Balance sheet reformation is the write-off of profit (loss) received by the company over the past financial year. The reformation is carried out on December 31, after the last business transaction of the company is reflected in the accounting.

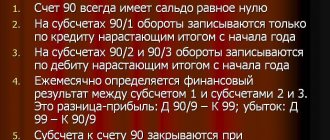

The balance sheet reform consists of two stages:

– close the accounts in which the company’s income, expenses and financial results of the company’s activities were recorded during the year. These are accounts 90 “Sales” and 91 “Other income and expenses”;

– include the financial result obtained by the company over the past year as part of retained earnings or uncovered losses.

Why is the balance sheet reformed?

The financial results of each organization during the reporting year are determined monthly.

This is required not only by the interests of persons using accounting data in their work, but also by the rules for closing cost accounts. The current financial result is formed on an accrual basis by adding to it data for the next closed month of the year. In accounting, it is reflected separately in an accounting account, different from the one that shows the financial results of work for previous years. This allows:

- control the process of generating financial results;

- analyze the ratio of its components;

- track its value without the influence of data from previous years.

However, at the end of the reporting year, its financial result must be added to the overall result of work for the entire period of the company’s existence, so that the new year begins with zero indicators in the accounting accounts of the current financial result. This is achieved by reforming the balance.

Closing 90 posting account at the end of the month

» Contents To summarize the results of the activities of organizations for ordinary activities, it is necessary to analyze the subaccounts of account 90:

- 90.1: this subaccount displays all receipts received by the company for goods sold. The balance of the subaccount is the revenue received for the period: Dt50.51 Kt90.01 – payment received; Dt62 Kt90.01 – sales revenue is reflected;

- 90.02: cost of goods sold upon sale: Dt90.02 Kt41 – write-off of the accounting value of goods; Dt90.02 Kt20 – cost of work performed;

- 90.03: VAT accrued for payment to regulatory authorities is displayed:

Every month, the subaccount data is compared, and the balance is transferred to subaccount 90.09, which displays the calculated financial results: Dt - loss; Kt – profit.

When closing the period, the balances of 90.09 go to the debit of account 99 with the profit received for ordinary types of business activities and to the credit of the account. 99 for unprofitable work. For transactions not related to the normal business activities of the organization, the analysis is carried out on the basis of monitoring subaccounts of 91 accounts:

- 91.02: here information is collected on all non-operating costs: bank commissions, shortages of goods, tax fines and penalties, etc.: Dt91.02 Kt66.67 - payment of interest for the use of borrowed funds; Dt91.02 Kt01 – reduction in the cost of equipment based on the results of revaluation.

- 91.01: the subaccount is intended to contain information about other income of the company. These may include: exchange rate differences, surplus inventories as a result of inventory, income from borrowed funds provided to counterparties, etc.: Dt50.51 Kt91.01 - income received from the sale of own equipment; Dt73 Kt91.01 – income from loans provided in the form of interest paid;

We recommend reading: Where to see the list of employees of the Ministry of Internal Affairs

Every month, the subaccount data is compared, and the balance is transferred to subaccount 91.09, which displays the calculated financial results: Dt - loss; Kt – profit.

When closing

When to Reform the Balance Sheet

Due to its semantic purpose, the reformation of the balance sheet is the last accounting operation performed in the current year. Accordingly, it is carried out on the last day of the year - December 31.

However, there is 1 exception to this rule. At other times, the balance sheet is reformed if the company is liquidated before the end of the calendar year. The liquidation process is accompanied by the preparation of a liquidation balance sheet, which is subject to the general rules for the formation of this report, but is compiled on a different time frame.

For more information about the liquidation balance sheet, read the material “Liquidation balance sheet - an example of a zero balance sheet in the new form”.

Analysis of account 90: sale of finished products, goods in 2021

Account 90 “Sales” is intended to reflect transactions related to the sale of finished products, goods, and services.

Accounting account 90 is complex and has a number of sub-accounts.

How are transactions recorded when selling on account 90? How is account 90 closed at the end of the year?

We will conduct a detailed analysis of account 90, analyze the implementation process using the example of the sale of finished products and goods, as well as accounting entries for account 90. As mentioned above, account 90 in the accounting department has several subaccounts; below are the main subaccounts used to reflect sales. Main subaccounts to account 90 1 – the loan reflects revenue from the sale of goods and products; 2 – the cost of what we sell is entered in debit; 3 – the debit reflects VAT accrued on sales; 9 – at the end of the month, results are summed up in this subaccount: the financial result from sales for the month is calculated, profit is recorded in debit, and loss is recorded in credit.

