Who must pay land tax and what determines its amount?

Not every businessman has to pay land tax.

As soon as a land plot appears as part of his property, the issue of calculating and paying this tax becomes relevant. For example, on January 21, 2020, the company registered ownership of land - from that moment on, it has the obligation to calculate and pay land tax (clause 1 of Article 388 of the Tax Code of the Russian Federation).

If the company decides to register the land under the right of free-term use or has entered into a lease agreement, it does not have the obligation to pay land tax and there is no need to look for an answer to the question of how to calculate the land tax (clause 2 of Article 388 of the Tax Code of the Russian Federation).

IMPORTANT! Land tax is local and is regulated not only by the Tax Code (Chapter 31), but also by land and municipal legislation (in terms of establishing benefits, rates, and payment procedures).

The amount of tax depends on several factors: the regional location and cadastral value of the site, the purpose of its use, the tax rate and the availability of benefits. In relation to this tax, regions are given the opportunity to:

- approve the amount of rates on it, without going beyond the limits established by the Tax Code of the Russian Federation;

- differentiate these rates;

- introduce additional benefits;

- decide on the payment of advance tax;

- set payment deadlines (until 01/01/2021).

From 01/01/2021, local authorities do not determine payment deadlines for land tax. The deadline will be the same throughout the country: March 1 for annual taxes and the last day of the month following the reporting period for advance payments. The new rules are effective from the annual payment for the 2021 tax period.

Starting with the tax for 2021, its declaration has been canceled, and the Federal Tax Service will send messages with the amount of tax calculated according to the data it has. The message will indicate the cadastral number of the plot, the amount of tax, the tax period, as well as the data on the basis of which the tax is calculated: tax base, tax rate, amount of tax benefits, etc. However, this does not mean that legal entities no longer need to calculate the tax themselves. This responsibility will remain with organizations in the future. After all, the payer must know the amount in order to make advance payments during the year (if such are established by local authorities). And the message from the tax office is more of an informational nature. And he will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

Important! Recommendation from ConsultantPlus Compare the amount of tax calculated by the inspectorate with the amount you calculated and paid. If they are equal, then the tax was calculated and paid correctly. If the amounts differ, check:... What to check and what to do in case of an error (yours or the tax authorities), see K+. Trial access to the system can be obtained for free.

ATTENTION! If you do not receive the notification, you are required to independently inform the tax authorities about your taxable property. Read about the nuances in the material “Organizations will have to report transport and land plots to the tax authorities.”

Next, we will consider the procedure for calculating land tax for a legal entity.

Tax notice

For individuals, the land tax is calculated by the tax service, after which it sends a notification to their place of residence, which contains information about the amount of the tax, the deadline for its payment, etc.

Tax notices in 2021 for 2021 will be sent to residents of Russia between April and September

.

If erroneous data

In the notification, you must write an application to the tax service (the application form is sent along with the notification). After confirming this data, the tax amount will be recalculated and a new notification will be sent to the taxpayer.

The tax notice did not arrive

Many land owners mistakenly believe that if they have not received a notice from the tax service, then they do not need to pay land tax. This is wrong

.

On January 1, 2015, a law came into force according to which taxpayers, in the event of non-receipt of tax notices, are required to independently report

to the tax authority about the availability of real estate assets, as well as vehicles.

The above message, with copies of title documents attached, must be submitted to the Federal Tax Service in respect of each taxable object once before December 31 of the following year. For example, if the land was purchased in 2020, and no notifications were received regarding it, then information must be provided to the Federal Tax Service by December 31, 2021.

Therefore, if you do not receive a notification, the Federal Tax Service recommends taking the initiative and contacting the inspectorate in person (you can use this service to make an appointment online).

If a citizen independently reports the presence of a land plot on which tax has not been assessed, the payment will be calculated for the year in which the specified message was submitted. However, this condition only applies if the tax office did not have information about the reported object. If the payment notice was not sent for other reasons (for example, the taxpayer’s address was incorrectly indicated or it was lost in the mail), then the calculation will be made for all three years.

For failure to submit such a message within the prescribed period, the citizen will be held accountable under clause 3 of Art. 129.1 of the Tax Code of the Russian Federation and was fined in the amount of 20% of the unpaid tax amount for the object for which he did not submit a report.

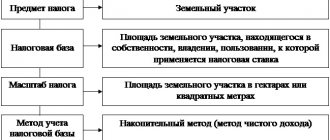

The procedure for calculating and paying land tax on a plot (basic formula)

How is land tax calculated for 2021? At first glance, it’s usually: we multiply the tax base by the rate. In this case, the cadastral value of the land established at the beginning of the corresponding tax year serves as the base (clause 1 of Article 389 of the Tax Code of the Russian Federation).

Important! Hint from ConsultantPlus Where to find the cadastral value of a plot for land tax There are several ways to find out the cadastral value: order an extract from the Unified State Register of Real Estate... You will find two more ways to find out the cadastral value in K+. You can get trial access for free.

