In almost every organization there is a need to send certain employees on a business trip. Such a work trip on the instructions of the employer requires a particularly careful approach to documentation and accounting. And one of the most difficult is the question of how, when and where to pay personal income tax on business trips. It is especially important to correctly take into account additional expenses and excess expenses and payments if a lot of work trips are organized, including to other countries.

Taxation of travel expenses: value added tax (VAT)

An accountant has the opportunity to apply for a deduction for value added tax only if the goods (work, services) that were purchased by a seconded employee on a trip were purchased on the territory of one of the constituent entities of Russia.

In the event that the route begins or ends abroad of the Russian Federation, services for the transportation of baggage or the transportation of passengers, which were issued under uniform international transportation documents, will be subject to VAT at a zero rate. Accordingly, there is no requirement to include VAT in the cost of a travel ticket (train or plane) to the destination of the posted employee located abroad and back to the place of permanent work.

Important!

If the VAT amount in travel documents purchased in one of the CIS countries is written on a separate line, a tax deduction cannot be issued.

The inability to claim for tax deduction the amount of VAT indicated on the travel document as a separate line is explained by the fact that:

- The place of sale of services, as a general rule, is the place where the company operates or services are provided to an individual entrepreneur.

- An exception to this rule are the situations referred to in paragraphs. 1-4 p. 1 tbsp. 148 of the Tax Code (that is, in each of these cases, the service is still considered to be sold on the territory of the Russian Federation).

- Railroad transportation is not included in the list of exceptions to the general rule, since nothing is said about them in the mentioned article of the Tax Code of the Russian Federation (which means that transportation services will be provided in the country in which the carrier company operates).

In connection with all of the above, a ticket purchased at the ticket office of an airline or railway station in another country makes it clear that the services of the carrier company are provided not on the territory of Russia, but abroad. That is why the “input” VAT, written as a separate line in the travel document, is not claimed by the company’s accountant for tax deduction.

VAT on air tickets from October 1, 2021

The VAT rate on air tickets depends on the type of transportation: domestic or international.

The current VAT rate for air transportation on domestic flights is 10%. The exception is flights to Crimea, the Kaliningrad region and the Far East, for which the rate is 0%.

From October 1, the VAT rate will be reset to zero.

for regional air transportation bypassing Moscow and the Moscow region (Federal Law dated 06.06.2019 N 123-FZ).

The 10% tax rate remains for flights for which at least one route point (destination, departure or transfer point) is located in Moscow or the Moscow region.

But if the place of departure or destination of air transportation is Crimea, Sevastopol, the Kaliningrad region or the Far Eastern Federal District, then the VAT rate of 0% is applied, even if the plane flies through Moscow airports.

For international air transportation of passengers and baggage, VAT is calculated at a rate of 0%.

Taxation of travel expenses: insurance contributions to extra-budgetary funds

According to the text of Federal Law No. 212-FZ of July 24, 2009, from January 1, 2010, enterprises must make deductions of insurance payments to extra-budgetary funds instead of paying the unified social tax (UST). Insurance premiums are levied on employee payments specified in employment agreements. The list of payments for which insurance premiums are not charged is listed in the text of Article 9 of the mentioned legislative act. For example, insurance premiums should not be charged for compensation paid to subordinates for expenses incurred in the performance of their official functions. As for business trips, if the posted employee has documents proving the fact of incurring expenses, the compensation payments issued to him will not be subject to contributions.

Important!

If an employee returning from a business trip does not have documentary evidence of the expenses he incurred on a business trip, only amounts within the limits approved by current legislation will not be subject to insurance premiums.

The following payments to seconded employees returning from a trip are not subject to insurance payments:

- daily allowance (the rate of payment must be specified in the collective agreement or other internal act of the company);

- costs of purchasing a travel ticket to the destination and back to the employer’s enterprise;

- costs of exchanging cash at a currency exchange office (or checks at a banking institution) for foreign currency;

- consular fee for visa application;

- costs of paying for telephone operator services and other communication services;

- costs of rented living quarters;

- costs for transporting personal belongings (luggage);

- costs of purchasing tickets in public transport (sometimes paying for taxi services) to travel to the place of train departure or plane departure, to the destination or to the place of transfer;

- various commission fees;

- airport fees.