Let us remember that this is a two-sided table, the left side of which is called debit, and the right side is called credit.

Schematically, account 90 can be depicted as follows: The main distinctive feature of this account is that it closes completely (to zero) only at the end of the year.

Throughout the calendar year, a balance accumulates in each subaccount from month to month. At the end of the year, each sub-account is closed, and the total financial result for the year is calculated.

Video - What you need to know about account 90: First, let's look at how, in general, sales are reflected on account 90, what transactions need to be made.

If the sale being made is a regular activity of the enterprise, then accounting account 90 is used to reflect it (if this is a one-time sale, for example, the sale of a fixed asset, then account 91 is taken here, which is analyzed in detail). Sales income is revenue; it is reflected on the credit of subaccount 1 in correspondence with the account for settlements with customers. (The topic of correspondence of accounts was discussed in).

That is, when shipping goods or products to the buyer, posting D62 K90/1 is made, which reflects the proceeds from this sale.

Preparatory stage of the reformation

The balance sheet reform provides for the closure of accounts 90, 91, 99. At the same time, accounts 90 and 91 on which, in essence, a zero total result is recorded, since their subaccounts 90/9 and 91/9 accumulate throughout the year the amounts of profit (losses) from, accordingly, sales and other income/expenses should simply be reset to zero. Let us recall that the monthly generated current financial result is reflected in account 99 by writing off there the financial results generated in subaccounts 90/9 and 91/9.

Thus, balance reformation consists of 2 procedures:

- resetting data on accounts 90 and 91, which have a zero final balance, but contain figures that should be removed from these accounts;

- closing account 99, on which the financial result of the current year was generated, in order to add its value to the financial result of previous years.

Resetting the data available on accounts 90 and 91 is carried out by internal postings to these accounts, in which figures from all sub-accounts on the account are written off to sub-accounts 90/9 and 91/9.

Preparation for the reformation procedure

The process of balance sheet reformation includes 2 successive stages:

- resetting the balances on the accounts used during the reporting period to record income, expenses and commercial results of the enterprise: account 90 for sales and account 91 for other expenses and income;

- inclusion of the financial result generated over the past year (profits and losses on account 99) in the indicator of uncovered damage or retained earnings by moving it to the account. 84.

Therefore, the company will begin the new financial period with balances equal to zero in accounts and sub-accounts that take into account the company’s performance indicators.

For your information! Before starting the procedure, the balances of all accounting accounts should be reconciled, and if errors are identified, the necessary corrective entries should be made in the accounting date of December 31. If there are adjustments in accounting, it is important to check their reflection in tax accounting and make an additional payment if necessary.

The final stage of the reformation

At the final stage, account 99 is closed. Let us recall that in this account, in addition to the financial results generated in correspondence with accounts 90 and 91, the following are taken into account:

- those who do not apply PBU 18/02 – the amount of accrued income tax;

- applying PBU 18/02 – the values of conditional income tax expense (income) and permanent tax liabilities.

Read about what kind of transactions when applying PBU 18/02 in accounting reflects the process of calculating the amount of income tax payable to the budget in the Ready-made solution from ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

The following may also be taken into account:

- income tax recalculations;

- accrued tax penalties.

The balance sheet reformation is completed by transactions writing off the data accumulated on account 99 to account 84.

Tax sanctions

If the tax inspectorate has assessed fines for violation of tax rules with income tax or similar taxes (UTII, Unified Agricultural Tax, single tax paid when applying the simplified tax system), which the organization does not intend to challenge, they are reflected in the accounting records as of the date of the decision to prosecute:

Debit 99 Credit 68 - a fine was assessed for violation of income tax rules.

Fines for violation of tax rules for other taxes, fines and penalties for insurance premiums, fines for late submission (failure to submit) of any declarations and reports to the Pension Fund are charged to other expenses and taken into account in account 91 on the date of the decision to prosecute.

The taxable profit of the amount of penalties, fines and other sanctions accrued for violations of tax legislation is not reduced (clause 2 of Article 270 of the Tax Code of the Russian Federation).

