Fixed assets (FPE) may be written off over time for various reasons. OSes can simply become unusable, they can be sold or even donated. How to process various asset disposal transactions in accounting, see below.

First of all, any disposal of fixed assets must be documented and all details of the operation must be indicated in the documents.

When the asset is worn out, a write-off act is drawn up, which is signed by members of a specially created commission.

To register the disposal of fixed assets, there are unified forms of acts. The main form is OS-4, it is suitable for the vast majority of OS. If you need to write off a car, use act OS-4a. For group write-off of fixed assets, form OS-4b is used.

All about the write-off procedure

Reasons, restrictions, sample orders and forms of acts.

Download for free here. Article navigation

- How to write off fixed assets from the balance sheet

- Features of write-offs in budget structures

- General logic of actions

- Accountant's actions

- Write-off order

- Reasons for write-off

- Act on write-off of fixed assets

- Tables of the write-off act form

- Protocol for write-off of fixed assets

All fixed assets sooner or later become unusable. Machines, equipment, and even the capital buildings themselves are deteriorating and can no longer be used for their intended purpose. Ultimately, the fate of these non-current funds is to be written off the balance sheet. How to do this correctly will be discussed in this article.

What do you need to know? ↑

Before considering this topic, let’s define what fixed assets are. Without a clear understanding of such information, it will not be possible to comply with all regulatory documents on the accounting of objects.

Required terms

Fixed assets are part of the property that is used as a means of labor in production, in the provision of services, and in managing a company for a year or more.

The natural form of such objects is preserved. Taking into account the degree of wear and tear, the cost of the asset will decrease and be transferred to the cost price using depreciation.

The price of a fixed asset minus depreciation accumulation is considered to be a net fixed asset. This is the residual value. Assets must be reflected correctly in accounting.

Why is this necessary?

Accounting tasks for such objects:

- control the availability of fixed assets and their safety from the time the property is acquired until the moment it is disposed of;

- calculate depreciation correctly and in a timely manner;

- receive information to make correct calculations of property taxes that are paid to the state treasury;

- control whether funds for repairs are used correctly and effectively;

- monitor the effectiveness of the OS application over a set period of time;

- receive information to prepare reports on the presence and movement of objects.

Legal basis

The rules for the disposal of fixed assets are discussed in paragraphs 75-85 of the Guidelines for the accounting of fixed assets (Order No. 91n dated October 13, 2003).

The procedure for accounting for fixed assets is discussed in PBU 6/01.

How to write off fixed assets from the balance sheet

Fixed assets include expensive means of production that last more than a year. They are written off from the balance sheet of the enterprise for the following possible reasons:

- The funds are outdated (physically or morally), that is, they have served their service life;

- They were sold to a third party;

- They were exchanged for something useful, for which a barter agreement was concluded;

- Given as a gift to a legal entity or individual;

- Equipment or other property is hopelessly damaged as a result of an accident;

- It wore out prematurely;

- It was stolen (more often accountants and lawyers use the word “stolen”, however, this does not change the essence).

In each of the listed situations, documentation is required, which includes recording the reasons on paper and reflecting the relevant business transactions in the financial statements.

According to paragraph 28 of the Accounting Rules (PBU 6/01), fixed assets are subject to write-off, the use of which cannot bring financial benefit to the enterprise.

Features of write-offs in budget structures

In budgetary institutions, the procedure for writing off obsolete, destroyed or stolen non-current assets is somewhat different from the norms in force for commercial structures. This is due to the fact that the owner of fixed assets in this case is the state, and therefore in many cases permission from a higher authority is required for the right to dispose of particularly valuable property on the balance sheet (the list of items is given in Law No. 7-FZ, Article 9.2, paragraph 11) . There are objects that the heads of budgetary organizations can write off themselves, if they are not included in the authorized capital of other companies. The general principle of withdrawal from the balance, however, remains the same.

Property disposal rules

Legislators have defined key rules for the disposal of property assets of government agencies. The scope of rights depends on the type of organization:

- government institutions are completely deprived of the right to dispose of any property without appropriate permission from the owner (founder, superior manager, body exercising the functions and powers of the founder);

- a budgetary and (or) autonomous institution does not have the right to dispose of real estate, as well as especially valuable property acquired at the expense of budgetary funds or assigned to the organization by order of the owner.

Budgetary organizations have the right to independently dispose only of movable property acquired at their own expense. An autonomous organization, in addition to movable fixed assets purchased through entrepreneurial activity, can also dispose of real estate acquired through its own assets.

