Modernization of fixed assets (FPE) is periodically carried out at the enterprise in order to increase the efficiency of their use.

This procedure, like any other business transaction, is subject to both accounting and tax accounting. Accountants often get confused in the relevant terminology, unwittingly replacing the concepts of modernization, repair work, and reconstruction projects.

However, there is a significant difference between these measures, often implemented to improve the operation of technical facilities.

In the process of normal use, any item of fixed assets is known to be subject to physical and moral wear and tear.

To restore its operational properties, modernization is being carried out. It is a set of works aimed at qualitatively changing the service or technological functions of an object.

As a result of this procedure, as a rule, it becomes possible to use modernized equipment to perform tasks that provide increased returns.

If we talk about how the results of repair, reconstruction, and modernization are reflected in tax and accounting documentation, then, of course, it is necessary to note the significant differences that exist when performing the corresponding accounting procedures.

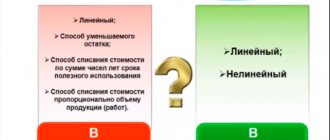

When the next asset is entered into economic accounting, the accountant often tries to choose the usual method for calculating depreciation. He follows a similar approach when determining the useful life of a technical device.

If the primary cost of the object being taken into account also turns out to be identical, this fact significantly simplifies its recording in documents, since the amounts of depreciation charges will also be similar.

However, when modernizing technical objects, it often becomes necessary to calculate different amounts of depreciation according to tax and accounting documents.

This circumstance is explained by the fact that the methods for controlling depreciation charges, applied after the implementation of the above measures, differ significantly in the accounting procedures carried out for tax and accounting purposes.

Repair, reconstruction and modernization of the OS

During operation, organizations have to bear costs to ensure the functioning of fixed assets. The ways in which these costs are reflected in accounting depend on their essence, so it is important to define concepts such as modernization, reconstruction and repair:

- According to paragraph 2 of Art. 257 of the Tax Code of the Russian Federation, modernization includes work that results in a change in the technological or service purpose of a fixed asset, as well as an increase in its capacity, performance, or the appearance of new qualities.

- Reconstruction is a reorganization of the operating system, which improves the results of its work, allows you to increase the variety of products produced, improve their quality or quantity. Also, the Tax Code of the Russian Federation uses the concept of “technical re-equipment”, which is associated with the use of the latest technologies and automation of production.

NOTE! These two concepts are united by the fact that as a result the fixed asset acquires improved performance or new functions.

- During repairs, technical and economic indicators do not improve, but remain the same. Its essence comes down to eliminating faults that have arisen or replacing worn parts.

How does a major overhaul differ from reconstruction and modernization? The answer to this question is in the ConsultantPlus legal reference system. If you have access to K+, proceed to the Typical Situation. If you don't have access, get trial access to the system for free.

See also “The workshop is turning into a warehouse and office - is this a renovation or reconstruction?” .

According to clause 14 of the accounting regulations “Accounting for fixed assets” PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, and clause 2 of Art. 257 of the Tax Code of the Russian Federation, the costs of modernization, reconstruction, technical re-equipment and other changes of this kind (we will further use the word “modernization” to refer to them) increase the initial cost of fixed assets.

Unlike modernization expenses, expenses for repairs of fixed assets do not affect the value of property and are classified as other expenses in tax accounting (Clause 1, Article 260 of the Tax Code of the Russian Federation). In accounting, repair costs are included in the maintenance costs of the unit in which the fixed asset is operated.

From 2022, PBU 6/01 will no longer be in force. Instead, FSBU 6/2020 “Fixed Assets” should be used. The standard can be applied earlier by fixing the decision in the accounting policy of the enterprise.

An overview of changes to the new Federal Accounting Standards was prepared by ConsultantPlus experts. Study the material by getting trial access to the K+ system. It's free.

Repair planning

To determine which category of expenses to include (repair, reconstruction, modernization or additional equipment), first of all you need to find out what type of work needs to be done to restore fixed assets:

- if work is carried out to restore operability, maintain technical characteristics, or external changes that do not affect the change of the fixed asset object to its original functions, then this is a repair;

- if work is carried out to improve the basic characteristics and add new functions of a serviceable object, then this type of work should be classified as reconstruction, modernization or retrofitting.

In this case, you need to determine the purpose of the operation:

– if replacement of units or parts is necessary, this is modernization (reconstruction);

– if units and parts are added to the object - additional equipment (completion).

