The production calendar for 2021 has appeared

The government approved the schedule of weekends and holidays for 2019 (Resolution No. 1163 dated October 1, 2018). The weekend of January 5th and 6th will be moved to Thursday and Friday May 2nd and 3rd, and the holiday break of February 23rd will move to Friday May 10th. So the coming New Year holidays will last from December 30, 2021 to January 8, 2021. The February holiday is on the 23rd and 24th, the March holiday from the 8th to the 10th, the May holiday from the 1st to the 5th and from the 9th to the 12th. The holiday on June 12 falls in the middle of the week; in November we rest from the 2nd to the 4th. Plan your work schedule for next year now.

Accounting changes

On October 1 of this year, a new report began to operate in Russia, which must be submitted to Rostrud. In 2021, management will provide new reporting on employees to the employment center. The form is necessary for Rostrud employees to obtain information about employed pre-retirees.

Accountants were also warned that there was no need to duplicate the document to the Pension Fund. Also, according to changes in accounting legislation, it is stated that the form is voluntary, so it can be submitted at the request of management.

From October 1, 2021, the requirements for SZV-M have been changed. Now accountants need to send a report to the Pension Fund, which must accept the documentation. In addition, penalties for supplementary reports of this form were legalized. Russian citizens can find these and other adjustments to the accounting and tax code on official Internet resources.

Contribution limits for next year announced

The Ministry of Finance has calculated the maximum bases for insurance premiums for employees for 2021:

- the base for pension contributions will be 1,150,000 rubles (in 2021 - 1,021,000 rubles): within these limits, pay contributions at a rate of 22%, above these limits - at a rate of 10%;

- the base for social contributions will be 865,000 rubles (in 2021 - 815,000 rubles): within these limits, we pay contributions at a rate of 2.9%, beyond these limits we do not charge contributions;

- there is no maximum base for medical contributions; they are always paid at a rate of 5.1%;

- There is also no limit for contributions for injuries; they are always paid at the rate that Social Insurance sets for you.

Changes in tax accounting from October 1, 2018

From the beginning of this month, the calculation of value added tax at the time of receipt of funds as an advance payment by the property seller has been changed. Such sellers must now calculate the tax amount taking into account the difference between the advance deposited into the account and the seller's costs of obtaining the title. The seller can deduct the tax amount in accordance with the legal framework of the country. Previously, property sellers calculated taxes on advance payments at a certain rate. It was also impossible to make tax refunds.

From the first day of this month, the documentary justification for the zero VAT tax rate for export transactions has been improved. If property is shipped to a branch of an enterprise that is located outside the EAEU, it is necessary to provide a photocopy of the bilateral agreement with the Russian company. Previously, there was no such or similar provision in tax legislation.

Now it is worth providing the inspection with contracts with details of previously submitted documents and details of the structure to which the package of documents was previously submitted. Before changes in tax accounting, it was necessary to submit documentation of previously filed contracts for periods that had expired.

From October 1, 2021, in Russia there is no need to submit a photocopy of invoices and other documents with marks to the tax office at the customs point when exporting products to other countries. The inspector may require photocopying of documents if suspicion arises.

Officials also reviewed the specifics of value added tax refunds. Now a company with an income of at least 2 billion rubles must pay taxes; previously this figure was 5 billion rubles more.

Deputies clarified the application of the zero rate for value added tax. Taking into account the changes, firms that manufacture precious metals and have not received permission to do so can count on a zero rate. Previously, such companies paid VAT at a flat percentage rate.

Legal entity and individual entrepreneur registration documents will be sent by email

The results of registration of an entrepreneur or legal entity, as well as changes to previous registration records, will now be issued only in electronic form . In this regard, the Tax Service reminds applicants not to forget to provide their email addresses. Such changes to Law No. 129-FZ of August 8, 2001 came into force on April 29. Amendments were introduced by law No. 312-FZ of October 30, 2021.

The rules apply to notifications of positive registration results, as well as refusals and suspensions. Moreover, it does not matter whether the documents were submitted electronically or on paper. If the applicant requires a paper version of the document, it will need to be requested separately.

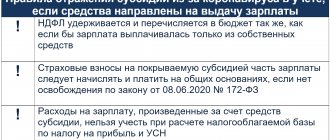

Child benefits are exempt from personal income tax

The list of payments on which personal income tax is not required has been expanded. Allowances for the first and second children were exempted from tax . Amendments were introduced by Law No. 88-FZ of April 23, 2018, which amended Article 217 of the Tax Code. The new rule applies to legal relations arising from the beginning of 2018.

