Until January 1, 2017, the Pension Fund of Russia was responsible for monitoring contributions to compulsory pension and health insurance. When a debt was incurred by the policyholder, the Pension Fund had the right to collect arrears, penalties and fines from him, in accordance with Law No. 212-FZ dated July 24, 2009. But today, insurance contributions, including “pension” ones, are supervised by the tax service, and it also has the right to collect debts. We will tell you in this article how you now need to repay the arrears in contributions that arose before and after the entry into force of the new Chapter 34 of the Tax Code of the Russian Federation.

Grounds for recovery

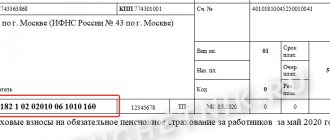

The procedure for paying insurance premiums is established by Article 15 of the Law of July 24, 2009 No. 212-FZ. If the organization has not paid (has not paid in full) the insurance premiums on time (no later than the 15th day of the month following the reporting month), the arrears are collected from it. This follows from the provisions of Part 5 of Article 15 and Part 2 of Article 18 of the Law of July 24, 2009 No. 212-FZ. The same procedure applies to contributions for insurance against accidents and occupational diseases (Article 22.1 of the Law of July 24, 1998 No. 125-FZ).

Arrears can be identified as a result of a desk or on-site inspection of the insurance premium payer (Part 1, Article 33 of Law No. 212-FZ of July 24, 2009). The rules for conducting inspections are established by Articles 34 and 35 of the Law of July 24, 2009 No. 212-FZ. Based on these rules, funds develop internal documents regulating the activities of inspectors. For example, the procedure for organizing on-site inspections by territorial branches of the Pension Fund of the Russian Federation is regulated by Methodological Recommendations, which were approved by Order of the Board of the Pension Fund of the Russian Federation dated February 3, 2011 No. 34r.

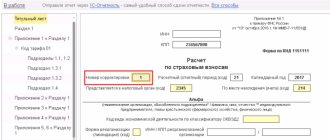

How to fill out section 6.6 of RSV-1

In section 4 of RSV-1, adjustment amounts are reflected separately by type of additional contributions (at basic tariffs for compulsory health insurance, at additional tariffs, for compulsory medical insurance) and for each month for which additional accruals were made. In the situation under consideration, payments to Fr. This means that the error was independently identified by the policyholder, and not by the regulatory authority.

By the way, section 4 of the RSV-1 is completed on an accrual basis. This means that additional accrued amounts will have to appear in all subsequent DAM-1 calculations of this billing period.

https://www.youtube.com/watch?v=ytcopyrightru

Additional accrued contributions must be reflected not only in section 4 and line 120 of section 1, but also in sections 6, which are issued separately for each employee. After all, additional charges appeared due to unaccounted payments in favor of specific individuals. This means that unreliable personalized information was also provided on them previously.

We invite you to read: What is not subject to insurance premiums?

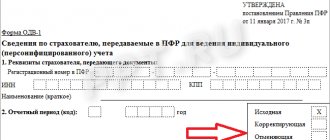

In this regard, in the calculation of DAM-1, corrective section 6 must be drawn up. In it, in subsection 6.3, the type of adjustment is noted - “corrective” and subsection 6.6 is filled in, which indicates the directly accrued amounts of contributions from payments of this individual (clause 35 of the Procedure for filling out DAM -1).

Request for payment

Within three months from the date of discovery of the arrears, the fund department is obliged to send the organization a request for payment of insurance premiums (fines, penalties). The dates of detection of arrears are recorded in special certificates. This is stated in Part 2 of Article 22 of the Law of July 24, 2009 No. 212-FZ. The forms of requirements and certificates were approved by orders of the Ministry of Labor of Russia dated November 27, 2013 No. 698n and dated June 23, 2014 No. 400n.

The requirement can be submitted to the head of the organization (its legal or authorized representative):

- personally against signature;

- by registered mail. In this case, the request is considered received after six working days from the date of sending the registered letter;

- in electronic form via telecommunication channels. The formats, procedure and conditions for sending claims for payment of arrears via telecommunication channels must be established by the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia.

This procedure is provided for by Part 7 of Article 22, Part 6 of Article 4 of the Law of July 24, 2009 No. 212-FZ.

