In what form should I submit my VAT return for the fourth quarter of 2021? What are the deadlines for submitting the declaration for the past year? How to fill it out correctly? We have prepared a detailed answer to these questions and will also show examples of filling out the declaration.

Who “rents” for VAT?

The obligation to submit a VAT return lies with (clause 5 of Article 174 of the Tax Code of the Russian Federation):

- Individual entrepreneurs and companies using OSNO (general taxation system), except for those exempt from VAT under Art. 145-145.1 Tax Code of the Russian Federation;

- VAT tax agents (including freight forwarders, developers, etc.);

- special regimes and merchants exempt from duties as VAT payers (if they have issued an invoice with VAT).

The VAT return is submitted quarterly, almost always in electronic form (with rare exceptions). The procedure for filling it out, the form and electronic format were approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. MV-7-3/ (as amended on December 20, 2016). The declaration form is expected to be updated in the near future.

Composition of the report

The declaration consists of a title page and 12 sections. Its composition is indicated in the table:

| Section number of the VAT declaration | Purpose of the section |

| 1 | Summary section containing the total VAT amount |

| 2 | Designed to determine the amount of tax paid by tax agents |

| 3 | Contains information that allows you to calculate VAT on transactions that are taxed at rates of 10%, 18% or calculated rates |

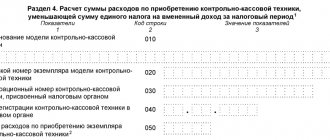

| 4 | To be completed in case of transactions taxed at 0% rates |

| 7 | Included in the declaration if there were transactions not subject to VAT under Art. 149 Tax Code of the Russian Federation |

| 8-9 | The data specified in the purchase book and sales book are reflected. |

| 10-11 | Prepared by tax agents (contain information from the invoice journal) |

| 12 | To be completed by taxpayers who are exempt from VAT but have issued VAT invoices |

However, it is not necessary to include all of these sections in the declaration. Let us explain why with an example.

Etude LLC uses OSNO. In the 1st quarter of 2021 the company:

- sold goods in the amount of 3,788,133 rubles. (including VAT = RUB 577,851);

- received invoices from suppliers, the total amount of VAT on which was 355,021 rubles.

The VAT return for the 1st quarter will include a title page, sections 1 and 3. In addition, you will need to upload information from the purchase book and sales book (sections 8 and 9) into the declaration preparation program.

This composition is explained by the fact that, in addition to the sale of goods at a rate of 18%, the company did not carry out other operations (taxed at a rate of 10% or 0%), did not act as a tax agent, etc.

The computer program with which the declaration is drawn up will itself calculate the VAT (payable or refundable) using the simplest formula:

VAT = 577,851 ─ 355,021 = 222,830 rubles.

How to fill out a VAT return for the example considered, see the sample.

The tax base has changed in the report

For VAT, new reporting from 2021 suggests some change as to what this charge is levied on. Thus, previously there was no need to pay when it came to bank guarantees or sureties, and the remuneration for them was taxed. Now, remuneration is not included in this list.

In 2021, a new VAT reporting form requires this fee to be withheld from all foreign companies offering electronic services, content or goods. If foreigners work through a domestic intermediary, then he must pay this fee. This change was made in order to establish equal conditions for companies from Russia and from abroad. Previously, only Russian organizations paid this fee.

In order to use the new VAT reporting form in 2021, foreign companies will have to register with Russian control authorities. They must create an account on the tax authorities’ website and subsequently use their personal account to submit a declaration.

If necessary, each new VAT report for 2021 and each organization (including foreign ones) may be subject to a desk audit.

What calculations will be needed to fill out the VAT return?

Before the figures for calculating the tax are included in the declaration, it is necessary to carry out preliminary actions:

- Check the accounting data with the information reflected in the accounting registers. You will need account information:

- 19 (amounts of deductions);

- 60, 62 and 76 (correspondence of the amounts of advances and related VAT);

- 90, 91 (sales volumes);

- 68 (participating in the calculation of the tax amount and the final result of the declaration).

- Conduct a preliminary analysis of deductions:

- calculate the total amount of deductions (DC) that you are entitled to claim based on the results of the 1st quarter;

- compare it with the safe share of deductions (SDR), determined by tax authorities by region;

- assess the possible risks and consequences of reflecting the calculated amount of deductions in the declaration if B > BDV.

