The peculiarity of transport tax tariffs is that they are individual for the constituent entities of the Russian Federation. That is, the size of the transport tax rate is determined in accordance with local legislation. However, both owners of prestigious cars and drivers whose vehicle is not used at all must pay funds for the use of vehicles.

It is worth noting that taxation is provided not only for cars for personal use, but also for a number of other vehicles.

Vehicles for which you must periodically pay a fee include:

- motor vehicles;

- cargo vehicles;

- airplanes and other vehicles moving by air;

- jet skis and other vehicles moving on water;

- snowmobiles.

The amount of tax deductions depends on several factors, largely dependent on the characteristics of the individual or legal entity.

According to accepted standards, the size of the tax rate depends on the following features:

- the subject's salary and standard of living;

- vehicle power;

- car category;

- the total number of vehicles owned by the person.

Less powerful cars require a lower transport tax rate. This is largely explained by the state's environmental policy: high rates should encourage drivers to purchase more environmentally friendly small cars.

Local authorities are still limited in their ability to set tariffs too high or low for the population. According to federal legislation, regional laws cannot provide for a rate that would differ from the basic rate by more than 10 times. In this case, the difference can be both smaller and larger.

When to pay

According to clause 1 of Article 363 of the Tax Code of the Russian Federation, tax is payable:

- taxpayers - individuals no later than December 1 of the year following the expired tax period;

- taxpayers - organizations within the time limits established by the laws of the constituent entities of the Russian Federation.

From 01/01/2021, a new version of this article will be in effect, according to which the tax will be payable by taxpayer organizations no later than March 1 of the year following the expired tax period. Advance tax payments will be subject to payment by taxpayer organizations no later than the last day of the month following the expired reporting period.

Who needs to pay transport tax

It is a common belief that only owners of trucks and cars pay the tax. However, it is not. The owners of any vehicles registered with the registration authorities have to pay a contribution to the regional treasury. The list includes airplanes, steamships, yachts, motor sleighs and much more.

Art. 358 of the Tax Code of the Russian Federation indicates exemption from tax payments to owners of the following vehicles:

- passenger vehicles equipped for driving by disabled people, if the installed engine has a power of less than 100 hp, and the receipt was made through social security authorities in accordance with the law;

- tractors, combines and special equipment registered to agricultural producing enterprises;

- boats without engines, as well as with engines, provided their power is less than 5 hp;

- aircraft registered for air ambulance and medical services;

- for transport of executive authorities, provided that service in their ranks is equivalent to military service or is such;

- sea, river and aircraft, if for their owners the main activity of transporting passengers or delivering goods;

- drilling ships and platforms;

- fishing and river vessels, as well as vessels registered in the Russian International Register of Vessels.

Transport tax is not withheld from stolen vehicles, even if the search for them has been stopped.

Methods for submitting applications and reporting on TN

All transport tax documents can be submitted to the Federal Tax Service both electronically and on paper.

Accepting applications for benefits from individuals. individuals and entrepreneurs, as well as registration of tax returns from organizations can be carried out in several ways:

- documents can be brought in person and submitted to the Federal Tax Service;

- transfer to the tax office through a legal representative;

- another way - remotely - send a package of documents by Russian Post (by registered mail with a list of attachments);

- a transport tax declaration can be sent online from the portal of the Federal Tax Service of the Russian Federation, for this purpose the tax authorities' resource "Taxpayer Legal Entity" is open, you can enter the program using the link, to generate reports, the responsible person needs an enhanced electronic signature and additional software;

- The vehicle owner can submit an application for a tax benefit from the taxpayer’s Personal Account on the Tax Service’s WEB website. At the same time, the citizen must have a strengthened unqualified electronic signature;

- Another online way to submit an application is through the government services portal, having endorsed the message with an enhanced qualified electronic signature (ECES).

Please note: when remotely submitting an application for a benefit and copies of the necessary documents to the Federal Tax Service (by mail, through the government services portal or the tax authorities’ website), inspectors will ask the authority that issued the document to confirm the authenticity of the scanned copy submitted for verification. Therefore, to optimize the process, it is recommended to have copies endorsed by a notary.

The response from the Federal Tax Service is received by the applicant or declarant in the same way as the submission. It can be both positive and negative.