If a demand for payment of insurance premiums (fines, penalties) is drawn up based on the results of an inspection, it must be sent within 10 working days from the date of entry into force of the decision on the inspection report (Part 3 of Article 22, Part 6 of Article 4 of the Law of 24 July 2009 No. 212-FZ). The forms of decisions were approved by orders of the Ministry of Labor of Russia dated November 27, 2013 No. 698n, dated June 23, 2014 No. 400n. They come into force after 10 working days after delivery to the representative of the organization (Part 12, Article 39, Part 6, Article 4 of the Law of July 24, 2009 No. 212-FZ).

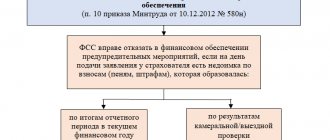

The repayment of arrears in compulsory social insurance contributions, which arose due to an overestimation of the amount of expenses accepted for deduction when calculating the monthly payment to the Social Insurance Fund of Russia, has some specific features. Having discovered such a violation, the territorial branch of the fund will make a decision not to take into account the costs of paying out insurance coverage and, within three days, will send the organization a demand for their compensation, indicating the amount and repayment period of the arrears (Parts 4 and 5 of Article 4.7 of the Law of December 29, 2006 No. 255-FZ). Based on this requirement, the organization is obliged to transfer the specified amount to the budget of the Social Insurance Fund of Russia, adjust the accounting data, and, if necessary, tax accounting, make changes to the reporting (clause 5, part 2, article 4.1 of the Law of December 29, 2006 No. 255-FZ , clauses 5–10 PBU 22/2010 and paragraph 2, clause 1, article 54, clause 1, article 81 of the Tax Code of the Russian Federation).

Situation: is the organization obliged to comply with the requirement to pay mandatory insurance contributions if it is incorrectly completed?

No, I don't have to.

The procedure for filing claims for payment of insurance premiums is provided for in Part 4 of Article 22 of Law No. 212-FZ of July 24, 2009. The requirement, in particular, must indicate:

- amount of debt on insurance premiums;

- the amount of penalties and fines accrued by the time the claim was made;

- deadline for payment of insurance premiums for which arrears arose;

- measures that will be taken by the extra-budgetary fund if the organization does not pay off the arrears;

- the grounds on which insurance premiums are collected, with references to specific provisions of the Law of July 24, 2009 No. 212-FZ.

If the request for payment of insurance premiums received by the organization does not contain any data from the above list, it is considered to have been drawn up with violations. The organization should not comply with such a requirement. This follows from the provisions of paragraph 9 of part 1 of article 28 of the Law of July 24, 2009 No. 212-FZ.

In arbitration practice there are examples of court decisions confirming the legality of this approach. For example, by resolution of February 20, 2012 No. A46-5496/2011, the Federal Antimonopoly Service of the West Siberian District invalidated the requirement to pay penalties on insurance premiums, since it did not indicate how much debt was owed and for what period the territorial branch of the Pension Fund of the Russian Federation charged the organization a penalty.

Voluntary debt repayment

To prevent the accrual of penalties and fines, entrepreneurs are required to take a responsible approach to their obligations to the Federal Tax Service and other government funds. Therefore, you need to pay an annual fee in the form of insurance premiums. For this purpose, details received from representatives of the Federal Tax Service are used. Information is provided on the website or during a personal visit to the service branch.

Payment orders can be generated through online services, which prevents the possibility of errors. The required values in such forms are inserted automatically, so the correct BCC and account numbers are entered. If you transfer the information yourself onto paper, you can confuse the numbers. This will lead to delays, as well as fines and penalties.

If debts are voluntarily repaid, it is advisable to contact the Federal Tax Service employees along with the check and receipt to provide them with evidence of fulfillment of the obligation. This will allow you to quickly make changes to a special database, so you don’t have to worry about additional fines, seizure of accounts or forced collection of funds.

It is also useful to read: Recalculation of insurance premiums

Deferment (installment plan) of payment of insurance premiums

The Pension Fund of the Russian Federation and the Social Insurance Fund of Russia have the right to provide deferments (installments) for the payment of insurance contributions (penalties, fines). This is stated in paragraph 11 of part 1 of Article 29 of the Law of July 24, 2009 No. 212-FZ.

The grounds and procedure for granting a deferment or installment payment of insurance premiums (penalties, fines) are established by Articles 18.1–18.5 of the Law of July 24, 2009 No. 212-FZ.

Granting a deferment (installment plan) to the payer is possible if the following grounds exist:

- damage caused as a result of a natural disaster, technological disaster or other force majeure circumstances;

- lack (delay) of budget funding;

- seasonal nature of production and (or) sale of goods (work, services).

