Any business activity is based on close cooperation with counterparties, as a result of which accounts receivable and payable obligations are formed in accounting. A significant excess of these indicators in the balance sheet indicates a deterioration in the financial situation and the emergence of a risk situation. Therefore, companies must periodically reconcile and seek debt reduction by any means possible. In particular, it is important to know how debt adjustment is carried out, what the documentation procedure is and the consequences for the organization.

Debt adjustment

Select the “Debt Adjustment” item in the 1C 8.3 “Purchases” or “Sales” menu.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Create a new document from the list form that opens and fill out the header. The most important field is “Type of operation”. Depending on it, the composition of the fields changes. Let's look at these types in more detail:

- Settlement of advances. This type is selected if it is necessary to take into account advances in mutual settlements.

- Debt offset. Selected if it is necessary to change mutual settlements against the debt of the counterparty to us, or a third party.

- Transfer of debt. This type is necessary for transferring debts, advances between counterparties or contracts.

- Debt write-off. This implies complete write-off of the debt.

- Other adjustments.

Types of tests

As mentioned earlier, the adjustment is a universal document for recording movements in receivables and payables. For a detailed and clear understanding, let us consider the scope of application of the operation using specific examples.

The need to adjust debt may arise due to an accounting error

Error correction

In practice, situations quite often occur when a double balance is formed, that is, at the same time there is a debt on the debit and credit of the same account in the context of the same subaccount. Such a picture will arise in accounting if the time sequence of recording business transactions in the automated program is violated, or the accountant did not process the document in a timely manner.

For example, a supplier’s invoice for the supply of materials has been received, and accounts payable have been generated according to account 60. After a certain time, the specialist received a bank statement and reflected the execution of the payment order confirming payment for the purchase on the same day as the delivery. As a result, we have a creditor and a debtor for the same client.

You can correct a technical defect by re-posting the documents, but such actions will be incorrect if the error is discovered after the closing of the reporting period. Then an alternative option would be to file a debt adjustment.

In fact, this operation will not in any way affect mutual settlements with the counterparty, but will bring the accounting data into line with reality. In order to protect yourself from further questions from inspection inspectors and conflicts with the other party, it is recommended to sign a bilateral reconciliation act. The form will confirm the absence of debt and show the actual balance under the contract.

The accounting service is recommended to regularly reconcile register data, monitor turnover on statements, and check the completeness and calendar order of documents.

Particular attention should be paid to operations when a certain balance is formed as a result of offset. For example, the debit shows the amount of debt equal to 300 thousand rubles, and the credit – 100 thousand rubles. Then, based on the results of completing the adjustment, the accounts receivable will amount to 200 thousand rubles. The company has the right to request from the debtor an invoice for the amount of the transferred advance and reflect the VAT deduction in the current period.

A more complex situation will arise if, according to settlements with customers, after the offset, there remains a receivable, that is, an outstanding advance received. In this situation, the specialist needs to reflect the transactions for calculating VAT and create a tax account. When an error is identified after the end of the reporting period, corrections will be required in the fiscal statements.

Settlement of mutual claims

There are often situations when, as a result of close cooperation, outstanding obligations of the parties arise under different contracts. The best option for closing the debt is to sign a netting agreement. In this case, the terms of the agreement are indirectly fulfilled, and the balance sheet data of the parties becomes reliable.

For example, company K has a debt to company M for renting premises. At the same time, M hires a vehicle from K to transport goods. Based on the situation, it is obvious that a false picture of the financial position of enterprises, the structure of assets and liabilities is being formed. The parties sign an agreement on mutual settlement.

The accounting department of both companies makes adjustments and pays off the loan obligation with debit turnover. As a result, the service provider will not require payment for transport, and the owner of the premises will pay the rent arrears.

Debt adjustment is carried out upon concluding an agreement on the repayment of mutual claims

It is important to take into account all possible nuances:

- The presence in the main contracts of a clause allowing for similar operations.

- Scope of mutual requirements.

- Legality of the transaction.

- Documentary written confirmation of the operation, etc.

Third party participation

One of the options for repaying accounts payable can be considered payment to a third party for the obligations of the counterparty. For example, a supplier has a payable arrears from a buyer, to whom another client, in turn, did not fulfill the agreement. Then the third party, by prior agreement, transfers the money directly to the supplier. As a result, the debt is repaid simultaneously to two participants in the relationship.

