The bank has the right to block the current account of an individual entrepreneur by a court decision, a request from the tax office, or if it suspects that the entrepreneur is laundering money. The fight against money laundering is regulated by Federal Law 115 - it obliges banks to check customer money transfers, identify suspicious ones and take action.

Blocking an individual entrepreneur's account means freezing money: the entrepreneur cannot pay partners, withdraw cash or buy goods. It will not be possible to open a second account in the same bank. It is possible to correct the situation, but it will take time: unlocking often takes weeks. Let's figure out how to save your account and not put your business at risk.

Who can block?

As part of the exercise of its powers, the tax service has the right, along with issuing a ban on the alienation of the debtor’s property, to block his current account. This interim measure is enshrined in Art. 72 of the Tax Code of the Russian Federation. If this happens, the individual entrepreneur will not be able to use such a necessary tool for business as a current account for its intended purpose: pay contractors, withdraw cash from it.

In modern realities, when an increasing number of business entities are switching to non-cash payments, blocking can be very effective. It encourages the taxpayer to quickly repay the debt to the budget, since delay threatens losses and loss of trust of partners, and activities are completely paralyzed. At the same time, the entrepreneur will not be able to open a new account, and not a single bank will go against the tax authorities’ decision.

In addition to the Federal Tax Service, other government services can also issue a decision to suspend the movement of funds:

- Rosfinmonitoring;

- customs Service;

- Bailiffs Service.

Like tax authorities, customs have reasons to apply this measure. This applies to those businessmen who import imported goods into our country and must pay customs duties for them. This procedure is prescribed in Art. 155 of Law No. 311-FZ of November 27, 2010 “On Customs Regulation”.

If an individual entrepreneur has allowed the formation of a significant debt with penalties and fines, then these amounts will be collected through the court. Do not forget that an individual entrepreneur can also be liable for the debts of an individual. Like any person, he may have unpaid alimony or utility bills. As part of enforcement proceedings for collection, bailiffs may conduct an inspection of all the debtor’s property, and his accounts may be “frozen.”

Attention! Even if an individual entrepreneur has a large amount of debt to the extra-budgetary funds of the Pension Fund and the Social Insurance Fund, they do not have the right to contact credit institutions to block expenditure transactions on the accounts of their debtors. But this does not mean that the debt will be forgiven. Now the Federal Tax Service is in charge of administering insurance premiums, and this body has all the powers to apply such strict measures.

In addition to government agencies, the bank itself can prohibit transactions on an account.

What to do if you can't unblock your account?

File a claim with the Arbitration Court, and the bank will be forced to prove the legality of its actions in court. According to Art. 65 of the Arbitration Procedure Code of the Russian Federation, it is the bank that is obliged to prove that the grounds for blocking the account were sufficient! If you sue, win and receive a writ of execution, the bank is obligated to enforce the judgment in your favor. And there are a number of cases in which the courts sided with the client, for example, the resolution of the Arbitration Court of the Ural District dated September 25, 2015 No. F09-6389/15 in case No. A60-2597/2015, the resolution of the Arbitration Court of the Far Eastern District dated May 7, 2015 No. F03 -1619/2015.

In principle, each credit institution has its own list of suspicious signs, so from time to time we hear that this or that bank blocks more often than its “colleague”. In general, according to Art. 7 of Law No. 115-FZ, the bank may pay attention to your transfer if it discovers:

- the confusing or unusual nature of the transaction;

- the transaction has no clear economic meaning or obvious legal purpose;

- the transaction does not correspond to the activities of the entrepreneur;

- repeatedly making strange transactions.

He does not have to block the account right away, but will require additional documents justifying your operation. At the same time, the law practically “freezes” the hands of banks - they can refuse a client to perform a transaction, essentially, without explaining the reasons.

Why is the tax office blocking?

The law clearly defines the list of reasons due to which transactions on the current account of an individual entrepreneur may be suspended. They can be found in Art. 76 of the Tax Code of the Russian Federation, and this list is closed. Based on the provisions of this article, we can identify situations that will entail this measure of compulsory enforcement:

- The individual entrepreneur has arrears of taxes or insurance premiums, the inspectorate sent him a demand for payment, but he ignored it. The interim measure of blocking is imposed only on the amount specified in the decision of the tax authority; the remaining funds can be freely used.