If land is bought or sold during the year, the land tax formula will be adjusted taking into account the period of land ownership (the coefficient Kv is calculated as the ratio of full months of land ownership to 12 months). A month in which the ownership right arose before the 15th day or was lost after the 15th day is considered complete (clause 7 of Article 396 of the Tax Code of the Russian Federation).

A different coefficient (Ci) should be applied if the cadastral value changes during the year.

How the tax is calculated in this case, read the article “Calculation of land tax when the cadastral value changes.”

A special procedure for calculating land tax applies if the land is located on the territory of two municipalities at once. Then the cost of the plot is divided between these entities, taking into account the share of area located in each of them (clause 1 of Article 391 of the Tax Code of the Russian Federation). And for each part, its own tax calculation is made using the benefits and rates corresponding to each of the entities.

An example of determining the base for land tax if the site is located in the territories of two municipalities from ConsultantPlus Organizational site with an area of 1,000 square meters. m is located on the territories of two municipalities (MO). Municipality No. 1 accounts for 480 sq. m, for municipality No. 2 - 520 sq. m. m The cadastral value of the plot in the Unified State Register of Real Estate as of January 1 of the year is 2,000,000 rubles. Let's determine the share of the plot for each municipality: For the full example, see K+. This can be done for free.

The company is required not only to calculate land tax based on the cadastral value using all coefficients - it is equally important to report to the tax office on time and pay the tax.

How to calculate and pay tax, read the article “Land tax for the year - how to calculate and when to pay?”

Regional law may require quarterly advance tax payments. Each such payment is calculated as ¼ of the annual tax amount (clause 6 of Article 396 of the Tax Code of the Russian Federation) taking into account the number of months of ownership in the corresponding quarter (clause 7 of Article 396 of the Tax Code of the Russian Federation).

We tell you when to pay advance payments for land tax in the article “Deadlines for paying advance payments for land tax.”

Correction factors for calculations

Conclusion. The tax return must indicate the amount to be refunded, which will be half of the previously collected tax amount.

The calculation results are presented in Table 1.

Table 1.

| Period | Holding time | Coeff. Kv | Coeff. Kuv | ZN, rub |

| 2013 | 9 months | 9/12=0,75 | 2 | 11342 |

| 2014 | 12 months | 1 | 2 | 15123 |

| 2015 | 12 months | 1 | 2 | 15123 |

| 2016 | 3 months | 3/12=0,25 | 2 | 3780 |

| 2016 | 9 months | 9/12=0,7 | 4 | 22682 |

| 2017 | 4 months | 4/12=0,33 | 4 | 10072 |

| Total | 78122 |

- For the first 3 years, Stroyinvest JSC paid tax with a coefficient of 2

- Then JSC Stroyinvest had to pay tax with a coefficient of 4.

- Since the construction and commissioning of the house took place over 4 years, there will be no refund.

Or on the website. It's fast and free!

Based on the amount received, it follows that the tax reporting must indicate the amount to be refunded.

The first 3 years of JSC “Zhara. July" paid tax at a coefficient of 2, then at a coefficient of 4.

There will be no partial refund, since the construction of a residential building and its commissioning took more than 4 years.

Joint Stock Company "Topoliny Pukh" registered the right to the land plot on January 10, 2015. A supermarket was built on the site. State registration was carried out on September 16, 2021. The cadastral value of the plot is 987,654 rubles. Tax rate – 0.3%. Kuv = 3.

987654 rub. × (0.3%) × 3 = 8888.88 rub.

JSC "Zhara" July”, a plot for the construction of a residential building was purchased on April 12, 2013. The cadastral value is 2526272 rubles. Tax rate – 0.3%. Construction ended in 2014, and the transfer of ownership of the apartments took place on April 20, 2021.

| Calendar year | Holding period in months | Kv | Kuv | Tax amount, rub. |

| 2013 | 9 | 0,75 | 2 | 11 368 |

| 2014 | 12 | 1 | 2 | 15 157 |

| 2015 | 12 | 1 | 2 | 15 157 |

| 2016 | 3 (until April) | 0,25 | 2 | 3 789 |

| 2016 | 9 (from April) | 0,7 | 4 | 21 220 |

| 2017 | 4 | 0,33 | 4 | 10 004 |

| Total 76,695 | ||||

Calculation of land tax based on cadastral value using an example

Let's see how to calculate land tax for 2021. For example, a company that registered ownership of a land plot on January 21, 2020, found out its cadastral value at the beginning of the year (980,000 rubles) and the tax rate (1.5%) in force in the relevant area (from the local land regulatory legal act). These legal acts do not provide benefits or increasing coefficients.

Let's calculate land tax in 2021:

980,000 rub. × 1.5% × 11/12 = 13,475 rubles,

Where:

11/12 is a coefficient that takes into account the full months of ownership of the plot (from February to December) from the 12 months of 2021. January is not included in the calculation, since the right to land arose in the second half of the month.

