Recently, the level of use of overtime work in cumulative accounting of working hours to optimize the production process and enhance the efficiency of labor has been increasing. It is not new to the labor legislation of the Russian Federation and is used in many organizations and institutions.

Many people doubt the legality of working beyond the allotted time. However, it is supported by law and is contained in Article 99 of the Labor Code of the Russian Federation. Therefore, there is no need to doubt the legality of this concept.

How are overtime hours calculated?

HR and accounting department employees are required to correctly take into account the duration of work for each employee.

According to Art. 91 of the Labor Code of the Russian Federation, the normal length of working time is 40 hours per week. It is important to remember that an employee should not work beyond the norm for more than 4 hours, 2 days in a row and longer than 120 hours a year (Part 6 of Article 99 of the Labor Code of the Russian Federation). For some categories of citizens, a shortened day (24-35 or 36 hours a week) is the norm, and working beyond this time is overtime for them. The time worked must be reflected in the working time sheet, form T-12 or T-13. Overtime hours o or code 04. There is a timesheet program for calculating overtime hours, which automates filling out the timesheet and calculates payment for overtime using formulas.

Overtime work is paid at an increased rate (Article 152 of the Labor Code of the Russian Federation):

- for the first 2 hours at one and a half times;

- for the following hours - double.

Instead of increased pay, the employee can choose another option - get additional time for rest (no less than he worked overtime). In this case, processing is still paid, but at a single rate.

What is the minimum amount an employer must pay for working after hours?

Article 152 of the Labor Code of the Russian Federation does not contain an answer to this question, and officials of the Ministry of Health in a letter dated 07/02/14 N 16-4/2059436 explain the situation as follows: to pay overtime you can use the rule of Art. 153 Labor Code of the Russian Federation. According to the norm of this article, the minimum amount of double payment is a double tariff without taking into account compensation and incentive payments. According to the logic of this norm, the least that an employer must pay is the employee’s average hourly earnings without bonuses and allowances, multiplied by 1.5 or 2 and multiplied by the number of hours worked in excess of the norm. Local regulations of a particular company, labor and collective agreement may establish higher payment for overtime: allowances and additional payments are included in the calculation in whole or in part, if the employer is ready for this.

Formula for calculating overtime:

Calculation of additional payments for piecework payment

If the employee has a piece-rate wage system, calculate the additional payment using the formulas:

| Additional payment for the first 2 hours of overtime work | = | Piece rate | × | 1,5 | × | Quantity of products manufactured in the first 2 hours of overtime work |

| Additional payment for subsequent work hours | = | Piece rate | × | 2 | × | Quantity of products manufactured during the third and each subsequent hour of overtime work |

An example of calculating additional pay for overtime work. The employee has a piecework wage system

Proizvodstvennaya LLC uses a piece-rate wage system. For the release of 1 product to worker A.I. Ivanov is awarded 50 rubles. In March, during main working hours, Ivanov produced 800 products. In addition, on March 14, during 3 hours of overtime work, he produced another 15 products (5 products per hour).

The amount of additional payment for overtime work is: 10 pcs. × 50 rub. × 1.5 = 750 rub. – for the first 2 hours of work; 5 pieces. × 50 rub. × 2 = 500 rub. - for the next hour.

Ivanov’s salary for March was: 800 pcs. × 50 rub. + 750 rub. + 500 rub. = 41,250 rub.

Calculation of overtime hours based on salary

To calculate additional payments, you need to calculate the hourly part of the salary - how much the employee earns per hour. Then pay one and a half or two times more for each hour of overtime (depending on the time worked above the norm). The formula for calculating the amount earned per hour is given in the letter of the Ministry of Health dated 07/02/14 N 16-4/2059436:

To calculate this formula, the average monthly number of working hours per year is taken - the average value for the whole year is displayed, and not the actual number of hours worked in a month.

