The Tax Code states that individual entrepreneurs and organizations using the simplified tax system are exempt from VAT. But there are a number of exceptions in which you still have to pay tax. We will tell you who should pay VAT on the simplified tax system and whether it can be reimbursed.

When to pay VAT on the simplified tax system

- You have issued a VAT invoice to the buyer

- You bought goods from a foreigner

- You conduct transactions with state property

- You have formalized trust management of property

VAT payment deadlines in 2021

How to recover VAT on the simplified tax system

Is it possible to work with VAT using simplified language?

As a general rule, companies and individual entrepreneurs using a simplified taxation system are exempt from paying VAT.

But sometimes, in the interests of business, it is necessary to pay a tax to attract customers. The law does not prohibit doing this - every “simplified” person has the right to issue an invoice and transfer VAT to the budget. In addition, there are operations in which working with VAT is the responsibility of an organization or entrepreneur using the simplified tax system. When performing such transactions, “simplified” not only can, but must issue invoices and pay value added tax.

Fill out, check and submit your VAT return online for free

Intermediary VAT

Simplified intermediaries reissue invoices. However, simplified people do not pay VAT here.

When a simplifier carries out transactions on his own behalf, his name is indicated on the invoice. In this case, two copies of the invoice are drawn up. It is impossible not to note an important feature of simplifiers - during intermediary transactions, they do not record these transactions in the books of purchases and sales. Accordingly, such transactions are not reported using a declaration, but a log of received and issued invoices must be submitted.

Let's look at an example of how to prepare documents when trading goods on behalf of an intermediary.

LLC "Klen" (customer) signed a commission agreement dated 04/09/2019 No. 117 with LLC "Krot" (intermediary on the simplified tax system). "Mole" is selling a batch of machines that belong to "Klen". The cost of the batch is 550,000 rubles (including VAT).

On April 17, 2019, Krot LLC signed a supply agreement with PSN LLC, and on April 20, 2019, the machines were shipped.

Krot LLC immediately transferred the invoice to the accounting department of PSN LLC, and sent a copy of it to Klen LLC. The Mole employee recorded the invoice in the first part of his invoice log.

Klen LLC issued an invoice to Krot LLC dated April 20, 2019 for the amount of goods sold.

The accountant of Krot LLC entered the invoice received from Klen LLC in the second part of the invoice journal.

A company using the simplified tax system can provide intermediary services on behalf of the customer, then the simplifier does not issue invoices on his own. And having sold the goods, the simplifier will give the buyer an invoice, which will be issued by the customer.

When do you have to pay VAT under the simplified taxation system?

Let's name the most common cases when you have to transfer VAT under the simplified system.

1. When issuing invoices with allocated VAT . Often clients using the general taxation system refuse to make transactions with suppliers using the simplified tax system. The fact is that “simplified” companies are not VAT payers and are not required to issue invoices. As a result, buyers are unable to deduct input tax.

To get out of this situation, sellers voluntarily issue invoices with an allocated VAT amount. This allows customers to apply the deduction. The supplier using the simplified tax system, in turn, must transfer to the budget the VAT indicated in the invoice (subclause 1, clause 5, article 173 of the Tax Code of the Russian Federation).

ATTENTION . Many sellers approach the issue differently. They register two legal entities: one is transferred to the simplified system, and the second is left on the general one. If the client uses a special regime and does not need an invoice, then the contract with him is signed by the first organization. If the buyer is on OSNO, then the second company becomes its supplier.

2. When importing goods. One of the operations in which the simplifier must pay VAT is the import of goods. This is directly stated in paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation.

If the supplier is located in a member country of the Eurasian Economic Union (EAEU), then the tax must be transferred after the importer accepts the goods for accounting. The taxable base will be the sum of two values: the cost of the goods and the excise tax (for excisable products).

If the foreign supplier is not located in the EAEU, then value added tax must be paid at customs. In this case, the taxable base is the sum of the cost of the goods, customs duties and excise taxes (for excisable products).

