Frequency of filling

In most cases, employees are paid twice a month. Such conditions are specified in the Labor Code of the Russian Federation; for violating it, the company risks incurring administrative liability. Moreover, the first payment is considered an advance payment (usually a percentage of the salary), and the second payment is considered the main payment (the remaining part of the amount). Thus, a simple payslip will be issued for the advance (it indicates the amount that was paid in the first half of the month).

Form T-51 serves to illustrate and document the main part of the payment of wages to employees of the institution.

The column “Retained and credited” in the tabular part of the document must also take into account the advance part - data from the first paper.

What documents are used to calculate employee benefits?

With the entry into force of Federal Law 402-FZ “On Accounting” (this happened on January 1, 2013), organizations were given the right to independently develop primary documents used in their activities (clause 4 of Article 9 402-FZ). This also applies to documents used in calculating amounts paid to employees for their work. In order to use an independently developed form, it is necessary to provide for the presence of all mandatory details (clause 2 of Article 9 402-FZ) and approve it by local regulations.

If there is no desire or need to develop a sample payroll slip on your own, then you can use unified forms approved by the State Statistics Committee.

Filling algorithm

For full functionality, the paper can be issued in a single copy. At the top of the document fill out:

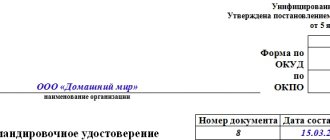

- Basic details. The OKPO code is already entered in the form - 0301010. OKUD is filled out.

- The full name of the company, if any, the structural division of the company within which the form is being filled out.

- The name of the statement, its number, the date of signatures.

- The period for which the calculations were made.

The date for drawing up the document can be chosen arbitrarily, but on the condition that this day will not be earlier than the last day in the current month and no later than the actual day the funds are written off from the organization's cash desk.

In addition, on the second page of the statement there is a table, each column of which must be filled in (otherwise a dash is placed in the table cell).

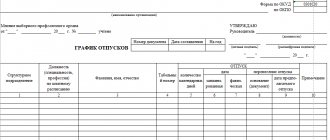

In total, the document contains 18 columns with the following names:

- serial number of the employee to whom the payment is intended;

- personnel number of the same employee;

- last name, first name and patronymic (the latter are abbreviated to initials);

- position held, profession or specialization in which the employee is engaged;

- salary or tariff rate;

- how many days or hours were worked during the specified period (weekends and weekdays are indicated separately);

- the amount accrued by the organization to this employee for the month (the column is divided into different types of fees, including a “general” column that summarizes the data);

- what amount was withheld and credited earlier (advance payment, income tax, etc.);

- the employee’s debts to the organization or, conversely, the exact amount;

- how much money is supposed to be paid to the employee according to this statement.

Filling out information about employees

Information about accruals and deductions is reflected line by line for each employee. If the company has few employees, then the order of filling out is not so important. If the number is larger, it is convenient to form the list in alphabetical order.

For each employee we indicate:

- FULL NAME.;

- job title;

- Personnel Number.

Data on salary or tariff rate are indicated in accordance with the employment contract concluded with the employee. It is there that the basic conditions for remuneration are stipulated.

At the same stage, we reflect information about the time worked for the billing month. They are filled out based on the working time sheet.

Signed by

The printed document must indicate the position, signature and transcript of the signature of the official who compiled the document. This could be the chief accountant or HR accountant.

ATTENTION! The statement will not be valid without the organization's seal on the last page.

By the way, according to the rules, it is permissible to fill out as many lines of the statement as necessary. It may have two, three, four or more sheets, compiled according to the sample tabular part of the paper.

Before receiving wages, the employee has the right to review the generated document at any time.

Are corrections allowed in the salary payment slip?

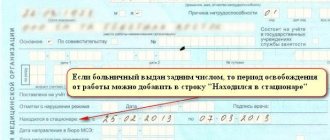

Corrections can be made to the payroll, but they greatly attract the attention of inspectors when checking compliance with cash discipline at the enterprise. So, if there are corrections and it is not possible to replace the form with a new one (the issuance of money according to the document has already begun and there are signatures confirming their receipt), then it is necessary to fill them out correctly.

The detected error is carefully crossed out, and a new one is made on top of this entry. Corrections must be signed by the manager, chief accountant and cashier. It would be useful to prepare an accounting certificate explaining the reason for the correction.

For information on how such a certificate is prepared, read the material “Accounting certificate of error correction - sample.”

Nuances of filling

When filling out, the employee’s personnel number is automatically taken from his personal card. The paper can be printed in a single copy. It is placed in the organization's archives. There should be no corrections on already completed paper. All necessary adjustments are made electronically.

If the performance of official duties does not require the employee to be in harmful or dangerous conditions, then the statement goes to the company’s archives. It must be stored there, in accordance with established requirements, for at least 5 years.

We calculate accrued wages

Let's move on to the calculations. To do this, fill out the “Accrued” section. It calculates the amounts. It is advisable to reflect each type of accrual in a separate column. This will allow you to check the accuracy of the calculations and analyze the accruals.

