Generating income is the main goal of commercial activity. When creating an economic society, the participants pursue precisely this. However, the founders cannot freely dispose of the company’s money. The owners have the right to claim only dividends. The distribution of profits in 2021 is made in accordance with Law 14-FZ dated 02/08/98. Violation of the rules can result in lengthy disputes with regulatory authorities.

Features of profit distribution

It is fundamentally important to distribute profits correctly. This must be done in such a way that the efficiency of the enterprise increases, not decreases. Let's consider the basic principles of fund distribution:

- The company's profit is directed to the needs of the enterprise, and is also paid to the state budget. That is, taxes are paid on this money.

- Profit tax is paid at a rate set by law. She can't change.

- Most of the profits should be directed to the enterprise budget for accumulation. The rest goes to various company expenses.

- Proposed expenses must be agreed upon by the majority of LLC participants.

What accounting data is used when filling out line 1370 “Retained earnings (uncovered loss) ” when preparing annual reporting?

The enterprise must pay taxes and various contributions, after which the state cannot interfere in decisions on the distribution of money.

What can retained earnings from previous years ?

Let's look at which funds the money goes to:

- Savings fund . This fund accumulates funds to ensure the stable operation of the company and its independence from creditors. If a company has free funds of its own, it is not subject to bankruptcy. For example, if a company received very little income in one month and therefore cannot pay its existing debt, funds to pay off the debt are taken from the fund. It also finances research work, issue of shares, personnel training, and purchases new property.

- Consumption Fund . Funds from this fund go to social needs. For example, this could be payment of bonuses, financing of travel packages, purchase of medicines for employees, and various allowances.

- Reserve fund . Reserves are needed to reduce the risks of an enterprise when conducting various transactions. They will be needed in case of unforeseen situations. That is, if the company makes a small profit in one period, expenses can be covered from the reserve fund.

Part of the funds, as a rule, remains undistributed. This money is directed to the authorized capital of the company.

Specific areas of spending

There are two areas where net profit goes:

- Accumulation of enterprise reserves. Increasing the volume of property.

- Consumption. Spending money on specific needs.

Let's look at examples of spending net profit:

- Purchase of new equipment.

- Repair of existing equipment.

- Increasing the working capital of the enterprise, which is “eaten up” by inflation.

- Payment of loans and debts. Payment of interest on debt.

- Measures aimed at protecting the environment from pollution.

- Payment of bonuses.

- Organization of charity events.

- Calculation of motivating bonuses to employees.

- Payment of debts to creditors and banks.

- Payment of taxes.

- Payment of various sanctions.

- Retraining of employees.

Almost all of these expenses are optional. Spending occurs at the will of the enterprise management. First, the money is directed to priority purposes. For example, a company has only obsolete equipment. Therefore, first of all, funds should be allocated to updating equipment.

The essence of the agreement

If you invest all the profit received in the reporting year in additional capital, this will be a decision in favor of those who want to refinance. If all profits are given out as dividends, then there will be no profit, and the enterprise will not be able to increase its economic power. Therefore, collective owners assume: part of the profit of the reporting year, which remains from the distribution of shares, can be claimed by the owners not based on the results of this year, but based on the results of economic activity in future reporting periods.

From a legal point of view, this is normal, but from a moral point of view it’s even good: I lend funds to an enterprise, but I can take them back later. However, there is a difficult point here. These funds are invested in the operating capital of the company, they work as part of it, sometimes for several years, become part of the enterprise, without which it is difficult to imagine its life and, suddenly, I or someone else demands huge dividends. If these whims are shared by other shareholders, the consequence may be a limitation of the company's future activities or even its economic collapse.

Accounting for distributed profits

Spending on taxes is deducted from the profit received. The tax base is determined based on the information set out in line 1 “Calculation of tax on real profit”. When deducting tax, the following entries will be used:

- Debit account 99 – the amount of profit is recorded.

- Credit to account 68 “Tax calculations”.

The company may receive extraordinary profits. For example, they appear when insurance companies pay compensation. In this case, the following wiring applies:

- Credit to account 99 “Profit”.

