As you know, individual entrepreneurs using the simplified tax system have the right to choose the object of taxation “income” or “income minus expenses”. The last option within the framework of the simplified tax system means, literally: “income reduced by the amount of expenses incurred.” This is exactly what will be discussed next.

An entire chapter 26.2 of the Tax Code of the Russian Federation is devoted to the simplified taxation system. As part of the application of the simplified tax system, attention should be paid to the following norms of this chapter of the Tax Code of the Russian Federation.

| Art. 346.14 | Art. 346.15 | Art. 346.16 | Art. 346.17 | Art. 252 |

| Objects of taxation | Procedure for determining income | The procedure for determining expenses | Procedure for recognizing income and expenses | Expenses and their grouping |

An individual entrepreneur using the simplified tax system “income minus expenses” (hereinafter abbreviated as the simplified tax system “DMR”) is required to keep tax records to determine separately expenses and separately income. For this purpose, it is necessary to use KUDiR and clearly understand what is recognized as income and expenses. Typically, when calculating tax, a rate of 15% is applied to payment, and the amount of income (tax base) is reduced by expenses incurred in a specific period.

Expenses that can reduce income when calculating tax are listed in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

Federal Tax Service of the Russian Federation (nalog.ru).

Introductory information about the simplified tax system

Under the simplified tax system, the taxpayer has the right to choose for himself the object of taxation from two options (clauses 1, 2, article 346.14 of the Tax Code of the Russian Federation):

- income;

- income reduced by expenses.

Each of these taxation objects has both advantages and disadvantages, which it is advisable for organizations and entrepreneurs to take into account when planning work on the simplified tax system. The table below shows a comparative analysis for each object of taxation under the simplified tax system

| How is the simplified tax system different? | |

| "income" | "income minus expenses" |

| Tax rate | |

| The general rate is 6% (clause 1 of Article 346.20 of the Tax Code of the Russian Federation) | The general rate is 15% (clause 2 of article 346.20 of the Tax Code of the Russian Federation) |

| The tax base | |

| Amount of income | The amount of income reduced by the amount of expenses |

Next, we’ll tell you how, with a simplified tax system of 6%, you can reduce the “simplified” tax on expenses incurred.

Results

We recommend keeping records of expenses under the simplified tax system “Income”, regardless of their reflection in KUDiR, since:

- some business transactions require restrictions on the use of the simplified tax system;

- tax authorities and law enforcement agencies may request documentation confirming the company’s expenses for the purchase of inventory and materials;

- Legal entities are responsible for accounting.

The use of the simplified tax system of 6% significantly simplifies the document flow at the enterprise, and the ability to reduce the tax on social payments allows you to save up to 50% of its amount.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

No cost control

Under the simplified tax system with the object of taxation “income,” the “simplified” tax should be calculated and paid on the entire amount of income received (clause 1 of article 346.18 of the Tax Code of the Russian Federation). In this case, the expenses incurred are not taken into account when calculating the tax base, and you are not required to document them. Therefore, the tax office does not check expenses under the simplified tax system with the object “income” at a rate of 6% (Letters of the Ministry of Finance of Russia dated June 16, 2010 No. 03-11-11/169, dated October 20, 2009 No. 03-11-09/353). This approach applies to both organizations and individual entrepreneurs. They are required to pay expenses. Neither your own expenses nor the expenses of suppliers are taken into account when calculating the simplified tax system at a rate of 6 percent. This, in essence, is the difference with the simplified tax system “income minus expenses”, when incurred expenses reduce the amount of tax.

Accounting for costs for suppliers using the simplified tax system of 6 percent

From the point of view of tax purposes, accounting for expenses under the simplified tax system, income of 6% fades into the background, since this category of payers can optionally not indicate them in the KUDiR. The company's costs, including those for suppliers, are not included in the calculation of the simplified tax amount.

But if, during a tax audit, documents for the purchase of goods sold are not provided, their value may be classified as goods and materials received free of charge, and the estimated tax amount will increase. This may lead to additional assessment of a simplified tax, payment of a fine (20% of the amount of underpayment, but at least 40,000 rubles) and the accrual of penalties (Article 120 of the Tax Code of the Russian Federation).

In addition to the tax office, documents from suppliers may also be of interest to law enforcement agencies in order to confirm ownership of certain valuables, as well as to the company’s clients to fulfill warranty obligations and confirm product quality.

From the point of view of accounting and management purposes, the absence of up-to-date accounting of settlements with suppliers is, in principle, impossible, since this will instantly nullify the system for calculating gross and net profit.