Attention! If a taxpayer receives a registered letter from the tax office, but he does not receive it, whether for a good reason or simply out of unwillingness, this will not relieve him of liability. The request is considered sent if it is sent by registered mail.

- The businessman did not report within the deadline established for filing a declaration or paying insurance premiums. 10 days after the deadline, a decision is made to block the account.

Important! If an individual entrepreneur is entrusted with the obligation to submit a declaration in accordance with the chosen taxation regime, then he must do this even if he has no income, or when he did not work. In this case, “zero” reporting is prepared. Errors or typos in the declaration will not in themselves lead to blocking of the account, but then you will need to submit corrective reports.

- The entrepreneur violates the rules of electronic circulation of documents with the tax authority and does not send receipts for receipt of documents via feedback via TKS. This applies to those individuals who use electronic communication channels to interact with the tax authorities. The individual entrepreneur must send confirmation of receipt of notifications within 6 days. If he does not do this, then the inspection’s response in the form of blocking operations occurs after 10 days.

- After an audit, the tax office made a decision against the individual entrepreneur to impose administrative liability, for example, in the form of a fine. For this decision to come into force, a certain time must pass, during which the taxpayer can sell or pledge his property and withdraw all money from his accounts. To avoid this, inspectors may impose a ban on the alienation of property or block the debtor's accounts.

In all of the above cases, the tax authorities’ actions are justified by law. As for banks, they are obliged to obey the decision of the state executive body and fulfill the collection order to write off the debt. The blocking of funds on the account may remain in effect until the debt is fully repaid.

Results

Blocking a current account is one of the sanctions applied to individual entrepreneurs who commit certain types of tax offenses. It is carried out by the bank, but it is done by decision of the Federal Tax Service. The main reasons for imposing such a sanction are non-payment of taxes, insurance premiums, penalties or fines, as well as failure to submit tax reports. During the blocking period, opening other current accounts is prohibited. To remove the blocking, it is necessary to eliminate the cause that caused it.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why is the bank blocking?

All banks in our country are subordinate to the Central Bank. They are required to comply with federal laws, orders and guidelines. One of the most recent legislative acts is the Central Bank Methodological Recommendations No. 4-MR dated 02/02/2017. They were created to identify and stop dubious transactions that are used by unscrupulous individuals for the purpose of:

- evasion of taxes and other obligatory payments;

- withdrawal of funds abroad;

- laundering (legalization) of funds earned by criminal means;

- providing financial support to terrorism.

Each bank has its own security service, which monitors all customer transactions, identifying dubious transactions among them. Particular attention is paid to transfers of amounts in large and especially large amounts (from 600 thousand rubles and 1.5 million rubles, respectively). To identify suspicious clients, bank employees focus on the following signs:

- if the share of taxes and other obligatory payments paid is less than 0.9% of all expenditure transactions, or the person artificially inflates this figure;

- if an individual entrepreneur has a staff of employees, but wages are not transferred from the current account to them, accordingly, personal income tax is not withheld and insurance premiums are not paid, or the wage fund is so small that it does not correspond to the number of employees, the minimum wage and the subsistence level;

- the cash turnover is very high, compared to the maximum stated when opening the account, and the money is constantly written off without a balance;

- funds are written off for purposes other than their intended purpose, transactions are not typical of the businessman’s activities (no payments for rent, for housing and communal services, etc.).

Important! The bank considers all these criteria in aggregate and on a systematic basis. If a client pays to the budget at a time for a certain tax period an amount that is less than 0.9% of the total turnover, then his current account will not be blocked.

Sometimes the blocking of transactions initiated by the bank in 2021 is due to a reason that the client cannot influence in any way: the revocation of the license by the Central Bank. Many people have faced this problem over the past three years, especially clients of small credit institutions. In this regard, only reliable banks, which value their reputation rather than the number of clients, can provide at least some bank guarantees to fund holders.

What's going on in life?

In practice, it comes to the point that commercial banks block all transactions on a current account from the moment a request for documents and information is sent until the response is received and processed. Moreover, this often happens to completely conscientious clients who have nothing to do with terrorism or money laundering.