But this is not the only method for calculating hourly earnings. There is also an option taking into account the actual working hours in a particular month. To do this, there is no need to divide the hours by 12 months; it is enough to divide the salary by the hourly work rate for a separate month:

Since there are different options, the method for calculating the hourly tariff rate must be fixed in the local acts of the company or in an agreement with the employee (collective or labor).

The norm of working time in a year or month is determined according to the production calendar (see production calendar) depending on which category the employee belongs to (whether he is entitled to a shortened working week).

Day off

If work is not provided on certain days of an employee’s schedule, then this is a day off. So, with the usual length of the working week (five days with two days off or “five days”), as a rule, the weekends fall on Saturday and Sunday, but the schedule can be constructed differently. Weekly uninterrupted rest is provided in accordance with Article 111 of the Labor Code of the Russian Federation to all employees. Moreover, its duration cannot be less than 42 hours (Article 110 of the Labor Code of the Russian Federation). According to Article 113 of the Labor Code of the Russian Federation, work on weekends and non-working holidays is prohibited. But it is still possible to attract employees to work on weekends and non-working holidays and is done with their written consent if it is necessary to perform unforeseen work, on the urgent completion of which the normal work of the organization depends in the future. The law stipulates when it is possible and when it is impossible to involve workers in work without their consent.

However, in any case, employees are recruited to work on weekends and non-working holidays by written order of the employer. In the event of an inspection by regulatory authorities, the employer must be prepared to explain that the involvement of employees was due to production needs.

Payment for work on a day off is made in accordance with Article 153 of the Labor Code of the Russian Federation.

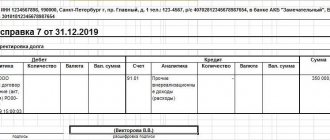

In order to reflect payment for work on a day off in “1C: Salary and Personnel Management 8”, you should draw up a program document Payment for holidays and weekends of organizations (Fig. 1)

Rice. 1

Increased payment in double amount is formed due to accruals under the documents Payment for holidays and weekends and Additional payment for work on holidays and weekends.

Helpful advice: if you use the Add button to fill out the document, then for each employee you need to enter two lines for each day off. But if you use the Fill button using a list of employees, then double entries will be generated automatically for the selected list.

According to the provisions of Article 153 of the Labor Code of the Russian Federation: “At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.”

In this case, in the document Payment for holidays and weekends of organizations, only the accrual of payment should be reflected, without registering additional payment for work on holidays and weekends (see Fig. 1).

When working with the document Payment for holidays and weekends of organizations in the 1C: Salaries and Personnel Management 8 program, you should pay attention to two points:

- you need to indicate the number of hours actually worked by the employee in the Hours worked field;

- payment is made based on the hourly rate (hereinafter referred to as the hourly rate), even if the employee has a salary.

Why do we indicate the number of hours worked?

In the schedule, a day off is indicated by the code - B. The employee’s work on this day is not provided, and accordingly, the number of working hours according to the plan is not indicated.

In accordance with paragraph 2 of the Explanations of the State Committee for Labor of the USSR and the Presidium of the All-Union Central Council of Trade Unions dated 08.08.1966 No. 13/P-21 “On compensation for work on holidays” (hereinafter referred to as the Explanations): “Payment for work on holidays is made as follows: a) piece workers - at double piece rates; b) employees paid at hourly or daily rates - in the amount of double the hourly or daily rate; c) for employees receiving a monthly salary - in the amount of a single hourly or daily rate in excess of the salary, if the work on a holiday was carried out within the monthly norm of working hours, and in the amount of a double hourly or daily rate, if the work was carried out in excess of the monthly norm.”

In this case, payment is made for hours actually worked. Therefore, it is necessary for the employer to record the number of hours actually worked.

