Rosstat collects and analyzes information about the country's economy. Additionally, the government structure summarizes information about the environmental situation, demographics and social situation. Not only legal entities, but also individual entrepreneurs are required to submit reports to the department reflecting actual indicators. Documents are sent to statistics as part of selective or continuous observation.

Content

- Regulatory reporting

- Do individual entrepreneurs need to submit reports to statistics?

- How to find out when you need to submit a report

- How reports are submitted

- What kind of reporting does the individual entrepreneur submit to statistics?

- Contents of reporting forms

- How to fill out reports correctly

- Reporting of an individual entrepreneur with no employees

- More details about deadlines

- Penalties

- Conclusion

Every year, Rosstat collects and analyzes data on the activities of companies in the Russian Federation. Therefore, entrepreneurs provide information about the results of their work. But this is not everyone’s responsibility; the final decision is made by Rosstat. Whether your company needs to do this and how reporting is done, we’ll talk today.

Where to find out about the obligation to submit reports to Rosstat

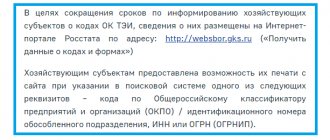

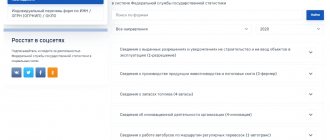

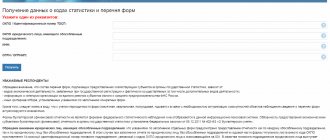

Statistical authorities are gradually abandoning the traditional notification procedure. Until 2015, persons included in the list of respondents were sent a letter. The notice was accompanied by forms for entering information and detailed instructions. Government Decree No. 381 amended the regulations. Now all forms are published on the Rosstat website. Paper forms will only be sent to the respondent upon written request.

Information on where and how to learn about responsibilities can be obtained on the World Wide Web. A special service https://statreg.gks.ru answers what kind of reporting needs to be submitted. The program is free and operates around the clock. Accessing it does not require registration or the use of an electronic signature.

Do individual entrepreneurs need to submit reports to statistics?

Individual entrepreneurs provide statistical reporting only in two cases:

- All small enterprises, and therefore individual entrepreneurs, must report once every 5 years;

- If Rosstat requests information from an entrepreneur.

Every year, only those who are representatives of large and medium-sized businesses (those with more than 100 employees) submit reports to statistics.

If you are on the Rosstat list, then the obligation to submit reports must be fulfilled monthly, quarterly or every year. It depends on what your company's turnover is.

Registering an entrepreneur with funds

After an individual submits documents for registration of an individual entrepreneur to the Tax Inspectorate and his application is approved, Federal Tax Service employees independently report information about the emergence of a new entrepreneur to the Pension Fund and RosStat.

After this, the Pension Fund of the Russian Federation sends the entrepreneur a notice of registration, which includes all the necessary information.

In the case of State Statistics, this happens very rarely.

As a rule, an individual must wait until the information on the website is updated and in this case he will be able to find his data or receive it by personally contacting this government agency.

Legal regulation

Registration of an individual entrepreneur with the State Statistics Service is carried out in accordance with Federal Law No. 129 “On State Registration of Legal Entities and Individual Entrepreneurs”.

What kind of reporting does the individual entrepreneur submit to statistics?

The following reporting forms must be submitted:

- MP (micro) - nature “Information about the production of products.” Annual. Available until 25.01 of the year following the reporting year;

- MP (micro) “Information on key performance indicators.” Annual. Available until 05.02 of the year following the reporting year;

- PM-prom “Information on production of products” . Available for rent if your business is a small business. Menstruation. The due date is the 4th day of the month following the reporting month;

- 1-IP “Information about the activities of individual entrepreneurs . All entrepreneurs whose field of activity is not related to agriculture report on it. Annual. Must be submitted by 02.03 of the year following the reporting year;

- 1-IP “Information on the activities of individual entrepreneurs in retail trade . Annual. You report if you provide services to the population or sell anything at retail. Deadline: until 17.10 each year;

- 1-IP (months) “Information on the production of IP products.” Menstruation. Due date: 4 working days following the reporting month;

- 1-IP (. Annual. Rented until 02.03 of the year following the reporting year.

Also, statistical authorities are provided with an annual balance sheet and financial report if the business is run by an LLC.

For a complete list of mandatory reporting, please check with the statistical authorities in your region.

What to do when changing the type of activity?

If you decide to change your main type of activity or additional ones, then to do this you need to contact the Tax Inspectorate with application P24001, which will indicate the new codes and exclude the old ones.

To enter new types of individual entrepreneur activities, you must use the first page of sheet E, and to remove unnecessary ones, including the main one, you should enter them on the second page of sheet E.

After transferring this information to the government agency, the entrepreneur will need to re-receive an extract from the Unified State Register of Individual Entrepreneurs and also print out the RosStat notification.

Self-registration of an individual entrepreneur requires payment of a state fee. What to do if an individual entrepreneur changes his registered address? Read here.

Is it possible to open an individual entrepreneur through the MFC? Detailed information in this article.

Update information

Information on the FSRS website is not updated as often as some users would like.