State officials do not have such a right, since all funds received from entrepreneurial and other income-generating activities must be directed to the state budget.

General logic of actions

In a situation where the write-off of deteriorated property on the balance sheet becomes an urgent task, the issue of execution is decided by the head of the enterprise, who issues an order to create a liquidation commission.

In turn, the commission, fulfilling this order, draws up an act. There is a story ahead about how these processes should take place, but it should be understood that they are the ones that give the accounting department the basis for making entries. Everything else is a matter of technique.

The chart of accounts has not changed in 2021, and there is reason to assume that it will remain unchanged in the near future. The commission's conclusion consists of stating the actual condition of the property, assessing the feasibility of its further use and the validity of liquidation. In some cases (when it is difficult or impossible to come to some conclusions on your own), outside experts are invited.

Write-off of fixed assets is carried out in accordance with the form established for each specific case, approved by the Ministry of Finance. If you have difficulty filling out the forms, you can use a sample.

Accountant's actions

Depending on the reason why the property needs to be removed from the balance sheet, the correspondent accounts involved in this operation change. The most common types of postings are discussed below.

The property is partially or completely worn out

The simplest case is when an object “died a natural death,” that is, it completely exhausted its service life, and after that it safely failed. In this case, it has no value in monetary terms, since it is completely depreciated. After the act is drawn up and signed by the members of the commission, and then endorsed by the head, the accounting department can deregister the asset without disturbing the balance, making an entry between subaccount 01.1 (at original cost) and 01.2 (the amount of full depreciation).

With premature moral or physical wear and tear, the task becomes more difficult. On the balance sheet asset is the full amount of the initial costs for the acquisition of the object (subaccount 01.1), on the other hand, depreciation is accrued incompletely, that is, an object with a residual value is subject to write-off, which is very simple to determine (you need to subtract the amount of depreciation from the initial cost). The wiring will look like this:

On loan account 01–1, the full value of the liquidated asset is written off to debit 01.2. Then depreciation is written off from the account. 02. Then follows the posting of depreciation amounts (Dt 02 - Kt 01.1). As a result, account 01.2 receives the residual value of the property (the difference between the debit and credit of account 01.2). The “under-depreciated” part is accounted for as expenses and written off on account 91.2 (Dt 91.2 – Kt 01.2). The account is closed.

Asset sold

The basis for write-off are two documents - the act of the liquidation commission and the purchase and sale agreement. The wiring is as follows:

- Dt01 – Kt01.1 – the initial cost of the property is entered;

- Dt02 – Kt01 “Disposal” – for the amount of depreciation;

- Dt91.2 – Kt01 – for the residual value of the object of sale;

- Dt62 – Kt91.1 – revenue (amount of agreement);

- Dt91.2 – Kt68.2 – VAT is charged.

The property was transferred to the authorized capital of another company (share contribution)

Property that is of no value to one owner may be useful to another. If the written-off asset acquires the quality of a share contribution, the accounting department uses account 58. Postings:

- Dt01 – Kt01.1 – at the original cost;

- Dt02 – Kt01 – for accumulated depreciation;

- Dt91.2 – Kt01 – for residual value;

- Dt58 – Kt01 – the amount of contribution to the authorized capital of the enterprise receiving the asset.

VAT is not charged, since the share contribution is not a sale.

The object is transferred free of charge (donated)

Yes, this can happen, but it is important that behind the act of gratuitous assistance there is not a hidden sale (for cash), which is a violation of the law. The write-off procedure is approximately the same as for sale or depreciation (VAT is calculated based on the market price of the asset), with the difference that the posting of Dt99 - Kt91.9 is carried out for the amount of the financial result (actually the sacrificed loss).

Partial liquidation

Most often this situation arises in relation to real estate. Anything else is difficult to write off completely, but some of the buildings, for example, inside a plant, can actually be demolished. At the same time, the main part of the workshops remains and functions, but the total value of assets and the amount of their depreciation charges are reduced. Transactions are reflected in account 91.

Low value assets

Not all fixed assets should be reflected on the balance sheet accounts of the institution. The accounting regulations of public sector institutions provide special rules for maintaining records of low-value assets. These include fixed assets worth up to 100,000 rubles.

The category of low-value assets is divided into two groups:

- fixed assets, the cost of which is no more than 10,000 rubles per unit;

- fixed assets, the price of which ranges from 10,000 to 100,000 rubles per unit.

