Form KND 0710096 is a simplified accounting statement that certain categories of legal entities have the right to prepare. The form is recommended; the company can develop its own. The article describes who has the right to use simplified reporting, what it consists of and how it is applied.

Form KND 0710096 is one of the simplified accounting reporting forms recommended by the Federal Tax Service of the Russian Federation. This type of reporting includes forms of a balance sheet, a statement of financial results and the intended use of funds.

Who has the right to conduct simplified accounting

The following have the right to keep accounting records in a simplified form (Article 6 of Law No. 402-FZ dated December 6, 2011):

- Small businesses.

- Non-profit organizations ( NPOs ), except foreign agents.

- Residents of Skolkovo.

Small enterprises include legal entities and individual entrepreneurs with the following business parameters (Article 4 of Law No. 209-FZ dated July 24, 2007):

- Number of people: up to 100 people.

- Revenue – up to 800 million rubles. in year.

In addition, for legal entities there are restrictions on the authorized capital (AC):

- The state, public organizations and foundations must own no more than 25% of the capital.

- Foreign companies and Russian organizations that do not belong to small and medium-sized businesses - no more than 49% of the capital.

However, there is also a list of businessmen who do not have the right to conduct simplified accounting, regardless of their belonging to a small business or other preferential categories. These are organizations that are engaged in certain types of activities listed in paragraph 5 of Art. 6 of Law No. 402-FZ:

— housing and credit cooperatives;

— microfinance organizations;

— budgetary organizations;

- political parties;

— bar associations, chambers and bureaus;

— legal consultations and notary chambers.

Also, those organizations whose reporting is subject to mandatory audit do not have the right to conduct simplified accounting.

The following criteria exist for a mandatory audit:

- According to their organizational and legal form, all joint-stock companies, as well as any companies whose securities are traded on the stock exchange, are subject to audit.

- For the types of activities listed in paragraphs. 3 p. 1 art. 5 of Law No. 307-FZ, for example – banks, insurance companies, investment and pension funds.

- By business scale:

— annual revenue – over 400 million rubles;

— balance sheet assets – over 60 million rubles.

Thus, the right of an organization to maintain simplified accounting must be checked in two stages: first, whether it belongs to a permitted category, and then whether it is not on the “prohibited” list.

For example, an LLC with one founder - an individual, 80 employees and annual revenue of 500 million rubles is classified as a small business. It would seem that the company has the right to switch to simplified accounting.

However, due to exceeding the revenue criterion of 400 million rubles. the organization is subject to mandatory audit, which deprives it of the right to maintain simplified accounting.

Why do we need several simplified accounting options?

Organizations that have the right to conduct simplified accounting are very different. This could be a “micro-enterprise” with several employees and revenue not exceeding 10-15 million rubles per year. But much larger companies, with close to 100 employees and annual revenues in the hundreds of millions, also have the same right.

It is clear that for such different businessmen the degree of simplification of accounting should be different. The Ministry of Finance and the Institute of Professional Accountants and Auditors (IPBR) of Russia have developed recommendations for maintaining simplified accounting records for various categories of businessmen (Information of the Ministry of Finance of the Russian Federation No. PZ-3/2016 and minutes of the IPBR Council dated 02/27/2020 No. 2/20).

Full form of simplified accounting

This option is suitable for “large” small businesses, i.e. for those whose parameters are close to the upper limit of the limit. Typically, such companies do business with a large range of products, goods and materials, a significant number of shipments and a complex payment structure.

The full form of simplified accounting is in many ways similar to standard accounting, but you can use an abbreviated chart of accounts and not apply some accounting standards.

In particular, a businessman who has chosen this form has the right to “enlarge” accounting for the following accounts:

- Keep records of all material inventories on account 10 “Materials”, without using accounts 07 and 11.

- Reflect all costs associated with production and sales on account 20 “Main production”, without using accounts 23, 25, 26, 28, 29.

- Take into account both finished products and goods on account 41 “Goods”, without using account 43.

- All non- cash funds should be reflected in account 51, without using accounts 52, 55, 57. In this case, a separate accounting of cash in the cash desk on account 50 must be kept in any case.

- Settlements with counterparties , as well as with personnel (except for wages ), should be accounted for in account 76 “Settlements with various debtors and creditors”. You may not use accounts 60, 62, 71, 73, 75, 79.

- All capital should be accounted for in account 80 “Authorized capital”, without using accounts 82 and 83.

- Generate the financial result immediately on account 99 “Profits and losses”, without using accounts 90 and 91.

Simplified working Chart of Accounts

| Chapter | Account name | Account number |

| Fixed assets | Fixed assets | 01 |

| Depreciation of fixed assets | 02 | |

| Productive reserves | Materials | 10 |

| Finished products and goods | Goods | 41 |

| Cash | Cash register | 50 |

| Current accounts | 51 | |

| Calculations | Payments for loans and borrowings | 66 |

| Calculations for taxes and fees | 68 | |

| Calculations for social insurance and security | 69 | |

| Payments to personnel regarding wages | 70 | |

| Settlements with various debtors and creditors | 76 | |

| Capital | Authorized capital | 80 |

| Retained earnings (uncovered loss) | 84 | |

| Financial results | Profit and loss | 99 |

Also, when maintaining simplified accounting, you may not comply with the requirements of some PBUs:

- Do not reflect estimated liabilities and assets, including reserves for vacation , warranty repairs, etc. (Clause 3 PBU 8/2010). At the same time, it is still necessary to create a reserve for doubtful debts, because it is separately mentioned in paragraph 70 of the order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.