- Debit account 76-1 “Insurance settlements”.

Let's consider all the transactions used when distributing funds:

- DT84 KT70, 75 – transfer of dividends to the owners of the company.

- DT84 KT82 – formation of a reserve fund.

- DT84 KT80 – increase in authorized capital.

- DT84 KT51, 52, 55 – financing of events that are not directly related to the activities of the enterprise (for example, charity concerts).

- DT84 KT01 – recording the valuation of fixed assets.

- Internal notes on account 84 “Retained earnings” - the direction of undistributed funds to finance the development of the enterprise, covering debts of previous years.

- KT84 – fixation of the balance of undistributed funds that are included in the authorized capital.

Each posting must be supported by primary documents. Each line displays a certain amount.

Categories

The article analyzes and summarizes non-standard situations that arise in practice when distributing profits in cases of payment of dividends (including interim ones) and changes in the composition of participants and their shares in the authorized capital. Specific examples show how to solve complex problems from tax consulting practice.

In some cases, in the absence of clear legal regulation of non-standard situations, the procedure for solving problems given in the article is based on the recommendations of the financial and tax departments.

Distribution of profits based on the results of financial and economic activities in an LLC falls within the competence of the general meeting of participants. Let us recall that a limited liability company is a company created by one or several persons, the authorized capital of which is divided into shares. Participants of the company bear the risks of losses associated with the activities of the company, within the value of the shares they own, and upon receipt of profit, the general meeting of participants of the company decides on the distribution of net profit in accordance with the adopted policy of the company.

The main documents regulating the activities of limited liability companies, which are the Civil Code of the Russian Federation (Articles 87–94) and the Federal Law of 02/08/1998 No. 14-FZ (as amended on 11/30/2011) “On Limited Liability Companies” (hereinafter referred to as — Federal Law No. 14-FZ), it is determined that net profit can be directed to:

• to replenish the company's funds, production development and creation of reserves;

• social programs and bonuses for employees;

• payment of part of the profit to the company's participants.

You should immediately pay attention to two features related to the distribution of net profit in an LLC.

Firstly, the term “dividends” for an LLC is not given in regulatory documents. In relation to such companies, it is correct to talk about the distribution of profits in accordance with Art. 91 Civil Code of the Russian Federation, Art. 28, 29 of Federal Law No. 14-FZ. However, the term “dividends” has become widespread in practice not only in relation to joint stock companies, but also to limited liability companies. Therefore, considering exclusively the solution of practical situations, we will adhere to this generally accepted term.

Secondly, as a general rule, the announcement of the amount of annual income of company participants (dividends) based on the results of activities for the year refers to events after the reporting date (clause 3 of PBU 7/98[1]), and the reporting period for which net profit is distributed, no accounting entries are made. An exception to this rule are cases when the company's charter directly indicates the purposes to which net profit should be directed, and the conditions regarding how net profit is distributed: once a quarter, once every six months or once a year. Payment of interim dividends refers to such cases. Therefore, the accountant has every right on the date of the decision of the general meeting of participants to pay part of the net profit (subclause 7, clause 2, article 33 of Federal Law No. 14-FZ) to reflect the accrual of dividends based on the results of the first quarter, half a year, nine months, using an account in accounting retained earnings of the reporting year.

Having defined the general rules, regulations and features of determining the income of LLC participants, let’s move on to analyzing specific situations.

Situation 1

The founders of Triumph LLC with an authorized capital of 250 thousand rubles. are individuals: the first participant has a 24% share in the authorized capital, the second participant (non-resident) - 25%, and the third participant - 51% of the share in the authorized capital.

Is it possible to distribute the profit received at the end of 2011 in the amount of 1 million rubles? disproportionate to their shares, for example, 30% for the first and second participants and 40% for the third, if such a decision was made by all participants at the general meeting? What are the tax consequences of such a decision?

