The simplified system is known for fairly simple accounting and reporting. If an entrepreneur does not have employees, then he reflects his income and expenses in KUDiR, and once a year submits a declaration according to the simplified tax system. Individual entrepreneurs do not maintain accounting records; this is the responsibility of organizations only.

But if there are employees, then the individual entrepreneur on the simplified tax system is obliged to submit the same reports for employees as other employers, and it cannot be called simple. What do you need to pay, manage and submit to individual entrepreneurs with employees in 2021?

Considering that entrepreneurs do not need full-fledged accounting, by accounting for individual entrepreneurs we will mean only tax accounting and reporting for employees. Individual entrepreneurs’ reporting on the simplified tax system with employees in 2021 includes reports to the Federal Tax Service and to the Pension and Social Insurance funds. In addition, employers pay monthly insurance premiums for their employees. In this article we will tell you about what kind of reporting an individual entrepreneur submits to the simplified tax system with employees in 2021.

Types of reports

The legislation of the Russian Federation provides for private businesses to submit reports to several authorities. The types of reports, submission deadlines, and completion rules depend on the form of taxation and the availability of employees at the enterprise. Thus, according to Order of the Ministry of Finance of Russia No. 66 n dated 07/02/2010 (as amended on 03/06/2018), the main types of declarations for all individual entrepreneurs are:

- Tax returns : forms 2-NDFL, 3-NDFL, 4-NDFL, 6-NDFL, VAT.

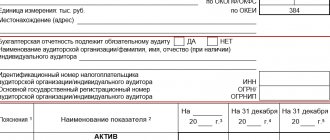

- Financial or accounting statements. Includes a balance sheet (OKUD 0710001), financial results (OKUD 0710002), reports on changes in capital (OKUD 0710003) and on the movement of material assets (OKUD 0710004), 4-FSS.

- Statistical reporting. These are questionnaire forms that entrepreneurs submit monthly or quarterly to the Federal Statistics Service of the Russian Federation (Rosstat). The contents of the questionnaires help to identify the main problems in the field of trade and services in a certain sector, as well as track the timely payment of funds to the tax budget. Mandatory forms for submission regardless of the taxation scheme (SNO): 1-IP, 1-IP (trade), PM-industrial.

- Zero reporting. The report is submitted if there were no cash turnovers in the tax period. If the enterprise has employees, then reports on insurance premiums are submitted to the Pension Fund (SZV-M) and the Social Insurance Fund (4-FSS) in any case.

According to Art. 6 Federal Law No. 402 of December 6, 2011 (as amended on July 29, 2018), an individual entrepreneur running a private practice is allowed not to keep accounting records, and accordingly, nothing needs to be submitted. But the businessman is obliged to keep records of the receipt of funds and expenses, which is reflected in a specialized book.

Sometimes it is more convenient for an entrepreneur to report to Rosstat and the Federal Tax Service, then it is preferable to use a simplified method of accounting, which includes reporting financial documentation.

Taking into account tax obligations to the state, the businessman reports to the tax authorities, as well as Rosstat, with a minimum reporting package.

Help 2-NDFL

At the end of the year, information about the withholding and payment of personal income tax from employees must be submitted to the Federal Tax Service in certificate 2-NDFL. The certificate form was approved by Order of the Federal Tax Service No. ММВ-7-11/566 dated 10/02/2018.

Form 2-NDFL is a certificate for each employee about how much the tax agent paid him and how much tax he withheld for the past year. Ibrahim must submit this document no later than April 1.

However, if for some reason the tax agent could not withhold personal income tax, he must report this no later than March 1.

An employee or contractor of a company may need a 2-NDFL certificate. And the employer must issue it:

- to an employee - upon oral or written request - within three days from the date of application;

- an individual who received a payment subject to personal income tax from the company - within 30 days from the date of application.

Also, an income certificate is provided to an individual on the day of dismissal from the company.