The hotel must have a category certificate

According to the Regulations on the Classification of Hotels, each of them must be assigned a category. Without a certificate of category it is prohibited to provide hotel services. Depending on the hotel room capacity, the ban comes into force:

- from July 1, 2021, if there are >50 numbers,

- from January 1, 2021, if numbers > 15,

- from January 1, 2012 – for all hotels.

Therefore, starting from July 1 of this year, hotels should be carefully checked before sending an employee on a business trip. When booking rooms, it is advisable to request a copy of the star award certificate. If the posted worker stayed in an uncertified hotel, disputes may arise with the tax authorities regarding written off housing expenses.

Taxation of travel expenses: personal income tax

Costs incurred by a posted employee while on a business trip are not subject to personal income tax, since the company only compensates the employee for expenses (that is, the amount of compensation does not bring commercial benefits to the subordinate).

Important!

If the amount of daily payments exceeds the norm (when traveling within Russia - 700 rubles per day, when traveling abroad - 2,500 rubles per day), the excess amount is included in the tax base for calculating personal income tax. If the daily allowance was paid in foreign currency for a trip abroad, it is necessary to calculate the amount in rubles at the Central Bank exchange rate on the date of payment.

The accountant must also remember that if an employee incurred expenses to pay for rented housing (hotel room or apartment) and received compensation in an amount exceeding the amount of 2.5 thousand rubles per day of stay (without confirming the expenses with payment documents residential premises), personal income tax must be withheld from the compensation amount.

Important!

Compensation payments for VIP lounges (at airports open for international traffic, Russian border checkpoints at railway stations, sea and river ports) are not subject to personal income tax - this decision was made by the Arbitration Judges and the Federal Antimonopoly Service of the Moscow Region (the Ministry of Finance has a different opinion) .

If an accountant doubts whether personal income tax should be withheld from compensation for the use of taxi services while an employee is on a business trip, when there is documentary evidence of payment for travel, the following rules should be followed:

- If the employee traveled by taxi to the destination, place of departure or transfer point, the compensation payment does not need to be subject to personal income tax.

- If the employee used the services of a taxi to travel to the destination and back to the employer, personal income tax is also not required to be withheld from compensation.

- If public transport was not available at the time required by the subordinate, and he had to use a taxi to get from the hotel to work, the amount of compensation is not subject to income tax, but provided that there are documents confirming the fact of the trip, the call of a taxi is due to production needs, and the possibility of using taxi service is specified in the collective agreement of the enterprise.

- If a posted employee took a taxi around the city during a business trip, the compensation amount is subject to personal income tax.

The following are cases when it is necessary to charge personal income tax on compensation for payment of rented housing by a posted employee, and when tax withholding is not required:

- In any case, if the employer paid the employee compensation for travel and/or accommodation costs, while the employee did not provide documents confirming the expenses, personal income tax is charged on the entire amount of compensation.

- If the employer agrees to compensate for accommodation costs, including breakfast at the hotel, personal income tax will have to be withheld from the cost of food (insurance contributions must also be calculated).

Payroll preparation

According to labor legislation, during a business trip the employer not only retains the employee’s position, but also guarantees him payments in the amount of average earnings for a specified period. This amount is part of the salary and therefore cannot be exempt from any additional charges, including insurance premiums and related taxes.

Particular attention should be paid to paying tax on average earnings when traveling on business to other countries. If an employee is a resident of the country, his income is taxed at the standard rate of 13 percent, since it is income from sources in the Russian Federation. If the employee is a non-resident, the rate will be 30 percent of average earnings. However, there is an important exception: the employment contract may provide that the employee has an assigned workplace abroad. In this case, the trip is not considered a business trip.