The VAT rate in general is 20%, and for certain goods - 10%. There is also a list of goods that are exempt from VAT upon import. These are cultural values, books for libraries, etc. (Article 150 of the Tax Code of the Russian Federation).

Fill out and submit a new VAT declaration online for free when importing from EAEU countries

3. In case of trust management of property. Another operation that obliges a company to remit VAT to the simplified tax system is the sale of property received by it in trust. According to Article 174.1 of the Tax Code of the Russian Federation, the trustee must issue an invoice. In this case, in the line “Seller” you should make a note “D.U.” - this is the requirement of paragraph 3 of Article 1012 of the Civil Code of the Russian Federation.

IMPORTANT. The remuneration for services that the trustee under the simplified tax system receives from the founder of the management (that is, from the owner of the property) is not subject to VAT.

The role of the VAT tax agent

Based on paragraph 5 of Article 346.11 of the Tax Code, companies using the simplified tax system may in some cases be recognized as tax agents for VAT, namely:

- when leasing property from state authorities and local governments;

- when purchasing goods (work, services) on the territory of Russia, the sellers of which are foreign persons who are not registered with the Federal Tax Service of the Russian Federation;

- acting as an intermediary involved in settlements when selling goods to foreign persons who are not registered with the Federal Tax Service of the Russian Federation;

- when purchasing or receiving state or municipal property that is not assigned to any institutions;

- when selling property that is subject to sale by court decision, as well as confiscated property, ownerless, purchased and found valuables (treasures);

- in some other cases established by Article 161 of the Tax Code of the Russian Federation.

Most often in practice we encounter the rental of state property and the purchase of goods from foreigners - we will talk about them in more detail.

Rent of state and municipal property

By leasing property from state and local authorities, a company using the simplified tax system becomes a tax agent. Consequently, she is required to transfer VAT on rent to the budget. Depending on the terms of the agreement, settlements with the lessor can be carried out in two ways:

- VAT is included in the rent. In this case, the tax is calculated as follows: VAT = AP × 18/118 , where AP is the amount of rent under the agreement. In this case, the tenant transfers to the landlord the amount of payment for renting the property, reduced by the amount of VAT, which is subject to transfer to the budget in the prescribed manner.

- VAT is not included in the rent. In this case, the tax is calculated using the formula: VAT = AP × 18% , where AP is the amount of rent under the contract. In this case, the lessor receives the full amount specified in the agreement, and the tenant transfers VAT to the budget from his own funds.

Let's look at the difference between these options using an example. Ajax LLC, which uses the simplified tax system, decided to rent premises from a government agency. The contract states that the monthly rent is 236,000 rubles, including VAT - 36,000 rubles. Thus, the lessor receives 200,000 rubles monthly as rent payment, and the remaining 36,000 rubles are retained by Ajax LLC, which acts as a tax agent in this transaction, and transferred to the budget.

If VAT had not been allocated in the agreement, then the monthly rental payment should have been 200,000 rubles, which the lessor would have received in full. At the same time, Ajax LLC had to withhold VAT in the amount of 36,000 rubles monthly from its own funds and transfer the tax to the budget in the prescribed manner.

Transactions that entail the calculation of VAT are formalized in organizations using the simplified tax system by drawing up an invoice. The tax amount is divided into 3 parts, each of which must be transferred to the budget no later than the 25th day of the month following the reporting quarter. After payment, the VAT amount can be taken into account as part of the expenses of the quarter in which it was paid.

Purchase from foreign companies in Russia

In the case when a domestic company purchases goods (work, services) in Russia from a foreign organization that is not registered with the Russian tax service, it is also charged with the role of a tax agent. And with it comes the obligation to determine the tax base for VAT, calculate, withhold and transfer this tax to the budget.

For example, the above-mentioned Ajax LLC decided to use the services of a European company that does not have a representative office in Russia. Thus, a domestic organization is recognized as a tax agent for this transaction: it is obliged to calculate VAT and pay it to the budget. According to the terms of the agreement, payment for services is 354,000 rubles, and it includes all taxes and fees payable in accordance with the legislation of the Russian Federation. Consequently, VAT is already included in the payment, although it is not allocated as a separate amount.