In some cases, tax authorities may refuse to accept documents:

- submission of documents in the wrong form, please note that the application and declaration forms are new;

- there are no necessary applicant details or required signature;

- documents proving the identity of the individual or confirming the authority of the representative have not been provided;

- delivery of the package to the wrong inspection.

Those cargo carriers who pay to Platon are exempt from advance payments and part of the tax fees

Advance payments by organizations

Organizations must make advance payments to the Federal Tax Service at the place of registration of the enterprise every quarter, unless this is separately regulated by local legislation. That is, at the end of the calendar quarter, the enterprise transfers ¼ of the transport tax fee to the tax authority.

At the same time, the regional executive body has the right to note quarterly reporting periods and advance payments.

It is necessary to take into account: according to paragraph 2 of Article 363 of the Tax Code of the Russian Federation, organizations whose vehicles are registered in the Platon toll system are not required to make advance payments to the budget.

Tax declaration for legal entities

Reporting for the tax period is provided only by organizations (LEs). The declaration period can be specified separately by regional authorities, but in accordance with Article 363.1. The declaration based on the results of the reporting period must be submitted to the Federal Tax Service by February 1.

If a situation arises when an enterprise is being liquidated, the Federal Tax Service of the Russian Federation recommends submitting tax reports on transport along with a notice of the beginning of the liquidation of the company, or - option number 2 - at the time of formation of the liquidation balance sheet. At the same time, when the declaration is submitted simultaneously with the notice of liquidation of the LLC, in the event of any costs or income, an updated tax report will need to be submitted.

When a company closes one of its separate divisions, a transport tax return is submitted to the following authorities:

- if the unit has not yet closed, to the Federal Tax Service at the location of the OP;

- if the reports were not submitted in time, at the location of the company’s head office (according to the comments of the Federal Tax Service dated 04/04/2017 No. BS-4–21/6264).

The transport tax declaration from 2021 is filled out in a new format, approved by order of the Ministry of Finance of the Russian Federation dated December 5, 2016 No. ММВ-7–21/ [email protected]

Let's look at what's new in the annual tax reporting:

- the declaration allows you to take into account when calculating the tax the period when the vehicle is registered after the 15th day of the month (the tax is reduced for this period);

- the report makes it possible to show the total amount of tax collection for all vehicles, in whatever region of the Russian Federation they are located (if this is agreed with the regulator before the beginning of the year);

- the reporting is not confirmed by the organization’s seal;

- several new lines have appeared in the structure: No. 070 and 080, which contain vehicle registration data;

- line No. 130 with the year of manufacture of the vehicle;

- as well as lines No. 280 and 290 to reflect the code and deduction amount for participants in the Platon system.

Comments of the Federal Tax Service of the Russian Federation on filling out lines according to “Plato”:

- if the owner does not pay the toll according to Plato, dashes are placed in all cells of lines No. 280 and 290;

- if an organization makes a payment to the register, then in line No. 280 it is necessary to indicate the deduction code “40200”, and in block No. 290 enter the amount paid to “Plato”;

- Moreover, if there are digital values in cells No. 280 and 290, you need to put “0” in blocks No. 023, 025, 027.

Photo gallery: new transport tax declaration

Title page of the transport tax declaration for reporting for 2021

There are no significant changes in the first section

The main changes are in the second section; lines confirming tax deductions have been added

Please note: according to the June clarifications of the Federal Tax Service of the Russian Federation, only owners who make payments to Platon themselves have the right to tax benefits. If such a violation is discovered during a desk check of the transport declaration, the report will not be accepted by the inspectorate.

Transport tax by region

- 01Adygea rep.

- 02Bashkortostan rep.

- 03Buryatia rep.

- 04Altai rep.

- 05Dagestan rep.

- 06Ingushetia rep.

- 07Kabardino-Balkarian Republic

- 08Kalmykia rep.

- 09Karachay-Cherkess Republic

- 10Karelia rep.

- 11Komi rep.

- 12Mari El rep.

- 13Mordovia rep.

- 14Sakha (Yakutia) rep.

- 15North Ossetia rep.

- 16Tatarstan rep.

- 17Tuva rep.

- 18Udmurt Republic

- 19Khakassia rep.