How to determine NPV

The hourly tariff rate (HTS) for employees is determined by the following formula:

NPV = Salary / Time

When converting the monthly salary into an hourly tariff rate, you can use one of three Time Calculation Algorithms, which should be selected when Setting up accounting parameters (see Fig. 2):

- The NPV in each month is determined by dividing the salary by the standard time in hours according to the employee’s work schedule. That is, with the same salary, employees with different schedules may have different NPV. For one employee, the NPV will also change from month to month;

- NPV is determined by dividing the salary by the average monthly number of hours per year. That is, throughout the year, with the same salary, it remains unchanged;

- NPV is determined by dividing the salary by the standard time per month according to the production calendar. That is, for employees with the same salary, regardless of their schedule, the NPV is the same, but varies by month.

Rice. 2

An example of calculating overtime hours with a salary

Salary of employee Malofeeva L.G. is 25,000 rubles per month. In September 2021, the employer delayed him twice: on September 1 for 3 hours, on September 8 for 1 hour. We will calculate overtime if the norm is for Malofeev L.G. 40-hour, five-day work week.

The first method (based on the average monthly number of working hours in 2016):

In 2021, the average annual working time for a 40-hour week is 1974 hours (see production calendar). Let’s calculate the hourly part of Malofeev’s salary in average form:

For overtime work on September 1, Malofeev L.G. will receive:

For September 8:

In total, the employee was credited 759.85 + 227.95 = 987.80 rubles in September 2021. for working overtime.

Second method (based on the actual number of working hours per month):

In September 2021, the average monthly working time for a 40-hour week is 176 hours (see production calendar). Let us calculate the hourly part of L.G. Malofeev’s salary. based on the actual (not average) number of working days in September:

We see that the result is a completely different amount of hourly earnings than when calculating using the first method (almost 10 rubles less). But at the same time, in another calendar month - in which the number of labor hours is less than in September - the amount obtained, on the contrary, will be greater than with the average annual calculation.

For September 1, Malofeev will receive:

For September 8:

Total for September 2021 Malofeeva L.G. overtime accrued: 710.20 + 213.06 = 923.26 rubles.

The amount turned out to be less than in the first case, which is unprofitable for the employee. The Ministry of Labor in letter No. 1202-21 dated 08/09/2002 recommends using the first method of calculating overtime if this improves the employee’s financial situation.

Holiday

Article 112 of the Labor Code of the Russian Federation establishes a list of holidays in the Russian Federation. As a rule, they are also non-working. But in some cases it is impossible to avoid including a holiday in the work schedule. If work on a holiday is not scheduled, then its registration and payment is no different from weekend pay, the procedure for reflecting it in “1C: Salaries and Personnel Management 8” was discussed above.

If work schedules include work on holidays, then you can create an additional payment for this work throughout the enterprise with one document, with one button - Fill in with those who worked on holidays. At the same time, for all employees whose workdays fell on holidays in the Month of accrual according to the schedule, records will be generated in the document about the Additional payment for work on holidays and weekends. Working hours correspond to the schedule.

Calculation of overtime hours on a shift schedule

According to Art. 103 of the Labor Code of the Russian Federation, a shift schedule implies work in two, three or four shifts, the need for which is determined by the continuity of the production process. Shift work must be fixed in the employment contract with the employee, since it is its essential condition. If a shift worker, at the request of the employer, goes out of his shift, then the payment for that day is doubled, or the employee is given a day off on his working day. If the scheduled shift falls on a holiday, non-working day, the work is paid twice as per Art. 153 Labor Code of the Russian Federation. In addition, the shift or part of it may fall at night, work during which is paid at an increased rate (at least 20%) according to Art. 96 Labor Code of the Russian Federation.

When an employer delays a shift worker at work beyond the scheduled hours, he is obliged to pay the employee additionally. Let's figure out how to calculate overtime hours on a shift schedule. And also if work beyond the norm occurs at night. The formula for calculating the amount of overtime does not change: the first two hours are paid at one and a half times the hourly portion of earnings, subsequent hours at double. As an example, let’s take the calculation of overtime and night shifts in a medical institution.

The specific nature of the work of doctors requires the presence of staff in the institution around the clock; the work schedule in the hospital is rotating. Moreover, in case of delay of doctors and other medical workers beyond the shift, management is obliged to pay for overtime. Let's figure out how to calculate night and overtime pay for doctors.

