Accounting for tax amounts is necessary to monitor the fulfillment of the enterprise’s obligations to pay taxes to the budget. Account 68 is used to reflect tax transactions.

In the article we will talk about the accounting rules for account 68, and also look at typical entries in tables and examples of transactions with VAT, as one of the most difficult taxes to account for.

Account 68 in accounting

Account 68 is credited for amounts according to tax returns or calculations in correspondence:

- Account 99 - for the amount of accrued income tax;

- Invoice 70 - for the amount of personal income tax;

- Accounts 20, 25, 26, 44 - for the amount of local taxes, transport tax, property tax, etc.;

- Accounts 90.3, 91.2, 76.AV - when calculating VAT for the reporting quarter;

- Invoice 51 - upon receipt of overpaid tax from the budget.

The debit of the account records the amounts of taxes actually transferred to the budget, including the amounts of VAT written off from account 19.

Postings for personal income tax

Personal income tax is one of the main taxes withheld from individuals, the rate of which for the average working citizen is 13%. It is necessary to calculate the amount due to the state from the employee’s income only after deducting benefits, if any, should be applied. To collect information about personal income tax amounts from enterprise employees, accounting account 68.01 is used.

The entry describing the calculation of tax is drawn up as follows: Dt 70 Kt 68.01 for the amount of personal income tax. When transferring a payment to the budget, account 68.01 is debited: Dt 68.01 Kt 51.

Subaccounts 68 “Calculations for taxes and fees”

Subaccounts under account 68 are used for taxes and fees paid by the company, depending on its chosen field of activity and tax regime. In this case, a separate sub-account is opened for each type of tax:

Additional sub-accounts can also be opened under account 68:

- 68.11 - UTII;

- 68.12 – simplified tax system;

- 68.13 – Trade fee.

Count 68 active or passive

Account 68 is used to summarize data on payments of an enterprise/individual entrepreneur to the state budget for taxes and mandatory fees.

Accrued and payable amounts of taxes are reflected in the credit of the account, and the amounts of transfers to the budget are reflected in the debit. Based on this, the question arises: is account 68 active or passive? Since it can have both a credit and a debit balance at the end of the reporting period, the account is active-passive. Let us further understand in detail what the turnover on the debit and credit of the account shows and what conclusion can be drawn about the final balance that is formed at the end/beginning of the reporting period.

Business operations in account 68 are reflected in the context of emerging tax obligations. Accounting for compulsory insurance premiums, which are paid to the state budget and controlled by the tax authorities, is made on account 69.

Typical wiring

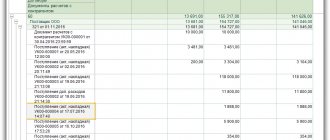

The main transactions for this account are presented in the table:

| Account Dt | Kt account | Wiring Description | A document base |

| 68 | 19 | Amounts of taxes actually transferred to the budget + VAT | Payment order |

| 68 | 50/51,52,55 | Payment of tax debts in cash or through a bank | Payment order |

| 70/75 | 68 | Personal income tax withheld from the income of employees or founders | Payslip |

| Based on settlement amounts for contributions to budgets | |||

| 99 | 68 | Income tax is reflected | Help-calculation |

| 70 | 68 | We reflect the amount of accrued personal income tax | Payslip |

| 90 | 68 | We reflect VAT, excise taxes, indirect taxes | Accounting information |

| 91 | 68 | We reflect financial results (operating expenses) | Certificate of calculation/Acceptance and transfer certificate |

Example 1. Postings to subaccount 68.01 “NDFL”

Let’s say that at the end of the month, at Osen LLC, an accountant assessed personal income tax on employee salaries in the amount of 107,256 rubles. Dividends were also paid to the founders, the tax amount was 65,123 rubles.

