What is included in the cost structure

The composition of costs is determined by Article 101 of the Arbitration Procedure Code of the Russian Federation and Article 88 of the Code of Civil Procedure of the Russian Federation. In particular, they include any costs arising from the proceedings, as well as state fees. Let's look at a sample list:

- Payment for the services of experts, lawyers and consultants.

- Amounts paid to experts, translators and others.

- Costs associated with the inspection.

- Postage costs.

- Other expenses deemed necessary by the court.

- Costs of representing a party.

- Compensation for lost time, paid on the basis of Article 99 of the Code of Civil Procedure of the Russian Federation.

- Expenses for transport and accommodation of persons participating in the proceedings (Article 94 of the Code of Civil Procedure of the Russian Federation).

- Duty.

Some expenses have a fixed amount. For example, this is a duty. Part of the costs can be of any volume. In particular, this is compensation for loss of time. Its amount must be reasonable and appropriate to all the circumstances of the case.

Economic justification of expenses

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. It is worth noting that the concept of “economic justification of costs” is not given in any act of the current legislation of the Russian Federation. The legislation on taxes and fees also does not contain any explanations of this concept for tax purposes.

Consequently, the term “economic justification” is an evaluative category, which means that if doubt arises about the justification of the expenses incurred, the tax authority must prove this circumstance (Articles 65 and 200 of the Arbitration Procedure Code of the Russian Federation). Currently, there are three options for the interpretation of this term by arbitration courts:

- connection with activities aimed at generating income;

- production feasibility;

- Compliance of prices for services with market levels.

In most cases, courts come to the conclusion that, within the meaning of Art. 252 of the Tax Code of the Russian Federation, the economic justification of expenses incurred by a taxpayer is determined not by the actual receipt of income in a particular tax period, but by the focus of such expenses on generating income. Confirmation of this is the Resolutions of the Federal Antimonopoly Service of the North-Western District dated August 2, 2004 in case No. A56-1475/04, dated June 18, 2004 in case No. A56-32759/03, dated November 4, 2003 in case No. A56- 11030/03, FAS East Siberian District dated October 6, 2004 in case No. A19-2575/04-33-F02-4074/04-S1.

Tax accounting

Accounting for legal expenses differs in a number of rules. All costs must be confirmed. These papers can be used as confirmation:

- Checks and receipts.

- Agreements for the provision of legal services.

- Travel tickets.

- Extracts from investigative bodies.

It is recommended that the costs of pre-trial settlement be specified in the agreement with the lawyer. Costs are calculated on the basis of documents attached to the case.

The costs will be classified as non-operating expenses. Expenses that can be included in this composition are stipulated by Article 106 of the Arbitration Procedure Code of the Russian Federation and Article 94 of the Code of Civil Procedure of the Russian Federation. However, the list considered is not exhaustive. Sometimes the court recognizes legal expenses that are not included in the list. For example, these may be the costs of copying documents, translating them, or notarizing them. Expenses are not recognized when their connection with the proceedings is not obvious.

When expenses will definitely not be recognized

The conditions for recognition are specified in paragraph 1 of Article 252 of the Tax Code of the Russian Federation. In particular, these are:

- Validity.

- Availability of supporting documents.

Expenses are not recognized in the following cases:

- No connection to legal proceedings. For example, a company entered into a subscription service agreement with a law firm. During the trial, the manager contacted lawyers about something unrelated to the case. Related expenses will not be recognized. In this case, they will be taken into account as part of expenses for legal services on the basis of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

- The representative did not take part in the proceedings. For example, the company paid for representation services, but the representative did not take part in any meeting.

- The firm is not a party to the proceedings. That is, the subject must be either a plaintiff, or a defendant, or a third party. If the firm is not a party, there will be no basis for recognizing legal costs.

- It is not the company that is involved, but its employee. If a company employee is held accountable, it will be his personal matter. That is, the company does not have to take into account associated costs.

Sometimes the company resorts to pre-trial settlement of the case. Related expenses for lawyers and consultants will also not be recognized. The corresponding decision was given by the Presidium of the Supreme Arbitration Court in Resolution No. 9131/08 of December 9, 2008.