What is overtime work activity and its differences from overtime

What is overtime work?

Overtime work is the activity that a worker carries out during his free time from work on the initiative of his boss. At the same time, the duration of work hours exceeds the norm established for the employee. Its main criteria:

- formality;

- leader's initiative;

- mandatory payment.

Many people, especially employees themselves, often confuse these two similar concepts: overtime and overtime work activities. Believing that by completing current work tasks and staying at work a couple of hours longer, they work beyond the norm. Because of this, there is a lot of misunderstanding and dissatisfaction on the part of employees regarding their employer. They are convinced that they must be paid for the extra time they spend at work.

Therefore, it is important to know the processing features:

- conditional nature;

- employee initiative;

- this kind of work is free.

Labor legislation distinguishes these two concepts in more detail.

Working beyond the norm means that the employee is officially involved by the employer in additional hours of work. The employee receives payment for this that corresponds to the workload.

During overtime, the employee actually remains at the workplace on his own initiative, because There is no official document to involve him in work beyond the norm. Accordingly, overtime is not paid.

An example of calculating overtime and night pay on a shift schedule

Medical worker I.P. Trifonov has a work schedule of two 12-hour shifts (day shift from 8:00 to 20:00, night shift from 20:00 to 8:00). The employee's salary is 16,000 rubles. The norm for Trifonov I.P. is a 40-hour work week. In September 2016, he was required to work overtime for 4 hours on September 2 after the day shift, and for 2 hours on September 5 after the night shift. The local regulatory act of a medical institution establishes an additional payment for night work in the amount of 40% of the official salary (the minimum amount of such additional payment according to the Labor Code of the Russian Federation is 20%, but employers have the right to establish more favorable conditions for employees). We will calculate the additional payment for I.P. Trifonov for work outside of school hours.

According to the production calendar in September 2021, for a 40-hour work week, the standard working time is 176 hours. To calculate overtime, we will highlight the hourly part of I.P. Trifonov’s salary:

Night hours are the time from 22:00 to 6:00 (work at this time is paid at an increased rate). September 2 Trifonov I.P. was brought to work after the day shift for 4 hours, the shift ends at 20:00. The employee worked overtime from 20:00 to 24:00, 2 hours of this period were at night. For these 2 hours, he is entitled to an additional 40% of the salary, in addition, they are paid at double the rate, while the first 2 hours of overtime are paid at one and a half times. But when calculating overtime and night, there is no need to multiply the coefficients at the same time. You should add up the amount of extra pay for night hours and the amount of overtime.

For September 2, Trifonov is entitled to:

Of which 72.72 rubles are for work on the night shift.

After the night shift on September 5, Trifonov worked 2 hours - the work occurred during the day, did not exceed 2 hours and was paid at time and a half.

Overtime for September 5:

Total in September Trifonov I.P. accrued for additional work, partly at night, 709.02 + 272.70 = 981.72 rubles.

How to calculate your earnings

The following algorithm is used for calculation:

- it is determined how much overtime the employee has in a month;

- the average hourly earnings of a subordinate are calculated;

- the norm of working days per month is calculated, multiplied by 2 - this amount of time is subject to payment in the amount of 1.5 hourly rates;

- determines how much time is due to be paid in double amount.

Example. An employee of the organization has a monthly salary of 23 thousand rubles. In July 2021, he worked 180 hours (with the norm being 168 hours), in August - 238 hours (with the norm being 184 hours). How to calculate the surcharge? The calculation is carried out as follows:

- in 2021, 1973 working hours, average employee pay - 140 rubles / hour (23,000 / (1973 / 12));

- in July, processing is 12 hours (180 – 168);

- in August – 54 hours (238 – 184);

- for July the additional payment will be 2,520 rubles (12 * 1.5 * 140);

- In August, one-and-a-half times the rate of payment was established for 46 hours of overtime (there are 23 working days in a month), double for the remaining eight;

- additional payment for August – 11,900 rubles (46 * 1.5 * 140 + 8 * 2 * 140).