If Ibrahim is late in submitting 2-personal income tax to the tax office, Evgeniy’s company may be fined under Art. 126 of the Tax Code of the Russian Federation for 200 rubles for each document that was not submitted on time. That is, Evgeniy will have to pay a fine of 600 rubles (200 * 3). Not much, but if the staff grows, so will the fine.

Note: Individual entrepreneurs without employees do not need to submit a 2-NDFL certificate. If the company employs 25 people or more, the report is submitted in the form of an electronic document and signed by a qualified electronic signature.

What reports do individual entrepreneurs submit with and without employees?

The Tax Code of the Russian Federation explains each type of taxation scheme and types of reporting documentation. The entrepreneur submits declarations and fills out forms for tax and statistical services, depending on the SSS.

Not every private business owner can use a certain scheme, since some areas of employment are not designed for a specific aid to navigation system. For example, agricultural production is carried out only according to the Unified Agricultural Tax. The table below explains the types of reports that correspond to each type of tax scheme.

| SNO | Mandatory reporting for individual entrepreneurs without employees | Additional reports of individual entrepreneurs with employees |

| USN (Chapter 26.2 of the Tax Code of the Russian Federation) |

|

|

| PSN (Chapter 26.5 of the Tax Code of the Russian Federation) | ㅡ |

|

| UTII (Chapter 26.3 of the Tax Code of the Russian Federation) |

|

|

| Unified Agricultural Tax (Chapter 26.1 of the Tax Code of the Russian Federation) | KND 1151059 |

|

| BASIC |

|

|

A zero declaration is submitted by individual entrepreneurs working under the simplified tax system, according to the approved form KND 1152017. When funds flow during the tax period, the form is a full report, and if the indicators are zero, it is zero.

How many employees can an individual entrepreneur hire?

An entrepreneur can hire as many employees as required by law, taking into account the type of business activity. For example, if a company operates on a patent, it can hire no more than 15 employees. On the simplified tax system and imputation - no more than 100 people.

If an individual entrepreneur employs more than 100 people, then he is no longer on the simplified tax system, but on OSNO - the main taxation system.

Filing reports between individual entrepreneurs and employees is complicated by the number of these same employees. The more there are, the more difficult it is to submit reports to individual entrepreneurs. In large companies, reports are submitted by a staff of accountants. Small companies do not have the opportunity to maintain an accounting department, so they hire a remote accountant, whom they contact only when necessary.

