Companies submit Form 4-FSS to the branch of the FSS of the Russian Federation at the place of their registration within the following deadlines:

- no later than the 25th day of the month following the reporting period, if reporting is sent electronically;

- no later than the 20th day of the month following the reporting period, if it is submitted in paper form.

Thus, you must submit the calculation in form 4-FSS for the first quarter of 2021 no later than:

- April 20, 2021, if the policyholder reports on paper;

- April 25, 2021, if the policyholder submits reports electronically.

Let us remind you that policyholders whose average number of employees exceeds 25 people send Form 4-FSS to social insurance in electronic form. Policyholders with this indicator of 25 people or less can submit the form on paper.

Federal Law No. 125-FZ of July 24, 1998 (as amended on July 29, 2017) “On compulsory social insurance against industrial accidents and occupational diseases.”

Which form to use (download)

According to the law, Form 4-FSS for the 1st quarter of 2021 is generated and submitted by organizations (merchants) that during this reporting period made to individuals, within the framework of employment and a number of civil law contracts, remuneration and other payments for which it is necessary to accrue contributions for injuries. Accordingly, insurance premiums must be paid based on these amounts at established rates.

Also in Table 5 the calculations reflect the results:

- carried out a special assessment of working conditions (certification of workplaces according to working conditions);

- mandatory preliminary and periodic medical examinations of personnel at the beginning of 2021.

ATTENTION

This report must be prepared and submitted to the Social Insurance Fund even if no payments were made for the first quarter of 2021, for which contributions for injuries are calculated. This will be the so-called zero form of 4-FSS.

For more information, see “Sample of filling out the zero form 4-FSS in 2021.”

Deadlines for submitting 4-FSS in 2021

The form is submitted to the Social Insurance Fund on a quarterly accrual basis. The deadlines depend on whether the report is submitted in paper form or electronically via TCS channels. Only policyholders whose average number of employees does not exceed 25 people have the right to report on paper.

For your convenience, the dates are presented in the table:

| Reporting period | Paper report | TCS report |

| 2018 | 21.01.2019 | 25.01.2019 |

| 1st quarter 2021 | 22.04.2019 | 25.04.2019 |

| 1st half of 2021 | 22.07.2019 | 25.07.2019 |

| 9 months of 2021 | 21.10.2019 | 25.10.2019 |

How separate units pass 4-FSS

Please note that “separate units” are handed over to 4-FSS for those individuals who received appropriate payments from them for their work. In this case, the division must have its own:

1. Balance.

2. Current account.

When both of these conditions are not met, the head office already makes payments to 4-FSS and the contributions accrued on them for such separate divisions.

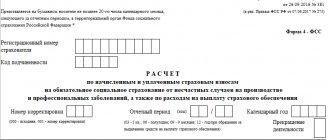

The current 4-FSS report form for the 1st quarter of 2021 is taken from Order No. 381 of the FSS of Russia dated September 26, 2021 (Appendix No. 1):

From our website you can download the new form 4-FSS for the 1st quarter of 2021 for free using the direct link here.

Also see "".

Form 4-FSS for the 1st quarter of 2021: general requirements for preparation

“Paper” Calculation 4-FSS can be filled out either manually or on a computer. However, you cannot use colored inks other than blue and black. All text fields must be filled in block letters.

Each line/column is intended to reflect only one digital indicator. If there is no data to reflect, the corresponding field is crossed out. All monetary indicators are indicated in rubles and kopecks.

Having discovered an error when submitting the 4-FSS for the 1st quarter of 2021, carefully cross out the incorrect value, enter the correct indicator next to it, and certify the correction with your signature and seal (if any) indicating the date. The use of corrective agents for corrections is prohibited.

All pages are numbered. On each page of the 4-FSS report for the 1st quarter of 2021, the signature of the policyholder (his representative) and the date of signing are placed.

When to submit it

Regarding the submission of 4-FSS for the 1st quarter of 2021, the deadlines vary depending on the method of submitting this report. If in electronic form, then until April 25, 2021 inclusive. It will be a regular working day - Wednesday. If on paper, then the deadline for submitting 4-FSS for the 1st quarter of 2021 is slightly less - until April 20, 2021 inclusive (this is Friday).