In accordance with paragraph 2 of Art. 33 of Federal Law No. 14-FZ, making decisions on the distribution of the company’s net profit is the exclusive competence of the general meeting of participants . Moreover, paragraph 2 of Art. 28 of Federal Law No. 14-FZ directly allows the right of organizations created in the form of an LLC to establish a special procedure for the distribution of profits - disproportionate to the shares in the authorized capital of the company.

Note! The procedure for distributing profits can be changed with the consent of all participants in the company and when changes are made to the relevant sections of the company's charter. The current legislation of the Russian Federation does not provide for any other procedure.

If the decision to distribute profits disproportionately to the shares of participants is made at a general meeting, and changes are not made to the constituent documents, another problem may arise.

For the income of individuals - members of an LLC, received by them during the distribution of profits, preferential tax rates for personal income tax are established by law. Yes, pp. 3, 4 tbsp. 224 of the Tax Code of the Russian Federation provides for rates of 9% for individuals who are tax residents of the Russian Federation, and 15% for individuals who are not tax residents of the Russian Federation.

In the case when, at the end of the year, a decision was made to distribute profits disproportionately to the shares of the participants, for example, as shown in table. 1, the use of a preferential rate for personal income tax may cause disagreements with inspection and control organizations.

| Table 1. Distribution of profits between LLC participants | |||

| Member of LLC | By decision of the meeting of LLC participants | Within the limits of the participant’s share in the authorized capital | Deviation (+/–) |

| 1 | 2 | 3 | 4 |

| First | 300 000 | 240 000 | +60 000 |

| Second | 300 000 | 250 000 | +50 000 |

| Third | 400 000 | 510 000 | –110 000 |

| Total | 1 000 000 | 1 000 000 | 0 |

Thus, according to the Russian Ministry of Finance, part of the net profit distributed among participants disproportionately to their shares is not recognized as a dividend for tax purposes. Accordingly, these payments are taxed at the general rate for both legal entities and individuals (letters dated June 24, 2008 No. 03-03-06/1/366, January 30, 2006 No. 03-03-04/1/65).

A substantially similar position was expressed by the Federal Antimonopoly Service of the Northwestern District when considering disputes related to the personal income tax taxation of payments in the form of dividends (Resolutions dated June 27, 2011 No. A13-2088/2010, January 12, 2006 No. A44-2409/2005-7).

In other words, according to financial and judicial authorities, the excessively paid part of the net profit does not meet the criteria of a dividend and a preferential rate (9 or 15%) cannot be applied to it.

Note! The official opinion is that only that part of the distributed profit that is proportional to the size of the share should be taxed at a preferential rate (in particular, at rates of 9 or 15%). The remaining portion should be taxed in accordance with the general procedure.

For the situation being analyzed, a preferential rate of 9% should be applied to the income of the first participant within the limits of his share, that is, to the amount of 240 thousand rubles, 13% - to income in excess of his share - 60 thousand rubles.

For the second participant - a non-resident, a preferential rate of 15% is applied to the tax base of 250 thousand rubles, 30% - to income in the amount of 50 thousand rubles.

For the third participant, a preferential rate of 9% is applied to the entire amount of income.

To summarize the above, we can recommend in this situation, before making changes to the constituent documents, to distribute the company’s net profit based on the results of the calendar year according to the decision of the general meeting of participants, and when taxing “dividends”, use a preferential personal income tax rate for that part of the income that is distributed in proportion to their shares in authorized capital of the company.

But you can do it differently. When calculating income, apply preferential rates to the entire amount of income of participants in accordance with the decision of the general meeting, that is, disproportionately to their shares in the authorized capital, and pay income to participants after registering changes in the constituent documents. After all, it is necessary to withhold tax on amounts of income (dividends) when paying them (clause 2 of Article 214, clause 4 of Article 226, clause 2 of Article 275, clause 4 of Article 287 of the Tax Code of the Russian Federation).

In the event that the procedure for distributing net profit is not only changed with the consent of all participants of the company, but is also registered by amending the relevant sections of the company's charter, the income of the participants (dividends) is taxed at preferential rates.