Postings for calculating personal income tax on account 68:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 70 | 68.01 | 107 256 | Personal income tax accrued on salary | Payslip |

| 75.02 | 68.01 | 65 123 | Personal income tax accrued on dividends | Tax card for personal income tax, accounting certificate |

| 68.01 | 51 | 107 256 | Personal income tax on wages transferred to the budget | Payment order |

| 68.01 | 51 | 65 123 | Personal income tax on dividends transferred to the budget | Payment order |

Example 2. Postings to subaccount 68.02 “VAT”

At Leto LLC based on the results of the 2nd quarter (core activities):

- VAT was charged in the amount of RUB 78,958;

- VAT accepted for deduction (advance) in the previous quarter in the amount of RUB 36,695 was restored;

- VAT on the sale of fixed assets amounted to RUB 7,959.

The accountant of Leto LLC reflected the accrual of VAT with the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 90.03 | 68.02 | 78 958 | VAT charged (sales) | Accounting information |

| 76 advance | 68.02 | 36 695 | VAT restored | Sales book |

| 91.02 | 68.02 | 7 959 | VAT charged (VAT) | Certificate of acceptance and transfer |

| 68.02 | 51 | 123 612 | The tax is transferred to the budget | Payment order |

Reflection of VAT amounts

68.02 an accounting account is created to account for VAT on the basis of issued and accepted invoices. Let's consider a situation: for example, an enterprise purchased materials from a supplier for a certain amount. The seller sent an invoice. What entries does the buyer make in account 68 in accounting? Postings are carried out in two stages:

- Dt 19 Kt 60 – “incoming” VAT is recorded.

- Dt 68.02 Kt 19 – the amount is written off to offset VAT payments.

If a company sells products, it becomes necessary to issue an invoice within a certain period. The operation is recorded in accounting account 68.2 with the entry: Dt 90.3 Kt 68.02.

It turns out that in the course of economic activity, the enterprise accumulates VAT for deduction in the debit of subaccount 68.02, and in the credit for payment. In total, the organization actually pays the difference between the VAT amounts issued and accepted. It should be noted that all transactions for this tax are carried out only with an invoice.

Subaccounts and analytics

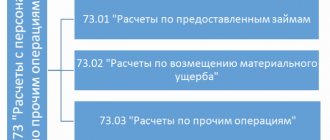

Subaccounts to account 67 are divided according to the method of calculation into the following types:

In addition, subaccounts are differentiated based on the definition of a specific tax or fee:

- 68.1 — personal income tax for all employees of the organization;

- 68.2 - accrued VAT;

- 68.3 - excise taxes;

- 68.4 - income tax and settlements with the budget;

- 68.6 - land tax;

- 68.7 - transport tax;

- 68.8 - tax on property of an organization;

- 68.9 - advertising tax;

- 68.10 - other taxes and fees;

- 68.11 - tax on imputed income.

An enterprise has the right to use only those subaccounts that correspond to the nature of its activities. Most Russian companies conduct their tax activities using account 68, using only the first and second subaccounts.

Analytical accounting for account 68 is carried out for each subaccount separately. This is due to the inevitable difference in balance for each of them. Debit balances are included in its assets, and credit balances are included in liabilities, which is important to correctly reflect in the tax return and other reporting.

Key VAT transactions

When interacting with counterparties, for example, during the shipment of goods or the purchase of services, companies are faced with VAT calculations. In this case, accountants identify the following as basic operations for this payment:

- calculation of the amount of the designated type of obligatory payment;

- maintaining records of entry fees;

- deductions;

- adjustment of the amount of obligations for this type of payment;

- reimbursement of paid amounts from the state budget;

- transfer of funds as part of settlements for the designated payment to the treasury.

Posting examples

An example of wiring can be given:

At the end of 2021, it sold spare parts for domestic cars in the amount of 637 thousand 200 rubles. This amount includes VAT 18%, which is 97,200 rubles. The company sold equipment in the amount of 33 thousand, paid wages in the amount of 146,000, from which personal income tax was deducted in the amount of 16,796 rubles. For November 2021, the accountant transferred personal income tax for employees in the amount of 14,575 rubles to the budget. At the end of the period, a profit of 13,600 was revealed.

