Every citizen of the Russian Federation is a taxpayer. The state replenishes the budget by deducting interest from wages. Regardless of the field of activity, citizens make mandatory payments. The amount of funds that goes to the state treasury is provided for by the current legislation of the Russian Federation.

The key place in the field of taxation is occupied by the personal income tax. In our publication today, we propose to find out what this tax is, what tax rates exist for personal income tax, what is subject to taxation and what is not, we will figure out how to calculate personal income tax in 2021, we will give examples of calculation.

Personal income tax: main features

Personal income tax is a tax on the income of individuals, through which the state treasury is filled. This tax is levied on the profitable part of the tax subject, which are individuals, namely:

- tax residents of the Russian Federation (persons staying in Russia for at least 183 days a year);

- tax non-residents of the Russian Federation (persons receiving profit in Russia).

Currently, there is talk behind the scenes in governments about equalizing personal income tax rates for residents and non-residents. Where this alignment will lead and when it will be done remains unknown. In any case, the Russian Federation budget for 2021 has already been approved, so if such an event occurs, it will not be earlier than 2021. Therefore, let’s consider the current personal income tax situation for 2021.

Personal income tax or personal income tax is calculated based on interest rates. It should be noted that the calculation of interest on wages is carried out only after taking into account tax deductions provided by the state. Personal income tax is calculated from the amount remaining after deduction. Tax deductions for children for non-residents are not provided for by the legislation of the Russian Federation.

Compensation to shareholders is not assessed

Absolutely new for personal income tax from 2021 - this is paragraph 71 of Art. 217 Tax Code of the Russian Federation. Law No. 342-FZ of November 27, 2021 added to the list of non-taxable payments. These include compensation from the compensation fund received by the shareholder within the framework of the Law of July 29, 2021 No. 218-FZ “On the protection of the rights of shareholders in the event of bankruptcy of developers.”

Since many people got burned by this scheme for acquiring new housing, the state decided to support those who were not lucky enough to move into a completed house.

Personal income tax rates in 2021

Personal income tax rates exist at 9%, 13%, 15%, 30% and 35%.

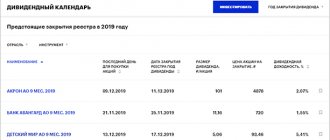

Tax rate 9%:

- receiving dividends (until 2015);

- receiving interest on mortgage-backed bonds (before January 1, 2007);

- receipt of income by the founders of the trust management of mortgage coverage (before January 1, 2007, based on the acquisition of mortgage participation certificates that were issued to managers of mortgage coverage).

Tax rate 13%:

for tax residents:

- wage;

- remuneration under civil contracts;

- income from the sale of property;

- other income.

Since 2015, dividends are taxed at a rate of 13%, rather than 9%.

for tax non-residents:

- from carrying out labor activities;

- from carrying out labor activities as a highly qualified specialist (based on the law “On the legal status of foreign citizens in the Russian Federation”);

- from the implementation of labor activities of the State program to assist the voluntary resettlement to the Russian Federation of compatriots living abroad, as well as members of their families who jointly moved to permanent residence in the Russian Federation;

- from the performance of labor duties by crew members of ships that sail under the state flag of the Russian Federation.

Tax rate 15%:

- dividends received from Russian organizations by non-resident individuals of the Russian Federation.

Tax rate 30%:

- all other income of non-resident individuals of the Russian Federation.

Tax rate 35%:

- income from winnings (prizes) in excess of the established amounts;

- interest income on deposits in banks in terms of excess of the established amounts;

- income from savings on interest when taxpayers receive borrowed (credit) funds in excess of the established amounts;

- income in the form of fees for the use of funds of members of a credit consumer cooperative (shareholders), as well as interest for the use of funds by an agricultural credit consumer cooperative (which were raised in the form of loans from members of an agricultural credit consumer cooperative or associated members of an agricultural credit consumer cooperative) in part of the excess established sizes.

Vacation pay

Since vacation payments are employee income, personal income tax is also withheld from them. The calculation is carried out as follows:

- From the amount due to the employee as vacation pay, remove tax deductions (social, property, investment, standard, etc.)

- From the resulting amount, subtract insurance premiums (medical, social, pension insurance).

- Insurance against accidents or occupational diseases must also be deducted.

- Multiply the resulting amount by the tax rate of 13%.