What expenses reduce tax?

According to the rules of the Tax Code of the Russian Federation, an organization or individual entrepreneur using the simplified tax system can still reduce the simplified tax for some expenses. In the formula for calculating tax on income simplification, expenses that reduce the amount of the simplified tax system of 6% are distributed according to the following formula:

Tax = Income x 6% – Expenses

Organizations and individual entrepreneurs can reduce the “simplified” tax at a rate of 6% for the following expenses (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation):

- insurance premiums and “injury” contributions paid from employee benefits;

- temporary disability benefits paid at the expense of the employer (except for industrial accidents and occupational diseases);

- contributions for voluntary insurance of employees in case of their temporary disability (under certain conditions).

However, keep in mind that expenses will not be able to reduce the simplified tax by more than 50%.

The expenses of an individual entrepreneur under the simplified tax system of 6%, if he has no employees, can include the insurance contributions he paid in a fixed amount for compulsory pension and medical insurance “for himself.”

Example 1. Calculation of tax for the six months for individual entrepreneurs using the simplified taxation system “DMR”, minus expenses incurred

Individual entrepreneur V.N. Malichenko needs to calculate the tax payable for the 1st half of 2021. When calculating, he sequentially calculates:

- Income for each month of the half year.

- Monthly expenses, which can be further reduced.

- The tax base is also monthly and then for the six months as a whole.

- The amount of tax payable for the entire six months at a rate of 15%.

The indicators given below in the table relate to the calculation of the tax base for 1 sq. (January, February, March) and 2 quarters. (April May June).

| Month | Income (RUB) | Spending (rub.) | Tax base calculation (RUB) |

| January 2021 | 500 000 | 300 000 | 500 000 – 300 000 = 200 000 |

| February 2021 | 600 000 | 400 000 | 600 000 – 400 000 = 200 000 |

| March 2021 | 450 000 | 300 000 | 450 000 – 300 000 = 150 000 |

| April 2021 | 700 000 | 600 000 | 700 000 – 600 000 = 100 000 |

| May 2021 | 780 000 | 700 000 | 780 000 – 700 000 = 80 000 |

| June 2021 | 800 000 | 650 000 | 800 000 – 650 000 = 150 000 |

In total, it turns out that the tax base is reduced by expenses and for 1 sq. amounted to 550,000 rubles, and for 2 quarters. – 330,000 rub. In total for the 1st half of 2021, the tax base minus expenses made by IP Malichenko is equal to 550,000 + 330,000 = 880,000 rubles.

The tax is calculated as follows: 880,000 rubles. * 15% = 132,000 rub. It follows that individual entrepreneur V.N. Malichenko must pay tax in the amount of 132 thousand rubles for the 1st half of 2021.

Don't forget about the expense book

All “simplified” people are required to keep a book of income and expenses (Article 346.24 of the Tax Code of the Russian Federation). It is also called KUDiR. The booklet was approved by Order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n. In this case, for example, at the simplified tax system of 6 percent, accounting for suppliers’ expenses in the Book may not be carried out, since they do not reduce the tax base.

With the simplified tax system at a rate of 6%, “income” expenses can be recorded in KUDiR - at the request of an LLC or individual entrepreneur. They, anyway, do not affect the calculation of tax.

Read also

17.04.2017

Is it necessary to keep track of expenses with the simplified tax system of 6%?

If for legal entities the obligation to maintain both tax accounting and accounting is legally regulated, then individual entrepreneurs are required to maintain only tax accounting (subclause 1, clause 2, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, Article 313 of the Tax Code of the Russian Federation) . But there are also operations for which the law requires documentation, regardless of the organizational and legal form.

So, in paragraph 4 of Art. 346.11 of the Tax Code of the Russian Federation provides for the preservation of the procedure for providing statistical reporting and conducting cash transactions for simplifiers. In paragraph 2 of Art. 346.11 of the Tax Code of the Russian Federation provides situations in which a simplifier is not exempt from certain taxes:

- Control over a foreign company.

- Dividend payment.

- Operations with debt obligations.

- The presence of objects for which real estate tax is calculated from the cadastral value.

- Import of goods into Russia.

- Performing the duties of a tax agent.

- Interest savings and other cases from clause 2 of Art. 224 Tax Code of the Russian Federation.

In such cases, the taxpayer is required to keep documented records of both income and expenses.

In addition to the above situations, careful management of expenses with a simplified tax system of 6% can be useful when switching to OSNO, reorganizing an enterprise, its liquidation, changing a founder and other legal actions that require accurate and up-to-date data on the state of economic activity.

