Issuing and receiving

For many simplified people under the simplified tax system “income minus expenses,” a loan can act as both a means to improve their financial situation and a way to earn money.

Let us recall that as part of a regular loan transaction, one party - the lender - transfers the ownership of money or other things to the other party - the borrower, and the latter is obliged to return one of two things to the lender:

- The same amount of money (loan).

- An equal number of other things he received of the same kind and quality.

Issues related to the loan agreement are regulated by Articles 807 – 814 of the Civil Code of the Russian Federation.

Also see “Loan agreement under the simplified tax system”.

There is no direct rule in the Tax Code of the Russian Federation that would regulate the accounting of loans under the simplified tax system “income minus expenses.” Therefore, you need to think logically:

- Loans are not included in expenses (clause 1 of Article 346.16 of the Tax Code of the Russian Federation), which are reduced when calculating the single tax on the simplified tax system.

- Loans appear as part of income, which are not taken into account when determining the object for simplified taxation (subclause 1, clause 1.1, article 346.15 and subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

Thus, issuing a loan under the simplified tax system “income minus expenses,” as well as receiving a loan under the simplified tax system “income minus expenses,” do not in any way affect the tax base for the simplified tax. That is, they do not participate in the calculations. Therefore, whether a loan is an expense under the simplified tax system, the answer will always be negative.

Here, in part, there is a complete analogy with the rules on income tax. With it, loans and credits received also do not form income. Moreover, for tax purposes, it is usually not of fundamental importance how exactly the borrowing is formalized.

Receipt and repayment of a loan in accounting

The issuance of a loan from the issuing party is displayed in transactions depending on whether interest is provided for the loan:

- in financial investments, if the loan is interest-bearing:

Dt 58 Kt 51;

- in settlements with other debtor-creditors, if payment of interest is not provided:

Dt 76 Kt 51.

When repaying borrowed funds, the postings will be reversed:

Dt 51 Kt 58 (76).

The receiving party has one method of reflection: as part of borrowed funds. Only the accounting account (66 or 67) may differ, depending on the period for which the loan was issued:

Dt 51 Kt 66 (67).

The borrower's return will be recorded by reverse posting:

Dt 66 (67) CT 51.

Yu.V., consultant of the Department of Taxation of Small Business and Agriculture of the Department of Tax and Customs Policy of the Ministry of Finance of Russia, answered some questions. Supported. See his answer in ConsultantPlus:

If you do not have access to the K+ system, get a trial online access for free.

Interest

If a simplifier receives money in debt using the simplified tax system, interest on loans is expensed on the day they are transferred to the other party to such a transaction. That is, at the time of repayment (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). Moreover, in the amount transferred to the lender.

If we talk about whether loan repayment is an expense under the simplified tax system, then the answer is negative. The loan amount itself cannot be taken into account.

When a simplifier issues a loan, he shows the returned interest in income on the date of actual receipt of money from the borrower (clause 1 of Article 346.15, clause 6 of part 2 of Article 250, clause 1 of Article 346.17 of the Tax Code of the Russian Federation). In this case, the order of calculation of interest - simple or complex - does not matter. In income, the simplifier must reflect the entire amount of interest received for the other party’s use of the loan.

Separately, it should be said about an interest-free loan under the simplified tax system “income minus expenses”. The Tax Code says nothing about the material benefit from receiving it. Hence, the Ministry of Finance, in letter dated March 23, 2017 No. 03-03-RZ/16846, concludes that such a loan cannot increase the tax base. Therefore, it also does not affect the tax on the simplified tax system.

Results

Funds transferred into debt are not taken into account either in income or expenses, or when issuing (receiving) or when returning.

The income of the party issuing the loan and the expense of the recipient will be the fee for the use of borrowed funds: interest stipulated by the loan agreement. In accounting, they are accrued, as a rule, monthly, and they can be taken into account in income or expenses for the purposes of calculating the simplified tax system only at the time of actual receipt or payment, respectively. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Return Features

There cannot be a situation where loan repayment is taken into account as expenses under the simplified tax system. Even if the loan in the agreement was written in foreign currency or cu, but was actually received in Russian rubles. That is, movements in exchange rates do not lead, in simplified terms, to a revaluation of this liability. There are no so-called differences.

The same cannot be said that loan repayment is an expense under the simplified tax system when the debt is repaid with products or other property.

If a simplifier transfers property to repay a loan debt, obligations to pay VAT and income tax do not arise (letter of the Ministry of Finance dated June 28, 2016 No. 03-11-11/37751)

Also see “Bank expenses under the simplified tax system “income minus expenses”.

Read also

17.04.2017

Reflection in accounting of accrued interest on a loan

Calculate the amount of interest due for each month of the contract yourself.

The procedure for calculating interest is determined by the agreement. Interest calculation according to our example:

The amount of interest for June in our example will be:

100 000 * 10% / 365 * 29 = 794,52 rub.

Reflect the accrual of interest in the document Operation entered manually in the Operations section - Operations entered manually - Create button - Operation.

Features of filling out a document Operation entered manually according to our example:

- Debit - 76.09 “Other settlements with various debtors and creditors”;

- Subconto 1 - borrower under the agreement, selected from the Counterparties directory;

- Subconto 2 - agreement with the borrower, selected from the Agreements directory;

- Credit - 91.01 “Other income”;

- Subconto 1 - Interest receivable (payable) : Type of item - Interest receivable (payable) ;

How is an individual entrepreneur’s loan taken into account under the simplified tax system?