Recognition of state duty

The fee must be included as an expense on the date the claim is filed. The latter is determined on the basis of the court's note on acceptance of the claim. Some do this on the payment due date, but this is not correct. The duty must be included in non-sales services on the basis of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

The fee may be returned by court decision. The amount received must be included in the structure of non-operating income on the basis of paragraph 3 of Article 250 of the Tax Code of the Russian Federation. Inclusion is made on the date the decision on the refund of the duty comes into force.

On what date should expenses be taken into account?

Legal costs are considered non-operating, and therefore they will be recognized on these dates on the basis of paragraph 7 of Article 272 of the Tax Code of the Russian Federation:

- Settlement date based on the terms of the agreement.

- The date of presentation to the payer of the papers on the basis of which calculations are made.

- The final date of reporting or tax time.

The company has the right to set its own dates for reflecting expenses on the basis of Letter of the Ministry of Finance No. 03-03-04/2/149 dated May 26, 2006. Typically, this is the date the service agreement is signed. For example, a company entered into an agreement with a lawyer. The date of signing the document will be the date of recognition.

Legal expenses reduce taxable income, regardless of whether they are recovered through the court. What does this mean? If the entity wins the case, the person found guilty must pay all of the winning party's legal costs. However, expense recognition is done regardless of wins or losses.

IMPORTANT! The costs of a third-party lawyer are also taken into account when the organization has a full-time lawyer on staff. However, if the work is carried out by a full-time lawyer, the costs are reflected in the structure of labor costs on the basis of Article 255 of the Tax Code of the Russian Federation. Expenses for your lawyer cannot be recovered from the losing participant in the case.

Documentary confirmation

The largest portion of expenses is legal fees. Related expenses can be verified. The following documents can be used as confirmation:

- Agreement with a specialist.

- Certificate of completed work.

- Payment papers.

The documents must indicate a list of services provided and their cost. It is necessary to record services in such a way that their connection with the proceedings can be traced. It is also recommended to prepare documents for confirmation:

- Power of attorney for a representative.

- Claim.

- Protocol of the proceedings.

- Judgment.

IMPORTANT! The enforcement fee is not taken into account when determining income tax.

Important terms of the agreement between a lawyer and a client

The agreement is drawn up in simple written form. The concluded contract must include the following terms and conditions: (click to expand)

- Data about counterparties - name of organizations, tax identification number, location address, contact phone number, other important details of the parties. The data may contain any details entered at the request of the parties.

- Information about the affiliation of the person provided with assistance to the bar.

- The name of the document is an acceptable type of agreement, preliminary agreement, or other applicable form.

- The subject of the contract, which is the main and mandatory condition of the contract.

- Deadlines for execution, cost of assistance provided and procedure for covering lawyer’s expenses.

- Place of conclusion of the contract, which allows you to obtain information about jurisdiction.

- Date of conclusion of the contract. Any date can be included in the contract. In this case, the start date of the contract for the provision of legal services is the day the document is signed by the last party.

- Liability for violation of obligations by the parties.

Essential conditions, in the absence of which the contract is considered invalid, include information about the parties, confirmation of the lawyer’s right to practice, subject matter, cost of the service, procedure for compensation of costs and liability.

Upon execution of the contract, the parties sign an act, which is drawn up in any form indicating the details of the parties: the provider of services and the recipient of the act. The document is an annex to the contract and a form of primary accounting, on the basis of which expenses are taken into account. There is no unified form of the act. The document is drawn up in any form indicating details that allow identification of participants, the cost of the service, the fact of its provision Legal services (

Features of accounting

As part of accounting, the state duty must be taken into account in the structure of other expenses on the basis of paragraph 12 of PBU 10/99 “Company Expenses”. Expenses must be recognized in the period in which they are incurred. This does not take into account the actual date of transfer of funds.

Fines and penalties are included in the structure of other expenses based on paragraph 8 of PBU 9/99 “Company Income”. Acceptance for registration is carried out in the amount awarded by the court. Analytical accounting of vessels with different counterparties and for different claims is carried out in separate sub-accounts.

The entries for accounting for legal expenses will be as follows:

- DT91 subaccount “Other expenses” KT68. Calculation of fees when filing a claim.

- DT68 KT51. Transfer of duties to the budget.