Depending on the value of the asset, the standard for reflection in accounting is determined. If the price of a low-value basic non-fiscal asset is below 10,000 rubles inclusive, then it cannot be taken into account on the balance sheet account 0 101 00 000 of accounting and budget accounting. Such fixed assets are subject to simultaneous write-off to the off-balance sheet, where they must be accounted for in a special off-balance sheet account 21 “Fixed assets in operation.”

Reflect the disposal of low-value fixed assets worth up to 10,000 rubles inclusive by the appropriate decision of the special commission. Write off assets based on the primary document (write-off act) at the cost at which they were accepted for off-balance sheet accounting.

Fixed assets worth up to 100,000 rubles, but more than 10,000, are accounted for on the balance sheet account 0 101 00 000. But their initial cost is immediately written off to depreciation charges. In simple words, the initial price of fixed assets in the amount of 100% is written off for depreciation - accounting account 0 104 00 000.

IMPORTANT!

Even 100% depreciation for a specific fixed asset does not provide grounds for its removal from accounting. Therefore, it is impossible to write off fixed assets worth from 10,000 to 100,000 rubles from the balance sheet.

Such an asset can be removed from the balance sheet only for certain reasons: moral and (or) physical wear and tear, liquidation, loss or damage, impossibility of restoration, irrationality and inexpediency of modernization. Or if the property is decided to be leased or rented (reflected on the recipient’s balance sheet), sold, donated or transferred free of charge.

Write-off order

The procedure for writing off fixed assets does not provide for an order as such. The management, by issuing such a document, expresses its intention to liquidate any expensive object “hanging” on the balance sheet, and at the same time appoints executors, which probably constitutes the most important part of the text of such an order. The basis for the actions of the accounting department is not an order, but an agreement (if we are talking about exchange, donation, sale or any other method of alienation) or an act on the complete unsuitability of the object for use.

However, many companies have a practice according to which the initiation of write-off is expressed by order. There is no strictly approved form (unlike an act), but an approximate example may look like this:

Sample order

The document briefly justifies the decision to liquidate the named facility, most often due to the economic inexpediency of further operation and (or) repairs, as well as:

- A commission is appointed, which, as a rule, includes one of the managers of the enterprise (deputy director, chief engineer), the head of the department for whose needs the asset was used, a representative of the accounting department (usually the chief accountant), etc.;

- The goal is formulated;

- A commission chairman is appointed who is responsible for its work.

The order is signed by all the persons mentioned in it, for which their surnames with “shelves” are printed at the bottom of the sheet.

Reasons for write-off

The process of writing off fixed assets at any enterprise is inevitable. Not only does equipment naturally age, new types appear, but accidents and natural disasters occur, as a result of which property, movable and immovable, becomes unusable. Numerous examples of funds failing prematurely and unexpectedly could take up more than one page of neat text. There are often cases when cars, which are still completely new, are damaged in an accident to such an extent that there is nothing to repair, and it’s good if people do not suffer. Due to voltage surges or other disturbances in normal operating conditions, electronic and electrical equipment deteriorates. There is also such a thing as obsolescence, which often happens suddenly, when equipment that has not yet been physically worn out turns out to be unnecessary or intended for the production of a product that is no longer in demand.

The most common and expedient reason for writing off fixed assets is the impossibility of their further commercial use, and the costs of restoration are unreasonably high.

In recent years, new terms have emerged to describe previously unaccounted for reasons for early withdrawal of equipment:

Environmental aging. It means non-compliance with new environmental requirements adopted at the legislative level. If, for example, an enterprise's treatment facilities do not meet established standards, they should be replaced and the old ones written off along with dismantling costs;

Social wear and tear. In this case, the reason for write-off may be the adoption of legislative acts that reflect more stringent requirements for industrial relations, and, as a result, fixed assets.

Nuances of calculating property tax on fixed assets with 100% depreciation

To calculate property tax, the residual value of property is included in the tax base (Article 375 of the Tax Code of the Russian Federation).

In this case, it is equal to 0, i.e. there will be no tax to pay. But before depreciation of fixed assets is written off, the organization must include information about them in the declaration or tax calculation of advance payments for property tax (letter of the Federal Tax Service of Russia dated December 8, 2010 No. 3-3-05/128).

IMPORTANT! From 2021, movable property is not subject to tax.

Read about all the news related to filling out and submitting a property tax return in the section “Tax return for corporate property tax .

Act on write-off of fixed assets

The requirements for the execution of acts of write-off of fixed assets are strict. In the forms approved by the State Statistics Committee of the Russian Federation (Resolution 7 of January 21, 2003), additions are allowed (if necessary), but any editing is possible with the written permission of the head of the organization and must be justified, but no columns can be excluded.