Final operations in tax accounting and balance sheet reformation

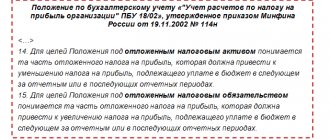

Reformation of the balance sheet is the final operation of accounting and tax accounting for the current year. In 1C programs this procedure is automated. However, to reveal its essence, it is necessary to familiarize yourself with the procedure for reflecting information on the formation of financial results and calculations of income tax using PBU 18/02 during the reporting year. Consultants cover these issues.

First, let's remember what transactions were reflected in accounting and reporting when making income tax calculations. When reflecting in accounting and financial statements calculations of income tax based on the results of the first quarter, half a year, nine months, year, the organization carries out actions recorded by the following changes in accounts (the digital code and names of accounts are given in accordance with the standard setting of the Chart of Accounts in the programs " 1C"):

Debit 90.9 “Profit/loss from sales” Credit 99.1 “Profits and losses” - financial result of the current period (profit received); Debit 91.9 “Balance of other income and expenses” Credit 99.1 “Profits and losses” - financial result of the current period (loss received); Debit 99.1 “Profits and losses” Credit 90.9 “Profit/loss from sales” Debit 99.1 “Profits and losses” Credit 91.9 “Balance of other income and expenses” - monthly advance payments for income tax; Debit 68.4.1 “Calculations with the budget” Credit 51 “Current account” - conditional income tax expense calculated according to accounting data (profit received); Debit 99.2.1 “Conditional income tax expense” Credit 68.4.2 “Calculation of income tax” - conditional income for income tax, calculated according to accounting data (loss received); Debit 68.4.2 “Calculation of income tax” Credit 99.2.2 “Conditional income for income tax” - permanent tax assets based on transactions made during the reporting period with positive permanent differences; Debit 99.2.3 “Permanent tax assets and liabilities” Credit 68.4.2 “Calculation of income tax” - permanent tax liabilities based on transactions made during the reporting period with negative permanent differences; Debit 68.4.2 “Calculation of income tax” Credit 99.2.3 “Permanent tax assets and liabilities” - deferred tax assets based on transactions made during the reporting period with deductible temporary differences when accrued; Debit 09 “Deferred tax assets” Credit 68.4.2 “Calculation of income tax” - upon repayment; Debit 68.4.2 “Calculation of income tax” Credit 09 “Deferred tax assets” - when written off; Debit 99.1 “Profits and losses” Credit 09 “Deferred tax assets” - deferred tax liabilities based on transactions made during the reporting period, with taxable temporary differences when accrued; Debit 68.4.2 “Calculation of income tax” Credit 77 “Deferred tax liabilities” - upon repayment; Debit 77 “Deferred tax liabilities” Credit 68.4.2 “Calculation of income tax” - when written off; Debit 77 “Deferred tax liabilities” Credit 99.1 “Profits and losses”.

Deferred tax assets and liabilities are written off upon disposal of the assets (liabilities) with which they were associated.

When moving from one reporting period to another, the amounts of the above indicators change. And for each reporting period, their value is either accrued anew (the amount accrued based on the results of the previous period is reversed in full), or adjusted by additional accrual or reversal of a part of the amount, determined as the difference between the values of the indicators accrued based on the results of the reporting and previous periods. As a result of adjusting the conditional income tax expense (income) by reflecting permanent and deferred tax assets and liabilities in the balance sheet, the credit balance of account 68.4.2 “Calculation of income tax” acquires a value equal to the amount of tax calculated from the actual profit of the reporting period , formed in tax accounting registers. This amount is determined in the income tax return and serves as the basis for calculating advance income tax payments transferred to the budget. Thus, the annual indicators of current income tax, deferred tax assets and liabilities are formed in stages (on an accrual basis from the beginning of the year).

As of December 31, the accounting records will include:

A) On the balance sheet

- on line 145 - the balance of deferred tax assets.

Account debit 09

- on line 240 - the composition of short-term receivables will also include an overpayment to the budget for income tax;

- on line 470 - the financial result obtained by calculation for the period from the beginning of the year will be included in retained earnings;

- on line 515 - the balance of deferred tax liabilities.

Account credit 77

- on line 624 - the debt on taxes and fees will be included, including the debt to the budget for income tax.