Taxation of travel expenses: income tax

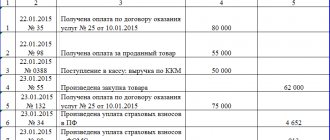

The procedure for accounting for expenses incurred by the company for an employee’s business trip is presented in the table below:

| Type of expenses | Possibility of taking into account costs when calculating income tax |

| Daily allowance | The full amount of daily allowance can be taken into account when calculating income tax. In this case, no documents confirming expenses are required - an accounting certificate with calculations, an order for sending on a business trip, tickets indicating the point of departure and arrival are sufficient. |

| Compensation for travel to the destination and back to the employer’s enterprise | Can be fully taken into account when reducing the tax base for income tax. When purchasing luxury train tickets (or business class air tickets), their cost can also be taken into account in full. If there is documentary evidence and justification for the need to pay for a luxury lounge or the cost of chartering an aircraft for travel to the place of performance of an official assignment and back to the place of work, these costs can also be taken into account when calculating income tax. |

| Travel compensation in case of loss of travel documents confirming the fact of the trip | If it was not possible to obtain a duplicate ticket, copy of a travel document or a certificate from the transport company, it is prohibited to take into account travel expenses when calculating income tax. |

| Compensation for the purchase of an electronic ticket | If there is documentary evidence of the purchase of an electronic ticket (printout, boarding pass, cash register receipt, slip, electronic terminal receipt), you can take into account the cost of the electronic document when calculating income tax. |

| Taxi fare compensation | Taxi fares can be taken into account if:

|

| Compensation for living expenses | If there is documentary evidence of payment for housing, the company's expenses can be taken into account in full. If there are no documents, costs cannot be taken into account. |

| Visa costs | If the trip took place, you can take the expenses into account when calculating your income tax. If the employee has not traveled abroad, costs cannot be taken into account. |

| Losses associated with payment of a fine for returning a ticket in case of interruption of an international business trip | You can include it in expenses and reduce the tax base for income tax. |

| Expenses for the services of intermediary companies (travel agencies, etc.) | They can be taken into account if there is a certificate of work performed with a breakdown of the cost of each service provided. |

Common mistakes

Common mistakes when calculating travel expenses include the following:

- Inaccurate determination of the timing of a business trip, which leads to incorrect calculation of daily allowances.

- Erroneous determination of daily allowances not subject to personal income tax for trips abroad.

- A discrepancy between the terms of the travel certificate and the dates on the arrival and departure tickets leads to an error in determining the amount of daily allowance.

- Acceptance of hotel invoices in a foreign language for the advance report on travel expenses. Government agencies insist that these documents must be provided with a translation into Russian.

- Increase in the cost of travel allowances by the amount of VAT indicated in the price of the service provided.

In addition, it is worth considering that documents confirming travel expenses that are not properly completed cannot be accepted with the advance report.

Legislative regulation

| Decree of the Government of the Russian Federation dated December 29, 2008 No. 1043 | On the abolition of the daily allowance rate of 100 rubles |

| clause 3 art. 217 Tax Code of the Russian Federation | The fact that travel expenses, confirmed by documents, are not included in the tax base for personal income tax |

| Art. 210 Tax Code of the Russian Federation | On the withholding of personal income tax from compensation for payment of accommodation and travel on a business trip, if the amounts of expenses were not documented |

| Letter of the Ministry of Finance of the Russian Federation dated October 14, 2009 No. 03-04-06-01/263 | On the withholding of personal income tax from the cost of breakfasts included in the invoice for hotel accommodation |

| Letter of the Ministry of Finance No. 03-03-06/1/30978 | On the possibility of taking into account, when calculating income tax, a company’s expenses for a remote employee’s business trip |

Daily allowances for employees working under civil contracts

If an employee sent on a business trip works under a civil contract, it is impossible to rely on the norms of legislation in force in the case of an employment relationship between the employee and the company.

Since the norms of labor legislation and other acts containing norms of labor law do not apply to employees working under a GPC agreement in accordance with the provisions of Article 11 of the Labor Code.

Accordingly, the guarantees and compensations provided for by the Labor Code of the Russian Federation, including those related to business trips, apply only to employees who have entered into an employment contract with the organization and are not applicable in the case of a GPC agreement.

A similar rule is contained in paragraph 2 of Resolution No. 749:

- Employees who have an employment relationship with the employer are sent on business trips.

Thus, if an employee works for a company under a GPC agreement, then sending him on a trip for official purposes is not a business trip . This means that the organization has no obligation to compensate such an employee for travel expenses.