Let's look at an example of how to calculate land tax if local land legislation provides for advance payments. Using the initial data of the previous calculation, we obtain the following:

- The advance payment for the 1st quarter of 2021, taking into account the number of months of ownership, will be 2,450 rubles. (1/4 × 980,000 × 1.5% × 2/3);

- for each of the following reporting periods (for half a year and 9 months of 2021), the payment will be 3,675 rubles. (1/4 × 980,000 × 1.5%);

- at the end of 2021, it will be necessary to pay to the budget an amount equal to the difference between the full tax amount calculated for the year, taking into account the number of months of ownership, and the amount of advance payments accrued for this year (13,475 – 2,450 – 3,675 × 2 = 3,675).

IMPORTANT! The tax is paid in full rubles (observing the rounding rule) - this is established by Art. 52 of the Tax Code of the Russian Federation.

Download a sample payment order for payment of land tax here .

Calculation formula

Note!

Since 2015, individuals, including entrepreneurs, no longer have to calculate land tax on their own. This responsibility is assigned to the Federal Tax Service. Payment is made according to the tax notice.

Land tax is calculated using the following formula:

Land tax = Kst x D x St x Kv

,

Kst

– cadastral value of the land plot (it can be found on the official website of Rosreestr or using a cadastral map).

D

– the size of the share in the right to a land plot.

St

– tax rate (you can find out the tax rate in your region on this page).

Kv

– coefficient of ownership of a land plot (applies only in case of ownership of a land plot for less than a full year).

How to calculate land tax taking into account the benefits?

Benefits contained in the Tax Code of the Russian Federation or established by local authorities can exempt a company from paying land tax in whole or in part (Article 395 of the Tax Code of the Russian Federation).

If municipalities have provided a benefit for a company's land plot, the tax is calculated taking into account this benefit.

Let's continue our example of calculating land tax: a company has located a scientific center on its land plot (it occupies 20% of the area and is used for its intended purpose), and local authorities have provided tax exemption for land plots used to house scientific institutions.

The land tax will then be calculated as follows.

- Let's determine the tax base:

(980,000 rub. – 980,000 rub. × 20%) = 784,000 rub.

- Let's determine the amount of tax at a tax rate of 1.5% and coefficient (Kv) = 0.9167 (previously calculated as 11/12):

784,000 rub. × 1.5% × 0.9167 = 10,780 rubles.

Read more about the benefits established by the Tax Code of the Russian Federation in the article “Object of taxation of land tax” .

Rubric “Question and answer”

Question No. 1. Citizen Kurilov registered ownership of the land on May 12, 2008. After purchasing the land, Kurilov began constructing a building on it for a store. The construction of the store was completed 10 years later; on 10/11/18 Kurilov registered ownership of the property. By what rules does Kurilov need to apply increasing coefficients to calculate taxes?

Since Kurilov used the land for the construction of commercial real estate, he should calculate the tax on a general basis. From 05/12/08 to 05/12/11 the tax should be doubled (coefficient 2), then four times (coefficient 4) until 10/11/18 (registration of the object). Tax recalculation and refunds are not provided for Kurilov.

Question No. 2. WWII veteran K.L. Komarov, living in the Moscow region, purchased a plot of land to rent out. There is no construction taking place on the site. How to calculate land tax for Komarov?

Since Komarov has veteran status, as a resident of the Moscow region, he can take advantage of a benefit in the form of tax exemption. In this case, the tax for Komarov must be paid by the actual tenant.

Question No. 3. In September 2021, Khomyakov acquired a plot for the construction of a farm (real estate objects for keeping and caring for cattle). In November 2021, Khomyakov completed construction. Starting from December 2021, the land and premises are used for the operation of breeding and selling cows and sheep. Can Khomyakov qualify for a reduced land tax rate (0.3%)? Is it necessary to apply a multiplying factor in this case?

Since the land is used for livestock farming, Khomyakov has the right to apply a rate of 0.3%. At the same time, when calculating the tax for Khomyakov, coefficient 2 is used - from September 2021 to September 2021, coefficient 4 - from October 2021 to November 2021. Tax recalculation for Khomyakov is not provided. From December 2021, Khomyakov can pay tax in the general manner, without taking into account the coefficient.

Is it possible to calculate land tax paid by legal entities online?

How to calculate land tax online? This is a completely natural question with modern automation of settlement processes. Services for calculating tax amounts using an online calculator are offered by many websites.

But you can take advantage of these offers if the tax calculation algorithm is quite simple (for example, there are no benefits, and the site is located on the territory of one municipal district). Otherwise, you will not be able to find a universal calculator.

As practical experience shows, it is better to calculate land tax using a formula you created yourself (automating the process using Excel spreadsheets or other proprietary computer developments).

And for individuals and individual entrepreneurs, a special service is available on the Federal Tax Service website, which will calculate the amount of tax online. See details here .