Sometimes the volume of documents requested by the bank is so large that it is physically impossible to provide the required amount of requested information within the specified time frame. Of course, I advise you not to violate the deadlines, but if you understand that the situation is hopeless and you don’t have time, don’t despair! Urgently write a letter to the bank and indicate the approximate volumes that you need to provide.

– If we are talking about a huge amount of information that needs to be copied on paper, describe the approximate number of pages or, perhaps, we are talking about volumes in bags and cars.

– If you are sending a response through a client bank, then write in the letter approximately how many containers of information you will have.

In any case, do not remain silent and start fulfilling the bank’s request immediately, this way you are more likely to respond in a timely manner.

According to Business Russia, almost half a million entrepreneurs had their bank accounts blocked. And not all of them were actually involved in money laundering and aiding terrorism. For those on the “black list”, even if they open a new current account, it is unlikely that they will be able to work normally. The situation for business is indeed very difficult. At the Eastern Economic Forum in September 2021, an entrepreneur complained about this to the head of Sberbank, German Gref, and heard in response that small businesses are “a profit laundering factory.”

This begs the question:

Why is Rosfinmonitoring blocking?

There is a special authorized body for supervision in the financial sector - Rosfinmonitoring. This service operates in accordance with the provisions of Federal Law No. 115-FZ of August 7, 2001 “On Combating Income Laundering and the Financing of Terrorism.” The banks themselves must comply with this law; it is for violations discovered during an audit of their activities that many of these institutions have lost their license over the past few years.

As judicial practice 115-FZ shows, Rosfinmonitoring applies strict sanctions to those who arouse suspicion by their manner of doing business. What might attract the attention of this service? Such situations are when:

- the identity of the director is suspicious, his status may hint at a nominee if several companies are registered under him;

- Questionable payments are often made using inappropriate details and activity codes;

- it is not possible to establish the location of the organization due to the absence of a legal address, or this address falls under the criteria for mass registration;

- the company did not transmit information to the bank about changes in the constituent documentation;

- a businessman often withdraws money from his account, but does not pay taxes by non-cash payment, or the share of these payments is extremely small compared to the total turnover;

- there is no variety in the description of the purpose of operations if the same basis is present;

- the entrepreneur makes transfers to persons who are accomplices of terrorists.

All banks are afraid of the Rosfinmonitoring service, so it is easier for them to apply harsh sanctions against several of their clients who are suspicious than to take a risk and lose their licenses.

How to withdraw money from a blocked current account

We discussed how to unblock a current account in the previous paragraphs. This begs another question - how to bypass this blocking and withdraw your money from a frozen account? The answer is very short: not at all. This is why your account was blocked so that you could not freely manage the funds on it.

Thus, withdrawal of funds is possible only after it is completely unblocked. To do this, you must either satisfy the bank’s demands or prove your innocence through court. At the same time, in some cases, it is possible to make priority payments from it: paying taxes, paying salaries, alimony, sick leave, benefits, etc.

If a businessman wants to open a new current account in another bank before the circumstances regarding the old account are clarified, he most likely will not succeed. The new bank will most likely refuse. Practice shows that banks have a certain system of notifying each other in order to protect themselves from problem clients.

What payments cannot be blocked?

Some types of transactions are possible even after the account is blocked. There is such a thing as the order of payments. In accordance with the Civil Code, the payment of taxes to the budget is preceded by:

- payments for compensation for personal injury;

- alimony payments;

- settlement of employees due to dismissal and payment of severance pay.

If funds allow, the individual entrepreneur can submit an order to the bank to pay such payments. In addition, the blocking only applies to expenses; no one prohibits replenishing the account.

Is it possible to withdraw funds from a seized account?

If the current account is seized, it is impossible to withdraw funds from it. The only way to get money is to correct all violations and contact the bank with a request to unblock it. You need to be prepared for the fact that the process of lifting the arrest is quite lengthy. The simplest situation is blocking by decision of the bank itself. In this case, lifting the arrest is simplified, since the decision is made by only one authority.

The longest process is the unblocking process by decision of a judicial authority or tax service. In these bodies, document flow is quite slow. Even if a person provides all the evidence of payment of the debt, it will still take a lot of time to unblock the account.

How to check?