However, paragraph 1 of Art. 24 of the Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law No. 125-FZ) allows you to choose the method of submitting 4-FSS only to payers with a staff of insured persons of 25 people or less. The rest submit 4-FSS calculations only electronically.

WARNING

For failure to comply with the 4-FSS report submission form, the fund may be fined 200 rubles (Clause 2, Article 26.30 of Law No. 125-FZ).

The requirements for the electronic format of the 4-FSS report are set out in the fund’s order No. 83 dated March 9, 2021. They must be taken into account by the developers of the software with which this calculation is filled out.

Also see “Deadlines for submitting 4-FSS in 2021: table.”

When and where to submit the 4-FSS report

The 4-FSS report is submitted by all insurers: organizations and entrepreneurs with employees. The report must be sent to the FSS:

- at the place of registration of the organization (including if there are separate divisions without their own current account or that do not pay salaries to employees);

- at the place of registration of the unit, if it is allocated to a separate balance sheet, has employees and pays them independently;

- at the place of residence of the individual entrepreneur.

Form 4-FSS must be reported at the end of each quarter. Deadlines for submission depend on the method of submitting the report.

4-FSS in paper form is submitted by legal entities with no more than 25 employees - before the 20th day of the month following the reporting period. The electronic format is intended for employers with more than 25 employees; they submit the report by the 25th.

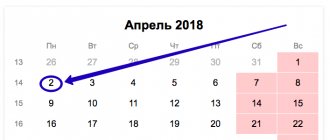

Report for the first quarter of 2021:

- Until April 20 - in paper form;

- until April 27 - in electronic form.

The deadline for submitting the paper report has been moved to April 27, since the 25th falls on a Saturday.

For the second quarter of 2021, report on time:

- Until July 20 - in paper form;

- Until July 27 - in electronic form.

For the third quarter of 2021, the FSS is waiting for a report:

- until October 20 - in paper form;

- until October 26 - in electronic form.

For the fourth quarter of 2021, the FSS expects a report only next year:

- until January 20, 2021 - in paper form;

- until January 25, 2021 - in electronic form.

For submitting a paper report instead of an electronic one, a fine of 200 rubles will be imposed.

You can see all current reporting and tax payment dates in our accounting calendar. For late submission of 4-FSS, a fine is imposed - 5% of the amount of insurance premiums for the 1st quarter. The fine increases by 5% for each full and partial month of delay, but cannot be less than 1,000 rubles and more than 30% of the amount of contributions.

If an organization is undergoing liquidation, then the 4-FSS calculation must be submitted to the FSS before submitting an application for liquidation to the tax office. It must include data from the beginning of the year until the day of submission to the fund. The amount of contributions must be transferred to the Social Insurance Fund within 15 days after submitting the report.

Possible sanctions

Please note that you must remember to donate 4-FSS to the fund. Otherwise, for its absence you will have to pay a fine of at least 1000 rubles (Clause 1, Article 26.30 of Law No. 125-FZ). In general, it will amount to 5% of the amount of contributions payable for January – March 2021, but not more than 30% of it.

In addition, most likely, the manager/employees of the enterprise who are responsible for the generation and submission of the reports in question will also face an administrative fine. They will have to fork out an amount of 300 to 500 rubles (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation). But this fine is not imposed on entrepreneurs.

What and how to fill out

The rules for drawing up the 4-FSS report are regulated by Appendix No. 2 to the order of the Social Insurance Fund dated September 26, 2016 No. 381 (the form was also approved by it). First, general points.

Let’s say right away that passing the 4-FSS implies the mandatory presence of the following completed sheets and tables:

| Title page |

| Table 1 – Calculation of the base for calculating insurance premiums |

| Table 2 – Calculations for compulsory social insurance against industrial accidents and occupational diseases |

| Table 5 – Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year |

Also see “Filling out Table 5 of Form 4-FSS.”