- DT51 KT76 subaccount “Calculations for claims”. Receipt of funds based on a writ of execution.

- DT76 subaccount “Settlements on claims” KT91 subaccount “Other income”. Reimbursement of duties and losses incurred.

All transactions are confirmed by primary documentation: writs of execution, receipts, and so on.

Resolution of controversial issues through litigation is accompanied by costs associated with the consideration of the claim. Legal costs include state fees and costs incurred in considering the claim. The amount of payment and the order of acceptance of costs depend on the characteristics of the claim. Before entering amounts into accounting and accepting them as expenses, you must have an idea of the procedure for their formation. In this article we will talk about accounting for legal expenses and give examples of accounting entries.

Cost of accounting for lawyers

There are many different subtleties and features in the accounting of law firms and lawyers that you need to know how to identify and distinguish from an accounting and tax accounting point of view. As a result, we invite you to use the services of the BUKhprofi company, which will outsource your law firm to accounting and assist you in minimizing taxes and expenses. The cost of accounting for lawyers averages from 10,000 to 12,000 rubles.

You can find out more about our prices and services provided on the Accounting page.

Legal expenses in the form of state fees

The amount of state fees for each type of appeal is established by Ch. 25.3 Tax Code of the Russian Federation. State duty is a fee collected when filing a claim in court. The original payer is the plaintiff. The final payer of the amount is the losing party, who is awarded costs.

- Type of claim – economic, non-property, administrative.

- Categories of appeal – statement of claim, appeal or cassation complaint.

- The level of the judicial body - arbitration, general jurisdiction, higher body.

The most common cases are those of a commercial nature. The amount of the fee depends on the value of the assessed claim. For applications from persons without specifying the price of the claim, a fixed fee is provided.

Payment is made before filing an application with the court using the details provided by the authority. If the amount increases during the meeting, an additional payment is made. The legislation establishes a list of persons exempt from payment or who have the opportunity to reduce the amount of payment. When filing a claim, persons belonging to the preferential category confirm their right with documents.

Read more: Up to what age can you donate blood?

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Legal expenses in the form of costs

The list of costs arising during the trial is defined in Art. 106 Arbitration Procedure Code of the Russian Federation. The list is open and individual in each specific case. Costs arise when considering a claim and are necessary for a more accurate decision. Costs are considered expenses only if they are determined by a court decision. Costs include:

- Remunerations paid to attracted specialists - translators, consultants, legal specialists.

- Compensation for current expenses of specialists and witnesses - travel, daily allowance, rental housing and other types of expenses.

- Payment for the cost of conducting an examination or inspection of the territory.

- Reimbursement of costs associated with postal expenses for notifying persons.

Amounts qualified as costs must meet the criteria of reasonableness. Rewards and compensation to individuals are assigned by the court in agreement with specialists in accordance with the time spent or established minimum wage standards. Payment of remuneration and compensation to the involved persons is made from the court's deposit account, where funds are deposited upon request to invite a specialist. Amounts spent on the initiative of the judicial authority are paid from the budget.

The costs incurred by the winning party to engage a lawyer and confirmed by the contract are compensated by the losing party, also based on the principle of reasonableness. The losing party also compensates for other expenses incurred during the proceedings. If the claim is partially satisfied, compensation for expenses is made partially.

Accounting for legal expenses

Acceptance of expenses when participating in court is carried out after their documentary confirmation and actual implementation. The date of acceptance of the state duty in expenses is the day of filing the statement of claim. The document will not be accepted for processing without presentation of a payment document or confirmation of release. If the claim is abandoned after filing the application, the amount will not be returned to the plaintiff.

To accept expenses in the form of expenses, you must have a court decision and documents confirming the expenses (clause 14.2 of PBU 10/99). When compensating for expenses incurred, the date of receipt of income is considered to be the day the court recognized the costs - made a decision (clause 16 of PBU 9/99). Court decisions are considered legal after they enter into force. To account for state duties, account 68 is used, and legal costs are accounted for in the subaccount “Settlements on claims” of account 76.

Execution of work: wiring

Let us give an example of the formation of accounting entries when the result has a material embodiment.