As a rule, in organizations, by order, those responsible for the operation of property are appointed (for example, the head of the laboratory is responsible for laboratory equipment, a metrologist is responsible for measuring instruments, etc.). Their responsibilities include, among other things, drawing up requests for repairs or modernization for the upcoming financial year.

The organization develops the application form independently.

Applications are approved by the head of the institution.

Based on applications, the economic department plans amounts by type of repair in the estimate of income and expenses. Each planned type of expense must be justified. This will make it possible to draw up a work plan, conclude agreements with suppliers for carrying out repair work, systematize the institution’s activities related to the maintenance and servicing of property, guarantee the continuity of the production process, and ensure the efficiency of the institution’s core activities.

Fragments of applications for the structural unit (laboratory for monitoring physical and chemical factors) are presented in the table.

Fragments of applications for repairs of fixed assets

| Object name | Application number | Cause | Planned events | Planned result |

| Automated workstation (computer included) | 2101542 | The image on the monitor is unclear and cannot be corrected by adjustments. | Diagnostics and repair, if necessary, by means of a third party | Restoring functionality |

| Automated workstation (computer included) | 2101543 | Installing a hard drive into the system unit | System unit repair, hard drive replacement | Restoring the system unit |

| Automated workstation (computer included) | 2101600 | System resources - the amount of RAM - are insufficient to use the Bank-Client program | Upgrading with additional RAM | Possibility to use the Bank-Client program |

| Autoclave AG-1000 horizontal | 2101752 | Automated control system for autoclave | Autoclave modernization | Ability to use sterilization mode, indexing (time, pressure, temperature) |

| Copy machine | 2101644 | The machine hums but does not pick up paper from the tray | Replacing a worn roller with a new one | Restoring functionality |

| Car VAZ-2107 (Lada) | 2101485 | Knocking sound when shifting to subsequent gears | Do-it-yourself repairs | Restoring functionality |

| Laboratory building | 2100378 | The roof is leaking | Partial roof replacement | Restoring performance characteristics |

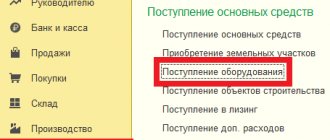

We conclude contracts for the performance of work on the restoration of fixed assets

When concluding contracts with suppliers and contractors for repair work, it is necessary to determine what type of work to restore fixed assets is provided for in this contract in order to correctly assign costs to KOSGU items.

If actions or events are planned that will increase the cost of fixed assets (reconstruction, modernization, etc.), you should use code 310 KOSGU “Increase in the cost of fixed assets”, but if you are talking about repairing a faulty fixed asset - code 225 KOSGU “Works, property maintenance services."

Within the framework of one contract, various types of work may be provided, therefore, in the “Subject of the contract” section, the costs of the corresponding types of work should be indicated separately. The contractor must prepare various reporting documents for the work performed.

Modernization of fixed assets - postings

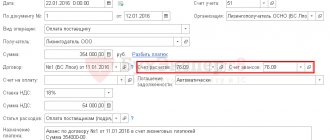

According to clause 42 of the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines), account 08 “Investments in non-current assets” is used to account for modernization costs.

Read about how to account for fixed assets worth less than 100 thousand rubles here.

Upon completion of the work, the costs are included in the cost of the fixed asset or are accounted for separately on account 01 “Fixed assets” in the subaccount “Modernization of fixed assets”.

OS modernization is reflected in postings as follows:

- Dt 08 Kt 10, 60, 69, 70, 76 - modernization costs are collected;

- Dt 01 Kt 08 - when modernizing a fixed asset, this posting indicates an increase in its original cost.

For organizations with a large number of assets, it is also important to pay attention to analytical accounting.

To break down existing investments in non-current assets by type, a separate sub-account “Modernization costs” is opened on account 08 for the OS being modernized. On account 01 it is convenient to create a separate sub-account, where only objects that are in the stage of modernization will be listed, for example, “Fixed assets for modernization”.

When transferring fixed assets for modernization, the posting for their internal movement will be as follows:

Dt 01 subaccount “Fixed assets for modernization” Kt 01 subaccount “Fixed assets in operation”.

Documenting

The decision to modernize fixed assets must be formalized by order of the head of the organization, which must indicate:

- reasons for modernization;

- timing of its implementation;

- persons responsible for modernization.