B) In the income statement

- on line 140 - profit (loss) before tax, total;

- on line 141 - deferred tax assets;

- on line 142 - deferred tax liabilities;

- on line 150 - current income tax;

- on additional line 151 - written off deferred tax assets and liabilities that change the net profit indicator;

- on line 190 - the amount of the financial result on an accrual basis from the beginning of the reporting year, obtained by calculation (net profit, loss);

- line 200 for reference - permanent tax assets and liabilities.

The state of settlements with the budget at the end of the reporting year is determined as the balance in account 68.4 “Income Tax”. Moreover, in the debit of account 68.4.1 “Settlements with the budget” and the credit of account 68.4.2 “Calculation of income tax” in accounting during the reporting year, the amounts transferred to the budget and accrued income tax are separately accumulated.

Balance sheet reformation occurs in 1C programs when posting the “Month Closing” document dated December 31. In this document, you must check the confirmation box in the “balance sheet reform” position.

To generate operations for closing the month of December, and, consequently, the current year, you must perform the following steps sequentially.

1. Post the document (menu “Documents”) “Month Closing” dated December 31 of the reporting year, checking all the boxes except the last four (Fig. 1).

Rice. 1. Closing the month

At this stage, the financial result of the reporting year (profit or loss) is determined, written off from the debit (credit) of accounts 90.9 and 91.9 to the credit (debit) of account 99.1 “Profits and losses”.

2. Post the document (menu “Tax Accounting”) “Routine Operations for Tax Accounting” dated December 31 of the reporting year with all the boxes checked except the last one (Fig. 2).

Rice. 2. Closing the month for tax accounts

After carrying out this document, permanent and temporary differences can be identified between the tax base for income tax and the accounting financial result.

3. Post another document “Month Closing” dated December 31 of the reporting year, checking the boxes only in the positions corresponding to operations according to PBU 18/02 (Fig. 3).

Rice. 3. Closing the month (application of PBU 18/02)

When applying PBU 18/02, deferred and permanent tax assets and liabilities are recognized, repaid and written off, due to which the current income tax formed on the credit of subaccount 68.4.2 acquires a value equal to that calculated in the Income Tax Declaration, that is, in tax accounting .

The above sequence of actions corresponds to a monthly month-end closing operation during the reporting year.

Next, we move directly to the process of reforming the balance sheet and closing the current tax period.

4. Post another “Month Closing” document dated December 31 of the reporting year, checking only one checkbox for the “Balance Sheet Reformation” operation (Fig. 4).

Rice. 4. Balance reform

5. Carry out the second document “Routine operations for tax accounting” dated December 31 of the reporting year, also checking only one box for the operation “Closing tax accounting accounts” (Fig. 5).

Rice. 5. Closing tax accounts

Currently, some experts also include the closing of income tax accounts 68.4.1 “Calculation with the budget” and 68.4.2 “Calculation of income tax” in the process of balance sheet reformation. This operation is carried out manually. To do this, you need to post the document “Accounting certificate” (menu Journals, General documents).

Thus, we entered the last transaction into the journal of business transactions for the reporting year. The balance has been reformed. Tax accounts are closed. Accounting for profits and losses and income taxes will begin in the new year from the beginning, “from scratch.”

Now let’s look at what transactions will be generated by 1C: Accounting automatically when posting the above documents.

1. The amounts of advance payments for income tax made during the year are counted against the payment of current income tax:

Debit 68.4.2 “Calculation of income tax” Credit 68.4.1 “Calculations with the budget.”

According to the recommendations of a number of experts, when reforming the balance sheet, it is also advisable to write off balances from subaccounts 68.4.1 and 68.4.2.

Depending on the decision made by the organization to close the sub-accounts noted above, the following actions can be performed.

2. The amount of overpayment of income tax can be transferred from the debit of subaccount 68.4.1 to a specially created subaccount of account 68 “overpayment of income tax for previous periods” or included in deferred tax assets:

Debit 09 “Deferred tax assets” (overpayment of tax) Credit 68.4.1 “Calculations with the budget.”

3. The resulting income tax debt is transferred from the credit of account 68.4.2 to the credit of a specially created subaccount of account 68 “Debt to the budget for income tax.”