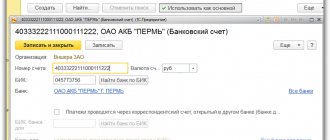

The official website of the Federal Tax Service has an expanded service, the capabilities of which allow you to check information about current decisions and suspensions. Its abbreviated name is “Bankinform”, the link to it is https://service.nalog.ru/bi.do. To get the result, just follow a few steps:

- Select the desired request type.

- Enter the details of the subject being checked: TIN and BIC of the bank.

- Pass the verification code and submit a request for processing.

- Receive a response in real time with the date of blocking and details of the Federal Tax Service that made such a decision.

Attention! The data in this database is freely available. Here you can find up-to-date information about all business entities: LLC, individual entrepreneur. Therefore, before concluding large transactions with counterparties, you can ask where to find information about blocking their current accounts. This measure will allow you to avoid the consequences of doing business with unreliable partners.

Powers of banks when fulfilling obligations under 115-FZ

This issue is also explained in the guidelines for businessmen.

Actions of the bank upon detection of a suspicious transaction:

- send a request for documents explaining the operation;

- set a deadline for submitting documents;

- ask for verbal explanations of suspicious activities;

- travel to the place of business;

- give advice on conducting banking operations;

- review the client's risk level.

So, if suspicious actions are detected, the bank blocks the transaction and asks for clarification of the reasons for the suspicious behavior. At this stage, the client’s task is to justify himself as convincingly as possible and prove that the company’s activities are legal.

For example, an individual entrepreneur works alone, he does not have a material base, and he does not pay business expenses. But millions pass through the checking account. As soon as he receives money from one company, he transfers it to the account of another and partially withdraws it. By all accounts, the company is suspicious. But this entrepreneur can provide the bank with an agreement with a large factory for the provision of services for the manufacture of parts. He himself cannot make them, so he entered into an agreement with another individual entrepreneur for production - he acted as an intermediary. If the entrepreneur proves the transparency and legality of the scheme, the bank will withdraw all claims. But at the same time, the chain of intermediaries can be longer than you to me - I to you, and the transactions are carried out through shell companies. In this case, it will be more difficult to justify yourself.

Actions of the bank after the deadline for reviewing documents:

- refuse payment or account opening and send the data to Rosfinmonitoring;

- carry out the operation, but send the data to Rosfinmonitoring;

- review the client's risk level.

Actions of the bank in relation to a client with an increased level of risk:

- limit or limit the use of remote banking services and cards;

- strengthen control, including requesting documents for each transaction.

The bank is not an investigative body. It is not their task to prove the illegality of their clients’ actions, much less punish them for it. The bank’s task is to identify suspicious cases, stop them and send data to Rosfinmonitoring.

How to unlock?

Since this strict measure was applied to induce the payer to take some action, in order to cancel the blocking, this action must be completed. Therefore, before doing anything, it is important to know exactly the initiator of the sanction and its reason. Such information can be obtained from the bank's help desk.

Depending on who applied the blocking operation, you need to do the following:

- If the decision was made by the Federal Tax Service, then the deadline for unblocking the tax account is as follows: on the day the decision to cancel is made, if the measure was taken to ensure the collection of the debt at the expense of the debtor’s property; 1 business day after repayment of the debt, filing a declaration, and sending receipts for the receipt of electronic documents ;2 business days if the taxpayer replenishes the account with an amount suitable to pay the debt, or provides details of other accounts. In each of these cases, the tax office must notify the bank no later than the next day.

- If the bank has blocked it, and the reason for this does not depend on the client’s actions, then you need to get a written explanation. To do this, you need to submit a written request there and receive a response within two days. This document will be useful in the future to assert your rights.

- If the blocking was done by bailiffs, then you must first find out the amount of the debt and pay it off. This can be done on the department’s website, where you can pay by bank transfer and save the receipt. After submitting the check to the bailiffs, the unlocking process may take about a month.

- If the blocking occurred on the initiative of Rosfinmonitoring, then it will be necessary to collect many supporting documents justifying the legality of the operations performed.

Important! To avoid unnecessary questions related to compliance with 115-FZ, an entrepreneur must save all documents related to the business: lease agreements, supplies, receipts for the purchase of consumables, equipment repairs, etc.

How to find out about account blocking

It is impossible to find out in advance about blocking an account; the tax office and the bank will not warn you. It seems that entrepreneurs themselves know about payment and reporting deadlines and must keep up. Therefore, it may happen that you buy a box of champagne for a corporate party using a corporate card, but the payment does not go through at the checkout because the account is blocked.

