The KBK attribute (budget classification code) is used when making payments to the state budget and is a combination of 20 digits. The structure of the BCC remains unchanged; separate codes for budget revenues and expenditures are approved by orders of the Ministry of Finance (Ministry of Finance) of the Russian Federation. From the state’s point of view, the KBK helps to group income, expenses, sources of financing of the state budget, and also track the financial flows of legal entities. From the point of view of a company accountant, the KBK is necessary for the distribution of taxes, payments to the Social Insurance Fund, the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund, and various fines for the organization and its employees.

In practice, the KBK details are used by private individuals who pay for kindergartens (parental fees), schools, property taxes, and fines for administrative offenses (for example, traffic police fines). Legal entities use the KBK details to pay income taxes and pay contributions to state budget funds. Most bank-client systems automatically download the KBK number when generating payment orders, however, due to regular changes in details, accountants and individuals check the Federal Tax Service website to transfer funds.

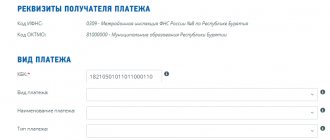

KBK is indicated in the Payee field of the standard form 0401-0460 (payment order), used by accountants of organizations. For individuals and organizations paying taxes on a receipt received from the Federal Tax Service (form PD-4), the KBK number is indicated on a separate line in the Recipient Details section.

Where is the KBK indicated in 2021?

The budget classification code must be indicated in payment orders when transferring taxes, fees, penalties, fines and other obligatory payments to the budget. In the current form of payment, given in Appendix 3 to the Bank of Russia Regulation No. 383-P dated June 19, 2012, field 104 is intended for KBK.

In addition, the BCC should be indicated in some tax returns: for income tax, for VAT, for transport tax (cancelled from 2021), as well as in the calculation of insurance premiums (DAM). This allows tax authorities to post payments according to ownership.

From January 1, 2021, indicate in your payment bills some new BCCs for taxes, fees and insurance fees, which were approved by orders of the Ministry of Finance of Russia dated June 8, 2020 No. 99n and dated November 29, 2019 No. 207n.

Budget classification - what is it and why?

In July 1998, the Budget Code of the Russian Federation in Federal Law No. 145 first introduced the term “KBK”, used as a means of grouping the budget.

There are 4 types of KBK:

- relating to government revenues;

- related to expenses;

- indicating the sources from which the budget deficit is financed;

- reflecting government operations.

What are KBKs used for?

- organize financial reporting;

- provide a unified form of budget financial information;

- help regulate financial flows at the state level;

- with their help, the municipal and federal budget is drawn up and implemented;

- allow you to compare the dynamics of income and expenses in the desired period;

- inform about the current situation in the state treasury.

INFORMATION FOR ENTREPRENEURS! KBK is an internal coding necessary, first of all, for the state treasury, where the distribution of incoming funds takes place. Entrepreneurs need these codes insofar as they are interested in complying with the requirements for processing government payments, especially taxes and contributions to extra-budgetary funds. Therefore, do not forget to indicate the correct and current KBK code in field 104 of the payment receipt.

Changes in KBK from January 1, 2021: new codes

From 2021 there are important changes to the BCC. In particular:

- approved by the KBK for a 15% personal income tax calculated on income exceeding 5 million rubles - 182 1 0100 110;

- The BCC was introduced for the payment of land tax in relation to plots located within the boundaries of municipal districts. It must be transferred to KBC 182 1 0600 110;

- BCC appeared to pay the tax levied in connection with the use of PSN, credited to the budgets of municipal districts - 182 1 0500 110;

- The BCC was introduced for the payment of mineral extraction tax on the extraction of other minerals, in respect of which a rental coefficient other than 1 is established for taxation, - 182 1 0700 110.

Order No. 236n dated October 12, 2020 added new BCCs for personal income tax, excise taxes and taxes, which form the budget of the new territorial division unit - the municipal district.