4. The balance on the subaccounts of account 90 is written off from the credit (debit) of subaccounts 1 to 8 to the credit (debit) of account 90.9 “Profit, loss from sales.”

5. The balance on the subaccounts of account 91 is written off from the credit (debit) of accounts 91.1 “Other income” and 91.2 “Other expenses” to the debit (credit) of account 91.9 “Balance of other income and expenses”.

6. The balance of the subaccounts of account 99 “Profits and losses” is written off from the credit (debit) of accounts 99.2.1 “Conditional income tax expense”, 99.2.2 “Conditional income tax income”, 99.2.3 “Fixed tax assets” and liabilities" to the debit (credit) of subaccount 99.1 "Profits and losses".

How these transactions are reflected in the program, see Figure 6.

Rice. 6. Posting the balance sheet reformation.

7. The balance formed on account 99.1 “Profits and losses”, namely the net profit (loss) of the reporting year, is transferred to account 84 “Retained earnings (uncovered loss)”:

Debit 99.1 Credit 84 - profit made; Debit 84 Credit 99.1 - loss received.

As a result, at the beginning of the new reporting year, subaccounts 68.4.1, 68.4.2, as well as accounts 90, 91, 99 do not have a balance.

At the end of the tax period, the 1C program also closes tax accounts - analogues of accounting accounts in tax accounting.

If an organization receives a loss, then a special procedure for accounting for it, defined by the Tax Code of the Russian Federation, comes into force.

As a general rule, losses are carried forward to the future. That is, the tax base of the current period will not be reduced by the amount of this loss, it will reduce the tax base over the next ten years. And according to the rules of PBU 18/02, a future decrease in the tax base for profit tax and, accordingly, the profit tax itself leads to the formation of a tax asset of the organization (clauses 11, 14 of PBU 18/02).

Let's look at the example of tax accounting for losses.

The procedure for maintaining records for 68 positions

All business entities, regardless of their form of ownership, must fulfill their obligations in a timely manner and in full, paying taxes and fees to the state budget.

Before we discuss the operating procedure of account 68, it should be said that taxes mean funds, the amount of which is determined at the legislative level and which must be paid to the state. These mandatory payments are required to be made by both legal entities and individuals. Such duties may be paid to the budgets of the federal, regional and local levels.

In the first case we are talking about income tax, excise tax and VAT.

By nature, the designated position is active-passive, and therefore, at the end of the reporting period, both a debit and a credit balance may form on this account.

The debit side reflects the amounts of funds allocated to repay the debt. In the credit part, you can see the volume of formed VAT obligations in accordance with the issued invoices.

Analytics on the account is carried out in the context of each type of mandatory payment.

Practical case

Let's imagine that a certain company purchased goods, the total cost of which was 49,300.0 rubles, including VAT in the amount of 8,874.0 rubles. During the reporting period, products were produced for sale for a total amount of 89,700.0 rubles, including a collection amount of 16,146.0 rubles. The company must transfer the tax, the amount of which amounted to 7,272.0 rubles, to the state treasury.

1) Dt 26

Kt 60 – RUB 40,426.0, receipt of goods from the supplier;

2) Dt 19

Kt 60 – RUB 8,874.0, accounting for the designated fee;

3) Dt 62

Kt 90 – RUB 89,700.0, accounting for products sold;

4) Dt 90

Kt 26 – 73,554.0 rubles, cost of goods sold;

5) Dt 90

Kt 68.2 – 16,146.0 rubles, accounting for VAT on products sold;

6) Dt 68.2

Kt 19 – RUB 7,272.0, accounting for the amount of tax payable.

How to close a 68.12 account?

We paid a single tax on 1C.

How can I close my 68.12 account now?

According to the code, it cannot be written off as expenses or should it be left as is?

Thanks everyone for the answers.

Sincerely, Vladimir Meleshenko.

Calculate the tax on UTII using accounting entries Dt 99 - Kt 68.12, and the account will be closed.

Calculate tax according to the simplified tax system using accounting entries Dt 99 - Kt 68.12, and the account will be closed.