Situation 2

Let's change the conditions of the previous situation. Participants of the company - individuals and residents of the Russian Federation - were accrued and paid dividends based on the results of the first quarter and half of 2011 (Table 2). In December (12/10/2011), the third participant sold part of his share in the authorized capital in the amount of 20% to a new participant and, instead of 51%, became the owner of a share of 31%. The composition of the participants has changed, which was recorded in the Unified State Register of Legal Entities. Can the annual profit be distributed taking into account the time during which the fourth participant was actually a member of the company? Is such a decision legal if it is made by a majority vote at a general meeting of participants?

In accordance with Part 1 of Art. 28 of Federal Law No. 14-FZ, a company has the right to make a decision quarterly, once every six months or once a year on the distribution of its net profit among the participants of the company. The decision to determine the part of the company's profit distributed among the company's participants is made by the general meeting of the company's participants.

The issue of distribution of profit at the end of the year between participants in the case when changes in the charter were registered in December 2011, and interim dividends were distributed based on the results of the first and second quarters, in our opinion, can be resolved as follows.

For joint-stock companies, there are the concepts of “interim dividend” and “final dividend”, which are determined on the basis of the final result of profit for the previous calendar year.

Essentially, an interim dividend is in the nature of an advance payment, the amount of which is taken into account when declaring the final dividend. When paying the final dividend, its size is determined in the total amount for the year, taking into account advance payments of interim dividends.

Note! Although the concept of dividend refers to part of the net profit in joint-stock companies, a substantially similar approach can be applied when distributing net profit among the participants of an LLC.

In other words, in intermediate periods, for example, based on the results of the first quarter or half of the year, advance payments are accrued, and the final amount of dividends or part of the net profit in limited liability companies is determined based on the results of the year.

So, based on the results of the first quarter in this situation, dividends were accrued and paid (see Table 2):

• first participant - 48,000 rubles. (24% × 200,000);

• second participant - 50,000 rubles. (25% × 200,000);

• third participant - 102,000 rubles. (51% × 200,000).

Based on the results of the first half of the year, dividends were accrued and paid:

• first participant - 72,000 rubles. ((24% × 500,000) – 48,000);

• second participant - 75,000 rubles. ((25% × 500,000) – 50,000);

• third participant - 153,000 rubles. ((51% × 500,000) – 102,000).

| Table 2. Profit to be distributed among LLC participants | |||

| Member of LLC | Based on the results of the first quarter, rub. | Based on the results of the half year, rub. | Based on the results of the calendar year, rub. |

| 1 | 2 | 3 | 4 |

| First | 48 000 | 72 000 | 120 000 |

| Second | 50 000 | 75 000 | 125 000 |

| Third | 102 000 | 153 000 | 55 000 |

| Fourth | 0 | 0 | 200 000 |

| Total | 200 000 | 500 000 | 1 000 000 |

When the final income is paid to the company's participants, its size is determined in the total amount for the year, but with the offset of advance payments. Then, based on the results of the year, dividends must be accrued and paid:

• first participant - 120,000 rubles. ((24% × 1,000,000) – 48,000 – 72,000);

• second participant - 125,000 rubles. ((25% × 1,000,000) – 50,000 – 75,000);

• third participant - 55,000 rubles. ((31% × 1,000,000) – 102,000 – 153,000);

• fourth participant - 200,000 rubles. (20% × 1,000,000).

The part of the LLC's profit intended for distribution among its participants is distributed in proportion to their shares in the authorized capital of the company. A different procedure can be established by amending the company’s charter by decision of the general meeting of company participants, adopted unanimously by all company participants (Part 2 of Article 28 of Federal Law No. 14-FZ).

Taking into account the above procedure, it should be concluded: if the participants of the company decide to distribute profits in proportion to the time during which the new participant was actually a participant in the company, then such a decision will not comply with legal norms. The new participant’s demands for payment of dividends in full at the end of the year will be recognized as legitimate. As an example of court decisions on a similar issue, one can cite the Resolution of the Federal Antimonopoly Service of the North-Western District dated March 23, 2009 in case No. A56-11686/2008.

Please note that in this situation, interim dividends for the first quarter and half of the year were not accrued and paid in a larger amount than was due to all four participants at the end of the year. However, this does not always happen.