Let's summarize the new KBK-2021 in the table:

| PURPOSE OF PAYMENT | KBK 2021 |

Personal income tax | |

| Personal income tax withheld from income exceeding 5 million rubles. at a progressive rate of 15 percent | 182 1 0100 110 |

| Personal income tax on fixed income CFC | 182 1 0100 110 |

| Personal income tax on interest, coupon or discount on circulating bonds of Russian legal entities that are denominated in rubles and issued after 01/01/2017 | 182 1 0100 110 |

Excise tax | |

| Excise tax on ethane aimed at processing | 182 1 0300 110 |

| Excise tax on liquefied petroleum gas for processing | 182 1 0300 110 |

Municipal taxes | |

| PSN tax (patent) | 182 1 0500 110 |

| Property tax for individuals – for objects located on the territory of municipal districts | 182 1 0600 110 |

| Land tax from organizations - for plots located on the territory of municipal districts | 182 1 0600 110 |

| Land tax from individuals - for plots located on the territory of municipal districts | 182 1 0600 110 |

Other BCCs for basic taxes/contributions in 2021 remain the same.

Why are budget classification codes changing?

This is the cry from the heart of the vast majority of entrepreneurs: how much easier it would be if these codes were uniform and established once and for all. But the Ministry of Finance makes certain changes to the BCC almost every year. Entrepreneurs and accountants do not always have the opportunity to timely monitor innovations and correct the specified BACs, this is especially evident during reporting periods. Responsibility for incorrectly specified code lies entirely on the shoulders of businessmen, which often results in unexpected expenses and hassle in correcting the error and proving that they are right.

There are various versions put forward by entrepreneurs and the Ministry of Finance and the Ministry of Justice do not comment in any way.

- The more receipts passed through incorrect BCCs, the more funds will be “suspended” for some time as unknown. Until errors are corrected, they can be used for unseemly purposes, and on a national scale this is a huge amount.

- Additional filling of the budget by charging fines and penalties for “overdue” payments that were made through the already inactive BCC. Proving timely payment is quite troublesome.

- Inconsistency between the actions of the Ministry of Finance, which assigns codes, and the Ministry of Justice, which approves them.

- Since the KBK is directly “tied” to the public sector, any changes within the relevant structures, the receipt of new directives, etc. lead to a change in coding.

FOR YOUR INFORMATION! There are opinions that since this coding is an internal matter of the Treasury, it should be done by them, and not by taxpayers. The KBK code can be assigned by bank employees based on the specified data about the recipient and purpose of the payment, or by treasury employees upon receipt of it. However, today the additional work of coding is placed on the shoulders of payers; they cannot avoid it, which means that all that remains is to comply with the current requirements and keep abreast of the latest innovations.

The most necessary KBK for 2021: table

Below are tables with the BCC for 2021 for basic taxes and insurance premiums.

KBK for paying taxes for organizations and individual entrepreneurs on OSN in 2021

| NAME OF TAX, FEE, PAYMENT | KBK 2021 |

| Corporate income tax (except for corporate tax), including: | |

| 182 1 0100 110 |

| 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| 182 1 0600 110 |

| 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK tax payment for organizations and individual entrepreneurs under special regimes in 2021

| NAME OF TAX, FEE, PAYMENT | KBK 2021 |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| 182 1 0500 110 |

| 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

KBC for insurance premiums in 2021

| TYPE OF INSURANCE PREMIUM | KBK 2021 |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for compulsory health insurance in a fixed amount (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| – for those employed in work with hazardous working conditions depend on the results | 182 1 0210 160 |

| – for those employed in work with hazardous working conditions depends on the results | 182 1 0220 160 |

| – for those employed in jobs with difficult working conditions depend on the results | 182 1 0210 160 |

| – for those employed in jobs with difficult working conditions depends on the results | 182 1 0220 160 |

| Insurance contributions to the Social Insurance Fund for injuries | 393 1 0200 160 |

Results

In 2021, BCCs began to be regulated by the new regulatory legal acts of the Ministry of Finance.

However, there were no large-scale changes in the codes because of this. Those who pay certain tax fines need to be careful: new BCCs have been introduced for them. Otherwise, everything remains the same. And errors made when specifying the BCC still lead to the payment being classified as unclear and entail the need to clarify it. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

KBK for payment of other taxes for all organizations and individual entrepreneurs in 2021

| NAME OF TAX, FEE, PAYMENT | KBK 2021 |

| Personal income tax on income sourced by a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| 182 1 0100 110 |

| 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Water tax | 182 1 0700 110 |

| Fee for negative environmental impact (NEI) | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of profits of controlled foreign companies (CFC) | 182 1 0100 110 |

KBK: decoding the components of the code

The first block of numbers is administrative. The first three numbers hide the main administrators of incoming payments. Their role is played by government agencies that carry out the functions of collecting, distributing and controlling funds:

- Pension Fund of the Russian Federation – encrypted with three characters 392;

- Tax Service of the Russian Federation – 182;

- Social Insurance Fund of the Russian Federation - 393, etc.