Reading the topic:

Events

1C free 1C-Reporting 1C:ERP Enterprise management 1C:Free 1C:Accounting 8 1C:Accounting 8 CORP 1C:Accounting of an autonomous institution 1C:Accounting of a state institution 1C:Municipal budget 1C:Settlement budget 1C:Clothing allowance 1C:Money 1 C: Document flow 1C: Salaries and personnel of a budgetary institution 1C: Salaries and personnel of a government institution 1C: Salaries and personnel management 1C: Salaries and personnel management CORP 1C: Integrated automation 8 1C: Lecture hall 1C: Enterprise 1C: Enterprise 7.7 1C: Enterprise 8 1C: Retail 1C: Management of our company 1C: Management of a manufacturing enterprise 1C: Trade management 1 Enterprise 8

When using materials, an active direct hyperlink of the form SOURCE: BUKH.1S is required.

The editors of BUKH.1S are not responsible for the opinions and information published in the comments to the materials.

The editors respect the opinions of the authors, but do not always share them.

Description of the account “Tax under the simplified taxation system”

When carrying out transactions with counterparties (shipment of goods, purchase of services, etc.), organizations are faced with the need to carry out VAT calculations. The main VAT transactions include:

- calculation of VAT amount;

- accounting for “input” VAT;

- acceptance of tax for deduction;

- adjustment of the VAT amount (including its restoration);

- reimbursement of VAT from the budget;

- transfer of VAT amount to the budget.

Standard charts of accounts and subaccounts are used in all enterprises. With the help of these plans, accountants make entries and take into account the organization's fixed and working capital. Based on accounting, taxes are paid to the budget. Standard chart of accounts for accounting, accounting.

Most transactions with VAT are carried out in connection with the purchase from a supplier (contractor) of goods (works, services), the cost of which includes VAT.

If an organization is a payer of the single tax on imputed income (UTI) for certain types of activities, then a subaccount 68.11 is opened to reflect calculations for UTII.

Reflection of debit and credit on account 68

The debit of account 68 shows the amount of taxes that were actually transferred to the budget. This also includes VAT amounts that are debited from account 19.

The credit displays accrued amounts that must be transferred to the budget. All data must strictly coincide with the results of the reports submitted to the tax office.

Account credit means all amounts contributed to the budget on the basis of reports, declarations and other calculations. These include:

- profit and loss D99;

- settlements with the founders - D75;

- sales - D90;

- settlements with personnel regarding wages - D70.

Debit to account 68 includes:

- all amounts from the value added tax account for VAT;

- funds actually contributed to the budget from the current account.

To account for all amounts, entries are made: D68 K51 and D68 K19.

Display of credit and debit

The balance sheet for account 68 is used for calculations based on the results of the periods. To generate income tax amounts for the budget, subaccount 68.04.01 is used. It is important to take into account that income tax is calculated on an accrual basis. When forming it, all advance payments for the reporting periods are taken into account. This includes:

In accordance with the chosen tax regime, an organization can independently open the necessary sub-accounts according to the types of required fees.

Account 68 postings are classified into two groups:

The following types of debit are distinguished:

- D68 K50 - the amount of fees that were taken in cash at the organization's cash desk;

- D68 K51 - the amount of funds transferred to the budget from the company’s current accounts;

- D68 K19 - value added tax, which is allocated on purchased goods, valuables, materials, aimed at reimbursement from budget funds.

Typical wiring

The loan includes:

- D70 K68.1 - a reflection of the amount of personal income tax that is withheld from the wages of the company’s employees. This amount must be paid to the budget;

- D90.3 K68.2 - the amount of funds, which reflects the amount of VAT on products sold or services performed;

- D99 K68.12 - reflects information on payment of the simplified tax system;

- D99 K68.11 - generates all accruals for UTII;

- D26 K68.8 - an accounting tool for generating amounts for payment to the budget for property;

- D90 K68.3 - display of excise taxes received by the company from the sale of excisable products;

- D99 K68.4 - the amount of income tax that is transferred to the Federal Tax Service;

Note! To reflect the amount of transport fees to be transferred to the budget, K68.7 D20.26 is used.