate * Quantity

In this case, the rate is set by the Tax Code of the Russian Federation. For an accurate calculation, you must use the current rate. Let's look at the next calculation.

- The rate for 1 individual moose is 1,500 rubles.

- The estimated number of individuals is 5 pieces.

- We substitute the data into the formula: RS = 1500 * 5.

- RS = 7500 rubles.

Please note that hunting is allowed only after the state issues a license for such activity. Otherwise, the actions may be considered illegal, which will result in legal proceedings.

Coefficients for calculating oil tax

When calculating the mineral extraction tax on oil in 2020-2021, the following special (related only to this fossil) indicators are used:

- taking into account fluctuations in world prices and determined monthly by the Government of the Russian Federation or by independent calculation (clause 3 of Article 342 of the Tax Code of the Russian Federation);

- characterizing the degree of complexity of production and taking on a certain value depending on the specific characteristics of the deposit and the year of development (clauses 1, 2 of Article 342.2 of the Tax Code of the Russian Federation);

- reflecting the degree of depletion of the field; depending on the value of the previous coefficient, it can take either a specific value or become a calculated one (clauses 3, 6 of Article 342.2 of the Tax Code of the Russian Federation);

- characterizing the characteristics of oil production and calculated using a formula that includes several coefficients, both calculated and taking a certain digital value depending on the year of application (Article 342.5 of the Tax Code of the Russian Federation).

The deduction provided for by the Tax Code of the Russian Federation, applied to the calculated tax amount, is also special for such a fossil as oil. It is used in production carried out in the Republic of Tatarstan and Bashkortostan, and is provided for oil that is desalted, dehydrated and stabilized. The amount of the deduction depends on the volume of the initial reserves of the field and is determined by a formula that takes a specific form depending on the year in which it is applied (Article 343.2 of the Tax Code of the Russian Federation).

An example of oil tax calculation can be found here.