The second block is the type of income. Includes signs from 4 to 13. Helps determine admission by the following indicators:

- The 4th digit from the beginning encrypts the type of income - “1” - income and “2” - gratuitous payments;

- the purpose of payments can be found out by the 5th and 6th digits in the KBK details: personal income tax is present as a combination of numbers 01;

- for social needs – 02;

- property tax – 06;

- state duty – 08;

- federal – 01;

The third block is the program , numbers from 14 to 17. They encrypt the program that details payments:

- taxes and fees – 1000;

- penalties - 2000;

- fines – 3000;

The fourth block is economic classification . The last three digits from 18 to 20 indicate the economic type of income received:

- 110 - tax;

- 120 - from property;

- 130 – provision of services;

- 150 - free payments.

You should be careful when entering 20 digits, otherwise the payment will not reach the recipient.

BCC for penalties in 2021

In most cases, when paying penalties in the 14-17th digits of the budget classification code, the value is “2100” (with some exceptions).

| TYPE OF INSURANCE PREMIUM | KBK 2021 |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount, paid by individual entrepreneurs for themselves | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| 182 1 0210 160 |

| 182 1 0210 160 |

Code structure

Each BCC can be divided into blocks:

- Administrative. This is the code of the government agency to which the payment will be received. And the institution that will continue to manage the money. Consists of three characters.

- Profitable. This code is written from the 4th to the 13th character. Indicates the type of income.

- Program. Indicated from the 14th to 17th digits. Necessary to differentiate income.

- Classification code. Indicates the three digits that come at the end.

Knowing this information will also help to understand what the BCC is on the receipt.

KBC for paying fines in 2021

As a general rule, when filling out a payment order to pay a fine, you need to replace the 14th category of the BCC from “1” to “3”. But here, too, there are exceptions.

| TYPE OF INSURANCE PREMIUM | KBK 2021 |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount, paid by individual entrepreneurs for themselves | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| 182 1 0210 160 |

| 182 1 0210 160 |

Work on mistakes

What is the KBK for employees of government agencies, where do the funds go? This is an important detail, an indicator of where to transfer the money. Thus, how quickly the funds will be transferred depends on the correctness of filling out the receipt. If the KBK is incorrectly indicated in the details, the money is most often returned to the sender’s account, but it may also end up in unclear payments or be credited to the wrong account. If you do not want to deal with government agencies and write requests for a refund, when filling out payment documents, the details must be checked especially carefully.

The most common mistakes:

- indication of an incorrect BCC applicable for another payment;

- error in one or more KBK digits.

To transfer funds to the required address, you must write an application addressed to the Federal Tax Service of the Russian Federation and indicate the correct details that are current with the KBK. Most often, the tax office makes a positive decision and satisfies the applicant’s request, while the date of payment of the duty is considered the date of the initial deposit of funds.

What to do if there is an error in the KBK in 2021

To correct an error in the KBK when paying taxes/contributions, send a written application to the tax office to clarify the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation).

Complete the application in any form. Indicate in it:

- tax authority where you are applying;

- information about yourself (name, address, TIN, checkpoint of the organization, full name, place of residence, TIN individual entrepreneur);

- information to contact you;

- details of the payment order in which the error was made;

- what exactly is the error;

- correct BAC value for 2021.

In order to quickly correct an error in the KBK, it is important to correctly write a statement to clarify the budget classification code in the payment order for the transfer. Regarding insurance premiums, such a sample is available in ConsultantPlus.

View the finished solution.

Attach a copy of the payment invoice to your application.

Read also

15.01.2021

Receipt value

If payments are made by enterprises represented by responsible accountants, then individuals pay according to receipts to the state budget. This could be payment of a fine for violating traffic rules, payment for education, or funds for medical services.

Usually the payer has a completed receipt in his hands, in which only the amount and purpose of payment should be entered. But if by some chance the BCC is not indicated in the document, then you can fill out the field by consulting the company’s accounting department. They are primarily interested in the timely receipt of funds to the correct accounts.

If a person makes a payment online or through a banking application from a mobile phone, then the BCC is automatically adjusted. Which is convenient and prevents the possibility of tax being transferred to the wrong account.