If various errors and omissions occur, the likelihood of imposing fines on a company or individual entrepreneur from the Federal Tax Service increases. Money borrowed based on a specific agreement cannot be recognized as profit. For this reason, there is no need to pay tax contributions on them. Moreover, this rule is valid when using simplification and many other systems.

Money and things accepted under the loan agreement do not count as income under the simplified tax system. This is not taken into account for the amount of payment in the form of interest payments for the loan provided to the entrepreneur.

Loans issued and transferred to the individual entrepreneur, or the receipt of money to pay off the debt (in other words, when the loan was issued to the individual entrepreneur, and now he receives the funds back) does not apply to income under the simplified tax system. At the same time, a loan issued without interest cannot be considered revenue. Interest accruals must be subject to tax contributions.

Individual entrepreneurs obtain loans and credits in cases where it is necessary to expand their business. In this situation, they require growth in working capital assets. Borrowed funds transferred to the organization's account have no connection with work processes. The receipt of funds is one-time in nature, indicating the need for their further return, depending on the terms of the loan agreement.

Applying for a loan from an LLC for the founder

An important condition for concluding a loan relationship between participants, one of whom is an individual entrepreneur, is the signing of an agreement on paper. According to legal norms, this need to include the necessary sections in the contract indicates its legal validity.

Important! Signing a financial agreement signifies the transfer of money or other property from the lender to the borrower at a certain time.

The main features of a loan agreement are considered to be:

- Payment indicating a demand for the return of borrowed money within a predetermined period.

- A unilateral obligation that entails the emergence of an obligation based on the results of the transaction on only one side.

- Validity indicating the validity of the credit agreement from the moment of transfer of funds. The fact of these actions must be documented.

A loan agreement can be characterized by parameters that make it easy to determine its essence:

- As a result of the execution of a loan agreement, the enterprise increases its assets that did not arise due to work activities.

- The borrowed funds belong to the borrower.

- The loan can be issued at interest or free of charge.

- The reimbursable loan is returned only by agreement of both parties.

- Property registered for a certain period for the purpose of its further use cannot be reimbursed with money.

The transfer of temporary use of the property of a credit institution to a client can be carried out for a specific purpose, which indicates a specific or diverse area of its application.

Receipt of interest on the loan

Receipt to the interest account is reflected in the document Receipt to the current account type of operation Other settlements with counterparties in the Bank and cash department section - Bank statements - Receipt button.

Please indicate:

- Payer - borrower under the agreement;

- Amount - the amount of accrued interest under the agreement;

- Settlement account - 76.09 “Other settlements with various debtors and creditors”;

- Income item - an article from the directory Cash Flow Items: Type of movement - Receipts from dividends, interest on debt financial investments .

Postings according to the document

The document generates the posting:

- Dt Kt 76.09 - credit to the interest account.

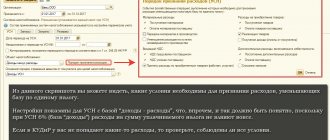

Posts by KUDiR

The document Receipt to the current account forms movements according to the register Book of Income and Expenses (Section I) :

- registration entry for income of the simplified tax system for the amount of interest received.

KUDiR report

Expenses on interest received are reflected in the report Book of Income and Expenses (Reports - Book of Income and Expenses of the simplified tax system).

See also:

- Interest received on the bank account balance. Do I need to fill out Section 7 of the VAT return?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- How to take into account a preferential loan at 2% under the simplified tax system for income and expenses? ...

- Receiving and spending a loan under Resolution No. 696 on the simplified tax system In 2021, some banks are providing non-repayable loans for renewal...

- Interest on loans and borrowings under the simplified tax system...

- Tax officials explained how to change the object of taxation for new simplified individuals. Legal entities and individual entrepreneurs who decide to work on the simplified tax system submit...

Interest-free loan

The main difference of this loan is the absence of interest charged for using the principal amount of funds. At the same time, this information about the absence of interest charges must be indicated in the contract.

In the course of accounting, the question arises whether the income consists of a material benefit. As for enterprises, a similar thesis is not used under mutual agreements.

According to Article 250 of the Tax Code of the Russian Federation, the list of such income does not include material benefits from credit products issued on preferential interest-free terms.

Companies or entrepreneurs who accept finance or property assets without paying additional expenses do not reflect the benefit in accounting for income.

Accounting for interest on loans and borrowings until January 1, 2015

Until January 1, 2015, interest was included in “simplified” expenses only within certain standards. There were two ways to standardize interest.

- Based on the actually accrued interest, but not more than the average interest, increased by 1.2 times, which was paid by the company on debt obligations of the same type (that is, under loan agreements, credit, etc.) obtained on comparable terms.

- Based on the refinancing rate of the Bank of Russia (paragraph 4, clause 1, article 269 of the Tax Code of the Russian Federation, as amended, in force until January 1, 2015). The maximum amount of interest taken into account depended on the currency of the loan (loan) and the time of interest payment. For example, for the period from January 1, 2011 to December 31, 2014, the amount of interest taken into account on ruble loans and borrowings was equal to the refinancing rate of the Bank of Russia, increased by 1.8 times. And for foreign currency loans and borrowings the refinancing rate was 0.8.

The company could choose any of these methods of rationing interest. The main thing is that the chosen method had to be reflected in the tax accounting policy.