Calculation of overtime with summarized recording of working time

According to Art. 104 of the Labor Code of the Russian Federation, in cases where it is impossible to comply with the daily (8 hours in the general case) or weekly (40 hours) standard working time, it is permissible to introduce a summarized recording of working time in the organization. Working hours are counted not for a week, but for the period established by the organization. This could be a month, a quarter or a year. Such accounting is introduced so that the duration of working hours does not exceed the normal number of working hours in the entire allotted period. In this case, one week an employee may work more than normal, and the next week, on the contrary, less. The employer will evaluate the time worked after the end of the accounting period - month, year or quarter.

Summarized accounting is convenient for companies with a shift schedule, in which employees work every other day, two to two, or several shifts a day. With such accounting, overtime may also arise, for which it is necessary to calculate payment.

Additional payment for extracurricular work in the case of cumulative recording of working hours is made after the end of the accounting period. Let's look at how overtime is calculated using an example.

Features of overtime work

Working overtime is not always paid.

Employees who, for a number of reasons, work more than expected are advised to keep in mind the following rules:

- overtime work activity with summarized accounting appears in situations where the standard hours of labor for the assigned time period are exceeded by the worker by at least one hour;

- the maximum value is the duration of 120 hours of labor above the norm per year. Exceeding the indicators is strictly prohibited;

- Managers are prohibited from involving employees in overtime for more than 4 hours over two consecutive days. The total amount of hours actually worked by the employee and those hours that he worked overtime is calculated at the end of the accounting period.

Thus, the manager’s obligation to pay an employee for hours of work exceeding the norm occurs in situations where the workers’ hourly workload is significantly greater than it should be.

In this regard, you should be very careful and monitor your working hours. If per year it exceeds the indicated figures, then such work will not be paid.

This is especially important because some managers do not keep such records or do it incorrectly.

An example of calculating overtime with summarized recording of working hours

To employee Selivanov M.A. The hourly wage is set at 150 rubles per hour, the organization operates a summarized recording of working time, the accounting period is a quarter. The general working hours for this employee are 40 hours per week. Let's calculate overtime for Selivanov M.A for the 2nd quarter of 2021, if he worked 496 hours in this quarter according to the time sheet.

According to the production calendar, the standard working time for a 40-hour week in the 2nd quarter of 2021 is 488 hours.

According to the results of the quarter, Selivanov worked 496 - 488 = 8 hours of overtime. Of this time, 2 hours are paid at one and a half times, and the remaining 6 hours at double:

Payment for overtime work Selivanova M.A. will amount to 2,250 rubles based on the results of the accounting period - 2 quarters of 2021 with summarized accounting of working hours.

Calculation examples

Example 1. The weekly work hours for a doctor are 39 hours. The institution has introduced summary accounting for the second quarter of 2021. Actual labor time for the period is 500.8 hours. How to calculate overtime hours in this case?

The calculation procedure is prescribed in the provisions of Order No. 588n, developed by the Ministry of Health and Social Development of the Russian Federation. In this situation it will be as follows:

- duration of work per day for a doctor – 7.8 hours (39 / 5);

- the norm of time in April and May is 156 hours each (20 * 7.8);

- the norm in June is 163.8 hours (21 * 7.8).

Thus, the norm for a physician in the second quarter is 475.8 hours. Overtime is 25 hours.

Example 2. The doctor worked 450 hours in the 1st quarter of 2021. From February 27 to March 3 he was on annual leave. Calculation in this situation is complicated by the appearance of shortened days in the accounting period and the employee being on vacation. Calculations are made as follows:

- the norm in January is 132.6 hours (17 * 7.8);

- the work norm in February for doctors, taking into account the shortened day on February 22, is 139.4 hours (18 * 7.8 – 1 hour);

- the norm in March, taking into account the abbreviated 7th day, is 170.6 hours (22 * 7.8 - 1 hour);

- missed hours due to vacation – 39 hours (7.8*5);

- the norm for an employee for the quarter is 403.6 hours (132.6 + 139.4 + 170.6 – 39);

- overtime worked – 46.4 hours.