Balance sheet reformation: postings if profit is made

The accounting of LLC “Success” at the end of the year for account 99 reflects:

- subaccount 99/1 “Profits and losses” - 210,000 rubles. (credit balance);

- subaccount 99/2/1 “Conditional income tax expense” - 42,000 rubles. (debit balance);

- subaccount 99/2/3 “PNO” - 6,300 rubles. (debit balance).

When reforming the balance sheet, the postings will be as follows:

- Dt 99/1 Kt 99/2/1 - 42,000 rubles;

- Dt 99/1 Kt 99/2/3 — 6,300 rub.

The result formed as a result in subaccount 99/1 (210,000 – 42,000 – 6,300 = 161,700 rubles) will give the credit balance. Its write-off will reflect the last operation to reform the balance sheet - posting Dt 99/1 Kt 84 in the amount of 161,700 rubles, equal to the net profit for the reporting year.

How profit from sales is reflected in financial statements, see the Guide from ConsultantPlus. Trial access to the system can be obtained for free.

What to check before reformation

Before you start reforming your balance sheet, be sure to check:

- availability of all accounting documents;

- reflection in the accounting accounts of all financial and economic transactions;

- calculation of all necessary taxes;

- whether an inventory has been carried out (clause 27 of the Regulations on maintaining accounting and reporting, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n);

- closing accounting accounts;

- financial result of the organization's activities.

To determine the financial result of an organization, it is necessary to check the closure of the following accounts for the reporting period (the reporting period is the month in accordance with clause 48 of PBU 4/99):

1. Accounts 25 “General production expenses” and 26 “General economic expenses” (in accordance with Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting financial and economic activities of organizations and instructions for its application”).

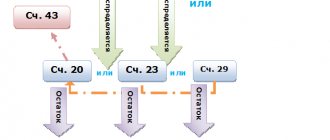

Account 25 “General production expenses” is closed monthly by writing off the amount of expenses (depending on the activity). Let's look at the accounting entries:

- Dt 20 “Main production” Kt 25 “General production expenses” - general production expenses are written off as expenses for the main production.

- Dt 23 “Auxiliary production” Kt 25 “General production costs” - inclusion of auxiliary production in the cost of products (works, services).

- Dt 29 “Service production and facilities” Kt 25 “General production expenses” - inclusion at the end of the month of a part of overhead costs in the cost of production.

The procedure for closing account 26 depends on the method of forming the cost of production and is fixed in the accounting policy of the organization:

- at full production cost;

- at reduced production costs (mainly used by SMEs).

When choosing “at full production cost”, costs are written off monthly using accounting entries:

- Dt 20 “Main production” Kt 26 “General operating expenses” - general operating expenses associated with the activities of the main production are written off when accounting for products at full production cost.

- Dt 23 “Auxiliary production” Kt 26 “General economic expenses” - inclusion of auxiliary production in the cost of products (works, services).

- Dt 29 “Service production and facilities” Kt 26 “General expenses” - inclusion at the end of the month of a part of general expenses in the cost of production.

When choosing “at reduced production cost”, general business expenses are fully included in the cost price:

- Dt 90.2 “Cost of sales” Kt 26 “General business expenses” - write-off of general business expenses for sales (sales) of products (works, services).?

2. Accounts 20 “Main production”, 23 “Auxiliary production” and 29 “Service production and farms”, which may have work in progress on the balance.

Closing accounts: 20 “Main production”, 23 “Auxiliary production” and 29 “Service production and facilities” are reflected in the following accounting entries:

- Dt 90.2 “Cost of sales” Kt 20 - write-off of the cost of work/services performed for sale.

- Dt 90.2 “Cost of sales” Kt 23 - expenses of auxiliary production are written off to sales.

- Dt 90.2 “Cost of sales” Kt 29 - the cost of work/services performed by OPiH is written off as sales.?

3. Accounts that form the financial result - 90 “Sales”, 91 “Other income and expenses”. Closing these accounts is part of the balance sheet reformation.

But before you start closing them, you need to make sure that all business transactions have been completed, all taxes have been calculated and the financial result has been determined.

Balance sheet reformation: postings if a loss is received

The accounting of LLC “Success” at the end of the year for account 99 reflects:

- subaccount 99/1 “Profits and losses” - 210,000 rubles. (debit balance);

- subaccount 99/2/2 “Conditional income for income tax” - 42,000 rubles. (credit balance);

- subaccount 99/2/3 “PNO” - 6,300 rubles. (debit balance).