Situation 3

Let's keep the conditions of the previous situation, but let's assume that at the end of 2011, the profit for distribution amounted to 1 million rubles. At the same time, the profit for the half-year was 1.3 million rubles, that is, in the second half of the year the company incurred a loss. How should interim dividends already paid be redistributed among the new participants?

The financial result of an organization's activities can be either profit or loss. According to Art. 29 of Federal Law No. 14-FZ, limited liability companies cannot make decisions on the payment of dividends:

• until full payment of the entire authorized capital;

• before payment of the actual share or part of the share of a company participant in cases provided for by law;

• if the company meets the signs of insolvency (bankruptcy) or there is a likelihood of such signs appearing as a result of the payment of dividends;

• if the value of the company's net assets is less than the authorized capital and reserve fund or will become less as a result of the payment of dividends.

Please note the last condition. Let us recall that the net asset indicator is calculated as the difference between assets and liabilities. So if the company's accounts payable is significant, net assets may well be less than the authorized capital. In this case, it is illegal to pay dividends.

But let’s assume that there are no signs of bankruptcy, the value of net assets exceeds the size of the authorized capital, and at the end of 2011, a profit was received for distribution among participants in the amount of 1 million rubles. The only obstacle is overpaid dividends in the amount of 1.3 million rubles.

In this case, the general meeting of the company's participants may decide to credit overpaid dividends to the upcoming dividend payments in subsequent years or to return them to the company's cash desk. However, the return of the paid amounts is carried out voluntarily by the company's participants - individuals; the company does not have the right to forcibly demand their return.

And vice versa: a company participant does not have the right to demand payment of part of the net profit to him if the decision on the distribution of profit was not made by the general meeting of company participants (subparagraph “b”, paragraph 15 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 90, Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of 09.12 .1999 “On some issues of application of the Federal Law “On Limited Liability Companies””).

It is also impossible to ignore a number of ambiguous situations regarding the distribution of profits as dividends in organizations with special taxation regimes (STS, Unified Agricultural Tax, UTII), under which organizations are exempt from paying income tax. Let's consider one of these questions using the following situation as an example.

Situation 4

LLC applies the simplified tax system with the object “income minus expenses”. Does the sole founder, who is also the director of the company, have the right to accrue dividends to himself and not switch to the general taxation system?

In a company consisting of one participant, decisions on issues falling within the competence of the general meeting of company participants are made by the sole participant of the company individually and are documented in writing (Article 39 of Federal Law No. 14-FZ, letter of the Federal Tax Service of Russia for Moscow dated April 19, 2007 No. 20-12/ [email protected] (a)).

The simplified taxation system is one of four special tax regimes operating in the Russian Federation (clause 2 of Article 18 of the Tax Code of the Russian Federation). It is aimed at simplifying the calculation and payment of taxes in small and medium-sized businesses. When applying the simplified tax system, the taxpayer is exempt from paying a number of taxes, including income tax (clauses 2, 3, article 346.11 of the Tax Code of the Russian Federation). Moreover, when working on the simplified tax system, organizations have the right not to keep accounting records, with the exception of accounting for fixed assets and intangible assets (Clause 3, Article 4 of Federal Law No. 129-FZ of November 21, 1996 (as amended on November 28, 2011) “ About accounting").

However, it should be emphasized that “simplified” organizations have the right not to use the traditional accounting system, but are not obligated.

In the case when it comes to the distribution of profit received, accounting will be the main documentary evidence of the possibility of calculating dividends and applying preferential tax rates for personal income tax.

Profit for distribution, or “net” profit, in the case of applying the simplified tax system, is determined in accordance with the procedure provided for in clause 23 of PBU 4/99[2]. A similar opinion was expressed in a letter from the Federal Tax Service for Moscow dated January 15, 2007 No. 18-11/3/ [email protected]

In other words, an organization that uses the simplified tax system and is exempt from paying income tax has the right to fully accrue and pay dividends when maintaining accounting records. There is no need to switch to a general taxation system.