A similar picture can emerge in another situation: the contractor writes a letter to the customer demanding that he pay a certain amount to his supplier using the specified details (for example, for electricity). The addressee of the request invites his direct buyer to pay. Then a triple offset is formed: between the buyer and the customer under the current contract, the client and the contractor, the contractor and the electricity supplier. These operations are associated with a high risk, since inspection authorities may consider them fictitious and illegal.

This method must be used especially carefully in a situation where the company has a large tax debt to the budget and is also undergoing bankruptcy proceedings.

Assignment

A frequently used method of replacing persons in an obligation is an assignment agreement. The procedure is regulated by Article 382 of the Civil Code of the Russian Federation and involves the transfer of obligations from one person to another.

For example, an enterprise has a debt to an audit firm, and there is a third-party company interested in formalizing the assignment of debt. If the terms of the contract do not prohibit the assignment, the creditor may unilaterally enter into an agreement with the new lender. In this case, the assignor (auditor) must inform the debtor about the concluded transaction.

The accounting of each participant in the relationship reflects the business transaction through a document. The assignee or defaulter will keep records of mutual settlements in other arrears accounts. The amount of debt and the main terms of the previous agreement continue to apply.

Transfer

A common life situation is incorrect filling out of payment and other primary documents, when the parties to the agreement have different accounting information. Then the shortcoming can be corrected by transferring the counterparty’s debt from one agreement to another in a debt adjustment.

For example, the lessee has several existing contracts with the owner of the instrument. The recipient of the service makes a payment and mistakenly indicates another agreement in the order. At the same time, in the payer’s accounting, the payment covers the creditor, and the lessor has the money listed in another subaccount. Discrepancies are identified through reconciliation. By agreement of the parties, the difference will be eliminated by transferring payment from one agreement to another.

Adjustments are necessary if services are provided to repay the debt

Replacement of obligations

Based on Art. 409 of the Civil Code of the Russian Federation, an outstanding debt can be closed by mutual agreement of the parties by providing compensation. The subject of the transaction is cash, inventory, real estate, transport, other property and intangible assets (Article 128 of the Civil Code of the Russian Federation).

The law does not impose special requirements on the content of the agreement. That is, the parties are guided by generally established criteria for confirming a transaction: they make it in writing, carry out state registration if there are legal grounds.

Let's give a specific example: organization B purchased lumber from company C, but was unable to fulfill its payment obligation on time due to a deterioration in its financial situation. The debtor has material and labor resources, so he offers the supplier to repair his warehouse premises in the form of compensation for arrears.

The defaulter's accountant will reflect the adjustment, repay the arrears, and record the difference in the direction of excess if the cost of the work performed exceeds the amount of obligations for the supplied goods and materials.

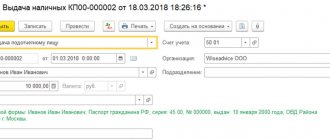

An example of writing off accounts payable in 1C 8.3

In our example, it is necessary to write off a debt of 3,000 rubles, which is owed to the supplier. There may be many reasons, but in this situation they are not particularly interesting to us.

Let's move on to filling out the main part of the document. This can be done automatically using the button of the same name, but keep in mind that there are two of them on the form. In this case, there is no difference, just as with the selected type of operation “Debt transfer”. In other cases, the “Fill” button, which is located at the top of the form, will fill in both accounts payable and accounts receivable.

Manual input is also available here. It is convenient in cases where adjustments are made based on one or two documents.

Everything was filled in correctly automatically. Our receipt of 11 chairs in the amount of 33,000 rubles appeared in the tabular section.

Now we will correct 33,000 rubles to the amount of our debt.

Next, fill out the “Write-off account” tab. In our example, we specified the account as 91.01. In the case where the debt is not with us, but with the counterparty to us, it is necessary to indicate account 91.02.

Transfer of debt

Also, situations often arise when one counterparty decides to pay the debt of another. In such situations, a debt transfer should be made. To carry out such an operation, you should indicate in the document, after selecting the desired operation, the counterparty whose debt obligations need to be transferred, then indicate the counterparty who will subsequently pay off the obligations.

