Commercial organizations are legal entities whose main purpose is to make a profit. However, legal entities can be created for other purposes. Organizations for which making profit is not a priority are recognized as non-profit.

Non-profit organizations can be created in the form of consumer cooperatives, public or religious organizations (associations), institutions, charitable and other funds, as well as in other forms provided by law.

The specifics of the forms of non-profit organizations are established in Chapter 4 of the Civil Code.

A consumer cooperative is a voluntary association of citizens and legal entities on the basis of membership in order to satisfy the material and other needs of the participants, carried out through the pooling of property shares by its members.

Public and religious organizations (associations) are recognized as voluntary associations of citizens based on the commonality of their interests to satisfy spiritual or other non-material needs.

The Foundation is recognized as a non-profit organization established by citizens and (or) legal entities on the basis of voluntary property contributions, pursuing social, charitable, cultural, educational or other socially beneficial goals.

An institution is a non-profit organization created by the owner to carry out managerial, socio-cultural or other functions of a non-commercial nature.

An institution can be created by a citizen or legal entity (private institution) or, respectively, by the Russian Federation, a subject of the Russian Federation, or a municipal entity (state or municipal institution).

Features of accounting in non-profit organizations

Non-profit organizations (NPOs) maintain accounting and prepare reports in accordance with the legislation of the Russian Federation. To maintain it, management is obliged to introduce the position of an accountant or draw up an agreement for the relevant services with another company.

Operations related to the activities prescribed in the Charter and entrepreneurship are carried out separately. Income and cost accounts are presented in the table. (click to expand)

| Activity | Check |

| Non-profit | 86 “Targeted financing” |

| Entrepreneurial major | 90 "Sales" |

| Other entrepreneurial | 91 “Other income and expenses” |

Unlike commercial companies, an NPO engaged in entrepreneurship does not have the right to distribute the income received during the period between participants. Profits must be used exclusively to fulfill the statutory goals of the association. The following entry occurs in the accounting:

Dt 90 Kt 99 - reflects the profit received at the end of the reporting period.

At the end of the year 99 close:

Dt 99 Kt 84 - net profit for the year is taken into account;

Dt 84 Kt 86 - financing of statutory work.

If the commercial activities of the NPO resulted in losses, make the following entries:

Dt 99 Kt 90 - loss for the period (month) is taken into account;

Dt 84 Kt 99 - annual loss is reflected.

The loss is covered from certain sources. For example, from the reserve fund, from last year’s profit, additional investments of participants, etc.

The following entries take place:

Dt 76 Kt 84 - the loss is repaid through membership fees;

Dt 86 Kt 84 - due to last year’s profit;

Dt 82 Kt 84 - from the reserve fund.

Example No. 1. Write-off of business results

NPO "Barrier" provides services for a fee. For 2021, income amounted to 614 thousand rubles, expenses - 389 thousand rubles.

Postings are made throughout the year:

Dt 62 Kt 90,614,000 - revenue from business is taken into account;

Dt 90 Kt 20,389,000 - the cost of services has been written off;

Dt 90 Kt 99,225,000 - the result of the association’s work is taken into account.

At the end of the year, the accountant will write:

Dt 99 Kt 84,225,000 - profit written off;

Dt 84 Kt 86,225,000 - annual profit added to target amounts.

An NPO can take property into account as fixed assets if the following conditions are met:

- Application in the work established by the Charter, for the needs of management or entrepreneurship;

- Application for a period exceeding one year;

- Donation or transfer of ownership to other persons is not provided for.

The object is assessed at market value at the time of registration. The cost of fixed assets is reflected by the entry: Dt 08 Kt 86.

For fixed assets, NPOs charge depreciation instead of depreciation, like commercial companies. The data obtained is used when calculating property tax based on the annual average value of fixed assets (Article 375 of the Tax Code of the Russian Federation).

The amount of depreciation is shown on the off-balance sheet account, and fixed assets are shown on the balance sheet at their original cost. Otherwise, the asset will not be equal to the liability. A feature of the accounting of fixed assets received from earmarked funds is the use of accounts.