Income in the form of dividends due to individuals is subject to personal income tax in accordance with Chapter. 23 Tax Code of the Russian Federation. Consequently, in the situation under consideration, the organization that is the source of dividends must fulfill the duties of a tax agent to pay personal income tax in accordance with clause 2 of Art. 214 Tax Code of the Russian Federation. The tax agent determines the amount of personal income tax separately for each taxpayer in relation to each payment of the specified income: at a rate of 9% - for individuals who are tax residents of the Russian Federation (clause 4 of Article 224 of the Tax Code of the Russian Federation), 15% - for individuals who are not tax residents residents of the Russian Federation (clause 3 of article 224, clause 3 of article 275 of the Tax Code of the Russian Federation).

When receiving income in cash, the date of actual receipt of income is defined as the day of payment of income , including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The status of an individual (whether the founder is on staff or not) does not matter for the calculation and payment of dividends. This is important only when choosing an accounting account based on the Instructions for using the Chart of Accounts for accounting the financial and economic activities of organizations[3].

So, if the founder performs the duties of a director, then the accrual of dividends is reflected in the credit of account 70 “Settlements with personnel for wages” subaccount “Settlements with employees for the payment of dividends (income from participation in the authorized capital)” in correspondence with account 84 “Retained earnings ( uncovered loss).

For your information. In accordance with paragraph 1 of Art. 28 of Federal Law No. 14-FZ, the participants of the company have the right to make a decision quarterly, once every six months or once a year on the distribution among themselves of the profit remaining after taxation, that is, on the payment of dividends. Thus, profit distribution is a right, not an obligation. And if the founder of the organization does not want to receive dividends, but wants to use the profits for something else, he can do so.

And one more nuance related to the situation when the sole founder is the head of the company. Rostrud, in letter dated December 28, 2006 No. 2262-6-1, notes the following. Cases when the sole founder of a legal entity is also its director (for example, general director) are not uncommon. According to Art. 56 “The concept of an employment contract. Parties to an employment contract" of the Labor Code of the Russian Federation, an employment contract is concluded between an employee and an employer. In this situation, according to Rostrud, in relation to the general director there is no employer.

However, the non-application of Sec. 43 “Features of labor regulation of the head of the organization and members of the collegial executive body of the organization” of the Labor Code of the Russian Federation to relations that arise in the case when the head is at the same time the sole founder of the organization, does not mean that these persons are not subject to other norms of labor legislation. From Art. 16 “Grounds for the emergence of labor relations” of the Labor Code of the Russian Federation it follows that labor relations arise between an employee and an employer on the basis of an employment contract, concluded, among other things, as a result of appointment to a position or confirmation in a position. Moreover, in the situation under consideration, on the basis of Art. 20 “Parties to labor relations” of the Labor Code of the Russian Federation, the employer is a legal entity (organization) that has entered into an employment relationship with an employee, and not an individual - the head of the organization.

There are often cases when in such situations they try to save on taxes on wages by accruing and paying only dividends, including interim ones, to the director.

But non-payment of wages to the director during the period when he, as a manager, is carrying out activities to manage the organization, signing financial documents and making decisions, including on the payment of dividends, in our opinion, does not meet the norms of labor law. This situation can be the basis for controversial and conflict situations with regulatory and inspection bodies, and if facts of unjustified non-accrual of wages are revealed, the organization can be brought not only to tax, but also to administrative liability (Article 5.27 “Violation of labor and labor protection legislation » Code of Administrative Offenses of the Russian Federation).

[1] Accounting Regulations “Events after the reporting date” (PBU 7/98), approved by Order of the Ministry of Finance of Russia dated November 25, 1998 No. 56n (as amended on December 20, 2007).

[2] Accounting Regulations “Accounting Statements of an Organization” PBU 4/99, approved by Order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n (as amended on November 8, 2010).

[3] Approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (as amended on November 8, 2010).

Various controversial issues

When distributing funds, a number of controversial issues may arise:

- New LLC members have appeared . How to make payments if new participants appeared right before the distribution of funds? They should receive the funds in the standard manner. That is, in accordance with the size of the share. The procedure for dividing funds is established by the LLC Charter.