- 21 Chuvash Republic

- 22Altai region

- 23Krasnodar region

- 24Krasnoyarsk region

- 25Primorsky Krai

- 26Stavropol region

- 27Khabarovsk region

- 28Amur region

- 29Arkhangelsk region

- 30Astrakhan region

- 31Belgorod region

- 32Bryansk region

- 33Vladimir region

- 34Volgograd region

- 35Vologda region

- 36Voronezh region

- 37Ivanovo region

- 38Irkutsk region

- 39Kaliningrad region

- 40Kaluga region

- 41Kamchatka region

- 42Kemerovo region

- 43Kirov region

- 44Kostroma region

- 45Kurgan region

- 46Kursk region

- 47Leningrad region

- 48Lipetsk region

- 49Magadan region

- 50Moscow region

- 51Murmansk region

- 52Nizhny Novgorod region

- 53Novgorod region

- 54Novosibirsk region

- 55 Omsk region

- 56 Orenburg region

- 57 Oryol region

- 58Penza region

- 59Perm region

- 60Pskov region

- 61Rostov region

- 62Ryazan region

- 63Samara region

- 64Saratov region

- 65Sakhalin region

- 66Sverdlovsk region

- 67Smolensk region

- 68Tambov region

- 69Tver region

- 70Tomsk region

- 71Tula region

- 72 Tyumen region

- 73Ulyanovsk region

- 74 Chelyabinsk region

- 75Transbaikal region

- 76Yaroslavl region

- 77Moscow

- 78St. Petersburg

- 79Jewish Autonomous Region

- 82 Crimea rep.

- 83Nenets Autonomous District

- 86Khanty-Mansi Autonomous Okrug - Yugra

- 87Chukotka Autonomous Okrug

- 89Yamalo-Nenets Autonomous Okrug

- 92Sevastopol

- 95Chechen Republic

See also: - Transport tax for a motorcycle, scooter - Transport tax for a truck - Transport tax for a bus - Transport tax for a boat, yacht, jet ski - Transport tax for an aircraft - Transport tax for pensioners - Transport tax for luxury cars

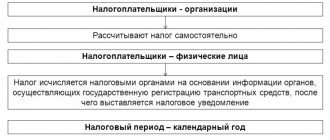

How is transport tax calculated?

Individuals do not have to worry about the amount of tax they will have to pay. The tax service makes the calculations independently. The taxpayer receives a notification of the need to pay on time in the form of a registered letter or notification on the State Services, as well as in the taxpayer’s personal account.

However, this does not mean that the tax amount is some kind of secret. If a citizen buys a car and wants to find out how much he will have to pay for it annually, you can use the calculator on the website of the Federal Tax Service. Those who do not trust government officials can make the calculations themselves

The vehicle tax formula generally looks like this:

Amount of transport tax = Regional rate * Engine power (hp)

And more precisely like this:

Amount of transport tax = Regional rate * Engine power (hp) * Period of use (months) * Increasing or decreasing factor

Those. If the vehicle ownership period is less than one year, another multiplier is added to the formula. It is equal to the number of months of ownership divided by 12.

The formula may also contain increasing and decreasing coefficients. For example, such a coefficient is provided for citizens who own cars worth more than 3 million rubles. All information on bets and odds is posted on the Federal Tax Service website.

Increasing coefficients for expensive cars

In 2021, a package of luxury taxes came into force in the Russian Federation. As part of these new fees, adjustments were introduced to the NKRF, affecting the procedure for fees from owners of premium cars. The list of such models is published annually on the website of the Ministry of Industry and Trade, and for 2021 includes about 1,300 items. The size of the increasing coefficients is determined by the provisions of Art. No. 362 NKRF, and depends on the average price of a new car of this model.

| Car price (million rubles) | Age of the car (no more than years) | Coefficient |

| 3…5 | 3 | 1,1 |

| 5…10 | 5 | 2 |

| 10…15 | 10 | 3 |

| Over 15 | 20 | 3 |

Existing benefits for this tax

As already written above, a number of individuals and legal entities are completely exempt from paying taxes by the state. However, regional executive authorities can establish their own rules regarding certain categories of citizens required to pay transport tax.