In our case, all employees have a time-based bonus payment system. Everyone works a five-day work week. In November there are 21 working days on schedule. Two of the employees did not work the entire month, so they need to calculate their salary for the time worked.

All other accruals (bonuses, allowances) are indicated on the basis of the orders of the manager, other administrative documents, and employment contracts.

It is necessary to calculate the total amount accrued to each employee. For example, “Total accrued” according to S.S. Sidorov. will be equal to:

Salary summary

A payslip is a document that is used by an organization to pay employees . It indicates all payments, deductions, etc., which ultimately allows you to receive exactly the amount payable that is due to the employee. An accountant can formalize the issuance of wages in the payroll, payroll, and payroll.

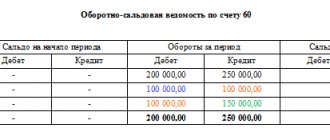

Summary statement of wages for the 1st quarter of 2001

A separate line indicates the amounts that were paid in kind for wages, as well as payments that are not part of the wage fund.

Salary summary sheet No. 58 includes:

- Section about employees who are engaged in the main activity

- Section on employees not engaged in activities that are core to the enterprise

- Section dedicated to employees not included in the list of enterprise employees

Without this document, it is impossible to conduct a statistical report on the use of funds from amounts intended for payment of wages. It has two sections, one of which reflects the accrued amounts, this is section A. The second section B indicates the amounts that were issued, transferred to accounts, and amounts withheld.

All indicators on the movement of employee wages (accruals, deductions, amounts issued) are summarized using a summary payroll sheet , where data based on the results of payroll and payroll statements is entered every month.

| Didn't find the answer? Ask your question to lawyers |

Courses 1C 8.3 and 8.2 » Questions about 1C ZUP 8.3 (3.0) » zup-3-osn-modul-1-faq » How to create a summary of the salary for a period without breaking it down by month? Get 200 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.2 and 8.3;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

Question: Please tell me how to create a summary of the salary for a period without breaking it down by month. I can't find the right settings. Answer: In the report, open “Report Settings” (the “Settings” button next to the “Generate” button) and go to the advanced option for viewing settings (the button at the very bottom of the window). On the “Structure” tab there is a grouping “Accrual month, Organization”.

How to create a salary summary for a period without breaking it down by month?

Important

From 8.2 (8.2.13.205) ed. 2.5 (2.5.30.4) 1. Tell me: in ZiK 7.7 you can create a general Summary of accrued salary for a certain period (quarter, year, etc.). In ZiK 8 it is formed, but broken down, T.

It is necessary to form a GENERAL CV for the 1st quarter, it is formed, but on a monthly basis (January, February, March). Maybe I'm doing something wrong? I need general numbers. 2.

Where to enter the advance amounts for each employee, in number seven it was entered on the card, in number eight I don’t see.

I made a calculation for the first half of the month, the program calculates it itself, but not like that, we have 40% of the salary.

Salary summary for the year

Let's consider payment through a bank, since this method is the most common in organizations. In the “Salaries and Personnel” menu, select “Statements to the Bank”.

Create a new document from the list form. In its header, indicate the month of accrual, division, type of payment (per month or advance). There is also a field for indicating the salary project.

It will be discussed later.

Next, click on the “Fill” button and after the data is automatically included in the document, enter it. See also video instructions for paying an advance: And the calculation and payment of wages in 1C: Salary project in 1C 8.

The salary project for an employee is indicated on his card in the “Payments and Cost Accounting” section.

Payroll calculation in 1C 8.3 accounting step by step for beginners

In this example, we selected the “In this program” item, since otherwise some of the documents we need will not be available.

Zup 8-set of accruals, advance

Standardly, the report displays summary information on accrued and paid wages for a specified period. But we will try to reconfigure the cat report to obtain information about accrued and withheld wages in an arbitrary period of time. First, let's go to "Settings" and delete everything that is configured there as standard.

Let's add a new table to the report structure.

Let's add the "Section" grouping and the subordinate grouping "Calculation Type" to the rows, and to the "Accrual Month" columns. Now we'll select the topmost element of the report hierarchy and in the selection setting we'll indicate the employee for whom we want to receive data, by the way, I think, the balance in the report will be superfluous, and we will exclude it using the comparison type “Does not contain” “Balance”. Great, now we can select a custom period to view employee salary information.

Source: https://bookerlife.ru/svod-po-zarabotnoj-plate/

Payroll (form No. T-51): features of preparation

If an organization uses a payroll (for example, according to form No. T-49), a separate payroll is no longer compiled.

The payroll is filled out for all employees, regardless of how they receive their wages (in cash or by transfer to bank cards).

Payroll T-51 is compiled by the accounting department in one copy.

The calculation of wages in the payroll is carried out on the basis of data from primary documents recording production, hours actually worked and other documents.

In the “Accrued” columns, amounts are entered by type of payment from the wage fund, as well as other income in the form of various social and material benefits.

At the same time, all deductions from the salary amount are calculated and the amount to be paid to the employee is determined.

In pay slips compiled on a computer, the composition of the details and their location are determined depending on the adopted information processing technology. In this case, the document form must contain all the details of the unified form.