Example 3. Making custom furniture

Lira LLC, based on the customer’s sketches, manufactured a wardrobe costing 40,000 rubles. (NDS is not appearing):

- The customer made an advance payment of 10,000 rubles to the cash register;

- cost of materials – 20,000 rubles;

- salary – 5,000 rubles;

- insurance premiums for salary – 1,500 rubles.

Let's make the wiring:

| The essence of the operation | Debit | Credit | Amount, rub. |

| The customer made an advance payment to the cash desk of Lira LLC | 50 | 62 | 10 000 |

| Material costs | 20 | 10 | 20 000 |

| Salary | 20 | 70 | 5 000 |

| Insurance premiums | 20 | 69 | 1 500 |

| The actual cost of the wardrobe is taken into account | 43 | 20 | 26 500 (20 000 + 5 000 + 1 500) |

| The cost of work has been written off | 90.2 | 43 | 26 500 |

| Revenue is reflected (the work completion certificate is signed) by posting | 62 | 90.1 | 40 000 |

| Final settlement with the customer | 50 | 62 | 30 000 |

| Profit of Lira LLC | 90.9 | 99 | 13 500 (40 000 – 26 500) |

Postings of the plaintiff and defendant using the example of payment of state duty

During the trial, M.’s organization filed a claim against the actions of IP K. of a non-property nature, the assessment of which cannot be made. The amount of state duty was 6,000 rubles. The amount of expenses reimbursed by the losing party is recognized as part of other income.

| Operation name | Correspondence from the plaintiff | Correspondence from the defendant | Amount (in rubles) |

| Payment of state duty | Dt 68 Kt 51 (50) | Not produced | 6 000 |

| Reflection of state duty as part of expenses | Dt 91/2 Kt 68 | Not produced | 6 000 |

| Recognition by the court of expenses for payment of state duty | Dt 76/2 Kt 91/1 | Dt 91/2 Kt 76/2 | 6 000 |

| Reimbursement of expenses has been made | Dt 51 Kt 76/2 | Dt 76/2 Kt 51 | 6 000 |

An example of reflecting expenses in the plaintiff’s accounting records

The Contractor enterprise did not receive payment for labor after completing work under a construction contract. The contractual terms set the terms of payments for the construction of the facility. Negotiations on payment for labor did not bring a positive result, which necessitated the need to resolve the issue in court.

When going to court, the company paid: a state fee in the amount of 2,300 rubles, the services of a lawyer in the amount of 5,000 rubles and an expert to confirm the compliance of the object with the terms of the contract in the amount of 7,000 rubles. According to the court's decision, the defendant must pay the plaintiff the cost of the contract and compensate legal expenses.

| Operation | Debit entry | Credit of record | Amount (in rubles) |

| Payment of state duty to the budget has been made | 68 | 51 | 2 300 |

| The state fee for filing an application with the court is included in the costs | 91/2 | 68 | 2 300 |

| Reflected legal costs when making a court decision | 91/2 | 60 | 12 000 |

| The court recognized the costs incurred when considering the issue in court | 76/2 | 91/1 | 12 000 |

| The court recognized the costs of paying the state duty | 76/2 | 91/1 | 2 300 |

| A sum has been received to compensate for expenses | 51 | 76/2 | 14 300 |

The court makes a decision on compensation for expenses based on documents confirming the expenses.

Procedure for documenting services

To confirm the fact of agreement on the terms, it is necessary to conclude an agreement between the parties of a certain form. Despite the use of the concept of “services” in accounting terms, lawyers are engaged in providing assistance, which is reflected in the contract. In legal practice, 3 types of agreements are used.

| Type of agreement | Purpose of services |

| Paid provision of services | Signed to provide legal advice or draft significant documents |

| Agency agreement | Issued to represent the interests of the principal in court |

| Mixed agreement | Contains elements of a contract for the provision of paid services and instructions |

The contract is considered concluded when agreement is reached between the parties on the terms of assistance. The document must be registered in a lawyer's office.