Next, fill in all the necessary details: old and new agreement, accounting accounts, currency and others. It should also be noted that this type of operation will help not only transfer debt from one counterparty to another, but also transfer it between contracts. In this case, the columns “Buyer (supplier)” and “New buyer (supplier)” are filled in by the same counterparty, and different contracts are indicated.

If discrepancies are identified, why is there a need for adjustment?

Firstly, incorrect reflection of transactions in accounting, as well as their non-reflection, distorts information about the assets and liabilities of the organization, including in the financial statements. In this case, due to an accountant’s mistake, the business owner may receive incorrect information not only about his financial situation, but also about the organization’s property. Building a further business plan on such information is fraught with the ruin of the company.

Secondly, any error in accounting leads to a distortion of the tax base for any tax. This, in turn, becomes the reason for claims from the tax authorities in the form of additional taxes, penalties and fines. Inaccuracies that led not to an understatement, but to an overpayment of taxes, are also undesirable, because in this case the accountant unreasonably withdrew a certain amount of working capital from the company’s budget.

Briefly about how to correct an error in tax accounting

Be sure to do this in the tax register even if the distortion did not result in an understatement of tax.

If an error was identified from a previous period and it affected the tax amount or the tax base, we will correct it in the income tax return.

If an inaccuracy is identified for the current year, it can be corrected in the tax return of the next reporting period or for the year.

As a rule, errors from previous years are corrected by filing amended tax returns, but there are exceptions.

Causes of Bad Debt

Write-off of receivables taken into account for tax purposes applies only to companies on OSNO. Unfortunately, the “simplified people” do not have the right to accept it as expenses, which are strictly fixed in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. A prerequisite for writing off a debt is that it is hopeless to repay it.

There are three reasons why a debt may be considered bad:

- the end of enforcement proceedings because the bailiffs were unable to establish the whereabouts of the debtor or his property is not enough to repay the debt;

- the organization is liquidated;

- termination of an obligation due to impossibility of performance.

First: you won the court, it decided to collect the debt, the bailiffs received a writ of execution, but either the debtor disappeared and cannot be found, or there is simply no property that can somehow cover the amount. You can write off the debt. But anything can happen, suddenly a debtor shows up and is ready to answer for his obligations, paying you everything that is due. But you have already written off the amount in your accounting, so you need to include the received debt in other income (clause 7 of PBU 9/99).

Second: the debtor organization went bankrupt, was liquidated, an entry about this appeared in the Unified State Register of Legal Entities, there is no one to ask for, this very day is considered the date the bad debt arose. But it may also be that the organization simply stopped showing “signs of life”: during the year no reports were submitted, there were no transactions on bank accounts, and the tax office forcibly deleted it from the Unified State Register of Legal Entities. Although there was no court decision, you can recognize the debt as hopeless by referring to paragraph 2 of Art. 64.2 of the Civil Code of the Russian Federation and judicial practice (Resolution of the FAS VSO dated September 27, 2012 No. A19-8821/2011).

If an individual entrepreneur is declared bankrupt, the date the debt arose is considered to be the day the court makes such a decision. If you see in the Unified State Register of Legal Entities that the individual entrepreneur has been deregistered, this does not mean that you cannot recover the due amount from him, since according to Chapter. 26 of the Civil Code of the Russian Federation, an entrepreneur is liable for his obligations with all his property, which is why confirmation of his bankruptcy is necessary.

Third: the event is sad, but the IP died. According to the law, his relatives are liable for his debts, but only within the limits of the inherited property. For example, if they inherited 1000 rubles, then collect 5000 rubles from them. it won't work.

Of course, all sorts of frauds are possible, which lead to the fact that there is no legal possibility of acknowledging the debt, but this is regulated by another code.

When?

The period and timing of the reconciliation are determined only by decision of the parties. The only exception is the reconciliation for the year for final reporting - here the period will be counted either from the start date to the expiration date of the contract, or from the beginning of the calendar year (January 1) to December 31.

As part of mutual settlements between the parties, more than one reconciliation may be carried out. Consequently, periods can follow one another - at the end of the date of the previous reconciliation, the next report is generated. If a debt is identified, it must be taken into account as a debt at the beginning of the next period.