Using the above formula, we calculate the amount of VAT: 354,000 * 18 / 118 = 54,000 rubles. This means that for those received, 300,000 rubles must be paid directly to the European company, and the remaining 54,000 rubles should be withheld and transferred to the budget as VAT.

We looked at common situations when they act as a tax agent for VAT, that is, they calculate and transfer tax to the budget, one way or another withholding its amount from the funds of the counterparty. However, sometimes companies using the simplified tax system themselves acquire the role of taxpayer. We will talk further about in what cases this happens.

VAT refund under simplified tax system

An invoice with an allocated VAT amount, voluntarily issued by a simplifier, does not give him the right to deduct input tax. In the same way, it is impossible to deduct the value added tax paid by the importer using the simplified tax system.

The reason is that deductions are provided when purchasing goods (works, services) by VAT taxpayers (Article 172 of the Tax Code of the Russian Federation). But “simplifiers” are not one of them. This means that they are not entitled to deduction of input VAT.

If an organization or entrepreneur applies the simplified tax system with the object of taxation “income minus expenses,” then it will not be possible to attribute VAT to expenses. Yes, there is subclause 22 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation, which allows you to include the amount of taxes and fees in expenses. But we are talking about taxes paid in accordance with the law. While the “simplifier” generates invoices and transfers VAT of his own free will. This means that this rule cannot be applied. This was indicated by the Russian Ministry of Finance in a letter dated November 9, 2016 No. 03-11-11/65552.

The situation is different with input VAT in trust management of property. The “simplified” manager has the right to deduct input VAT if he has an invoice from the supplier (clause 3 of Article 174.1 of the Tax Code of the Russian Federation).

Connect to the service for automatic reconciliation of invoices with counterparties

Responsibility to prepare invoices

In addition to the obligation to pay VAT to the budget, “simplified” companies who carry out operations under partnership agreements (see Article 174.1 of the Tax Code of the Russian Federation) may have the obligation to draw up an invoice. Let us give examples of such situations. The company as a commission agent (agent acting on its own behalf) receives an advance or ships goods (work, services) to the principal (principal) - a VAT payer. Either the company, as an intermediary involved in settlements, ships goods (work, services) to a foreign person who is not registered for tax purposes in the Russian Federation, or receives an advance for them. In these situations, the invoice is issued in two copies, one of which is transferred to the buyer.

In addition, an invoice must be drawn up if the “simplified person”, as a commission agent (an agent acting on his own behalf), transferred an advance or received goods (work, services) purchased for the principal (principal) from the seller - a VAT payer. And in this case, the invoice is drawn up in two copies, one of which is transferred to the principal (principal).

The Code also provides for other situations that force payers of the simplified tax system to know their VAT obligations.

VAT under the simplified tax system in 2021

In a situation where the seller, using a simplified system, has issued an invoice to the supplier with an allocated amount of VAT, he must transfer the tax to the budget within the following terms:

- for the first quarter of 2021 - no later than April 27, May 25 and June 25, 2021;

- for the second quarter of 2021 - no later than July 27, August 25 and September 25, 2021;

- for the third quarter of 2021 - no later than October 26, November 25 and December 25, 2021;

- for the fourth quarter of 2021 - no later than January 25, February 25 and March 25, 2021.

To summarize, we note that although VAT under the simplified tax system in the general case does not need to be paid, the “simplified tax” can work with value added tax at will. To do this, it is enough to generate an invoice during implementation and highlight VAT in it. There are also operations when it is necessary to pay VAT under the simplified system. This includes, among other things, the import of goods and the sale of property to trustees.

Double Taxation: Coming Changes

Companies using the simplified tax system, which by force of law must pay VAT, sometimes find themselves in a situation of double taxation: the amounts of tax paid are included in the income from sales and, therefore, in the tax base for a single tax in connection with the simplified tax system. This happens, for example, when issuing a “simplified” invoice with allocated VAT.