83. In the balance sheet, its balances are reflected in the line “Real estate and movable property fund”.

Results

The procedure for submitting financial statements of non-profit organizations in 2021 is somewhat different from that for commercial enterprises. Non-profit organizations have the right to submit financial statements in a simplified form, as well as independently determine the detail of its articles and the level of materiality. From June 1, 2019, updated accounting forms must be used. The rules for its presentation have also changed.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Federal Law of January 12, 1996 No. 7-FZ

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

- Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n

- Letter of the Federal Tax Service of Russia dated July 16, 2018 No. PA-4-6/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Simplified taxation in non-profit organizations

NPOs have the right to apply simplified taxation. They can choose the simplified tax system upon creation by submitting a corresponding application to the tax office, or switch to the regime during the management process. Restrictions on the use of the simplified tax system are presented in the table.

| Index | Limitation |

| State | No more than 100 people |

| Income for 9 months | Not higher than 45 million rubles. |

| Residual value of funds | Less than 100 million rubles |

| Branches | None |

| NPO is not a manufacturer of excisable products | |

Organizations on the simplified tax system submit a single simplified declaration to the inspectorate every year. They are exempt from paying income taxes, property taxes and VAT. NPOs use a simplified method to calculate the single tax. When taxed “by income”, it is equal to 6% of all income received. With the object “income minus expenses” - 15% of the difference, and if there is no difference - 1%. (see → NPO taxation, rates in 2021)

Revenues used for statutory purposes are not subject to a single tax. This applies to grants, membership fees, donations, and subsidies for targeted needs. Simplified NPOs are required to account for income and expenses of available target amounts separately.

Under this system, the manager has the right to perform the duties of the chief accountant and not resort to the services of other organizations for accounting. The transition to the simplified tax system is beneficial for non-profit organizations engaged in the sale of goods, work for a fee and having taxable property on their balance sheet.

Reporting of non-profit organizations

The composition of the reporting forms differs depending on the types of activities of the NPO. The differences are shown in the table.

| Activity | Reports | Frequency of delivery |

| a commercial | balance sheet how to fill out form 1; profit and loss how to fill out form 2; changes in capital (form 3); movement of money (f. 4); how to fill out form 4 appendix to the balance sheet (form 5); intended use of funds (form 6); explanatory note. | Quarterly |

| Non-profit | Forms No. 1, 2, 6. | Once a year |

In addition to accounting, NPOs submit tax returns for the following:

- VAT;

- property tax;

- income tax;

- land tax;

- transport tax.

Property tax is calculated based on its value according to the cadastre (Article 346.11 of the Tax Code of the Russian Federation). NPOs provide data on the average number of staff and 2-NDFL certificates. NPOs submit Form 4-FSS quarterly to the social insurance fund, and RSV-1 calculations to the pension fund. Read also the article: → “Calculation using the RSV-1 form (reporting for employees to the Pension Fund of Russia).” Form 1-NKO is submitted to the statistical office. It contains data about the work of the organization. Short Form No. 11 is submitted annually and includes data on the availability and movement of fixed assets.

Three forms are submitted to the Ministry of Justice:

- OH0001 - data on the management and nature of the activities of the NPO;

- OH0002 - expenditure of targeted funds and use of assets;

- OH0003 - filled out on the website of the Ministry of Justice.

Information on the personnel of the governing bodies of a non-profit organization (Form No. ON 0001)

Report on the expenditure of funds by a non-profit organization and on the use of other property, including those received from international and foreign organizations, foreign citizens and stateless persons (Form No. ON 0002)

Report on the volume of funds and other property received by a public association from international and foreign organizations of foreign citizens and stateless persons on the purposes of their expenditure or use and on their actual expenditure or use (Form No. ON 0003)

These forms are submitted only by those organizations whose annual receipts exceed 3 million rubles, there are receipts from foreign individuals and companies, or if there are foreigners among the NPO participants.

Accounting for funds in accounts

To record, store, and use cash, NPOs must use a cash register. The cash balance limit is mandatory and is pre-agreed with the credit institution providing services to the entity.

Cash transactions are carried out using cash registers if the organization is engaged in trade or provides services. To accept contributions, donations, and other receipts from individuals, cash register equipment is not needed. Cash transactions are completed using standardized document forms.