individual entrepreneur reporting with employees in 2021 individual entrepreneur reporting for employees in 2021 individual entrepreneur reporting with employees individual entrepreneur reporting to the Pension Fund for employees individual entrepreneur reporting on PSN with employees reporting to the Pension Fund individual entrepreneur with employees reporting for individual entrepreneurs in 2021 individual entrepreneur reporting with employees in 2021 sourcing will be 5 times cheaper than acquiring sourcing will be five times cheaper than acquiring free employee search sites in Moscow is it worth looking for a job during coronavirus is it possible to find a job during quarantine is it possible to find a job during coronavirus is it possible to get a job during coronavirus is it worth it is it possible to change jobs during the coronavirus period is it worth changing jobs during the coronavirus period is it possible to get a job during the coronavirus period is it possible to get a job now coronavirus is it possible to get a job during the coronavirus period will there be remote work due to coronavirus reporting services for individual entrepreneurs is acquiring subject to VAT on the general taxation system, a cash register when applying a simplified taxation system, a patent taxation system for self-employed citizens, a cash register under a patent taxation system, a simplified taxation system, a cash register, a bill on the taxation system for the self-employed, a new taxation system for the self-employed, a taxation system for self-employed citizens, a special taxation regime for self-employed citizens, a taxation system without a cash register reports simplified taxation system self-employed new taxation regime taxation regime for the self-employed taxation system for the self-employed taxation project for the self-employed self-employed tax from renting out an apartment declaration for self-employed persons tax for self-employed citizens of the Russian Federation how the tax will be calculated tax for self-employed citizens of the Russian Federation 2021 in which regions the tax for self-employed citizens of the Russian Federation 2020 what is this tax for self-employed citizens of the Russian Federation 2021 what does this mean tax for self-employed citizens of the Russian Federation 2021 types of activities how the tax will be levied on self-employed citizens of the Russian Federation tax on self-employed citizens 2021 law income bracket tax on self-employed citizens of the Russian Federation how the tax will be calculated for self-employed citizens of the Russian Federation 2021 who will be affected by the tax for self-employed citizens of the Russian Federation 2021 what is this tax deduction 18,000 per KKM NK self-employed definition in NK accounting for LLC on USN without employees CCP for UTII without employees UTII without employees cash desk fines for self-employed workers not registered with the tax authorities individual reporting entrepreneur without employees can the self-employed hire workers self-employed population taxes and contributions in 2021 will the self-employed pay contributions to the Pension Fund contributions to the Pension Fund for self-employed citizens contributions to the Pension Fund of the self-employed 2021 self-employed contributions to the Pension Fund can the SNT accept contributions to the cash desk do self-employed citizens have to pay insurance premiums do self-employed people pay insurance premiums during the pension period of registration of the contract currency control is an individual entrepreneur obliged to keep accounting records is an individual entrepreneur required to keep accounting records how to keep accounting records for an LLC on UTII accounting for a cash register when using the usn accounting for interest on an overdraft usn accounting for the income of the self-employed agreement in foreign currency payment in rubles accounting with the buyer information from the Federal Tax Service of Russia on registering self-employed citizens agreement in foreign currency payment in rubles accounting with the supplier loan agreement between legal entities accounting and tax accounting non-cash conversion transactions on behalf of the client and their accounting register the cash register in tax documents, accounting for bank guarantees from the principal in accounting, registering a cash register for tax accounting of bank guarantees from a beneficiary according to IFRS, how to register as a self-employed person, how to register as a self-employed citizen, a cash register for UTII, from which year should it be withdrawn? a cash register with accounting, is it necessary to use a cash register for UTII, is it necessary to have a cash register for the USN? is it necessary to use a cash register for the USN? is it necessary to use a cash register for the USN? is it necessary to register a cash register for the USN? interest monthly for the lender what is needed to close a bank account for a legal entity what is needed to open a bank account for legal entities payment by acquiring do you need to punch a check at the cash register online what is needed to take out a loan for a business from scratch bookkeeping LLC on the basis independently basic services to the population cash register accounting for overdraft on the basis of how to withdraw z report on a cash register how to withdraw z report on a cash register report to the bank on currency transactions how to withdraw a report on a cash register what is the name of the salary card