This is explained by the fact that all operations must be confirmed by primary documents (Article 9 of the Law of December 6, 2011 No. 402-FZ).

If an organization does not carry out the modernization of fixed assets using its own resources, it is necessary to conclude a contract agreement with the contractors (Article 702 of the Civil Code of the Russian Federation).

When transferring a fixed asset item to the contractor, issue an act of acceptance and transfer of the fixed asset item for modernization. It can be compiled in any form. If the fixed asset is lost (damaged) by the contractor, the signed act will allow the organization to demand compensation for losses caused (Articles 714 and 15 of the Civil Code of the Russian Federation). In the absence of such an act, it will be difficult to prove the transfer of fixed assets to the contractor.

When transferring a fixed asset for modernization to a special division of the organization (for example, a repair service), you should draw up an invoice for internal movement in form No. OS-2. If the location of the fixed asset does not change during modernization, no transfer documents need to be drawn up.

Upon completion of modernization, an act of acceptance and delivery of modernized fixed assets is drawn up, for example, in form No. OS-3. It is filled out regardless of whether the modernization was carried out economically or by contract. Only in the first case, the organization draws up the form in one copy, and in the second - in two (for itself and for contractors). The act is signed by:

- members of the acceptance committee created in the organization;

- employees responsible for the modernization of fixed assets (or representatives of the contractor);

- employees responsible for the safety of fixed assets after modernization.

After this, the act is approved by the head of the organization and it is transferred to the accountant.

If the contractor carried out the modernization of a building, structure or premises, which relates to construction and installation work, then in addition to the act, for example, in form No. OS-3, an acceptance certificate in form No. KS-2 and a certificate of the cost of work performed and costs in form No. KS-3, approved by Decree of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

Modernization of depreciated fixed assets

OSes that are already fully depreciated and have a residual value of zero are often upgraded. There is no specific guidance in the regulations on how modernization costs should be taken into account in such a case. So you should proceed similarly to the general principle:

- In accounting, increase the initial cost by the amount of modernization costs. The residual value will be equal to the amount of modernization costs.

- Review the JPI, estimating how much longer the facility will be used, taking into account the work performed.

- Calculate annual depreciation based on new data.

How to take into account the modernization of a fully depreciated operating system in tax accounting, read here .

Creating a reserve

I would like to highlight separately the issue with the reserve. At the very beginning, we discussed the definitions (which applies to the work discussed in the article), one thing can be said for sure - they have nothing to do with repairs. Its accounting is carried out in completely different ways for accounting and tax purposes.

Conclusion: the reserve created for repairs cannot be used for other purposes, including reconstruction or modernization. During an on-site inspection or upon request for documents, the Federal Tax Service, having discovered such transactions, will certainly force a recalculation and accrue depreciation, and will deduct the expenses reflected as repairs.

Note! If the use of reserves for purposes not provided for by law has led to an underestimation of the tax base, you will have to submit amended declarations and pay additional taxes and penalties. Both the organization and the manager will receive administrative fines for violations in tax and accounting records and incomplete payment of taxes.

You can use part of the net profit to carry out the specified work. In the postings to account 84, the reconstruction of the operating system is as follows (we focus on the recommendations of the Chart of Accounts and instructions for its use):

- D 84 “Net profit” K 84 “PE to be distributed” - we reflect the amount that we are going to use for work (usually the exact amount is unknown, the size of the estimate and design data is taken into account).

- D 84 “Private emergency subject to distribution” K 84 “Reconstruction of operating systems” - indicate the actual amount spent.

- D 84 “Reconstruction of OS” K 60 (76, 70, 26, 25, 69, 10) - various expenses for performing work at the expense of profit are reflected.

The accounting procedure must be fixed in the accounting policy, and the subaccounts to account 84 - in the working chart of accounts.

Tax accounting for modernization of fixed assets

According to paragraph 2 of Art. 257 of the Tax Code of the Russian Federation, modernization costs increase the initial cost of fixed assets, which continues to be repaid by depreciation.

Make sure you correctly distinguish between fixed asset repairs and upgrades for income tax purposes. Get trial access to K+ for free and proceed to expert explanations.

Example 2

On 04/05/2020, the organization modernized the machine. The cost of the work performed by the contractor was 130,000 rubles.

The useful life has not changed. The work lasted less than a year, depreciation was accrued all the time.

The initial cost of the object is 900,000 rubles. It belongs to the 3rd depreciation group. SPI - 5 years (60 months).