If an employee takes vacation in installments, income tax is withheld only from the amount of vacation pay actually paid

By law, an accountant must accrue vacation pay and withhold tax money on the same day, so these transactions must be reflected in tax reports at the same time.

General rules for calculating personal income tax

The general rules for calculating personal income tax are established by the provisions of Art. 225 Tax Code of the Russian Federation:

1. To calculate personal income tax for the tax period, all income subject to income tax is determined (clause 3 of Article 225 of the Tax Code of the Russian Federation).

2. For each type of income, the tax rate should be clarified in accordance with Art. 224 Tax Code of the Russian Federation.

3. The tax base for personal income tax for the tax period is calculated. It must be remembered that in order to calculate personal income tax when applying several tax rates, the tax base is calculated separately for each type of income.

How to submit reports during reorganization

If you are reorganizing your business, there are important income tax changes to consider in 2021. Thus, from January 1, the Tax Code of the Russian Federation regulates the rules for submitting reports in this situation. This is a new paragraph 5 of Article 230, introduced by Law No. 335-FZ of November 27, 2021.

The main requirement is this: regardless of the type of reorganization - accession/separation/transformation/merger - the legal successor is obliged to submit Form 2-NDFL and report 6-NDFL for the reorganized structure to the Federal Tax Service at the place of its registration, if it has not done so. If there are several legal successors, then the responsibility of each is established by the transfer deed or separation balance sheet.

Also see “New rules for determining the tax period for various taxes for individual entrepreneurs and legal entities.”

How to calculate personal income tax on wages in 2021

In order to calculate personal income tax on wages, you need to use a special formula, which looks like this:

N = PS x OS, where:

N - personal income tax, PS - interest rate, OS - taxable amount.

Please note that in order to determine the fixed assets, it may be necessary to make additional calculations due to the fact that tax deductions may be used on the income side.

OS = DC - V, where:

DC - income part of the person, B - deductions.

An example of calculating personal income tax from salary without deduction:

Citizen Ivanov A.S. receives a salary of 35,000 rubles. It is necessary to find out how much his monthly personal income tax will be.

In this case, the calculation of personal income tax in 2021 is made from wages, which means at a rate of 13%. Thus:

35,000×13% = 4,550 rubles.

In this amount from citizen Ivanov A.S. Personal income tax will be withheld every month. His net income will be:

35,000 - 4,550 = 30,450 rubles.

As you can see, calculating the personal income tax amount is quite simple.

Certificate and calculation of 2-NDFL

Certificate 2-NDFL is a document in which a person reflects his income, wages and the amount of taxes paid.

The 2-NDFL certificate must contain the following information:

- employer information;

- employee information;

- income taxed at a rate of 13%;

- tax deductions;

- calculations of taxes, income and deductions.

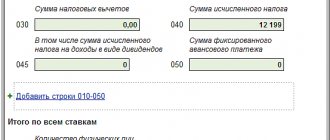

An example of data entered into the 2-NDFL certificate:

Citizen Petrov S.N. has a monthly income of 55,000 rubles. Child deductions (5 years old) are applied to his salary. Let's consider what calculations in this case need to be made to fill out the 2-NDFL certificate.

Calculation of annual income

55,000×12 (months) = 660,000 rubles (per year).

Tax deduction calculation

The deduction per child is 1,400 rubles. In 2021, you can use the benefit with an income not exceeding 350,000 rubles (for 2021, they plan to raise the maximum income bar by 50,000 rubles to 400,000 rubles), which means you need to calculate how many months Petrov can use the child deduction:

350,000 / 55,000 = 6 months.

Calculation of the amount of deduction for the year

6 months x 1,400 rubles = 8,400 rubles.

Let us subtract the amount of deduction from the total annual income:

660,000 rubles - 8,400 = 651,600 rubles.

Calculation of tax paid

653,000 rubles x 13% = 84,704 rubles.

Thus, S.N. Petrov, having calculated the personal income tax, must enter the following information into the 2-personal income tax certificate:

- tax amount - 84,704 rubles;

- income - 660,000 rubles;

- the amount of deductions is 8,400 rubles.

Taxes

The entire amount of tax payments that the state collects from the population goes primarily to the benefit of the state budget, as the main source of its financing. This is practically the most important instrument of fiscal policy of the Russian Federation. However, now very often there are bad rumors about upcoming changes, which is quite suspicious and frightens people who are not familiar with it.

