An inventory list in the INV-16 form is used when checking securities and strict reporting documents. They, just like other objects and assets of the company, must be subject to inventory. The form is filled out by a specially created commission based on the results of the procedure. It displays data on the actual availability of securities and BSO in the organization and compares it with accounting information. We’ll figure out how to fill out such a form in the article.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What should be checked to generate an act

Before you begin to carry out an inventory of economic investments, you should determine whether the assets are legally assigned to the 58th accounting account, for which several conditions must be simultaneously met:

- there is a real chance of benefiting from the investment;

- availability of correctly formed papers for the right to own property and profits from it;

- transition to organizing risks for this property.

In order to ensure complete and truthful information about economic investments, actual expenditures in securities, authorized capitals of other companies and loans issued to third companies are checked. They must be taken into account on the basis of the following papers: contracts, payment orders, invoices for goods, investment certificates, acceptance certificates, as well as other primary papers.

What documents are prepared?

Documentation of the BSO inventory is of great importance for the subsequent legalization of its results. The organization can record the results of the audit performed using independently developed document forms.

However, he has a convenient alternative - to use standard templates approved back in 1998.

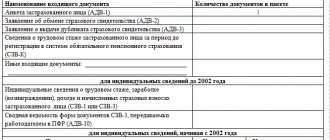

As a rule, we are talking about the preparation of the following standard papers:

- order regulating the inventory (reason, timing, composition of the commission);

- inventory list for BSO;

- act of inventory of available documents;

- statement of comparison (reconciliation) of the results of the performed check (filled out if inconsistencies are detected between the fact and the accounting).

If a company uses its own template forms, it should ensure that these documents contain a number of mandatory details, the composition of which is regulated (by the accounting law).

In addition, independently developed templates must be approved by the manager. The results of the audit are documented in standard documentation, usually drawn up in 2-3 copies.

When and how is this form used?

Based on the BSO inventory report, companies draw up inventories that reflect information about the availability of securities and strict reporting forms.

This inventory is compiled to detect possible discrepancies between audit data and accounting information.

The entries for the inventory of financial investments are as follows:

- D58 – K91 – unaccounted securities were capitalized;

- D94 – K58 – write-off of damaged securities or shortages.

The basis for registration of these transactions will be the inventory report in the INV-16 form.

Legislative regulation

The inventory procedure is regulated by a document such as the Guidelines for Inventory of Property and Financial Obligations. They are an annex to the Order of the Ministry of Finance of the Russian Federation No. 49 of June 13, 1995.

As for the use of the INV-16 form, the law does not indicate anywhere that it is mandatory. On the contrary, Information of the Ministry of Finance of Russia No. PZ-10/2012 indicates that since 2013, all unified forms have become only recommended for use. Companies have the right to develop their own forms, not forgetting that a number of details must be on the document.

Important! The decision on which forms to use in work must be recorded in the accounting policies of the company.

Many business entities use unified forms out of habit, as well as being guided by their convenience and the absence of complaints from officials from inspection departments. INV-16 is no exception.

How to fill out a form

The financial investment inventory form in the INV-16 form has the following structure:

- title of the document – act;

- date of formation of the act;

- name of the company that executed the act;

- types of business transactions;

- units of measurement of inventory objects;

- position, surname, name and patronymic of the employee bearing financial responsibility;

- positions, as well as last names, first names and patronymics of all members of the commission;

- signatures of the chairman of the commission, all its members and mat. - responsible employee.

INV-16 - sample filling

Form INV-16, which is an act of inventory of financial investments - a sample developed by the State Statistics Committee of the Russian Federation. Like other unified documents, it is not mandatory for use. But when drawing up their own form, organizations need to take the developed act as a basis.

The website has access to the unified form INV-16, the form of which can be downloaded at the end of the article. If desired, it is possible to generate a document of your own sample indicating the required details: name of the form, business transactions, signatures of responsible persons and other data.

The formation of a document is subject to general rules:

- Filling out is possible both using computer technology and manually.

- Corrections may be made by crossing out incorrect information and writing the correct information above. Corrections are recorded with the signatures of commission members.

- Blank lines should be filled with dashes.

- The last sheet of the document must be certified by the signatures of the persons included in the inventory commission.

Based on the results of the inspection, 2 copies of the inventory are generated or 3 (when transferring values from one financially responsible person to another). One of the forms is stored in the accounting department, the others are handed over to responsible persons.

AND . We'll talk about this today.

Features of the inventory of securities

When making an inventory of securities, you need to make sure that:

- all primary documentation is prepared properly;

- the price of all investments is correct;

- the actual number of securities coincides with accounting data;

- investment profitability is reflected correctly and timely in accounting.

If the securities are in the company, their inventory must be carried out simultaneously with the inventory of cash in the cash desk. If these papers are transferred for safekeeping to another company, during the inventory the balances of the amounts are verified on special accounts. accounts with statements from the company where the securities are stored.