Documents confirming expenses

Documents must be in a unified form or developed and approved by the entrepreneur. They are filled out in accordance with legal requirements.

The most frequently encountered documents are:

- consignment note TORG-12;

- waybill;

- act of completed work or services;

- invoice (if the supplier is a VAT payer).

When paying in cash for stationery, household goods, etc.:

- sales receipt (if the company is on UTII);

- sales receipt + cash register receipt (if the company is on the simplified tax system or OSNO).

Expenses must be documented

Documented expenses are expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation. Primary documents either must be drawn up according to forms approved by law, or according to independently developed forms, but they must contain the following details:

a) name of the document;

b) date of preparation of the document;

c) the name of the organization on whose behalf the document was drawn up;

d) content of the business transaction;

e) measures of business transactions in physical and monetary terms;

f) the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

g) personal signatures of these persons;

For the convenience of considering the correctness of paperwork, we classify expenses into the following groups:

- expenses for services;

- material costs;

- expenses for the acquisition of fixed assets and intangible assets;

- labor costs;

- other expenses.

Documentary evidence of expenses for payment of services

According to Art. 38 of the Tax Code of the Russian Federation, a service for tax purposes is an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity. For the correct execution and acceptance of these expenses, it should be remembered that in order to determine and describe the essence of the service provided, a contract for the provision of services is drawn up, it also specifies the procedure for its provision and the date of signing by the parties of the act of acceptance of the services provided, and in addition it helps to determine - to to which period a particular service should be attributed, or expenses will be distributed proportionally - throughout the entire term of the contract (for example, in a rental agreement).

Thus, we get two mandatory documents:

- a written agreement,

— certificate of services rendered (optional only in case of concluding a lease agreement).

There is no specially developed unified form for the act, so organizations can use independently developed forms containing the mandatory details of the primary document.

Documentary evidence of material expenses

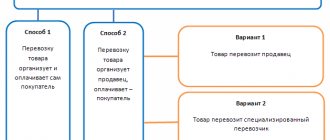

In accordance with paragraphs. 1 item 2 art. 346.17 of the Tax Code of the Russian Federation, material expenses (including expenses for the purchase of raw materials and materials) are recognized at the moment of payment of the debt to the supplier through a bank account, or by paying money from the cash register, and in case of another method of repaying the debt (debt transfer, compensation) - at the moment such repayment. Please note that the costs of paying for services associated with the acquisition of material assets or the implementation of the main type of activity are also taken into account in this group of expenses; we discussed the procedure for documenting them in the previous paragraph.

The basis for registration is:

- contract, delivery note (form TORG-12), drawn up by the seller;

- advance report of the accountable person, with the attachment of sales receipts, invoices for the release of material assets, and documents confirming their payment;

- contracts for the provision of services and acts indicating the fact of provision of the service.

Material expenses may include:

- for the purchase of goods intended for resale;

- for the purchase of protective clothing and other means of individual and collective protection provided for by the legislation of the Russian Federation;

- for the purchase of tools, devices, equipment, protective clothing and other means of individual and collective protection provided for by the legislation of the Russian Federation.

- for the purchase of detergents and cleaning products for washing floors, cleaning walls and windows, etc.

- for the purchase of materials for packaging goods sold and expenses for the purchase of work clothes and equipment. In this regard, the costs of stores for the purchase of materials used for packaging goods, as well as the costs of purchasing workwear for loaders and sellers, can be taken into account when determining the tax base for the single tax.

- expenses for paying for services for issuing a hygiene certificate, medical books for employees, conducting a medical examination of personnel, etc.

In addition, when calculating the tax base for the tax paid in connection with the application of the simplified tax system, transport and forwarding costs, as well as transport costs associated with the delivery of goods from the customs warehouse to the warehouse to the buyer, which are taken into account as part of material costs (Letter of the Ministry of Finance Russia dated April 15, 2010 N 03-11-06/2/59).

The cost of the above-mentioned property is included in the material costs in full as it is put into operation - that is, when drawing up an act of write-off of materials, shipment of goods, or when filling out a demand invoice for the transfer of materials to production.

In addition, expenses may include mandatory payments and fees, for example, payments for maximum permissible emissions (discharges) of pollutants into the natural environment and other similar expenses. To take such expenses into account, a free-form accounting calculation is sufficient.