What wiring to use

Let's show it with an example. Let the results of the reconciliation reveal discrepancies in the recorded work in the report. The specialist reflected 10,000.00 rubles, but the work was performed for 15,000.00 rubles. Let's imagine the entries for adjusting data in the table:

| Wiring | Sum | Description |

| Dt 20 Kt 60 | 10 000,00 | Costs of work performed. This entry does not affect the financial result in any way, we do not adjust it |

| Dt 91 Kt 20 | 10 000,00 | Recognition of work costs as expenses. Affects the results of the report, correct the entry |

| Adjustment | ||

| Dt 20 Kt 60 | 10 000,00 | Wrong entry posted |

| Dt 20 Kt 60 | 15 000,00 | The correct transaction amount is indicated |

| Dt 20 Kt 91 | 10 000,00 | Recovery from expenses |

| Dt 91 Kt 20 | 15 000,00 | Accounting for the correct amount of costs for work performed |

How to register

As a general rule, based on the results of the debt analysis, a reconciliation act for mutual settlements is prepared. There is no unified form of the document, so the parties can use any form or develop their own, enshrining it in the accounting policy.

The report is drawn up for a certain reporting period. The document indicates all transactions of the parties, notes the date of the actions and the amount for each transfer. It is recommended to refer to accompanying and supporting documentation.

After reflecting mutual settlements, the amount of debt resulting from the discrepancy between payments is given. The register is signed by authorized persons from both parties.

Why is reconciliation with the counterparty necessary?

The legislation on accounting or tax accounting does not contain requirements for cases when reconciliation should be mandatory. It can be carried out:

- as part of the inventory of calculations and obligations when preparing the annual report;

- upon expiration of the contract to close settlements under it;

- to confirm accounts payable or receivable by the counterparty in order not to miss the statute of limitations for collection;

- to formalize the offset of mutual claims with a counterparty with whom you have several agreements, under which there are both receivables and payables;

- in other cases.

In addition, timely reconciliation of accounting data with the counterparty will help to avoid accounting errors. After all, if the debt according to your data and the data of the counterparty coincides, it means that all business transactions for this counterparty are correctly reflected in the accounting: there are no unrecorded acts or “double” payments. If the reconciliation reveals discrepancies, obviously one of the parties must adjust the debt.

What should the commission pay attention to?

When the commission considers each specific debt situation. She carefully pays attention to the presence of nuances that will not allow him to be considered hopeless. Among these features it is worth highlighting:

- there is a written conclusion on the recognition of the party’s debt;

- there is a reconciliation report signed by the parties;

- there is a letter from the individual entrepreneur acknowledging its debts;

- there is at least partial repayment of the amount, penalties or penalties;

- you have been contacted with a request to extend the payment period;

- there is a claim to collect the debt.

If a debt has the characteristics described above, its statute of limitations is calculated first, but within a ten-year period from the original date of its occurrence. This is a requirement of the Civil Code of the Russian Federation that cannot be missed.

How to fix

Accounting errors can be corrected. This is stated in PBU 22/2010. The order in which errors are corrected directly depends on whether they are significant or insignificant. Each organization determines the degree of materiality independently, not forgetting to reflect this in its accounting policies. Many organizations consider a significant error to be one that distorts reporting data by more than 5%.

Let's imagine the procedure for correcting errors in the table:

| Date of detection | Correction date | Legislative norm |

| Incorrect information was identified before December 31 of the reporting year | Corrections are made when an inaccuracy is detected | clause 5 PBU 22/2010 |

| Incorrect data detected on or after December 31st of the reporting year | The adjustment is made as of December 31 of the reporting year | clause 6 PBU 22/2010 |

| Minor error detected | Corrected upon discovery | clause 14 PBU 22/2010 |

To correct incorrect information, the accountant must correct erroneous accounting entries, create correct entries and draw up an accounting statement. It indicates the erroneous transaction, the date of its identification and the posting of debt adjustment according to the reconciliation report.

If incorrect accounting data does not affect the financial statements (balance sheet and income statement), then such inaccuracies are not corrected. If inaccuracies affected the indicators of retained and net profit in the final reporting, then the appropriate account corresponds with account 91 in the following order:

- Dt 02 Kt 91 - incorrectly calculated depreciation;

- Dt 91 Kt 02 - correct depreciation charges.

If any other balance values are affected, the erroneous transactions are reversed and the correct entries are made.