To inventory securities, it is necessary to analyze information for each issuer. In this case, the following information must be entered into the financial investment inventory form: number of securities, their series, actual denomination and other data.

Similar articles

- Inventory report of receivables and payables (sample)

- Inventory results report (filling sample)

- Inventory of financial investments

- Cash inventory report (form and sample)

- Inventory list of intangible assets (sample)

Inventory procedure

Rules

- The BSO audit is carried out simultaneously with the inventory of money in the cash register (usually once every 3 months).

- If an employee who is the financially responsible person changes, an extraordinary audit may be assigned.

- It is determined whether all receipts are included in the Book, whether there are lost or damaged forms.

- Each type of form is checked separately, taking into account financially responsible persons, storage locations, starting and last numbers.

- It is important that there are no corrections on the completed documents, the amounts correspond to those reflected in the accounting.

Inventory form INV-16

The INV-16 inventory form has been used for inventory since 1999. Resolution of the State Statistics Committee No. 88 (08/18/1998) established that it must be filled out in 2 copies.

The goal is to identify discrepancies in quantity and amount when compared with accounting data. If there are forms with the same numbers, a set is formed with an exact indication of the number of sheets.

Before the start of the audit, the persons responsible for storage sign receipts. They become parts of the inventory. On the final page there are lines to indicate the series and numbers of the last completed documents, if their movement does not stop during verification. If the inventory is filled out automatically, a document is issued in which columns from the first to the tenth are already filled in. The commission fills out columns 11 and 12.

The unified form INV-16 consists of 4 pages; it is convenient to download it using.

- You can fill out the form either manually or on the computer.

- It is allowed to use forms developed by the enterprise if it has all the required details.

- Corrections are made by striking out. The updated data is indicated above. Signatures of commission members are required.

- Lines that are not filled in are marked with dashes.

- The completed inventory is signed by members of the commission and persons responsible for storage. One copy is given to the accountant, the second to the employees responsible for storage.

- If the inventory is carried out in connection with a change in the employee responsible for storage, 3 copies are drawn up in order to transfer one to each employee responsible for storage (the one who left and the one who came).

Sample of filling out INV-16

INV-16

is a unified form used for inventory of securities, as well as strict reporting forms (SSR). We will tell you in our article what the key nuances of working with this document are and where you can download it.

Results

Form INV-16 is used to formalize 2 business procedures: inventory of securities and BSO forms, as well as recording the fact of transfer of the relevant assets of the company from the jurisdiction of one MOL to another. It will need to be executed in the first case in 2 copies, and in the second - in 3.

Sources

- https://okbuh.ru/inventarizatsiya/finansovye-vlozhenija-akt

- https://assistentus.ru/forma/inv-16-inventarizacionnaya-opis-cennyh-bumag-i-blankov/

- https://praktibuh.ru/buhuchet/denezhnye-sredstva/nalichnye/bso/inventarizatsiya-blankov-strogoj-otchetnosti.html

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/poryadok_provedeniya_inventarizacii_bso_nyuansy/

- https://spravochnick.ru/rynok_cennyh_bumag/inventarizaciya_cennyh_bumag/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_inv16_blank_i_obrazec/

BSO accounting

Strict reporting forms include the following documents: receipts, certificate forms, diplomas, licenses, invitations, checks, receipt books, insurance policies, certificates, subscriptions, tickets, vouchers. They must be printed, have machine-readable six-digit numbering, have the necessary degree of protection and contain mandatory details.

Enterprises are required to monitor the consumption of paper forms by name, series and numbers. Accounting is maintained on off-balance sheet account 006 for each type and storage location in the conditional valuation. Shares, bonds and other securities, employment record forms must be taken into account in the same manner.

Read more about BSO in the article “What applies to strict reporting forms (requirements)?”

Example

In May 2021, Quint LLC ordered 5,000 receipts from the printing house for a total of 10,000 rubles for settlements with the population. without VAT. The transfer of the forms is documented in the BSO acceptance certificate. Forms in the amount of 1,000 pieces were received under the responsibility of the accountant-cashier.

The company's accountant reflected this transaction as follows:

- Dt 10 Kt 60 - 10,000 - documents are accepted for accounting at the actual cost of production.

- Dt 006 - 10,000 - received forms are reflected in the off-balance sheet account.

- Dt 26 Kt 10 - 2000 - the cost of issued BSO is included in expenses.

- Kt 006 - 2000 - issued under report based on the intake control sheet.

Forms are registered in a special book, which must be numbered and laced. The book must be sealed and certified by the signature of the manager and chief accountant. As a sample, you can take the form according to OKUD 0504045, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n for state-owned enterprises.

BSO must be stored in conditions that prevent their damage and theft.

You can learn more about accounting and storage of forms from the article “Procedure for accounting and storage of strict reporting forms.”