Documentary evidence of expenses for the acquisition of fixed assets

A separate accounting procedure is provided for expenses for the acquisition of fixed assets. Thus, taxpayers can reduce income received by expenses for the acquisition, construction and production of fixed assets and the acquisition of intangible assets. Fixed assets (FA) include property used as means of labor for the production and sale of goods (performing work, providing services) or for managing an organization with an initial cost of more than 100,000 rubles, not intended for further resale (Article 257 of the Tax Code of the Russian Federation).

Intangible assets (IMA) include property that does not have a tangible form, used in business activities for a period of more than 12 months, for example, computer programs, patents, licenses, copyrights, etc.

The document confirming the acquisition of fixed assets (intangible assets) is either a consignment note (in the TORG-12 form) or an act of acceptance and transfer of valuables (free form). The document confirming the acceptance of the object for accounting is the commissioning act (form OS-1 - for fixed assets, for intangible assets - free form). Payment is confirmed in the general manner - on the basis of available payment documents, or documents on the offset of debt, assignment of claims. As part of expenses, a fixed asset (intangible asset) is taken into account only after payment (or partial payment), in the manner prescribed by clause 3 of Art. 346.16 part 2 of the Tax Code of the Russian Federation - this procedure determines what part of the cost of property is included in expenses, depending on its useful life.

Document form

As follows from the norm of paragraph 2 of Article 9 of Law No. 129-FZ, primary accounting documents must be compiled according to unified forms, and in the absence of specially developed unified forms - in any form in compliance with the necessary requirements.

Of course, all taxpayers must comply with the requirements of Russian legislation, but what to do if, for one reason or another, the documents received by the taxpayer from their executors do not meet these requirements? Such situations occur in the activities of business entities much more often than we would all like. Is it really true that due to formal violations in the preparation of primary accounting documents, the taxpayer should be deprived of the right to include the corresponding costs in the expenses taken into account when calculating income tax?

A very serious argument in favor of taxpayers are the provisions of paragraph 7 of PBU 1/98, approved by Order of the Ministry of Finance of Russia dated December 9, 1998 No. 60n, which indicates that when maintaining accounting records, the principle of priority of the content of a document over its form must be implemented. It is this point of view that is predominant in law enforcement practice.

When considering case No. A56-21172/03, the Federal Antimonopoly Service of the North-Western District took a very loyal approach to resolving the issue of improper execution of primary accounting documents. In this case, the taxpayer included the costs of carrying out major repairs as expenses that reduce taxable profit. The tax inspectorate considered the reduction of taxable profit to be unlawful, since the acceptance certificate for the work performed was drawn up in a free form that does not correspond to the unified form KS-2. In its ruling dated May 27, 2004, the court indicated that the failure of the work acceptance certificate to comply with the established form cannot be qualified as a lack of documentary evidence of costs incurred. The court assessed the documents presented to justify the expenses incurred (contract, terms of reference, protocol for agreeing on the contract price, certificate of cost of work in the KS-3 form, payment documents for payment for work), in their entirety, and concluded that they were legally taken into account when determining taxable profit.

When considering another case*, the Federal Antimonopoly Service of the North-Western District recognized as lawful the actions of the taxpayer, who included in the costs the costs of paying for the travel of employees on business trips and back by non-urban bus.

Note:

* Resolution of the Federal Antimonopoly Service of the North-Western District dated May 12, 2003 in case No. A52/2874/2002/2.

The arbitration court indicated that the albums of unified forms of primary accounting documentation do not establish the form of travel tickets, but the travel tickets presented by the taxpayer contain all the necessary details provided for in Article 9 of Law No. 129-FZ. Thus, there are no grounds for refusing to accept tickets that do not comply with a certain form as evidence of expenses incurred, if they contain all the necessary details.

The procedure for recognizing individual entrepreneur's expenses on OSNO

To account for the expenses of an individual entrepreneur on OSNO as part of tax deductions, these expenses must relate directly to the conduct of business, be fully paid and confirmed by relevant documents (invoices, acts, invoices, etc.).

With the cash method of accounting, there is a relationship between the time expenses are recognized and the receipt of revenue associated with those expenses. The Russian Ministry of Finance believes that an entrepreneur using OSNO has the right to take into account the cost of purchased goods in expenses only after receiving payment from the buyer for this product. That is, the goods must be sold and paid for by the buyer.

What are professional deductions for individual entrepreneurs on OSNO

Professional deductions for individual entrepreneurs on OSNO are expenses that reduce the income of an individual entrepreneur and are associated with his professional activities. They must be documented, and if there is no confirmation, they can be accepted in the amount of 20% of income (only one of the options can be used).

We recommend reading: How to refund VAT for individual entrepreneurs on OSNO: return procedure and reasons for refusal.