This follows from the provisions of Part 3 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ.

A deferment (installment plan) can be obtained for any of three or several types of insurance premiums at once, the payment of which is regulated by Law No. 212-FZ of July 24, 2009:

- in the territorial branch of the Federal Social Insurance Fund of Russia - for contributions to insurance in case of temporary disability and in connection with maternity;

- in the territorial branch of the Pension Fund of the Russian Federation - for pension contributions and for contributions to compulsory health insurance.

Important: deferment (installment plan) for insurance contributions for the funded part of the pension is not provided. Moreover, the presence of debt for this part of pension contributions makes it impossible to obtain a deferment (installment plan) for contributions to the insurance part of the labor pension. In other words, until the organization pays off the arrears in contributions to the funded part of the pension, it will not be provided with a deferment (installment plan) for the payment of pension contributions. The presence of debt on the funded part of pension contributions does not prevent you from receiving a deferment (installment plan) for contributions to compulsory health insurance.

This follows from the provisions of parts 4 and 7 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ.

If a deferment (installment plan) is granted due to the seasonal nature of the organization’s activities, the debt on insurance premiums will have to be repaid with interest. Interest will be calculated based on the amount of debt and half the refinancing rate in effect during the deferment period (installment plan).

In other cases, the funds do not charge interest for providing a deferment (installment plan).

This procedure is provided for by parts 5 and 6 of Article 18.1 and Article 18.3 of the Law of July 24, 2009 No. 212-FZ.

As a rule, a deferment (installment plan) can be granted for a period of no more than one year (Part 1 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ).

There are circumstances that exclude the possibility of obtaining a deferment (installment plan) for the payment of insurance premiums. A deferment (installment plan) will not be provided if in relation to the organization:

- proceedings are underway regarding violation of the legislation on insurance premiums;

- proceedings are underway regarding administrative offenses in the field of insurance;

- there is a decision by the fund to terminate a previously granted deferment (installment plan). Another deferment (installment plan) will be denied if such a decision was made within the previous three years.

This follows from the provisions of parts 1 and 2 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ.

To receive a deferment (installment plan) for the payment of insurance premiums, you need to submit to the territorial office of the fund:

- statement. Each fund has its own application form. Submit an application to the Pension Fund of the Russian Federation in the form approved by Resolution of the Board of the Pension Fund of February 20, 2015 No. 35p. And in the FSS of Russia - in the form approved by order of the FSS of Russia dated May 21, 2015 No. 205;

- act of joint reconciliation of calculations for insurance premiums;

- a certificate from the tax inspectorate about the organization’s open bank accounts;

- bank statements on monthly cash flows for the six months preceding the submission of the application;

- certificates from banks about the organization’s availability of payment documents placed in the file cabinet (about the absence of such documents);

- bank statements about cash balances in all accounts opened by the organization;

- the organization’s obligation to comply with the conditions under which the deferment (installment plan) is granted;

- debt repayment schedule;

- documents confirming the existence of grounds for granting a deferment (installment plan).

This procedure is provided for by Part 9 of Article 18.1, Parts 1 and 6 of Article 18.4 of the Law of July 24, 2009 No. 212-FZ.

The list of documents that will confirm the existence of grounds for granting a deferment (installment plan) depends on the specific basis. For example, to confirm the seasonal nature of an organization’s activities, documents must be submitted to the fund indicating an uneven flow of income (for example, contracts with counterparties with implementation dates in the spring-summer or, conversely, autumn-winter period).

In addition, depending on the reason for applying for a deferment (installment plan), a number of additional documents will have to be submitted to the fund. For example, if the basis for deferment (installment plan) is the seasonal nature of the activity, then a statement of calculation must be attached to the application. This calculation must confirm that the organization’s income from seasonal activities constitutes at least 50 percent of its total income. This follows from the provisions of Part 5 of Article 18.4 of the Law of July 24, 2009 No. 212-FZ and paragraph 5.1 of Article 64 of the Tax Code of the Russian Federation.

The territorial branch of the Pension Fund of the Russian Federation will make a decision on granting a deferment (installment plan) or refusing to change the deadlines for payment of insurance premiums (penalties, fines) within 30 working days from the date of receipt of the organization’s application. At the request of the organization for this period, the fund may decide to temporarily suspend the payment of insurance premiums (Parts 7, 8, Article 18.4 of the Law of July 24, 2009 No. 212-FZ, Resolution of the Pension Fund of the Russian Federation Board of February 20, 2015 No. 35p).