account for the declaration payment of insurance premiums by the self-employed population self-employed payment of insurance contributions what fine for self-employed citizens of the Russian Federation there is a black list of the Central Bank of the Russian Federation for legal entities of the Russian Federation insurance of deposits of legal entities in banks of the Russian Federation 2020 changes amount when the law on self-employed citizens in the Russian Federation comes into force banks of Russia reliability rating 2021 Central Bank of the Russian Federation for today the bill on self-employed citizens of the Russian Federation when will it come into force how to deregister a cash register from the tax register in 2021, a cash register for an LLC on the USN law until 2021, do you need a cash register for an LLC on the USN in 2021, online cash register for the USN in 2021, changes, latest news, the use of cash registers for the USN in 2021 for an LLC cash register machine for LLC with USN in 2021 online cash registers for LLC with USN in 2021 online cash registers for USN in 2021 latest news control of income of the self-employed bank guarantee to ensure the execution of the contract 44 Federal Law terms article bank guarantee to ensure the execution of the contract 44 Federal Law terms bank term guarantees under 44 Federal Laws 2 months the income tax of self-employed will be 4 percent law on self-employment of the population 2021 how to calculate these 4 percent requirements for a bank guarantee under 44 Federal Laws in 2021 changes in the bank guarantee from 2021 under 44 Federal Laws changes in the bank guarantee under 44 Federal Laws in 2021, a bank guarantee to ensure the execution of a contract 44 FZ what is a cash register online cash desk under Federal Law 54 with a fn included which banks have the right to issue bank guarantees under 44 FZ the return period for a bank guarantee under 44 FZ when securing a contract accounting for an LLC on the eskhn independently term the validity of the bank guarantee is less than the deadline for submitting applications; the deadline for submitting supporting documents for currency control of the LLC on the usn income minus expenses buying a car on credit expenses for online cash registers with the usn income minus expenses payment of the bank guarantee with the usn income minus expenses income tax for self-employed Russians how they will control income self-employed how will they track the income of the self-employed self-employed what is it to the tax office cash registers with the transfer of data to the tax office what data is transferred to the tax notice of self-employment in the tax fine 1 of the amount of the bank guarantee limit fine for self-employment in the full amount of income fine for failure to provide documents in currency control currency control fine for violating the delivery deadline what is the fine for working without a cash register? A cash register is not registered in the tax system fine fine for accepting cash without a cash register loan between legal entities with or without VAT interest under a loan agreement between legal entities is subject to VAT VAT when commodity loan between legal entities loan agreement between legal entities VAT is subject to VAT in a loan agreement between legal entities loan in goods between legal entities VAT interest-free loan between legal entities VAT how to deregister a cash register with the tax authorities in 2021 how to deregister a cash register in 2021 currency control deadlines providing documents 2020 law on self-employed citizens of Russia for 2021 types of activities law on self-employed citizens from January 1, 2021 text law on self-employed citizens of Russia for 2021 latest news top 10 banks of Russia according to the Central Bank for 2021 top 30 banks of Russia according to the Central Bank for 2021, the top 50 banks of Russia according to the Central Bank for 2021 for which types of activities until 2021 you do not need an online cash desk requirements for banks issuing bank guarantees from January 1, 2021 assistance to small businesses from the state in 2021 1,000,000 rubles self-employed citizens taxation in 2021 reviews and types of activities open a bank account for LLC in 1 day requirements for banks issuing bank guarantees from June 1, 2021 open a bank account for a legal entity in 1 day open a bank account for legal entities in 1 day how to close a bank account for a legal entity in 2020, the minimum interest rate under a loan agreement between legal entities in 2021, the minimum interest rate on loans between legal entities in 2021, a bank guarantee from 07/01/2021 to 44 Federal Laws, opening a current account for an LLC, deadlines from the date of registration, opening a current account for an LLC after registration, closing deadlines bank accounts of a legal entity deadlines for closing a current account upon liquidation of an LLC deadlines for Sberbank to open a current account for an LLC deadlines for returning money through the terminal to a card deadlines for opening a current account for an LLC deadlines for online cash register news exceptions and deadlines for online cash registers for medical institutions deadlines for providing information on currency operations, currency control, deregistration of a contract with a bank, how to remove a cash register from tax registration, remove a cash register from tax registration, type of bank cash register intended for accounting for money, deregistration of a cash register from tax registration