We recommend reading the article about other changes in child benefits.

Changed the rules for issuing certificates of incapacity for work

In accordance with the order of the Ministry of Health dated November 28, 2021 No. 593n, the rules for issuing sick leave have changed since April 10. Now there is no need to count how many days an employee was absent from work due to the illness of a child who is a preschooler. From the specified date, sick leave covers the entire duration of the child’s illness . Let us remind you that a 90-day maximum has now been established for diseases that are included in the special list, and a 60-day maximum for all other diseases. The limit on days for caring for a disabled child was also lifted.

Tax return for UTII

When preparing reports for the 3rd quarter, the tax office recommends using the new form. If there is a need to submit an “adjusted” one, it must be formed according to the form in which the initial declaration was filled out.

The new UTII declaration contains an additional line 040 in section 3, indicating the amount of the applicable deduction on the cash register.

Among the innovations is the appearance of section 4. It provides information about each cash register for which the entrepreneur claims a deduction. The sample UTII declaration in this section provides an indication of the cash register model, its serial and registration number, and the cost of purchase. The date of registration of the equipment must be indicated.

Response to the repeated request of the Federal Tax Service

What should a taxpayer do if inspectors from the Federal Tax Service repeatedly request documents or information? Now the answer is in the Tax Code of the Russian Federation, and the changes also come into effect on September 3. So, tax legislation requires that the inspectors be informed that the requested documents (information) have already been submitted once. This must be done within 10 working days from receipt of the request. The notification will need to indicate where the requested information was sent and the details of the document with which it was sent.

Changes in accounting of budgetary institutions (2018)

In the public sector, there has been a change in the reporting procedure, including accounting. The beginning of the year was marked for accountants of public sector enterprises by the introduction of federal accounting standards into accounting, which apply only to public sector organizations.

Changes in accounting from 2021 - table according to the introduced FSB:

| Standard | Regulatory document |

| A standard that covers the basics of accounting and reporting for institutions in the public sector | Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 256n |

| FSBU dedicated to fixed assets | Approved by order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 257n |

| Lease Accounting Standard | Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 258n |

| Procedure for recording asset impairment transactions | Enshrined in the standard from the order of the Ministry of Finance dated December 31, 2016 No. 259n. |

| Regulation of financial statements | FSBU from the order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 260n |

Changes in the accounting of budgetary institutions also affected the forms of inventory documentation used by them - an inventory list with a discrepancy statement form (Order of the Ministry of Finance dated November 17, 2017 No. 194n). Amendments have been made to Instructions No. 162n and No. 157n.

Changes in accounting 2021, based on updating Instruction 162n, affected the following issues:

- Accounting entries are given, with the help of which the internal movement of individual assets from among fixed assets should be shown in the case of their rental or transfer to third parties for free use, when concluding a trust management agreement or sending the accounting object to other storage locations.

- An algorithm of actions for isolating obligations supported by executive documents is given, provided that information about the source of the debt, BCC and information about the amount of obligations cannot be identified.

What changes did accounting receive after updating Instruction 157n:

- reporting will be considered reliable if there are inaccuracies in its preparation that do not affect the terms of subsidies and decisions made by the founders (for example, the analytical account for accounting for fixed assets is incorrectly determined);

- a rule has been introduced for separately reflecting correspondence to eliminate errors discovered in past periods;

- changes in accounting in 2021 affected the names of accounts 204 32, 206 61 and 206 63;

- Two accounts were excluded from the Chart of Accounts - 204 51 and 215 51.

Tax Free stores will fill out purchase and sales books in a new way

the Tax Free system has started working in Russia . The stores affected will have to fill out VAT registers according to the new rules. They are contained in Government Decree No. 98 of February 1, 2021.

The new procedure concerns VAT amounts that the company accepts for deduction in accordance with paragraph 11 of Article 172 of the Tax Code of the Russian Federation. The procedure for filling out the purchase book is as follows:

- Column 3 contains the details of the cash receipt on the basis of which the VAT refund is made.

- Column 7 contains the number and date of the receipt that the foreign buyer received at the retail store. The same details should be on the “return” check.

- Column 13 reflects information about the customs mark. It is she who confirms that the purchase was exported outside the EAEU.

- Columns 15 and 16 reflect the purchase amount, including VAT, as well as the amount of tax.

In addition, the resolution states how the receipt for VAT refund is reflected in the sales book.

Change #7

To increase the objectivity of the decision made based on the results of the inspection, an addition will now be drawn up to the executed act. The document will record the essence of the activities carried out and the conclusions that were drawn based on the summed up results.