The territorial branch of the FSS of Russia will also make a decision on granting a deferment (installment plan) or refusing to change the deadlines for payment of insurance premiums (penalties, fines) within 30 working days from the date of receipt of the organization’s application. At the request of the organization for this period, the fund may decide to temporarily suspend the payment of insurance premiums (Parts 7, 8, Article 18.4 of the Law of July 24, 2009 No. 212-FZ, order of the FSS of Russia of May 21, 2015 No. 205).

The territorial branch of the fund is obliged to notify the organization of its decision within three days after its adoption (Part 13, Article 18.4 of the Law of July 24, 2009 No. 212-FZ).

The decision to refuse a deferment (installment plan) can be appealed both to a higher department of the fund and in court. Unlike decisions of tax inspectorates, complaints can be filed simultaneously: to go to court, you do not need to wait for the conclusion of a higher department of the fund (Part 12, Article 18.4, Article 54 of the Law of July 24, 2009 No. 212-FZ). The period for appeal is three months from the date of the decision (part 4 of article 198 of the Arbitration Procedure Code of the Russian Federation, paragraph 2 of article 55 of the Law of July 24, 2009 No. 212-FZ).

How to find out the debt to the Pension Fund of an individual entrepreneur: personal appeal

Of course, the easiest way to find out the arrears of contributions to the Pension Fund of an individual entrepreneur is to resort to electronic resources. After all, registration on government portals in the future can significantly simplify the monitoring of various payments, as well as help in solving many problems without coming into contact with employees of government departments. In most cases, this significantly saves the entrepreneur’s time and effort. If it is not technically possible to use electronic resources, you can go in person to the Pension Fund the old fashioned way and get all the necessary information from a specialist.

Decision on collection

If the arrears are not repaid within the established period, the fund department will make a decision on the forced collection of insurance premiums (Part 1, Article 19 of the Law of July 24, 2009 No. 212-FZ). The forms of decisions are approved by orders of the Ministry of Labor:

- dated June 23, 2014 No. 400n – to collect arrears on contributions for insurance against accidents and occupational diseases;

- dated November 27, 2013 No. 698n – to collect arrears in contributions to compulsory pension (social, medical) insurance.

As a general rule, fund employees must prepare a decision on collection no later than two months from the moment when the deadline for fulfilling the requirement for voluntary repayment of arrears has expired (Part 5, Article 19 of Law No. 212-FZ of July 24, 2009).

This rule does not apply to insignificant amounts of arrears - in such cases, representatives of funds can make a decision to collect several claims at once, if the total debt on them (including penalties and fines) does not exceed:

- 1500 rub. – on payments to the Pension Fund of the Russian Federation;

- 500 rub. – for payments to the Federal Social Insurance Fund of Russia.

The deadline for making decisions in these situations is 14 months from the date on which the deadline for voluntary compliance with the earliest requirement has expired.

Decisions made after the established deadlines are considered invalid. It is not necessary to fulfill them.

This follows from the provisions of parts 5.1–5.3 of Article 19 of the Law of July 24, 2009 No. 212-FZ.

If the deadlines established for making decisions on collection are missed, representatives of the funds can collect the arrears in court. Moreover, in the first case, they must go to court no later than six months from the moment when the deadline for fulfilling the requirement for voluntary repayment of the arrears expired. In the second case - no later than six months from the moment when the deadline for making a decision on collecting the arrears expired.

This is stated in parts 5.4–5.6 of Article 19 of the Law of July 24, 2009 No. 212-FZ.

The decision to collect arrears must be communicated to the organization within six working days after its adoption. The decision on recovery can be transferred to the head of the organization (authorized representative):

- personally against signature;

- by registered mail. In this case, it is considered received after six working days from the date of sending the registered letter;

- in electronic form via telecommunication channels. The formats, procedure and conditions for sending decisions via telecommunication channels must be established by the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia.

This procedure is provided for by Part 6 of Article 19, Part 6 of Article 4 of the Law of July 24, 2009 No. 212-FZ.

The fund department can forcefully collect the arrears through:

- Money;

- property;

- accounts receivable.

Summary

Arrears are debts formed due to the fact that the enterprise does not make tax deductions, contributions to insurance funds, and the Pension Fund of the Russian Federation. Arrears are discovered during checks and errors in payment documents are discovered by the head of the company himself. Subject to recovery in court. First, the creditor sends a demand for payment to the debtor. If the debtor does not respond to the demands, the creditor has the right to appeal to a judicial authority. Collection occurs through withdrawal of funds from bank accounts and seizure of property.