To avoid such situations, amendments have been made to the Tax Code, which will come into force on January 1, 2021. According to these changes, companies using the simplified tax system, as well as payers of the Unified Agricultural Tax, will no longer have to take into account tax amounts received on invoices with allocated VAT as part of their revenue.

Conditions for simplified taxation system

But in order to have the right to switch to a simplified regime, an individual entrepreneur must meet certain conditions:

- Annual income should not exceed 150 million rubles (according to paragraph 3 of Article 346.12 of the Tax Code)

- There cannot be more than 100 employees.

- The residual value of its fixed assets should also not increase more than 150 million rubles.

You will find out why piecework wages are beneficial in our article.

Find out more about floating salaries, their pros and cons in our material.

What is the child tax deduction and how can you use it to your advantage? Our article is devoted to this issue.

An example of VAT accounting for purchased goods for subsequent sale

August 10, 2021 I bought 100 office chairs with a total cost of 590,000 rubles. for further resale. The supplier included an added tax of 90,000 rubles in this price. The chairs were paid to the supplier on August 12.

In August, 20 chairs were sold, the buyers paid the full price.

Costs include the cost of twenty chairs sold - 20*5000 = 100,000 rubles.

For the chairs sold, the corresponding share of the added tax can be attributed to expenses.

VAT = 100,000 * 18% = 18,000.

Tax can be paid

What to do if incoming VAT exceeds outgoing VAT

It is possible that the incoming VAT is greater than the outgoing VAT. For example, if a company actively purchased goods and paid for services, but sold less of its own products. In this case, based on the results of the quarter, you can refund the VAT paid or take into account the overpayment against other taxes. Also, penalties and fines can be reduced by the amount of VAT already paid.

Businesses have the opportunity to count overpayments for any type of taxes and fees, regardless of what level of budget the tax is paid to, in 2021. This right is regulated by Letter of the Ministry of Finance of the Russian Federation dated August 10, 2021 No. 03-02-07/1/72100).

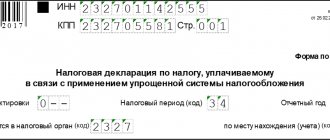

The procedure for submitting reports in electronic form

Starting from 2021, VAT returns must be submitted electronically through TKS with the help of a special operator for electronic document management.

You can find out the information you are interested in about the operator at the Federal Tax Service inspection at the place of registration, or on the website of the regional department of the Federal Tax Service of the Russian Federation.

It is necessary to select an operator and conclude an appropriate agreement with him for the provision of services. Next, he is obliged to install a reporting system, provide a number of software tools and an electronic qualified signature.

Once your tax return is due, put together the appropriate files. For organizations using the simplified tax system, you need to submit a title page and 1 section as part of the declaration. Confirm the prepared files with an electronic signature and send them using the program through your operator. After this, he needs to generate confirmation of the date of sending the reports. The date in the confirmation will be the date for the organization to submit the VAT return to the regulatory authority.

The operator will send you and the tax office confirmation of the date of the declaration at the same time, after which it will go through all the necessary stages of verification and control.

Based on their results, you will be sent a receipt stating that the declaration was accepted, or a notice of non-acceptance of the reporting with the specified grounds provided for by law. This means that it will need to be reintroduced.

For sending a document not in electronic form, but by post office or on paper to the inspector personally, the tax service has the right to impose penalties under Article 119 of the Tax Code of the Russian Federation, as well as freeze bank accounts and suspend electronic money transfers.

If the declaration is not submitted on time due to no fault of yours, but due to a technical failure in the operator’s work, then the law does not provide that this fact relieves you of liability. However, some liability is provided for a guilty act, according to Chapter 16 of the Tax Code.

If the special operator writes a letter confirming the technical failure and the absence of accounting fault, the organization or entrepreneur will be exempt from the fine.

Recognition of ownership of a land plot through the court is carried out only in certain cases. How to find out the coordinates of a land plot by cadastral number? Step-by-step instructions are in our article. What is special about establishing a temporary easement? Find out about it here.