The Federal Tax Service recently once again updated data on BFV (as of 02/01/2018). By region, the spread ranges from 50.9 (Baikonur) to 125.7 (Nenets Autonomous Okrug).

If deductions exceed the BDV, do not forget about your right to partially include VAT in the deduction (clause 1.1 of Article 172 of the Tax Code of the Russian Federation): VAT on goods, works and services can be deducted in parts for 3 years. However, this rule does not apply to VAT deductions on fixed assets, intangible assets and equipment for installation - the deduction for them is made in full after registration (clause 1 of Article 172 of the Tax Code of the Russian Federation).

New format: now electronic

As before, the 2021 VAT report format assumes a base rate of 18 percent. Certain goods and services are not subject to this fee, so the rate for them is considered 0 percent if you request this to be included in the calculation. A reduced fee of 10 percent also applies.

A summary of this tax is required to be generated quarterly. To determine the payment amount, two indicators are used:

- to accrual;

- for deduction.

If previously it was possible to generate a document, print it out and take it to the tax authorities in person, then in 2021, only electronic VAT reporting format is allowed. Some types of enterprises and businesses can still report on paper, but this applies to very small organizations - with a staff of up to 25 people. And even for them, not all forms associated with this fee can be submitted this way.

This is not all new in the 2021 VAT report, there are other changes as well. So, if you need to submit explanations for a completed declaration, they must be exclusively electronic. On paper, this will now only be accepted if the declaration itself is on paper.

2021 was also marked by new VAT reporting. The sample has already appeared on the tax service website.

What to pay attention to

It is important to pay special attention to deductions - even before sending the VAT return to the Federal Tax Service. It should not include data from “dangerous” invoices (containing errors, received from dubious counterparties, etc.). Thanks to the ASK VAT system, controllers identify any discrepancies in accrued tax and deductions. With this system:

- unscrupulous taxpayers are identified;

- illegal VAT deductions are excluded.

Thanks to the connection of ASK VAT to the banking system:

- the search for merchants dependent on each other is made easier;

- the movement of amounts withdrawn from taxation is monitored.

Inconsistencies identified by the system in the declaration will entail:

- submission of explanations to the Federal Tax Service (they also need to be transmitted to controllers via electronic communication channels, like VAT);

- submission of an updated declaration.

Another equally important issue when preparing a declaration is the correct indication of codes for types of transactions. If the code is used incorrectly or is not reflected at all, the declaration will not pass format-logical control, resulting in:

- it will be considered not accepted by the controllers;

- a fine may follow (if you do not have time to correct the erroneous declaration before the reporting deadline);

- you can provoke an unscheduled tax audit;

- VAT deduction may be denied.

Transaction codes are replenished and updated from time to time, so it is necessary to regularly monitor their relevance (letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3/).

Before sending the declaration to the inspectorate, check it for errors. Use the control ratios for this (letter of the Federal Tax Service dated March 23, 2015 No. GD-4-3/). It is also necessary to monitor their relevance - their last update was in the letter of the Federal Tax Service dated 04/06/2017 No. SD-4-3/

Declaration and changes in legislation

The latest legislative innovations also need to be taken into account when preparing the VAT return for the 1st quarter. For example, from 01/01/2018, buyers of raw animal skins (as well as scrap, waste of ferrous and non-ferrous metals, secondary aluminum and its alloys) have an obligation to reflect the corresponding amount of VAT in the declaration and pay it to the budget. That is, in this situation, the buyer is obliged to perform the functions of a tax agent (letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3/):

- determine the amount of VAT using the calculation method;

- indicate on line 060 of section 2 of the VAT return the total amount of tax (taking into account possible deductions for transactions with raw hides and scrap, and amounts of restored VAT);

- transfer taxes to the budget.

Legislators periodically supplement and adjust VAT legislation, so it is important to regularly monitor such changes and take them into account when filling out the declaration.

Simplified or zero declaration - which is correct?

If in the 4th quarter of 2021 you did not have business transactions reflected in the VAT return, you can not file it, but instead fill out a simplified report. Its form was introduced by order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62n. This is recommended by the officials themselves (letter of the Ministry of Finance of the Russian Federation dated March 10, 2010 No. 03-07-08/64). However, in order to take advantage of this opportunity, a number of conditions must be met.

Read about what these conditions are in this article. And here you will find a completed sample of a simplified declaration for the 4th quarter of 2019.