For tax accounting purposes, the monthly depreciation rate will be: 1 / 60 × 100% = 1.6666%.

Monthly depreciation amount: 900,000 × 1.6666% = RUB 15,000.

Initial cost of the modernized facility: 900,000 + 130,000 = 1,030,000 rubles.

In tax accounting, the amount of depreciation per month after modernization: 1,030,000 × 1.6666% = 17,167 rubles.

The Tax Code of the Russian Federation also provides for the possibility of increasing the useful life of an operating system if, after modernization, it can be used longer than the established period. According to paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, it is possible to increase the SPI within the depreciation group to which the fixed asset belongs. If the SPI is equal to the upper limit of the depreciation group, it cannot be increased after modernizing the fixed asset.

You will learn about other nuances of tax accounting of fixed assets from the article “Procedure for tax accounting of fixed assets.”

Calculation of the new depreciation rate

Depreciation is calculated almost continuously, with the exception of some cases:

- OS are preserved for a period of more than 3 months. This can also happen due to reconstruction. For example, during a large-scale reconstruction of a production building, in order not to interfere with work, or for safety reasons, the activities of part of the production or a separate workshop are suspended. Equipment is not used, vehicles are idle, etc. Management issues an order to send the OS for conservation, indicating the justification and planned period.

- The OS undergoes reconstruction (modernization) for more than 12 months. Moreover, if the object continues to be used, then the accruals do not stop. Example: a conveyor belt in a workshop is being modernized, but the production process is not suspended, the line is running.

For accounting purposes, the minimum initial cost of fixed assets is 40,000 rubles. Under normal conditions, it remains the same throughout use, but after drastic changes have been made, it must be adjusted, or rather, revised to correctly reflect depreciation.

To calculate the new depreciation rate after reconstruction (modernization), you need to recalculate the cost of the fixed assets. To do this, we use the formula: NS = OS + M (P) , where OS is the residual value (as of the last date before completion of the work), and M (P) is the costs incurred. It is reasonable to take as reference the first day of the month following the completion of work.

Then we calculate the monthly depreciation rate (MRA): MRA = NS/SPI. Moreover, a new service life is taken taking into account the past period.

Example No. 1: A machine worth 360,000 rubles, its initial TPI is 36 months (3 years). Depreciation charges – 10,000 per month. It has been used for a year, after which it was decided to carry out modernization for 100,000 rubles, it lasts 1 month, as a result, the service life increases in general from 3 to 5 years. Let's calculate the new norm: 360,000 - 10,000*13 = 230,000 - residual value at the time of changes. 230000 + 100000 = 330000 - the new cost of the OS. SPI from the moment of modernization - 47 months (initial 36 months minus 13 months of use plus 24 “added”). 330000/47= 7021.28.

This option refers to the straight-line method of accounting for depreciation. As a rule, it is used most often (clause 60 of Guidelines No. 91n).

Results

Important points when accounting for OS modernization are the separation of the concepts of “repair” and “modernization” and the organization of convenient analytical accounting. It is also necessary to take into account the differences in accounting and tax accounting for the modernization of fixed assets, which will require the accountant to take action to ensure the correct reflection of temporary differences.

Read more about all the nuances of fixed asset accounting in this article.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n

- Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Logging changes to OS characteristics

As a result of completion, the characteristics of the building (structure), which were originally indicated during its state registration, may change. For example, the total area of the building or number of floors. In this case, the new characteristics of the building (structure) must be registered in the state register (clause 67 of the Rules, approved by Decree of the Government of the Russian Federation of February 18, 1998 No. 219). In this case, the building (structure) is not re-registered, but only an entry is made in the register about changes in its characteristics.

To register changes, you need to submit to the territorial office of Rosreestr:

- application for amendments to the state register of rights to real estate and transactions with it;

- documents confirming changes in the relevant information previously entered into the state register of rights (for example, a certificate from the BTI);

- payment order for payment of state duty in the amount of 600 rubles. (Subclause 27, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

This is stated in paragraphs 4 and 5.1.1 of the Regulations approved by Decree of the Government of the Russian Federation dated June 1, 2009 No. 457, Section IX of the Methodological Instructions approved by Order of the Ministry of Justice of Russia dated July 1, 2002 No. 184.

Costs for completion (retrofitting) of fixed assets change (increase) their initial cost in accounting (clause 14 of PBU 6/01).