On average, this is done once every couple of months, so if the notification needs to be received urgently, then it is better for an individual entrepreneur to contact RosStat independently.

In this case, registering an individual entrepreneur in statistics will take five days and you will have all the necessary documents on hand.

Contents of reporting forms

The form contains the following sections:

- The title sheet;

- The first section is where you provide information about your company;

- The second section, which contains characteristics of the activity;

- You will fill out the third section only if your business received government support measures. In it you will need to clarify: do you know that the state provides support to individual entrepreneurs, if you have used it, indicate in what form it was provided: financial, informational or other.

As soon as you answer all the questions, sign, decipher your signature, indicate the date and contacts where you can be contacted if any questions arise.

Procedure

In order to obtain statistics codes, individual entrepreneurs need to contact the FSRS with:

- statement;

- a package of documents necessary for this procedure.

After five days, you can receive a notification when you contact a government agency again if it is needed urgently.

If there is no urgent need, you can simply wait for the information to be updated on the website and add your document there by printing it in the office or at home.

Currently, there are several ways to receive notification from the FSRS:

- when independently applying to this government agency;

- when choosing intermediary services;

- The organization itself sends a notification to the individual entrepreneur’s email.

But this option happens very rarely, so it’s better not to count on it.

Required documents

In order to receive statistics codes, an individual entrepreneur must submit the following documents:

- passport;

- extract from the state register of individual entrepreneurs;

- certificate of registration with the tax office;

- certificate of creation of an individual entrepreneur with an individual registration number.

A sample certificate of registration of individual entrepreneurs is here.

How to fill out reports correctly

There are key requirements for filling out information, violation of which is strictly not recommended:

- Do not connect sheets of forms together with paper clips or a stapler;

- Do not confuse the fields to fill out: enter all information in the appropriate lines;

- Write the numbers as required by the presented sample;

- If you made a mistake and discovered it yourself, correct it in the manner indicated in the report form;

- Do not use strokes or correctors;

- Do not use paper to cover marks.

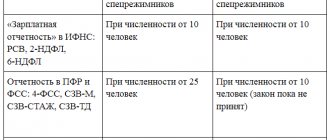

If you don't pass, then

If you miss the deadline for submitting the report, you will be fined. The minimum fine is 10,000 rubles. Maximum – 20,000 rubles. If the reporting deadline is not violated for the first time, the fine increases from 30,000 to 50,000 rubles. In general, it is difficult to miss the deadline, since you cannot forget about Rosstat; it itself sends you all the documents along with instructions for filling them out.

More details about deadlines

We have already mentioned reporting deadlines in today's conversation. Let us dwell on them in more detail, and also consider what the entrepreneur faces if they violate them.

So, when and what we hand over:

Ready:

- MP (micro) - in kind: until 25.01 of the year following the reporting year ();

- MP (micro): until 05.02 following the reporting year (Download form);

- 1-IP “Information on the activities of individual entrepreneurs”: until 02.03 of the year following the reporting year (Download form);

- 1-IP (services): until 02.03 of the year following the reporting year (Download form);

- 1-IP trade: until 17.10 of the year following the reporting year (forms).

Period:

- PM-prom: until the 4th day of the month following the reporting month (Download form);

- 1-IP: until the 4th day of the month following the reporting month (forms).

If you are late by at least a day, a fine will be generated immediately. If the deadline for submitting one of the reports is a weekend or non-working holiday, the deadline will be moved to the first working day.

Normative base

A list of legislative acts and current orders can be found on the official Rosstat portal. Regional departments also have websites on the world wide web. The regulatory framework is presented:

- Federal laws No. 282-FZ of November 29, 2007, No. 402-FZ of December 6, 2011, No. 209-FZ of July 24, 2007;

- government regulations No. 420 of July 2, 2008, No. 620 of August 18, 2008, No. 367 of May 26, 2010;

- by orders of Rosstat No. 618 dated November 27, 2012.

The list includes dozens of departmental orders, instructions and methodological recommendations. The legal framework is supplemented by regional documents.

What it is

Today there are a large number of different government bodies carrying out registration and other activities on the territory of the Russian Federation. One of the most important, solving a large number of different problems is Rosstat.

At the moment, Rosstat (formerly called Goskomstat) is a federal government body that generated statistical data in the following areas:

- social;

- demographic;

- environmental.

A mandatory function is also constant control in the field of statistical activities on the territory of the Russian Federation.

In addition to the functions indicated above, this government body carries out the following tasks:

- a list of various statistical data is presented to the following persons and institutions: the President of the Russian Federation;

- to the Government of the Russian Federation;

- Federal Assembly of the Russian Federation;

Moreover, this institution includes a fairly large number of different types of divisions.

At the moment, Rosstat includes the following:

- administrative management apparatus;

- Department of Statistical Observation Organization;

- management of summary works, as well as public relations;

- cost management, output;

- management of statistical data on prices and finance;

- enterprise statistics management;

- management of agricultural statistics;

- Department of Trade and Services Statistics;

- Department of Population Statistics;

- Department of Financial and Economic Development;

- management of the organization of the population census.

Also, another function that Rosstat implements is the registration of individual entrepreneurs. The procedure has some peculiarities. It is worth familiarizing yourself with them in advance if there is a need to carry out this procedure in this way.