Collection from cash

The decision to collect the arrears is executed through the bank in which the organization has an account. After the decision to collect the arrears has been made, the fund branch must send to this bank an order to transfer insurance contributions (fines, penalties) (including in electronic form) (Part 7 of Article 19 of the Law of July 24, 2009 No. 212-FZ). The bank is obliged to fulfill this order:

- no later than the next business day, if the collection is made from the organization’s ruble account;

- within two business days if the arrears are collected from a foreign currency account.

This procedure is provided for by Part 12 of Article 19 of the Law of July 24, 2009 No. 212-FZ.

If there is not enough money in the organization’s account to fully repay the arrears, the order is placed in the file cabinet of unpaid settlement documents. In this case, the arrears will be repaid gradually as money arrives in the organization’s account. The bank will determine the balance of funds to repay the arrears after deducting the first and second priority payments. This follows from the provisions of Part 13 of Article 19 of the Law of July 24, 2009 No. 212-FZ and paragraph 2 of Article 855 of the Civil Code of the Russian Federation.

If there is a shortage of money in a ruble bank account and the organization has a foreign currency account, the arrears can be recovered from foreign currency funds (Part 9, Article 19 of Law No. 212-FZ of July 24, 2009). To do this, the fund branch must give the bank an order to sell the currency. The amount of arrears, which is repaid using foreign currency, is determined at the Bank of Russia exchange rate on the date of sale of the currency. This procedure is provided for by Part 10 of Article 19 of the Law of July 24, 2009 No. 212-FZ.

It is prohibited to collect arrears from funds placed on the organization’s deposit account before the expiration of the deposit agreement (Part 11, Article 19 of Law No. 212-FZ of July 24, 2009).

If the arrears are not repaid at the expense of funds, the fund department may recover it at the expense of other property of the organization (Part 14, Article 19 of the Law of July 24, 2009 No. 212-FZ). The decision on recovery at the expense of other property is made within one year after the end of the deadline for fulfilling the requirement to pay insurance premiums (fines, penalties) (Part 3 of Article 20 of the Law of July 24, 2009 No. 212-FZ).

How is arrears identified?

Arrears, in most cases, are identified as follows:

- A tax return is prepared.

- Tax is calculated.

- If the tax is not paid on time, arrears arise.

- The amount of the penalty is formed.

Arrears may be discovered as a result of a tax audit.

Found under the following obligations:

- Incorrect preparation of payment documents, as a result of which the money was not received by the creditor.

- Errors that appeared during calculations.

The owner of the enterprise can find the arrears during the process of checking documents. In this case, he must make the payment immediately.

Recovery from property

Collection of arrears at the expense of other property is carried out by a bailiff based on a decision and on the basis of a resolution issued by the department of the fund (Part 2 of Article 20 of the Law of July 24, 2009 No. 212-FZ). In this case, the procedure provided for by the Law of October 2, 2007 No. 229-FZ must be observed. The list of property that can be recovered to pay off the arrears is given in Part 8 of Article 20 of the Law of July 24, 2009 No. 212-FZ. The organization has the right to indicate the property that should be collected first, but the final decision on the order of collection is made by the bailiff (Part 5 of Article 69 of the Law of October 2, 2007 No. 229-FZ).

Situation: can a territorial branch of an extra-budgetary fund collect debt on mandatory insurance premiums from the receivables of a commercial organization?

Yes maybe.

If there is insufficient money in a bank account, the fund branch has the right to collect debt on insurance premiums at the expense of the organization’s property (Part 14, Article 19 of the Law of July 24, 2009 No. 212-FZ).

The general procedure for the enforcement of decisions of regulatory agencies is established by Law No. 229-FZ of October 2, 2007. This is stated in Part 2 of Article 20 of the Law of July 24, 2009 No. 212-FZ.

According to subparagraph 1 of paragraph 1 of Article 75 of the Law of October 2, 2007 No. 229-FZ, collection can be applied to the debtor’s receivables. In this case, receivables are taken into account as part of the second stage of the debtor’s property, subject to seizure and sale (clause 2, part 1, article 94 of the Law of October 2, 2007 No. 229-FZ). Thus, the branch of the extra-budgetary fund has the right to collect arrears on insurance premiums from the organization’s receivables. The procedure for foreclosure on receivables is established by Article 76 of Law No. 229-FZ of October 2, 2007.