What is KUDiR

KUDiR ㅡ book of accounting of income and expenses, necessary for participants of the simplified tax system. Entries are made in the book in accordance with the requirements of Order of the Ministry of Finance of Russia No. 135 n dated October 22, 2012 (as amended on December 7, 2016). The document includes a title page and five sections, which reflect:

- sales revenue and costs of the enterprise;

- calculating the costs of purchasing and creating funds, which are taken into account when calculating the tax base;

- calculation of the loss in the total amount, which leads to a reduction in the duty;

- other expenses that reduce the amount of tax;

- a trade tax that reduces the tax that is calculated to be paid.

Depending on the type of “simplified” document, the entrepreneur fills out different departments of KUDiR. On “income” ㅡ 1 and 4, on “income minus expenses” ㅡ 1, 2, 3. The fifth is drawn up by entrepreneurs who are subject to the trade fee.

KUDiR is maintained electronically or on paper. Every year a businessman starts a new book, and prints out the old one, laces it and numbers it. On the final page, the end date is indicated, the entrepreneur puts a signature and, if any, a seal.

Insurance premiums

Evgeniy withholds personal income tax from employee salaries, that is, he reduces payments by the amount of tax. But he must pay insurance premiums himself. From business money or personal funds, he must fulfill his obligations to the team he hired.

Insurance contributions must be made monthly. Money is transferred to the Federal Tax Service and Social Insurance Fund every month. What are these payments?

- 22% - for compulsory pension insurance. Reduced to 10% if the total amount of payments to the employee during the year exceeds the limit. For 2021, the limit of 1,150,000 rubles was established by Government Decree No. 1426 of November 28, 2018.

- 5.1% - for compulsory health insurance.

- 2.9% - for compulsory social insurance in case of temporary disability and in connection with maternity. Just like pension contributions have a base limit. As soon as payments in 2019 reach 865,000 rubles, contributions are no longer accrued until the end of the year.

- From 0.2 to 8.5% - contributions for injuries. They pay for employees signed under an employment contract, as well as for contractors whose contract contains such a condition. The amount of the contribution depends on the professional risk group of the enterprise.

Ibrahim will transfer contributions for injuries to the Social Insurance Fund, the rest - to the Federal Tax Service. Then the tax office will distribute the money among the funds.

The occupational risk group and the amount of contributions are indicated in the “Notice on the amount of insurance contributions for compulsory social insurance against accidents at work and occupational diseases” from the Social Insurance Fund. It is issued upon registration, and then upon annual confirmation of the main type of activity. True, the individual entrepreneur confirms the type of activity only when it changes.

Contributions must be remitted monthly. The last day is the 15th of the next month. If it falls on a weekend or non-working holiday, then the end of the period is considered to be the next working day following it.

Report submission deadlines

The businessman is not warned about the deadlines for filing declarations. Each report is submitted within the period approved by the Legislation of the Russian Federation. The period is also affected by the type of aid to navigation. The balance sheet OKUD 0710001 and reports on financial results OKUD 0710002 are submitted at the end of the year. Only those individual entrepreneurs who conduct accounting submit reports. The main declarations for each tax scheme are submitted within the deadlines approved by the Tax Code of the Russian Federation. Each declaration is submitted in the month, quarter or year that follows the reporting year. Deadlines for submitting reporting documentation for individual entrepreneurs:

- Declaration of the simplified tax system KND 1152017 ㅡ annually until April 30.

- PSN are reported only “by employees”, if any. These are reports from 4-FSS, SZV-M. The due dates are listed below.

- Declaration of UTII KND 1152016 ㅡ quarterly until the 20th of the month.

- Declaration of Unified Agricultural Tax KND 1151059 ㅡ annually until March 31 of the year.

- The main declaration for OSNO ㅡ VAT ㅡ is submitted quarterly by the 25th of the month.

Other reports:

- 3-NDFL ㅡ until April 30 of each year.

- 4-NDFL is submitted upon receipt of the first revenue.

- 6-NDFL ㅡ until the last day of the month following the reporting period.

- 4-FSS “on paper” ㅡ monthly until the 20th day of the month following the reporting month; in electronic form by the 25th day of the month following the reporting month.

- SZV-M ㅡ before the 15th of each month after the reporting month.

- 1-IP ㅡ annual report, which is submitted no later than March 2 of the year following the reporting year.

- PM-PROM ㅡ monthly no later than the 4th.

The deadlines for filing declarations change almost every year. Therefore, it is worth monitoring current information on specialized resources.

Tax reporting of individual entrepreneurs on OSNO

Based on the above, what kind of reporting does an individual entrepreneur submit to the tax office first? When registering an entrepreneur, such a document will be form 4-NDFL. It is based on the amounts of estimated income indicated in it that the tax inspectorate will calculate the amount of advance payments for income tax. The calculation is based on:

- The amount of monthly income received multiplied by the number of months of work in the current year (for new individual entrepreneurs).