You might be interested in:

The government cancels the fee for registering LLCs and individual entrepreneurs

This document can be provided to the taxpayer and he, in turn, has the right to raise his objections, if any.

Mandatory execution of an addendum to the tax audit report

Now it will be much easier for taxpayers to understand what inspectors from the Federal Tax Service discovered during additional tax control activities. Indeed, from September 3, tax authorities will have to draw up additions to the tax audit report in relation to each additional tax control event:

- requesting documents;

- questioning witnesses;

- carrying out examinations.

Currently, there is no such obligation, so tax officials do not draw up any single document based on the results of additional measures. Therefore, the essence of claims against the taxpayer can be difficult to understand. In less than a month, the taxpayer will have to receive such an addition to the act within 5 business days from the date of its execution. Copies of all materials obtained as a result of control activities must be attached to the document. Within 15 working days, the taxpayer will be able to submit to the Federal Tax Service his objections to the addition to this act. The new procedure will apply to all inspections completed after September 3, 2018.

Taxes were allowed to be collected from accounts in precious metals

In accordance with Article 1 of Law No. 343-FZ dated November 27, 2017, tax debt can now be recovered not only from an account in rubles or foreign currency, but also from an account in precious metals (if there are insufficient funds in other accounts). To calculate the write-off amount, banks will use discount prices of the Central Bank of the Russian Federation for a given date. The requirement to write off funds from the client’s “metal” account must be fulfilled by banks from June 1, otherwise he himself will be held accountable.

The same law amended Article 149 of the Tax Code of the Russian Federation , according to which banks' transactions with precious stones are no longer exempt from VAT.

Transport tax ↑ up

There have been three changes to the transport tax, which we discussed in detail in the article Transport Tax (2018). Transport tax changes for 2018 are as follows:

- The declaration form has been updated. The changes affected the Platon system and the affixing of a company seal to the declaration.

- The size of the increasing coefficient for expensive cars has been reduced. Now, for cars costing from three to five million rubles, there is one increasing factor - 1.1 for all cars aged from one to three years.

- The procedure for providing tax benefits to citizens has been simplified. Previously, it was necessary to submit to the tax service both an application and documents confirming the right to the benefit. Now, it is enough to submit one application.

Information about tax debts made public

In just a few days - from June 1, 2021 - on the Federal Tax Service website in the Transparent Business service you will be able to check the tax debts of your counterparties . This information becomes public in accordance with the order of the Federal Tax Service of the Russian Federation dated December 29, 2016 No. ММВ-7-14/ [email protected]

In addition, the following data on business entities :

- on the use of special regimes;

- on participation in a consolidated group of taxpayers;

- on income and expenses (according to financial statements);

- about the number of employees;

- about paid taxes and insurance premiums.

Payment of taxes and administrative fines

According to the proposed amendments to the legislation, initiated by the Ministry of Finance and the Federal Tax Service of the Russian Federation, all property taxes of individuals (including transport and land) can be paid with a payment tentatively called “advance payment”. This will simplify the process of transferring funds and help avoid mistakes, which is especially important if the objects are located in different regions.

From July 31, 2021, it will be easier to make payments for administrative fines: details of payment orders will be attached to fine protocols - this will avoid the risk of transferring a fine to an incorrectly specified beneficiary.

In addition, it is known that the Ministry of Finance is already proposing to amend the Code of Administrative Offenses to allow third parties to pay administrative fines for each other - both legal entities and individuals - individuals - can have this opportunity.

The amount of the recycling fee has been increased

Government Decree No. 300 of March 19, 2021 introduced new coefficients for calculating the recycling fee for cars . Popular types of vehicles will become more expensive to dispose of. The new odds are:

- For passenger cars with an engine capacity of 1.5-2, the tariff increased from 44.2 thousand to 84 thousand rubles .

- For trucks weighing 2.5-3.5 tons, the fee increased from 198 thousand to 300 thousand rubles .

As for Russian-made cars, including foreign cars assembled here, the recycling fee is compensated by a subsidy from the state.

Simplification of the application procedure for VAT refund

From the VAT refund declared by taxpayers in the tax return for the fourth quarter of 2021, the requirements for the amount of taxes paid by the organization for VAT refund in the application procedure are reduced. Now it will not be 7 billion rubles, but only 2 billion rubles. In addition, the requirements for guarantors are being relaxed. For them, the limit on taxes paid is also being reduced - from 7 billion to 2 billion rubles. But the amount of obligations under guarantees, on the contrary, will increase from 20 to 50% of the value of net assets. In this way, the guarantor organization will be able to issue more guarantees for VAT refunds on an application basis.