Determination of legal costs by the judicial authority

Recognition of costs incurred is carried out by the court in each specific case. Costs cannot be allocated to the losing party without filing a claim. The need to cover expenses must be addressed to the court and a request must be included in the statement of claim or in the form of additional demands stated during the hearing. When covering expenses, several repayment options arise.

| Procedure | Compensation of expenses |

| The fee was paid by the plaintiff, the application was not submitted to the court | Refunds are made by the territorial office of the Federal Tax Service before the expiration of 3 years. |

| The fee has been paid, the claim has been satisfied pre-trial | In some cases, the amount of fees and costs is returned in a separate claim. |

| The claims were partially satisfied | The costs incurred by the plaintiff are partially compensated, in part of the recognition of the claim or at the discretion of the court |

| The defendant has no obligation to pay state duty | Only expenses are subject to compensation; the amount of state duty to the plaintiff is not covered. |

Expenses incurred by the plaintiff in the course of pre-trial consideration of claims are not covered. Expenses often include costs for the services of lawyers. The courts do not recognize such expenses and do not attribute them to the losing party.

In some cases, the losing party may be able to avoid paying the winning party's costs. In order for the court to make a decision, it is necessary to apply to the court to provide documentary evidence of the difficult financial situation, the unintentionality of the motives for causing the damage, and to pay off the claims during the proceedings or upon receipt of a deferment.

Service concept

There are different options for describing what a service is:

- This is an activity that does not create an independent product, materialized object or material assets.

- A series of actions that are tools for the production of value, they can create value, but they themselves are not independent value.

We will use the concept given in the Tax Code of the Russian Federation: activities, the results of which do not have material expression, are sold and consumed in the process of carrying out this activity (Part 1, Chapter 7, Article 38, paragraph 5).

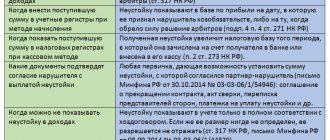

Tax accounting of expenses

According to paragraph 10, paragraph 1 of Art. 265 legal expenses are included in non-operating expenses. The legislation does not specify the procedure for accepting expenses and the date of write-off. To confirm expenses you will need to have:

- documentary confirmation;

- economic feasibility of costs;

- connection with the legal process (being one of the parties);

- presence of a decision of a judicial authority that has entered into force;

- confirmation of payments using the cash method of accounting for expenses and income.

Enterprises that use the general tax system for accounting include legal expenses in calculating the tax base of profits. The costs may include any costs confirmed by the court. When reimbursement of expenses, the amount is included in non-operating income.

Composition of expenses in bankruptcy

The insolvency procedure is carried out under the supervision of the Arbitration Court. The body determines the stage of the procedure and the manager conducting financial control of the operations. Covering expenses is carried out at the expense of the debtor and is not compensated by third parties. Expenses subject to judicial approval include:

- Manager's remuneration.

- Payment for current activities in the form of postal, office, and transportation expenses.

- Amounts required for publication of notifications about the start of the procedure in the Bulletin.

- Funds spent on holding public auctions of the debtor's property.

- Payments for the services of appraisers, auditors, experts and others.

When determining the amount of expenses, the validity of the expenses, reasonable amount and proportionality to the result are taken into account.

How to recover attorney fees

Moscow dated February 22, 2005 N 20-12/10937.

Documents confirming the actual payment of legal services can be a payment order, an expense cash order, a receipt (see, for example, Resolutions of the Federal Antimonopoly Service of the Moscow District dated May 19-26, 2005 in case No. KA-A40/3315-05, Ninth Arbitration Court of Appeal dated November 4 - 12, 2004 in case No. 09-4012/04-AK, FAS North-Western District dated April 16, 2004 in case No. A42-5920/03-28).

Situation 2. The tax inspectorate applied to the arbitration court with an application to collect penalties from the organization. The court refused to satisfy the stated claim and recovered legal costs from the tax authority in favor of the organization.

The court's position. The court was guided by Art. 110 of the Arbitration Procedure Code of the Russian Federation, according to which the costs of paying for the services of a representative incurred by the person in whose favor the judicial act was adopted are recovered by the arbitration court from another person participating in the case, within reasonable limits. To protect its interests, the organization used the legal services of a representative. The documents confirming the provision and payment of services were an agreement with a representative, a power of attorney and an expense cash order.

Based on these documents, the court decided to recover from the tax inspectorate the organization’s expenses for paying for the representative’s services.

(Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 10, 2005 in case No. A43-7224/2005-31-264)