In turn, if necessary - when there are appropriate indicators - fill in:

| Table 1.1 - Information necessary for calculating insurance premiums by policyholders specified in clause 2.1 of Art. 22 of Law No. 125-FZ (so-called outstaffing) |

| Table 3 - Expenses for compulsory social insurance against accidents at work and occupational diseases |

| Table 4 - Number of victims (insured) due to insured events in the reporting period |

Please note that in the upper left part of each sheet of form 4-FSS there are 2 details - “Insured Registration Number” and “Subordination Code”. They are taken from the notice (notification) received upon registration with the Social Insurance Fund:

By the way, you can clarify the policyholder’s numbers in the Social Insurance Fund using the TIN/KPP using a special electronic service on the official website of the Social Insurance Fund. Here is the exact link to it:

https://portal.fss.ru/fss/insurant/searchInn

INFORMATION

If you are submitting a zero 4-FSS for the 1st quarter of 2021, then fill out 4 sheets: the title sheet and tables 1, 2, 5. Place dashes only in those columns that would be filled out in your situation. Leave the rest blank. In Table 1, in lines 5 and 9, do not forget to indicate the amount of the insurance rate assigned to the enterprise by the Social Insurance Fund.

The general requirements for filling out 4-FSS for the 1st quarter of 2021 are quite standard. Among them:

- can be done on a computer or by hand;

- ballpoint (fountain) pen, black or blue;

- block letters only;

- one column – one indicator;

- if there is no indicator, put a dash;

- corrections certified by signature, date and seal (if any) are acceptable;

- corrector cannot be used;

- continuous numbering;

- at the end of each sheet - the signature of the policyholder (successor) or his representative and the date of signing.

When a legal entity fills out a 10-character TIN, put zeros in the first two cells, since there are 12 cells in total.

On the title page, in the “Contact telephone number” field, you can provide the city or mobile number of the policyholder (successor) or the representative of the policyholder with the city code or mobile operator, respectively. Keep in mind that the numbers are filled in in each (!) cell without (!) dashes and parentheses:

Calculate the details “Average number of employees” according to the instructions of Rosstat from its order No. 772 dated November 22, 2021.

At the end, the 4-FSS calculation is signed by the head of the company. On the title page indicate his full name, signature and date of signing. In the "M.P." field – stamp (if any):

Even if there is a company seal, but not affixed to 4-FSS, the fund is still obliged to accept the payment.

Example of filling out for the first quarter

Let’s assume that the limited liability company “Guru” (LLC “Guru”) is registered in Moscow. It includes 3 employees (together with the manager), with whom employment contracts have been signed. Moreover, one of the employees has a group II disability. All employees are citizens of the Russian Federation. During the 1st quarter of 2021, their number did not change.

For the 1st quarter of 2021, employees of Guru LLC received payments subject to injury contributions:

| Period | Taxable payments accrued to employees (rub. kopecks) | ||

| excluding payments in favor of a working disabled person | payments to a disabled person | Total, including payments to disabled people | |

| January | 65 000,00 | 32 000,00 | 97 000,00 |

| February | 65 000,00 | 32 000,00 | 97 000,00 |

| March | 65 000,00 | 32 000,00 | 97 000,00 |

| Total for the first quarter of 2021 | 195 000,00 | 96 000,00 | 291 000,00 |

The company did not accrue any other payments for the first quarter of 2021.

LLC applies a general tariff for contributions without discounts and surcharges in the amount of 0.50%.

In relation to payments to a disabled employee, the organization applies a tariff of 0.30% (60% of 0.50%).

For the first quarter of 2021, the company accrued the following amounts of contributions for injuries:

| Period | Accrued contributions for injuries (RUB kopecks) |

| January | 421,00 ((65 000,00 × 0,50% ) + (32 000,00 × 0,30%)) |

| February | 421,00 |

| March | 421,00 |

| Total for the first quarter of 2021 | 1263,00 |

At the beginning of the first quarter of 2021, Guru LLC has no debt to the territorial Social Insurance Fund and vice versa.

At the end of the first quarter of 2021, the organization incurred a debt in the amount of 421.00 rubles. These are March 2021 contributions due in April 2021.

A special assessment of working conditions was carried out in 2021. Based on its results, no workplaces with harmful and/or dangerous working conditions were found.

Let us also agree that in the first quarter of 2021 there were no industrial accidents at the company.

Please note that when calculating 4-FSS for the first quarter of 2021, Guru LLC must attach a certificate of disability of the employee (on 1 sheet).

The following link shows the completed sample 4-FSS for the 1st quarter of 2018. It includes a title page, tables 1, 2 and 5 of the calculation. There are no indicators to fill out the remaining tables, so we ignore them and do not include them in the final report.

Also see “Gateway for receiving FSS reports”.

Read also

29.02.2020