Trade is a special economic area. Its main characteristic is the presence of operations to transfer goods to buyers for money. The specific nature of the activity makes it mandatory to maintain special accounting and tax records. The nuances of accounting are determined by PBU and the Tax Code of the Russian Federation.

Question: How is the sale of goods at retail reflected in accounting if buyers pay for them using bank cards? Goods are accounted for at purchase prices. This month, customers paid for goods worth RUB 360,000 using bank cards. (including VAT 60,000 rub.). The specified amount was credited to the organization’s current account minus the acquiring bank’s remuneration, the amount of which was 4,248 rubles. (VAT is not presented). The fact of provision of banking services is confirmed by the relevant acceptance certificate for the services provided. The actual cost of goods sold this month and paid for by customers using bank cards amounted to 200,000 rubles, which is equal to the cost of purchasing goods according to tax accounting data. For income tax purposes, income and expenses are determined using the accrual method. View answer

Wholesale and retail

Trade, and therefore accounting in it, traditionally has two directions:

- wholesale;

- retail.

The difference between them lies in the volume of products sold. Retail sales involve small batches or single products, most often intended for the personal needs of the population. Wholesale trade operates in large quantities. Of course, there is a difference in accounting. Indeed, in retail, the parties to the transaction, as a rule, are an organization-seller and an individual buyer, and in wholesale trade, products are bought by other legal entities or individual entrepreneurs. In the first case, cash payments are used, and in the second, non-cash payments. All this must be taken into account when maintaining accounting records.

Wholesale and retail trade

Trade is directly related to the purchase and sale of goods (Article 2 of the Federal Law of December 28, 2009 No. 381-FZ). Products are assets that a company originally purchased for resale rather than producing itself.

Accounting for goods is regulated by PBU 5/01. From this PBU we can conclude that the cost of goods includes the purchase price, transportation costs, customs duties, and more. Even interest on loans issued for the purchase of goods can reasonably be included in the cost price.

Companies can trade wholesale and retail. The difference between retail and wholesale trade lies in the volume of goods sold.

At retail, goods are sold in small quantities or individually to satisfy the personal needs of the buyer, while wholesale involves trading in large quantities of goods.

In addition, in retail trade, a transaction is made between a company and an individual, and in wholesale trade, goods are most often sold to a legal entity or individual entrepreneur.

Create receipt orders automatically, not manually! Connect Kontur.Market and Kontur.Accounting. The services are integrated and it will be easier for you to calculate taxes, maintain an income book and maintain cash discipline.

More details

Main account for inventory accounting

All goods intended for resale, according to the standards of PBU 5/01, should be accounted for in account 41 “Goods”. This account usually has several more sub-accounts, which each company can define and apply independently. It is necessary to take into account inventory items based on several criteria:

- name (nomenclature);

- quantity;

- storage location;

- responsible financially responsible persons.

Cost is the purchase price of goods and materials together with delivery costs, duties, agency fees and similar expenses (clause 6 of PBU 5/01). Plays an important role in accounting.

Features of accounting in trade

Accounting in trade is about correctly executed documents and transactions drawn up on their basis.

Goods for resale are accounted for in account 41. The account has several subaccounts. The most commonly used account is 41.4 “Purchased Items”.

Goods are accounted for by name, quantity, storage location and financially responsible persons.

The cost of a product is its acquisition price, delivery costs, duties, agency fees, etc. (clause 6 of PBU 5/01).

for finished products. This account cannot be used in trading. Here you will need account 41 “Goods”. Sub-accounts are opened for this account. The purchase of goods is reflected by posting Debit 41 Credit 60. If necessary, VAT is allocated as a separate posting.

The sale of goods includes three entries: Debit 62 Credit 90 - revenue Debit 90 Credit 68 - VAT Debit 90 Credit 41 - cost

Let's analyze the differences between accounting in trade for wholesale and retail sales.

Accounting in wholesale trade

Let's begin our consideration of the practical application of accounting standards by trade organizations with wholesale. It uses slightly fewer accounts than retail, although wholesale itself involves larger volumes. Let us follow the postings of the path of a consignment of goods from the moment it arrives at the company until it is sold to the buyer. And let’s find out what features accounting in wholesale trade has.

So, let’s imagine that our Vesna LLC (operating on the general taxation system with VAT) purchased a batch of gardening equipment from another company for 150,000 rubles. The price includes VAT in the amount of 22,881.36 rubles. In addition, a car was hired to deliver the goods for 10,000 rubles excluding VAT. Let's move on to accounting. So, when posting this batch, the accountant will make the following entries:

- Dt 41 Kt 60 127 118, 64 - purchase of a consignment;

- Dt 19 Kt 60 22 881.36 - allocation of VAT;

- Dt 41 Kt 60 10,000 - delivery costs, which increase the cost of the purchased product.

There was already a buyer for this batch, so the organization sold it, as they say, “on the fly,” or in transit. But there could be another option when the goods arrived at the company’s warehouse. The batch was sold for 180,000 rubles, including VAT. The cost consists of the purchase price and overhead costs (in this example we will not take into account the costs of administration, business needs, utilities and other things that need to be taken into account in the case of trading from a warehouse). In fact, when selling, we need to write off products, charge VAT and write off cost. The accounting entries will be as follows:

- Dt 62 Kt 90 180 000 - sales revenue;

- Dt 90 Kt 68 27 457, 63 - VAT on sales;

- Dt 90 Kt 41 137 118, 64 - cost written off.

Unfortunately, it happens that defective products are discovered during storage or sale. Let's assume that its cost was 15,000 rubles or 10% of the cost of the batch with a natural loss rate of 7%. It cannot be sold, but it must be reflected in accounting. Defects in trade are written off; the wiring will look like this:

- Dt 94 Kt 41 15 000 - identification of defects;

- Dt 44 Kt 94 10 500 - write-off of losses within the limits of natural loss;

- Dt 91 Kt 94 4500 - write-off of losses in excess of the norms of natural loss.

If those responsible for the incident have been identified, for example, a storekeeper, the losses can be attributed to them. The main thing is that the procedure prescribed by law is followed. In this case, the accountant will make the following entry:

Dt 73 Kt 94 15 000 - losses due to marriage are attributed to the guilty party.

Features of tax accounting in trade organizations

"Financial newspaper EXPO" No. 3

“Do those who don’t count anything know how to count money?” V. Vlasova

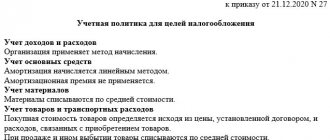

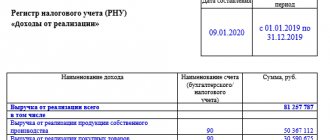

Chapter 25 of the Tax Code of the Russian Federation (TC RF) establishes principles common to all taxpayers for recognizing income and expenses, maintaining tax records, and the procedure for reflecting income and expenses (cash method or accrual method). However, in accordance with Art. 252 of the Tax Code of the Russian Federation for certain categories of payers may provide for some features of cost accounting. Organizations engaged in wholesale, small wholesale and retail trade determine the expenses of the current period, taking into account the individual provisions of Chapter 25 intended for this group of taxpayers.

Tax accounting recognizes only those expenses that are economically feasible, related to activities aimed at generating income, and supported by documents (Article 252 of the Tax Code of the Russian Federation). Moreover, the documents must be drawn up in accordance with Russian legislation.