IMPORTANT! If the necessary conditions are not met, you will have to account for zero VAT. Our publication will tell you how to do this. Do not forget that administrative and tax liability is also provided for failure to submit a zero report.

The time is approaching for the 4th VAT declaration campaign for 2021, but the problems are not getting smaller. Let's face difficulties together! In our section “VAT Declaration 2019-2020” you will always find relevant materials, and our experts will help you deal with the most tricky questions. You can ask them through the message submission form located under each article, or on our professional forum. We welcome both professionals and beginners!

The declaration is completed - what next?

The amount indicated in the declaration must be included in the budget in a timely manner. To do this, it is important to follow the legally established rules. Clause 1 Art. 174 of the Tax Code of the Russian Federation states that the tax amount calculated in the declaration is divided into 3 parts and transferred for the 1st quarter no later than:

- 25th of April;

- May 25;

- June 25.

However, you can not split the payment, but transfer VAT according to any scheme suitable for you (½ the amount on the first two dates, the entire amount at once on the first payment deadline, etc.). There is no prohibition in the Tax Code of the Russian Federation on the use of such payment schemes. The main thing is that the tax goes to the budget in full and in an amount not less than the minimum amount allowed for each period.

Example:

In the VAT return for the 1st quarter of Triathlon LLC, the amount payable was 466,230 rubles.

Here are several options for payment schemes for Triathlon LLC:

| Last payment date | Option #1 | Option No. 2 | Option No. 3 | Option No. 4 |

| 25.04.2018 | 155 410 | 310 820 | 466 230 | 300 000 |

| 25.05.2018 | 155 410 | ─ | ─ | 10 820 |

| 25.06.2018 | 155 410 | 155 410 | ─ | 155 410 |

Triathlon LLC is characterized by uneven revenue receipts across the months of the quarter (peak revenues occur in the first half of April, and then a lull until June). Therefore, three of the presented options are suitable for him:

- No. 2 - transfer at once twice the minimum allowable amount of VAT on the first payment deadline, do not pay in May and send the remaining third of the tax to the budget in June;

- No. 3 - pay the budget in full on the first payment date;

- No. 4 - distribute VAT based on payment capabilities with payment of most of the tax in the first term and additional payment in the second term of the amount missing to the minimum allowable.

However, splitting payments is not always allowed and the company may be deprived of the opportunity to choose payment schemes. Let's explain with an example:

IP Gordeev S.L. and Gorets LLC sent payment slips to the bank on April 20, 2018 to transfer VAT for the 1st quarter:

| VAT payer | Applicable taxation system | Amount of VAT payable according to the declaration, rub. | The VAT amount indicated in the payment order (due for payment no later than 04/25/2018) |

| IP Gordeev S.L. | BASIC | 456 078 | 152 026 |

| LLC "Gorets" | simplified tax system | 1 386 123* | 462 041 |

*In the 1st quarter, Gorets LLC issued an invoice with VAT in the amount of RUB 1,386,123.

As a result, VAT paid to the budget by entrepreneur S.L. Gordeev (in the amount of 1/3 of the amount indicated in the declaration), safely fell into the budget, and the tax authorities had no complaints against this payer.

And Gorets LLC, which calculated VAT payable according to the same principle as IP Gordeev S.L. (under clause 1 of Article 174 of the Tax Code of the Russian Federation), received from the Federal Tax Service a requirement to pay penalties for late payment. Why?

The company did not take into account the norms of clause 4 of Art. 174 of the Tax Code of the Russian Federation, according to which the simplifier, when issuing an invoice with allocated VAT, is obliged to transfer it in full to the budget (splitting the payment is not allowed).

Not only the payer himself, but also another person can transfer tax to the budget (the rules for this option of settlement with the budget are described in the order of the Ministry of Finance of Russia dated April 5, 2017 No. 58n).

IMPORTANT! Identification of errors in the declaration after its submission will require the following actions from you:

- mandatory filing of an adjustment return (if the tax was underestimated);

- additional payment of arrears and penalties (before filing an updated declaration) - this will help avoid a fine (subclause 1, clause 4, article 81 of the Tax Code of the Russian Federation).

If the error in the declaration did not underestimate the tax payable, whether or not to submit an updated declaration, you decide for yourself (clause 1 of Article 81 of the Tax Code of the Russian Federation).

Read also

27.12.2017