It should be noted that collecting arrears through accounts receivable can be beneficial to the organization. After all, in fact, she was given the opportunity to pay off extra-budgetary funds at the expense of the outstanding debts of buyers (customers). In the absence of funds in bank accounts, this use of the asset is very effective.

An example of collecting arrears of insurance premiums from an organization’s receivables

The property of an organization that produces products was seized in the amount of RUB 3,000,000.

The organization's balance sheet includes:

- accounts receivable – in the amount of RUB 4,500,000;

- finished products - worth 150,000 rubles;

- materials - in the amount of 150,000 rubles;

- equipment for production - in the amount of 1,700,000 rubles.

The assessment of the property by the bailiffs coincided with its value according to accounting data. As a result, the receivables were enough to pay off extra-budgetary funds.

Situation: what should be done to prevent the territorial branch of an extra-budgetary fund from collecting out of court the amount of arrears on mandatory insurance contributions?

Appeal the decision to collect the arrears and apply to the court for interim measures.

The organization has the right to appeal the requirement to pay insurance premiums in court (Part 1 of Article 54 of the Law of July 24, 2009 No. 212-FZ). Simultaneously with filing a statement of claim, an organization can apply to the court with a request to take interim measures in relation to the disputed amounts (Articles 90, 91, 199 of the Arbitration Procedure Code of the Russian Federation). If the court agrees with this request, then until the end of the trial the fund department will not be able to collect the arrears (parts 4, 5 of article 96 of the Arbitration Procedure Code of the Russian Federation).

In this case, the period during which the court’s ruling on the adoption of interim measures is in force is not included in the two-month period provided for by part 5 of Article 19 of the Law of July 24, 2009 No. 212-FZ, allotted to the fund branch for collecting arrears out of court. That is, if the demand for payment of insurance premiums is recognized as legitimate, the fund department will be able to make a decision to collect the arrears within two months from the moment the court cancels the interim measures. Such clarifications are contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 12, 2009 No. 17533/08. Despite the fact that the said resolution dealt with the case of collecting taxes and penalties, the explanations given in it can also be used in relation to collecting arrears on insurance premiums.

Write-off of bad debts

The organization's arrears in insurance premiums (fines, penalties) can be considered uncollectible and written off only:

- upon liquidation of the organization;

- due to the expiration of the period for collection by a court decision;

- when excluding an organization that does not actually carry out activities from the Unified State Register of Legal Entities.

This follows from the provisions of parts 1, 2 of Article 23 of the Law of July 24, 2009 No. 212-FZ and subparagraphs “a”, “d”, “e” of paragraph 1 of the Decree of the Government of the Russian Federation of October 17, 2009 No. 820.

The decision to write off arrears of insurance premiums (fines, penalties) (form approved by order of the Ministry of Labor of Russia dated March 12, 2015 No. 162n) is made by:

- Pension Fund of the Russian Federation - in relation to contributions to compulsory pension and health insurance;

- FSS of Russia - in relation to contributions to compulsory social insurance in case of temporary disability and in connection with maternity.

This is stated in paragraphs 2 and 3 of the Decree of the Government of the Russian Federation of October 17, 2009 No. 820.

What to do to write off debts

The amnesty is offered on the basis of official orders of the Government, and to write off debt, entrepreneurs do not need to make any applications, prepare documents or contact Federal Tax Service employees.

Attention! The regulations do not contain information about the timing of write-offs, and there is also no information about the duration of the amnesty.

The fiscal authorities of each region independently form a special schedule, on the basis of which the debts of individual entrepreneurs are written off. Errors and misunderstandings often arise, so the individual entrepreneur’s debts are simply not written off.

Therefore, entrepreneurs perform the following actions:

- Initially, your personal account is checked on the Federal Tax Service website, which reflects current and written-off debts;

- if you have any doubts about the existence of an outstanding debt, you can clarify this issue by telephone or during a personal visit to a Federal Tax Service office;

- if necessary, a special appeal is drawn up to representatives of the Federal Tax Service, which contains a request to reconcile debts and write them off as part of the ongoing amnesty.

Such actions help reduce the risk that debts that can be written off by law will have to be repaid yourself.

Amnesty is a measure of support that is offered to entrepreneurs who, when faced with crisis situations, were unable to pay taxes and insurance premiums . But this does not apply to unscrupulous businessmen who hid income or are trying to write off recently incurred debts.

It is also useful to read: Refund of overpaid insurance premiums