- Take into account calculations under construction on a general basis, i.e. as “ordinary” income and expenses (clause 2.1 of PBU 2/2008).

- Do not revaluate fixed assets and intangible assets (clause 15 of PBU 6/01 and clause 17 of PBU 14/2007).

- Completely write off commercial and administrative expenses to cost in the reporting year (clause 9 of PBU 10/99)

- Take into account all expenses on loans and borrowings as other expenses (clause 7 of PBU 15/2008).

- Revaluate any financial investments as investments for which the market value is not determined (clause 19 of PBU 19/02).

- Do not reflect the differences between accounting and tax accounting (clause 2 of PBU 18/02).

- Correct any errors identified after the approval of the annual statements as immaterial, i.e. at the expense of other income and expenses (clause 2, clause 9 of PBU 22/2010).

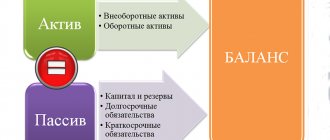

Institution's balance sheet

| Line | Explanations |

| Assets | |

| Tangible non-current assets | We indicate the cost of the organization's fixed assets and capital investments in fixed assets. |

| Intangible, financial and other non-current assets | The total value of investments in intangible assets, development and design of intangible assets, we indicate long-term loans, bonds and bills. |

| Reserves | Finished products, inventories, work in progress, fuels and lubricants, etc. |

| Cash and cash equivalents | The organization's funds are in the cash register or on the current account in rubles or foreign currency (equivalent). |

| Financial and other current assets | Accounts receivable in total for the financial period. |

| Passive | |

| Capital and reserves | The amount of authorized, additional, reserve capital and retained earnings. Non-profit organizations include endowed funds and especially valuable property. |

| Long-term borrowed funds | Credit obligations, loans and interest on them (obligation period - more than 1 year). |

| Other long-term liabilities | Creditor and reserves for future expenses for a period of more than one year. |

| Short-term borrowed funds | Loans, credits, installments (term - less than 1 year). |

| Accounts payable | Current accounts payable (suppliers, contractors, founders, budgets, employees). |

| Other current liabilities | Reserves for upcoming expenses, targeted financing (term - less than a year). |

| BALANCE | |

Abbreviated form of simplified accounting

In this case, the same simplified accounting methods and abbreviated chart of accounts are used as in the previous version. The difference is that all information can be reflected in one register: the Accounting Book. A fragment of the book developed by IPB specialists is given below. But a businessman can also use his own form, having approved it in the accounting policy.

The businessman makes the decision to switch to the abbreviated form on his own. The Ministry of Finance recommends this option for organizations whose number of business transactions does not exceed 30 per month.

Accounting book for the period from 01/01/2020 to ________

| p/p, recording date | Name, date of the primary accounting document | Contents of the fact of economic life | Sum | Current accounts (51) | Settlements with various debtors and creditors (76) | Profit and loss (99) | |||

| D | TO | D | TO | D | TO | ||||

| 1 | 2 | 3 | 4 | 13 | 14 | 23 | 24 | 29 | 30 |

| X | X | Balance as of 01/01/2020 | 5000 | 1000 | 0 | 0 | |||

| X | X | incl. LLC 1 | 1000 | ||||||

| 1/10 | Payment order No. 1/01 dated 10.01. | Transferred from the current account to supplier LLC 1 to pay off the debt as of 01/01/2020 | 1000 | 1000 | 1000 | ||||

| 2/17 | Payment order No. 2 dated 17.01. | An advance was transferred from the current account of LLC 2 under service agreement No. 3 dated January 16, 2020 | 500 | 500 | 500 | ||||

| 3/30 | LLC 3 Certificate of provision of services dated January 30 | Liability for services recognized (ordinary activities) | 100 | 100 | 100 | ||||

| X | X | Total turnover | 1600 | — | 1500 | 1500 | 100 | 100 | — |

| X | X | Balance as of 01/31/2020, incl. | X | 3500 | — | 500 | 100 | 100 | — |

| X | X | LLC 2 | 500 | ||||||

| X | X | LLC 3 | 100 | ||||||

Simple Form of Accounting

The fundamental difference between the simple form of accounting and the two previous ones is that in this case, accounting accounts and double entry are not used (clause 6.1 of PBU 1/2008). The simple system is permitted for micro-enterprises with up to 15 people and annual revenue of up to 120 million rubles, as well as for non-profit organizations, with the exception of foreign agents (clause 6.1 of PBU 1/2008).