When reforming the balance sheet, the postings will be as follows:

- Dt 99/2/2 Kt 99/1 - 42,000 rubles;

- Dt 99/1 Kt 99/2/3 — 6,300 rub.

As a result, a debit balance in the amount of 174,300 rubles will be formed on subaccount 99/1.

(–210,000 + 42,000 – 6,300 = 174,300 rubles). It will be written off to account 84 by posting Dt 84 Kt 99/1 and reflect the amount of net loss for the reporting year.

Closing the month: postings and examples

Closing the month is a list of mandatory transactions and entries made to determine the interim financial result.

Let's look at the basic transactions for closing a month manually using an example. Table of contents The procedure for closing a month in accounting includes:

- Closing income and expense accounts and determining the tax base.

- Closing sales accounts and determining financial results;

- Determining costs and writing them off to cost;

The company's expenses are reflected in active accounts 20, 23, 25, 26, 44, etc.

- all these accounts have the common name “cost accounts”.

Types of enterprise costs:

- Costs of auxiliary production;

- Production costs;

- General running costs;

- Production costs, etc.

Let’s say that the accounting of Buttercup LLC in January 2021 reflects the following transactions:

- Depreciation charge for the month - 96,000 rubles;

- The purchase from the service provider (electricity) is reflected - RUB 17,000. (without VAT);

- Payroll for administrative and management personnel - RUB 250,000;

- Products sold for the amount of RUB 1,062,000, incl. VAT 162,000 rub.

- Calculation of wages for workers in the workshop - 780,000 rubles;

The accountant reflects these transactions with postings: Dt Ct Description of transaction Amount, rub.

Document 20 02 Reflected depreciation 96,000 Accounting.

certificate 20 70 Salary calculation reflected 780,000 Accounting.

certificate 26 70 Salary calculation reflected AUP 250 000 Accounting.

certificate 20 60 Purchase of electricity 17,000 Invoice Reflection of revenue: Dr Cr Description of transaction Amount, rub.

Document 62 90.1 Revenue 1,062,000 Invoice, Sales Act 90 (VAT) 68 VAT accrued on sales 162,000 Invoice 90.2 41 Cost of goods sold 400,000 Invoice To calculate the cost, two methods can be used: classical cost write-off and direct costing:

- Closing the cost using the first method can occur using accounting at discount prices, that is, using account 40, or without using it.

Tax nuances when reforming the balance sheet

Due to differences in the recognition of income and expenses in accounting and tax accounting, the following situation is possible: according to tax accounting data, the company’s activities are unprofitable, but in accounting there is a profit.

In this case, the amount of income tax cannot be negative, and in this case there is no income tax (no profit - no tax). According to the law, the resulting tax loss can be taken into account over the next 10 years (Article 283 of the Tax Code of the Russian Federation).

In the described situation, the accountant will have to record a deferred tax asset as of December 31. It is easy to calculate: the amount of the tax loss should be multiplied by the income tax rate. You need to make an entry for the amount received: Dt 09 Kt 68.

As a result, the amount of accrued income tax becomes zero, and there are no discrepancies between tax accounting and financial statements.

About the rules for transferring losses and the restrictions that apply, read the material “How and for how long can losses be carried forward?” .

Closing the year in the 1C:Accounting 8 program

To close the year, it is necessary to carry out routine operations step by step:

- depreciation and wear of operating systems;

- closing accounts 90 “Sales”, 91 “Other income and expenses”;

- calculation of income tax;

- balance reform.

To complete them, go to the “Operations” - “Month Closing” section. Next, set the month - December 2021.

- Accrued depreciation of fixed assets

Using the link with the name of the routine operation “Depreciation and depreciation of fixed assets”, select “Perform operation”.

Using the link with the name of the routine operation “Depreciation and depreciation of fixed assets”, select “Show transactions” and check the movement of the document.

- Closing accounts 90 “Sales”, 91 “Other income and expenses” and calculating income tax

Before performing regulatory operations to close accounts 90, 91 and calculate income tax, we will analyze the amounts accumulated in these accounts. The “Turnover balance sheet” report will help us with this (Fig. 3). Let's go to the section: “Reports” - “Account balance sheet” (ACB).