- Increase in capital volume . Increasing the authorized capital is relevant if it is necessary to increase the company’s attractiveness to investors and other external parties. A given amount of capital is needed to engage in a certain activity. It can be increased due to profit. However, before sending funds to the management company, you must pay taxes, various fees, and fines. The decision to change capital is made at a meeting of participants.

- Cancellation of a decision made at a meeting . Issues regarding the direction of money are resolved at the general meeting. The decision that is supported by the majority of participants will be made. However, it may be revised at an extraordinary meeting. If you need to reconsider a decision, you need to contact a judicial authority. The statement of claim is filed by those participants whose rights have been violated.

If controversial issues arise, one should focus on external and internal sources of law. That is, this is legislation, as well as company regulations.

Balance sheet and retained earnings

When the balance sheet was compiled for the current owners, that is, for those who currently own shares, and for management personnel, the main thing in it was the amount of profit received in the reporting year. This was the case just recently.

Now other trends have prevailed. The balance sheet is considered as an advertisement for the company. Its goal is to seduce the potential owner, the buyer. In this case, it is assumed not how much profit is received in the reporting year (firstly, this is not important, and, secondly, the amount can be seen in the profit and loss statement), but how much of the profit presented and accumulated by the company can be withdrawn, by purchasing its shares.

Thus, the interests of users dictate the rules of work for accountants. In which groups of reporting users the company is more interested, those interests prevail in the accounting methodology.

In what cases is it prohibited to distribute profits?

Profits are distributed in accordance with the decision made at the meeting of the LLC. However, in some cases, profits cannot be spent at your own discretion. Consider these cases:

- The authorized capital has not been fully paid.

- The participant who leaves the LLC is not transferred funds in the amount of his share.

- There are signs of bankruptcy. This is relevant even if bankruptcy proceedings are not carried out against the enterprise.

- If the money is spent, the company will show signs of bankruptcy.

- The amount of net assets (that is, the funds remaining after paying all taxes and other obligatory payments) should not be less than 10,000 rubles. This is the minimum limit specified by law.

ATTENTION! The general director is responsible for ensuring compliance with all these rules. In case of violations, responsibility will fall on him.

What taxes do founders pay on dividends in 2021?

Article 43 of the Tax Code of the Russian Federation recognizes distributed net profit as the income of the founders. The procedure for taxation of transactions depends on the status of the owner. Ordinary individuals and entrepreneurs deduct personal income tax from dividends. Organizations are recognized as payers of income tax, regardless of the regime applied.

In both cases, the company is the tax agent. The calculation is made according to the formula (Article 275 of the Tax Code of the Russian Federation):

K x CH x (D1 – D2), where

K – the ratio of dividends due to the participant to net profit;

Сн – tax rate;

D1 – net profit that must be distributed;

D2 – total dividends received by the organization from ownership of other companies.

Explanations regarding the application of the formula are contained in the letter of the Federal Tax Service of the Russian Federation No. ED-4-3/10475 dated 06.10.13. A rate of 13% is applied to the income of Russian residents. In other cases, the tax increases to 15% (Article 224 of the Tax Code of the Russian Federation).

The Mak company belongs to Ivan Ivanovich Ivanov (100%). The company owns 25% of the capital of Lyutik LLC. In 2017 and 2021, she received dividends in the amount of 30 thousand rubles. Net profit from own activities amounted to 230 thousand rubles. Ivanov decided to distribute this amount in his favor. He is a citizen of the Russian Federation and pays personal income tax at a rate of 13%. The tax calculation will look like this:

K = 230,000 ÷ 230,000 = 1,

1 × 13% × (230,000 – 30,000) = 26,000 rubles.

Insurance fees are not deducted from dividends. The position is confirmed by FSS letter No. 14-03-11/08-13985.