The OS-4 form of the same type is the most universal and therefore is used more often than others. You can easily download it for free on our website:

OS-4

This form assumes the possibility of recycling suitable parts, mechanisms or assemblies and serves as the basis for their receipt in the warehouse, as well as further useful use for production purposes or sale.

The OS-4 act form is intended for writing off a wide range of assets, but to remove a vehicle from the balance sheet, another is used, OS-4a (or OS-4b for several objects) which is carried out in triplicate (one is intended for deregistering a car from the state registration with the traffic police) .

If property is alienated due to gratuitous transfer to another owner or is sold, then the form of the OS-1 act (acceptance and transfer) should be used.

In any case, the document contains a number of general required items:

- Reasons for liquidation of property;

- Description of the technical condition of the object identified as a result of the inspection carried out by the commission;

- Possibility and feasibility of restoration work;

- The degree of suitability of operable components, parts or parts of an object and their price in monetary terms;

- Reasonable argumentation for writing off the operating system;

- A defect report in the event of failure due to normal operational wear and tear, listing all existing defects.

In case of obsolescence, a defective act is not needed in the OS-4 form, but instead an order from the manager is attached.

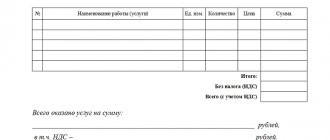

Tables of the write-off act form

The main responsibility of the members of the liquidation commission is to fill out three tables contained in the OS forms.

- The first of them is intended for entering information contained in the acceptance certificate, on the basis of which the equipment was used in production during the period preceding the write-off, general information about it (lifetime and accrued depreciation);

- The second table should contain information about the property being written off, the presence of precious metals in its parts and other information from acts OS-1, OS-1a and OS-1b.

- The third part records the costs of disassembling and recycling an object in order to extract useful components, as well as their cost.

With the exception of form OS-4b, all others are made in two copies, one of which is transferred to the accountant and serves as the basis for postings, and the second is given to the employee appointed responsible for the safety of written-off fixed assets, who delivers the recycled products to the warehouse.

Results

The write-off of fixed assets should be carried out solely upon the consideration of a commission that meets and is appointed by order of the head of the institution.

Documents must be drawn up in accordance with the legal regulations of federal, municipal bodies or bodies of constituent entities of the Russian Federation. In accounting, write-off is carried out after the actual liquidation of the asset. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Donation of a fully depreciated OS object

Donation of property worth over 3,000 rubles. between two commercial organizations is prohibited by law (Article 575 of the Civil Code of the Russian Federation).

For details of gratuitous agreements between legal entities, see here.

Since there is no separate procedure for determining the price of an asset with a zero book value transferred as a gift, the calculation should be made by analogy with other legal norms, in particular Art. 105.3 and 154 of the Tax Code of the Russian Federation (based on the market value of the object).

NOTE! The zero residual accounting value of an asset does not mean at all that the market value of this asset is 0. An expert assessment of the object will be required for a gratuitous transfer.

Free transfer to non-profit organizations and institutions, as well as individuals, is allowed. Wherein:

- With regard to income tax in accordance with the content of Art. 39 and 41 of the Tax Code of the Russian Federation, the transferring enterprise does not have an object of taxation (income) for income tax upon gift. At the same time, according to the norms of Art. 270 of the Tax Code of the Russian Federation, an enterprise does not have the right to take into account donation expenses for tax accounting. Thus, the transfer of fixed assets as a gift should not in any way affect income tax calculations.

- With regard to VAT, the donation of any fixed asset will be recognized as a sale for tax purposes (clause 1, article 39 and clause 1, article 146 of the Tax Code of the Russian Federation). The tax will need to be calculated and paid on the market value of the transferred asset (Clause 2 of Article 154 of the Tax Code of the Russian Federation). The amount of VAT paid on a gift should not reduce the income tax base (Clause 16, Article 270 of the Tax Code of the Russian Federation).

IMPORTANT! In some cases listed in paragraph 2 of Art. 146 of the Tax Code of the Russian Federation, donation of fixed assets is not subject to VAT. For example, if OS are transferred to state or local authorities. In this case, the donor should restore the input VAT on the transferred objects. The amount of tax to be restored is determined in proportion to the residual value of the fixed assets (clause 3 of Article 170 of the Tax Code). That is, for fully depreciated fixed assets (whose residual value is 0), VAT for restoration will also be equal to 0.

In accounting, all expenses associated with the donation are taken into account as part of other expenses in the period in which the fixed asset is written off from accounting.