Thus, in order to calculate the duration of overtime, subject to additional payment, you should first calculate the normal duration of work in the accounting period for each category of employed citizens.

Irregular working hours

If an employee has been assigned irregular working hours, then there can be no talk of overtime work. Since this mode of work initially assumes that, by order of the manager, the employee may occasionally be involved in work outside the working day. This is indicated by Article 101 of the Labor Code of the Russian Federation. Overtime in this case is compensated by additional rest time. But there are no restrictions regarding payment on weekends and holidays. These workers are generally exempt from work on weekly rest days and holidays.

Common mistakes

Error: The employer gave an employee who worked overtime time off instead of paying him for overtime work.

Comment: The employer must pay the employee for the work in any case. If an employee wishes to take time off, his earnings for overtime hours are paid as the performance of work duties during normal working hours.

Error: The employer, without the employee’s knowledge, gave him an extra day off instead of paying him for overtime work.

Comment: Compensation for overtime work can be replaced with time off only with the written consent of the employee.

The procedure for introducing summarized accounting

According to Art. 104 of the Labor Code of the Russian Federation, the procedure for introducing summarized recording of working time is established by the internal labor regulations (hereinafter referred to as PVTR).

The PVTR regulates the working hours, rest periods, incentive and penalty measures applied to employees, as well as other issues of regulating labor relations with a given employer.

Summarized recording of working time at an enterprise can be introduced by order (instruction) of the employer, taking into account the opinion of the elected body of the primary trade union organization (if the enterprise has a trade union).

Summarized working time tracking can be introduced throughout the organization or for specific employees. The condition of summarized accounting must be included in the employment contract.

According to Art. 74 of the Labor Code of the Russian Federation, if the terms of the employment contract determined by the parties, related to changes in organizational or technological working conditions, cannot be preserved, they can be changed at the initiative of the employer, with the exception of changes in the employee’s labor function.

That is, if the PVTR did not initially provide for summarized recording of working time, appropriate changes must be made when applying it.

Taxation issues

Payments for work on weekends and holidays, for overtime work are fully included in the tax base for personal income tax and in the calculation base for insurance premiums.

Overtime, weekends, and holidays should be considered a reasonable expense. For profit tax purposes, all expenses recognized when calculating the tax base must be documented and justified, that is, economically justified and aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). Thus, expenses for remuneration of employees working overtime (including if the number of hours worked by them overtime exceeds 120 hours per year), working on weekends and holidays, for profit tax purposes are considered expenses in accordance with paragraph 3 of Article 255 Tax Code of the Russian Federation. However, it should be borne in mind that there is conflicting judicial practice regarding the recognition of labor costs for employees working overtime over 120 hours per year. In the decisions of the FAS PO dated 08.28.2007 No. A55-17548/06, FAS UO dated 02.15.2006 No. F09-628/06-S7 in case No. A71-383/05, the judges considered the recognition of such expenses to be legitimate and justified. And in the resolution of the FAS ZSO dated 08/09/2006 No. F04-5008/2006(25216-A75-40) in case No. A75-12558/2005, the arbitrators indicated that the conclusion about the economic justification (justification) of the costs of paying remuneration for overtime work over 120 hours is incorrect, since the costs incurred by the organization in connection with its violation of legal requirements (including labor) cannot be recognized as justified.

What to do if the accounting period has not been fully worked out

If an employee gets sick or goes on vacation during the accounting period, then the standard number of hours for him becomes different. To find it, you need to subtract the hours due to rest or illness from the “general” standard.

Example 2

Let's assume that operator Sidorov from example 1 worked 140 hours in January and February 2021. From March 1 to March 28, I was on vacation; accordingly, I worked zero hours in March. In total, in the first quarter he worked 280 hours (140 + 140).