The calculation of payments from dividends due to the founders-legal entities is also compiled by the company. The corresponding rule is enshrined in Art. 275 Tax Code of the Russian Federation. The formula doesn't change. The tax regime will not play a role. The transition to special systems does not exempt companies from income tax on dividends (Articles 346.1, 346.5, 346.11, 346.26 and 284 of the Tax Code of the Russian Federation). For Russian enterprises the rate is 13%, for foreign associations – 15%. A zero tariff applies to payments in favor of participating organizations with a share of 50% or more. The condition for the benefit is continuous ownership of the asset for 365 days.

The Kolokolchik Company applies the simplified tax system with the taxable object “income”. During the year, the company earned 3,400,000 rubles. Additionally, the company is due dividends from participation in the capital of Ryabina LLC in the amount of 300,000 in domestic currency. Payments to the budget will be calculated as follows:

3400 000 × 6% = 204 000 (STS),

300,000 × 13% = 39,000 (income tax).

Thus, Kolokolchik LLC will independently pay only the simplified tax system to the budget - 204,000 rubles. The money will be transferred by the Ryabina company minus income tax:

300,000 – 39,000 = 261,000 rubles.

If dividends are paid by property, taxes are calculated on the market value. Before transferring values to the founder, the company evaluates them.

Unitary enterprise

Analysis of profit generation, as well as its distribution, have some features in a unitary enterprise. Such an organization does not have the right to own the company's property. It is only assigned to this organization. The owner in this case is the state. With his consent, the company's management can dispose of the property entrusted to him.

The net profit of a unitary enterprise is formed after the provision of services or work, as well as as a result of the sale of finished products. This amount is used for further development of the organization, social needs, and maintenance. The standards are established by law. They are being developed by the Ministry of Finance of the Russian Federation.

The rest of the profit is withdrawn by the state and sent to the federal budget.

Content

- The essence and functionality that makes a profit

- What affects profit levels

- Typology

- Formation and distribution of profits

- Optimal profit distribution

- Profit distribution management

- The procedure for distributing profits at enterprises of various forms of ownership

- Distribution of profits in LLC

- Peculiarities of the procedure in a company with one founder

- Distribution of profits in a joint stock company

- Distribution of profits in a production cooperative

- Distribution of profits in a limited partnership

- Procedure for distribution of profit of a unitary enterprise (unitary enterprise)

- Distribution of profits by property

- Terms of profit distribution

- How is profit distributed under the simplified tax system?

- Conclusion

What affects profit levels

Experts divide factors influencing profit into several groups:

- Internal factors - affect profit through output volumes, by improving the quality characteristics of products;

- External factors do not depend on the activities carried out by an enterprise or company, but they have an impact on the level of profit.

When an enterprise carries out economic activities, the entire complex of these factors is dependent and interconnected with each other.

Typology

Profit comes in various forms. Let us briefly describe some of them.

| Profit type | Brief description of the type |

| Balance sheet | Final result for the reporting period |

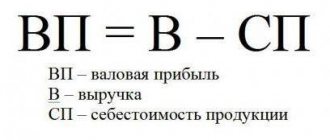

| Gross | The difference between revenue and cost, excluding selling expenses |

| Clean | Which remains after deducting all expenses |

| Marginal | It turns out when revenue exceeds production costs |

| Normal | Allows you to maintain your position in this market |

| Capitalized | Used to increase assets |

| Nominal | Corresponding balance sheet reflected in financial documents |

How is profit distributed under the simplified tax system?

Profit under the simplified tax system is most often distributed in order to pay dividends. Taxpayers under the simplified tax system are most often LLCs, this is already an established fact.

Let us remind you that you can distribute profits under the simplified tax system once a year, or every quarter. This requires only a decision of the meeting of shareholders or a single participant.

There are also joint-stock companies working on the simplified tax system. In this case, payments are made based on the results of the quarter, 6 months and year.

Net profit under the simplified tax system is calculated based on accounting data. accounting. This will not be difficult if all the information is reflected on time and reliably.

The amount of net profit here is the difference between the assets and liabilities of the balance sheet. At the same time, future income is not included in liabilities, but accounts payable are included in them.

If the balance sheet is not compiled, it is impossible to determine net profit and, accordingly, to pay dividends.