Of course, in the current conditions of state education in Russia, you can expect anything. The latest news about problematic oil prices, restrictive sanctions and empty state reserve funds, in principle, lead to a logical continuation in the form of huge reforms. And naturally, one of these reforms should be an increase in taxes.

Of course, such prospects are never encouraging, because a Russian citizen already constantly lacks money for a banal existence. Expenses for paying for your own housing, utilities, food and clothing, as well as less obvious expenses in the form of travel fees and small but expensive necessities already greatly narrow the range of a person’s possibilities.

Especially today, in the unstable political situation with the past elections. It’s even scary to imagine what you can count on in 2021. Although for personal income tax the rate will most likely rise further and further. After all, even government organizations are happy to support such reforms.

The Ministry of Finance itself has already stated that, according to internal calculations, an increase in personal income tax by 2 percent will be quite significant for the state, since it will already bring half a trillion rubles in one year. These are very large numbers even for an entire country, since the entire budget as a whole consists of 3.5 trillion rubles. And if the reform is very important and profitable for the state, citizens can be patient.

But before we talk about the future, let’s go back and discuss what personal income tax actually is.

Calculation of 3-NDFL

Certificate 3-NDFL is a special document intended to be filled out by certain categories of persons (for carrying out activities that are related to a certain type of income). Such persons include:

- persons who independently calculate taxation (lawyers, individual entrepreneurs);

- residents of the Russian Federation (whose income was received outside of Russia);

- persons with additional income (profit).

The above categories of citizens are required to annually provide the tax service with information about the income received and the taxes that were paid on it.

It should be noted that this document makes it possible to apply for the use of a deduction. To receive it, you need to make the necessary calculations and indicate the amount to be returned.

An example of calculating personal income tax in 2021

Citizen Sidorov bought an apartment worth 1,700,000 rubles. This purchase was subject to tax. At the end of the year, Sidorov plans to submit an application for deduction. Let's calculate what the amount of the deduction will be. The operation was taxed at a rate of 13%.

1,700,000×13% = 221,000 rubles.

Thus, Sidorov will indicate in the 3-NDFL certificate the deduction amount of 221,000 rubles. In addition, to receive a deduction, you must have all supporting documents (purchase agreement, receipts, etc.).

Down payment for a car is not taxed

The list of non-taxable personal income tax payments has been supplemented with one more item. This is payment of part of the down payment towards the cost of the purchased car from the federal treasury when applying for a loan to purchase a car (the procedure is regulated by the Government of the Russian Federation. This is a new paragraph 37.3 of Article 217 of the Tax Code of the Russian Federation, which was introduced by Law No. 335-FZ of November 27, 2021.

The essence of this latest news about personal income tax changes in 2021 is that they are retrospective in nature. The exemption is valid from January 1, 2021.

Calculation of penalties for personal income tax

For late payment of personal income tax, fines are provided in the form of a penalty, which is calculated according to the formula:

Penalty = Arrears X Refinancing rate (key rate) valid during the period of delay X 1/300 X Number of days of delay

The penalty is calculated for each subsequent day after the deadline for paying taxes.

Example

Citizen Elkin was 8 days late in paying taxes. The amount of mandatory payment was 2,800 rubles. Let's calculate how much penalty will need to be paid along with the main tax.

1. Calculation of the amount of fines for one day:

2,800 rubles X 7.75% X 1 / 300 X 1 = 0.72 rubles.

2. Now let’s calculate the total fine for all days:

0.72 rubles X 8 days = 5.79 rubles.

If the delay in payment of personal income tax was more than 30 days, say 36 days, then the calculation of the penalty will be as follows:

(2800 rub. x 7.75% x 1/300 x 30 days) + (2800 rub. x 7.75% x 1/150 x 16 days) = 44.85 rubles.

What is taxable

The list of income on which Russian citizens pay personal income tax includes:

- income received as a result of work (salaries, vacation pay, bonuses);

- profit from renting out property (most often, real estate);

- funds received from foreign sources;

- funds won in lotteries;

- other income.

At the same time, you do not need to pay income tax:

- from the sale of real estate owned for less than the minimum period of ownership of real estate (from 3 to 5 years depending on certain conditions);

- from inheritance received after the death of close relatives;

- from income under a gift agreement concluded with a family member or close relative.