In connection with the holiday, the standard for March and for the entire accounting period (first quarter) for Sidorov will be reduced.

First, let's calculate what the reduced standard for March is equal to. To do this, you need to determine how many vacation days fall on working days in a 40-hour week. There are 19 such days (March 1, 4, 5, 6, 7, 11, 12, 13, 14, 15, 18, 19, 20, 21, 22, 25, 26, 27 and 28). Then you need to multiply these days by 8 hours and subtract the resulting result from the “usual” standard. It turns out that Sidorov’s reduced standard in March will be 7 hours (159 hours - (19 days x 8 hours)). This means that in the accounting period the reduced standard will be equal to 302 hours (136 + 159 + 7). We see that in the first quarter Sidorov has no processing.

Similarly, the reduced standard should be calculated in the case where the employee quit before the end of the accounting period. That is, you need to determine how many working hours in a 40-hour week fall from the beginning of the accounting period to the employee’s last day of work. This will be a reduced standard.

Example 3

Let’s say the operator Sidorov from example 1 quit on January 21, 2019, having worked 6 shifts (from January 15 to January 20). The actual time worked for him in January was 60 hours (6 shifts x 10 hours).

To determine Sidorov’s standard for January and for the entire accounting period (first quarter), you need to find out how many working days in a 40-hour week fall in the period from January 1 to January 20. There are 8 such days (9, 10, 11, 14, 15, 16, 17 and 18 January). Now the resulting number should be multiplied by 8 hours. We will find that the reduced standard for Sidorov will reach 64 hours (8 days x 8 hours). We see that in the first quarter Sidorov has no processing.

Registration of summary accounting in production

The organization must develop and approve a work schedule for employees for whom summarized accounting has been introduced. The schedule is approved by order of the manager, employees become familiar with the schedule according to the internal regulations.

You need to understand that if a schedule is not established, then by law the employee must work in accordance with the general working hours adopted by the organization. And then the hours that he worked in excess of the provided general norm are considered overtime, which must be paid in accordance with the Labor Code.

Keep track of working hours in the online service Kontur.Accounting: it is suitable for all types of working time tracking. In Kontur.Accounting it is easy to calculate salaries, do accounting, pay taxes and send reports.

Try for free

How to make changes to an employment contract

If before the introduction of summarized accounting, the employee was on a different regime, for example, a 5-day work week with two days off, then an additional agreement is drawn up to the employment contract, which reflects the conditions for the use of summarized recording of working time. In the section “Working hours” of the additional agreement to the employment contract, it is advisable to indicate the following points:

1. The employee is provided with a summarized recording of working time.

2. The procedure for introducing summarized recording of working time is established by the Internal Labor Regulations.

3. The accounting period is a month.

4. The standard working time for the accounting period is established based on a 40-hour work week with two days off.

5. The date and time the employee goes to work, the duration of work, the end time of work, and days off are determined in the work schedule.

6. Work schedules are brought to the attention of the employee no later than 1 month before they come into effect.

7. A break for rest and food (45 minutes) is provided every 4 hours of work.

8. The hourly rate for calculating wages for salaried employees is calculated by dividing the official salary by the average annual standard number of hours and remains unchanged during the current year.

Note!

The employer is obliged to notify employees of changes in the terms of the employment contract (in our case, the transition to summarized recording of working hours) in writing no later than 2 months in advance (Part 2 of Article 74 of the Labor Code of the Russian Federation) - for example, issue an order to amend the PVTR with employee list application.

If the employee refuses the working conditions in the new regime, i.e. in new organizational conditions, then the employment contract is terminated in accordance with clause 7, part 1, art. 77 Labor Code of the Russian Federation.

When switching to summarized recording of working hours, the employer is obliged to develop a work schedule that contains information about the standard working hours, the number of days off and working days, the boundaries and duration of the working day, as well as the combination of working periods with rest periods.