If there is no way to find out about the blocking in advance, then you can at least find out about it as soon as possible. This way you won’t have to refuse champagne at the checkout. There are several ways.

Through the bank. The problem is that the bank is not obliged to write to the client about blocking the account; according to the law, the blocking itself is sufficient. Therefore, the bank can silently block the account and wait until the client notices it.

There are banks that write about blocking. For example, Modulbank sends the client an SMS, a message to his personal account and a letter. The client will learn about the blocking a minute after the blocking itself and will be able to quickly fix everything.

Check with your bank to see how they report a block so you don't miss a message.

By ourselves. To find out about the blocking yourself, the tax service is suitable. Go to the website, select the item on suspensions, enter the data, and the tax office will show whether there is a block or not:

If the tax office has blocked the account, a suspension message will appear.

The service has a drawback. You cannot subscribe to service updates, so you will have to check the blocking manually and for each bank where you have an account.

If your bank does not send messages about blocking, log into the service every day. It takes a minute or five, but you won't be blocked suddenly.

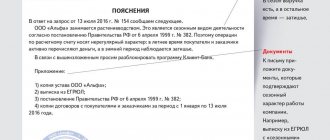

According to letters from the tax office. The blocking should not be a surprise: the tax office first sends letters and notifications, and only then blocks the account.

Therefore, pay attention to letters from the tax office. If a demand comes to pay taxes, fines or penalties, you have several days to pay off the debt, and then the tax office will block the account. The requirement looks like this:

It will not be possible to predict blocking due to reports and requests. The only way is to remember the reporting deadlines.

If you do not live at the IP registration address, ask your relatives to inform you about the letters. The tax office sends requests to pay taxes to the address where the company or individual entrepreneur is registered. If you registered as an individual entrepreneur in Sochi, and live in Moscow, make sure that your relatives receive the letters and report them.

Illegal blocking

The procedure for applying this interim measure has many nuances. A businessman who finds himself in this unpleasant situation must not only know his rights well, but also have an idea of the work procedure of the body that blocked the account. Violations of these provisions make blocking illegal. Most often, this sanction is unlawful if:

- it was initiated by a body that does not have such powers, for example, the Pension Fund, Social Insurance Fund or Compulsory Medical Insurance Fund;

- the decision was made regarding the type of account to which this measure cannot apply, for example, loan, deposit, transit accounts;

- the taxpayer is already bankrupt;

- the decision to suspend was not sent in accordance with the form;

- the deadline for sending a tax demand for payment of the debt was violated, or the letter was sent by regular mail (not registered);

- the business entity violated the deadline for submitting financial statements, while submitting the tax return on time;

- the taxpayer made inaccuracies in the declaration, but submitted it on time;

- The deadline for filing tax reports was missed through no fault of the individual entrepreneur: it was delayed by the post office or the operator of electronic communication channels.

How to deal with illegal actions of the regulatory body, are there any levers of influence for them? You can defend your case in a higher authority, for the Federal Tax Service this is the Tax Service Department for the subject of the Federation. Usually it is located in the capital of the republic, or a large regional city. If this does not help, then you can complain directly to the Arbitration Court. As arbitration practice shows, it is quite possible to appeal an illegal decision, and the victim can receive interest from the inspectorate for each day of illegal blocking.

Thus, one of the important tools for doing business is a current account. The suspension of expenditure transactions on it greatly slows down activity. To avoid falling under this sanction, you need to pay taxes and other obligatory payments on time.

If the bank has blocked an individual entrepreneur's account for withdrawing cash

Banks often block individual entrepreneurs' accounts for frequent cash withdrawals, and in most cases on suspicion of cashing out money for illegal purposes. You risk being sanctioned if you withdraw funds from your account:

- Regularly, for example, every day or within three to seven days from the date of receipt of the transfer.

- At the end of one trading day and then at the beginning of the next.

- Immediately about 600,000 rubles for one operation.

You will also come under suspicion if you use several business cards, but only to receive cash, that is, there are no other transactions on the account. In order not to risk funds in your current account, pay for goods and services of counterparties by non-cash payments, and use the card for corporate expenses.