For example, large families are most often exempt from the tax burden. Depending on the situation, they are provided with either a discount or a complete exemption. However, there are regions in Russia where such benefits are not provided. To find out exactly who is entitled to concessions in a region, territory or republic, you need to familiarize yourself with the law on transport tax in force in a particular territory. For example, in the Yamal-Nenets Autonomous Okrug this will be the “Law on Transport Tax Rates on the Territory of the Yamalo-Nenets Autonomous Okrug”, and in Crimea - the Law of the Republic of Crimea “On Transport Tax”.

The tax office takes into account discounts and benefits independently; the notification indicates the total amount. However, in order for the coefficients to be applied, the citizen is required to provide a corresponding application.

If a transport tax payer is entitled to a benefit that he did not know about, he can submit an application for recalculation for the three previous years.

The legislative framework

The transport tax is regulated by Ch. 28 of the Tax Code of the Russian Federation. All payments from it are credited to the budgets of the constituent entities of the Russian Federation. When determining the rate of this tax, the legislative power of each region independently sets the tax tariff. At the same time, legislators, when setting transport rates, are limited by the 28th chapter of the Tax Code of the Russian Federation, which determines standard tariffs when calculating transport taxes. Subjects of the Russian Federation under this point do not have the right to deviate from the tariffs defined in the Tax Code of the Russian Federation up or down by no more than 10 times.

Taking into account the above, the executive power of the region, when setting the transport tax tariff for organizations (LEs), independently determines the procedure and timing of tax payments, regulating these provisions in separate regulations. Also, the regional legal act on transport tax may provide benefits and grounds for their application. Regional legislation also has the right to link the tax to the year of manufacture of the vehicle or to the environmental class of the car.

In regions where local authorities have not established individual rates, generally accepted tariffs, regulated by Article 361.1, apply. Tax Code of the Russian Federation.

There have been no fundamental changes in the calculation of transport tax. The government has maintained average rates, retained the general approach to accrual and reporting, etc.

Let us note several innovations that should be taken into account when calculating and declaring transport tax:

- In a number of regions, tariffs for 2021 have been adjusted, therefore, before calculating and submitting reports, it is recommended to check whether regional rates have changed (this happened, for example, in Khakassia and Karelia).

- The key change in reporting for legal entities is the introduction of a new declaration form. In particular, the reporting document is supplemented with blocks related to the Platon system. You will only need to report using the new form based on the results of 2021.

- Since 2021, the Tax Code of the Russian Federation has been replenished with penalties in case of concealing from the Federal Tax Service of the Russian Federation the fact of purchasing a vehicle for individuals. person - 20% of the tax (clause 3 of article 129.1 of the Tax Code of the Russian Federation).

- The main innovations of the year are new clarifications from the regulator on benefits for heavy transport when using the Platon system: in particular, if the owner does not pay the freight toll independently, he is deprived of preferences when calculating the transport tax declaration (letter of the Federal Tax Service of the Russian Federation dated 06/08/2017 No. BS-4–21/10954);

- the forms of documents that justify the legality of using the exemption for heavy cargo vehicles have been clarified - this is a new form confirming payments to the budget, No. BS-4–21 / [email protected] dated 01/09/2017, applies to paper media and reporting in electronic form (letter from the Federal Tax Service of the Russian Federation dated 05/04/2017 No. PA-4–21/8499);

- The Ministry of Finance provided clarifications on advance payments and deductions in the Platon system (Letter of the Ministry of Finance dated January 26, 2017 No. 03–05–05–04/3747).

The main innovations for 2021 in TN relate to the Platon system

What happens if you don't pay tax?

Transport tax is one of the property taxes, the payment of which, as a general rule, is made before December 1. If this date falls on a weekend, the deadline for receipt of payment by the Tax Office is postponed to the next business day.

In case of non-payment, the Federal Tax Service begins the collection procedure. First, the debtor will be notified of the need to pay, and then the withholding will be made on the basis of a court order. If the tax is not paid on time, you will also have to pay a penalty - 1/300 of the Central Bank rate of the debt amount for each day of delay.

Court order and trial

From the moment the debt is formed, the tax office will send you relevant notifications for 3 months. If this does not encourage you to make a payment, the Federal Tax Service will begin preparing documents to go to court. In this case, no trial is carried out; the participants in the process are not called into the courtroom. The magistrate single-handedly reviews the submitted documents and issues a court order, within which the tax service has the right to:

- Seize property

- Write off funds from the debtor's accounts (if the debt is small).