Let's return to the section: “Operations” - “Month Closing”.

Using the link with the name of the regulatory operation “ Balance Reformation ”, select the item “Skip operation ” , the “ Down Arrow ” (Fig. 4).

Source:

Materials from the newspaper “Progressive Accountant”

Heading:

Accounting

balance reform

- Valentina Petrova, accountant-consultant Consultation lines

Sign up 7800

9750 ₽

–20%

Results

Balance sheet reformation is a process that leads to the resetting of data on accounts 90, 91 and 99. The first 2 accounts, which have a zero final balance due to the rules for forming the figures reflected on them, are closed with internal postings.

Account 99 is closed using internal entries that close the analytics for it at the expense of the overall financial result, and a final entry that writes off the amount of net profit (loss) to account 84. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to close a 90 03 account at the end of the month

— — VAT is calculated by posting: Dt 90.03 Kt 68 “VAT”.

Excise taxes are reflected in a similar way on the corresponding sub-account: Dt 90.04 Kt 68 “Excise taxes”. A peculiarity of accounting for excise taxes is that they must be accrued on the day the goods are transferred to the buyer, regardless of when ownership is transferred to him.

At the end of each month, it is necessary to calculate the result of the enterprise's activities. This is done extremely simply: credit turnover on the account. 90.01 is compared with the amount of debit turnover of the account.

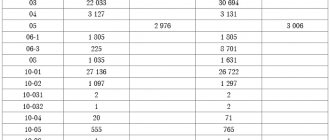

90.02–90.07. If the difference is positive, a profit is generated; if it is negative, a loss is generated. Credit 90.01 Turnover 52,952,105.23 Final balance 52,952,105.23 90.02 Turnover 38,745,863.10 Final balance 38,745,863.10 90.03 Turnover 8,077,439.78 Final balance 8,077,439.7 8 90.09 Turnover 6,128,802.35 Final balance 6.128.802.35 90 Turnover 52.952.105.23 52.952.105.23 Final balance Output data: accounting data (accounting data) Correspondence with account 99 closes the synthetic accounting level at 90 at the end of the month. But the formation of a balance of 90 accounts is impossible and incorrect according to the PBU and the standard chart of accounts.

After calculating the financial result for December, subaccounts 90 of the account are subject to closure. Postings are prepared in the same way as when writing off amounts at the end of any other month: Dt 90.01 Kt 90.09, Dt 90.09 Kt 90.02–90.07.

As a result of the entries made, account 90 is closed: the debit and credit turnover for each of the subaccounts are equal, and the final balance is equal to zero. At the beginning of next year, the accountant will re-open the synthetic account and each of the sub-accounts of its components. Account 90 from month to month accumulates information about the income and expenses of the enterprise, which relate to its main type of activity.

Important At the end of the month, the balance is calculated for each subaccount and the financial result for the month is displayed.

How does this happen?

1. The amounts for each subaccount are added up, that is, the turnover for credit is 90/1, for debit 90/2, for debit 90/3.

2.

Closing production accounts

Let's make a reservation right away that the balance for BSC 20, 23, 29 is unfinished and does not require mandatory write-off at the end of the reporting or financial periods.

How to determine? If the production cycle does not coincide with the reporting periods, then a debit balance is formed on the BSC - the cost of work in progress. And if the production process fits into a calendar month (year), then, according to the BSC, there should be no leftovers. Typical entries for writing off production costs:

| Operation | Debit | Credit |

| Production costs written off to cost of sales | 90-2 “Cost of sales” | 20 |

| 23 | ||

| 29 |

Note that companies whose activities are related to the provision of services can additionally establish in their accounting policies which accounts are closed at the close of the month. In other words, to secure that BSCs 20, 23, 29 will be closed monthly, without any work in progress balances.

We write off general production costs

The BSC is closed monthly, and all accumulated overhead costs must be written off to the accounts of the relevant production facilities. In other words, costs are written off to the accounts of those production facilities that were serviced.

Typical accounting entries:

| Operation | Debit | Credit |

| ODA written off in favor of core production | 20 | 25 |

| ODA included in the costs of servicing auxiliary production facilities and workshops | 23 | 25 |

| ODA aimed at maintaining service farms is written off to the appropriate accounts | 29 | 25 |