- The amount reflected in the 3-NDFL declaration (for existing individual entrepreneurs). At the same time, the indicators of forms 4-NDFL and 3-NDFL are compared. And if the estimated income turns out to be half that received last year, then the basis for calculating advance payments is taken from the real figures from the 3-NDFL declaration.

Special rules regarding filling out the 3-NDFL declaration:

- it can be filled out by hand, but the handwriting must be large and legible;

- the tax amount is reflected only in rubles (without kopecks);

- In empty columns, dashes must be placed.

The VAT return takes into account information obtained from invoices, the purchase and sales ledger, and other registers containing tax amounts. The peculiarity of filing reports for this tax is that it is submitted only electronically. If you submit a declaration on paper, it will be accepted by the tax office, but the entrepreneur will be fined.

Sample forms for submitting tax reports for individual entrepreneurs in 2018 were slightly modified. An updated sample VAT return was adopted. In it, some lines are combined, which simplifies its completion and at the same time requires careful attention from the accountant. The changes affected the obligation of entrepreneurs to provide a clarifying document to the declaration, which reflects corrections in reporting for previous years. The table of tax adjustments and the line of tax liabilities are now maintained in a simplified form.

VAT is calculated by a simple step: the amount to be deducted is subtracted from the amount to be charged. Property tax is calculated based on the amount and rate not exceeding 2 percent. This payment affects the entrepreneur's personal property used to generate profit.

Penalties for late submission

According to Art. 119 Federal Law No. 146 of July 31, 1998 (as amended on August 3, 2018) of the Tax Code of the Russian Federation, part 1, if an individual entrepreneur does not submit one or another tax return on time, then the businessman is subject to a fine of 5% of the accrued duty amount. In case of long delay ㅡ more than a month ㅡ 30% for each overdue month, but not more than 1000 rubles.

According to Art. 13.19 Code of Administrative Offenses of the Russian Federation, punishment of individual entrepreneurs for late statistical reporting (PM-PROM, 1-IP, 1-IP (trade)):

- for a primary offense ㅡ 10,000 − 20,000 rubles;

- for secondary ㅡ 30,000 − 50,000 rubles.

Delay in filing reports with the Pension Fund of Russia (SZV-M) is punishable by a fine of 500 rubles for each insured citizen. Conducting a private business, regardless of the taxation scheme, does not reduce the entrepreneur’s responsibility to tax and statistical authorities, but reduces the requirements for the amount of documentation. The choice of SNO directly affects reporting, but not every taxation scheme applies to the chosen area of activity.

Calculation and deduction of personal income tax

Not only companies, but also individuals share income with the state. This is done by withholding income tax - personal income tax on the income of individuals. The tax rate is generally 13%.

If an individual is an employee or contractor of a company, then the employer or customer becomes the tax agent of this individual. She must calculate, withhold and transfer the tax on the employee’s salary to the Federal Tax Service.

Note: a contractor with the status of an individual entrepreneur himself must calculate and pay personal income tax on income for a contract that is paid for by the customer, be it another individual entrepreneur or organization.

But let's get back to our dumplings. Evgeny spends 80,000 rubles on salaries, including tax: he pays 50,000 to Ibragim, 30,000 to apprentice Nikita. He transfers his salary twice a month, in accordance with Art. 136 Labor Code of the Russian Federation.

Personal income tax is calculated on the full amount of the salary, but is transferred only once a month - no later than the next day after the payment of salaries for the month. If this day falls on a weekend or official holiday, the payment is postponed to the next business day.

Personal income tax on vacation pay and sick leave must be transferred to the budget no later than the last day of the month in which the income was paid.

So how much money will Evgeniy’s employees receive in their hands for a full month?

Let's calculate Nikita's salary: 30,000 – 30,000 * 13% = 26,100 rubles

And now Ibrahim’s salary: 50,000 – 50,000 * 13% = 43,500 rubles

Both replenish the budget monthly by the amount:

3,900 + 6,500 = 10,400 rubles

Evgeniy also pays 6% on the individual entrepreneur’s income minus expenses, because he uses the “Income minus expenses” tax regime. Last month he paid 7,080 rubles.