NPO participants deposit money into the cash register or into the organization’s account. This procedure must be determined by the head or the Charter of the association.

Receipt of contributions from members of the association is formalized as follows: Dt 50 (51, 52, 55), Kt 86 - the receipt of target funds to the cash desk (account) is reflected. The cash register inventory is carried out in accordance with the legislation of the Russian Federation.

Extended capabilities

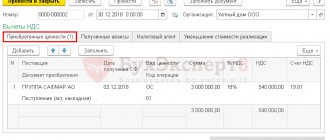

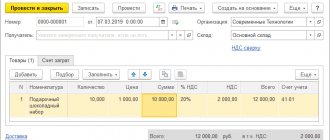

In the full interface of “1C: Accounting for a non-profit organization 8”, advanced capabilities are available: accounting for estimates, accounting for educational services and accounting for meals.

Currently, this functionality is more focused on users moving from 1C: Accounting Autonomous Institution 8. Since accounting needs for NPOs have their own specifics, expanded capabilities will develop.

Accounting for estimates

NPOs can take part in competitions for grants. The program provides the ability to compile and print estimates for the grantor. Estimates can be adjusted if changes occur, or closed if the work is completed. For control, a report on the execution of the estimate is provided, taking into account planned and actual expenses and income.

Educational accounting automated operations to provide schoolchildren and students with educational and other services, which are provided both free of charge and on a paid basis.

It is possible to generate a statement of payments for paid education of students or for other services, for example, for the provision of a hostel or meals.

Operations for calculating fees for the care of children in child care institutions, including parental fees, as well as fees for additional services that are provided on a paid basis, have been automated.

The program supports the calculation of amounts payable, issuing and printing receipts for parental fees and additional educational services provided by the child care institution. Reports have been developed to analyze and provide data:

- statement of settlements with parents,

- payment receipt report,

- children's attendance sheet,

- statement of calculation of compensation for parental pay.

Power accounting

The program provides the ability to register those who are satisfied and reflect business transactions related to the write-off of food products as expenses. To summarize information about the receipt and consumption of food products during the month, a cumulative statement is generated for the receipt or consumption of food products. These reports are generated for each financially responsible person, by names and codes of food products.

Accounting for intangible assets

Intangible assets (IMA) are accounted for in non-profit organizations on the basis of PBU 14/2007. When accepting them for accounting, the period of planned use for solving the statutory tasks of the organization is established. This period is subject to annual review and clarification. If there are adjustments, they are reflected in accounting and reporting forms at the beginning of the year as changes in estimates.

Depreciation on intangible assets is not accrued in non-commercial organizations, even when they are used in commercial activities (clause 24 of PBU 14/2007). If intangible assets are acquired using business income, then depreciation is allowed.

For example, if you create your own computer program, the postings will be as follows:

Dt 08.5 KT 10, 70, 69 - the costs of creating the product are taken into account;

Dt 04 Kt 08.5 - the program is registered as an intangible asset;

Dt 86 Kt 83 - target amounts were used to create intangible assets.

Conclusion

The general accounting rules for nonprofits are the same as for commercial companies. But there are a number of features - there is no authorized capital, no depreciation is charged, and profits are not distributed.

Most NPOs (except foreign agents) have the right to conduct simplified accounting.

If an NPO, in addition to its main activities, also conducts commercial activities, it is necessary to organize separate accounting of income and expenses. The profit received should be used to finance non-profit projects.

Postings and decoding of operations

Account 86 is used in the following main business transactions.

| Debit | Credit | Explanation of the operation |

| 86 | 20, 26 | Target amounts spent |

| 83 | Amounts spent are included in additional capital | |

| 98 | Target amounts added to future expenses | |

| 07 | 86 | Equipment for statutory events taken into account |

| 08 | Contribution to non-current assets reflected | |

| 10, 11 | Materials (animals) were capitalized as a target receipt | |

| 15 | Inventory taken into account for events according to the Charter | |

| 20 | The main production facility was received | |

| 41 | Goods transferred for targeted programs are taken into account | |

| 76 | Financing accrued |