Where do these 17,480 rubles go every month? For the work of kindergartens, schools, police and courts, for road repairs and social programs, support for the poor. Taxes go mainly to the budget of the region where the company is registered.

Ibrahim explained all this to Evgeny and Nikita. And Evgeniy promised that soon Ibrahim would receive 50,000 rubles in his hands, and Nikita - 30,000 rubles. How to calculate personal income tax based on a given salary value? Ibrahim will explain with his own example.

To do this, you need to divide the amount of salary that you plan to pay in person by the difference between 100% and 13%:

50,000: 87% = 57,470 rubles

So, the tax was calculated and transferred to the treasury. What's next? Ibrahim will report on the performance of this duty to the Federal Tax Service.

Individual entrepreneurs

So, first of all, you need to understand why it is possible for an individual entrepreneur to reduce the tax percentage from six to zero. This can be done because Article 346.21 of the Tax Code of the Russian Federation applies in the simplified taxation system.

It reads: “Taxpayers who have chosen income as an object of taxation reduce the amount of tax (advance tax payments) calculated for the tax (reporting) period by the amount...”.

This is achieved through different insurance premiums. It works like this: the taxpayer makes small amounts of insurance contributions throughout the year, and when he submits reports as an individual entrepreneur without employees, he reduces the tax by the amount of these payments.

Individual entrepreneur reporting to Rosstat

Since statistical authorities collect data on the activities of companies, individual entrepreneurs also need to report to them on their activities. But there is one point here - not all entrepreneurs are required to report to Rosstat, but only those that are on its lists. And here a fair question arises - how to find out that an individual entrepreneur is on these lists? Everything here is extremely simple - Rosstat itself will send a notification, all the reporting forms that need to be filled out, and even instructions for filling them out. The frequency of reporting depends on the size of the business. Individual entrepreneurs that are not on Rosstat’s lists report once every five years.

Statistical authorities study and collect information on the performance of enterprises

Methods for filing patent reports

If we consider the methods of submitting reports, there are no special features for individual entrepreneurs working on a patent. You just need to take into account that tax reporting in the form of an Income Accounting Book is submitted to the Federal Tax Service only upon a separate request from the tax authorities.

Otherwise, all methods are no different from the generally accepted ones:

- all reports (for example, 6-NDFL for employees) can be submitted in person by visiting the tax office at the place of registration of the individual entrepreneur, in this case it is recommended to have a flash drive with reports uploaded to it; tax authorities are increasingly demanding an electronic format when submitting;

- the second way of reporting is through electronic document management; for this purpose, both in extrabudgetary funds and, naturally, in the Federal Tax Service of the Russian Federation there are special software products;

- There is also an “old-fashioned”, but working way - to send reports by Russian Post, the letter is issued with a notification and a mandatory list of attachments, of course, this is the longest method, but the period indicated on the postmark is confirmation of the submission of the reports.

According to the requirements of tax authorities, if the number of employed employees of a commercial enterprise does not exceed 25 people, then all reporting can be submitted, including on paper, but strictly according to approved machine-oriented forms. That is, any report can be filled out by hand, or you can enter all the data on a computer, send it to print and endorse it. Since the staff of an individual entrepreneur on a patent cannot exceed 15 people, accordingly, there are no restrictions on the method of submitting calculations. The electronic method is only welcomed by tax authorities.

Reporting on other taxes

Since individual entrepreneurs can conduct almost any activity, in the process they have obligations to pay and submit reports on other taxes. For example:

- transport tax,

- land tax,

- water tax,

- payments for the use of subsoil.

Transport and land taxes are paid by individual entrepreneurs based on notifications from the tax authority. There is no need to file returns for these types of taxes.

The water tax declaration is submitted quarterly, as are calculations of payments for the use of subsoil.