But not only the scale of the business is important here. In any case, accounting should provide complete information about the company (Clause 1, Article 13 of Law 402-FZ). Simple accounting will satisfy this requirement if the following conditions are met:

- The nature of the company's activities allows it to determine its financial results using the cash method. Under this method, revenue is recognized when cash is received and expenses are recognized when payment is made.

- The company does not have depreciable assets.

- All receivables and payables are repaid in the period of their occurrence.

- There are no significant balances of other property and liabilities that could affect the assessment of the company's financial position.

An example of maintaining a Book with simple accounting is given below.

Accounting book for ______________

rub. cop.

| Contents of the fact of economic life | Current account transactions admission + write-off - | Normal activities | USN income tax | |

| Revenue | Expenses | |||

| 3 | 4 | 5 | 6 | 9 |

| Cash balance at the beginning of the reporting year | 0 | |||

| Contributions received from founders | 2 000 000 | |||

| Paid supplier invoices for goods received (300 units)* | -6 000 000 | 6 000 000 | ||

| Payment was received from buyer “A” for the goods delivered (100 units)* | 4 400 000 | 4 400 000 | ||

| Payment was received from buyer “B” for the goods delivered (180 units)* | 7 600 000 | 7 600 000 | ||

| Paid rental services | -400 000 | 400 000 | ||

| Wages transferred to employees | -1 600 000 | 1 600 000 | ||

| Transferred to the personal income tax budget, withheld from employees’ wages | -240 000 | 240 000 | ||

| Mandatory insurance contributions transferred to the budget | -555 680 | 555 680 | ||

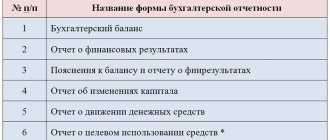

What forms are required?

In the table we will show which forms of accounting are mandatory and which are not, and on the basis of what, what are their features.

| Form, report | Mandatory or not | Availability of template by order 66n | Peculiarities |

| Accounting | |||

| Balance | Yes | Yes | Divided into consolidated articles that group several elements at once. Selection of an indicator is necessary only if its value and if it is significant. |

| About financial results | Yes | Yes | It does not contain a division by type of expenses for core activities; the current income tax is not highlighted, as are other indicators, which are most often insignificant. |

| Applications | |||

| About capital changes | No if the indicators are insignificant | The general one is used taking into account the significance of the indicators | |

| About cash flow | Likewise | Likewise | |

| Explanations | Likewise | Likewise | |

| About the intended use of funds | Mandatory only for NPOs and legal entities with targeted revenues | Yes | There is no detail or breakdown by type of contribution. |

Read more about how companies fill out reports using the simplified tax system in our article by clicking on the link.

Accounting statements with simplified accounting

With any option for maintaining simplified accounting, the organization is required to submit financial statements .

Small enterprises can submit only two forms: a balance sheet and a statement of financial results in an abbreviated format (clause 6, 6.1 and Appendix 5 to Order of the Ministry of Finance dated July 2, 2010 No. 66n).

Also, representatives of small businesses may not disclose in their financial statements certain types of information that are mandatory for most medium and large companies:

- Information about related parties - legal entities and individuals who can influence the company or are themselves influenced by it (clause 3 of PBU 11/2008).

- Information on segments, i.e. for individual divisions (clause 2 of PBU 12/2010).

- Information on discontinued activities - about those areas of work that the organization plans to abandon (clause 3.1 of PBU 16/02).

However, here we should proceed from the same principle as when keeping records in general. Reporting should enable users to gain a complete understanding of the financial health of the business.

In cases where the abbreviated reporting format is not sufficient, a small business must use the forms and disclosure procedures provided for large companies.

Rules and features of filling out accounting reports

The Ministry of Finance published clarifications for simplified reporting in information No. PZ-3/2015. Basic principles of compilation:

- The inclusion of financial information in reporting forms is permitted without detailing the accounting items.

- Disclosure of information in a smaller volume, in comparison with the full volume of final documentation.

- The organization has the right not to disclose information about discontinued activities.

- Transactions after the reporting date are reflected on a rational basis (if the changes are significant).

Let's look at the features of filling out simplified accounting reporting forms.

Simplified accounting for individual entrepreneurs

Individual entrepreneurs may not have to do accounting at all if they keep tax records. But often individual entrepreneurs organize accounting voluntarily.

Firstly, tax accounting does not provide complete information for business management. This especially applies to tax regimes such as UTII and PSN, where all accounting comes down to calculating physical indicators.

In addition, if an individual entrepreneur wants to get a loan from a bank or attract financing in another way, he will need accounting reports. Also, accounting reports in most cases will be needed when concluding government contracts and generally when working with large buyers and customers.

Since an individual entrepreneur is not required to keep accounting records, he can freely choose the option of organizing it, regardless of revenue or other parameters. Therefore, in order not to complicate their lives, entrepreneurs often use one of the simplified options discussed above.

Annual form for individual entrepreneurs and LLCs on the simplified tax system: what balance to submit for 2019

Taxpayers submit:

- a regular 3-page report with numerous appendices;

- or simplified on 2 pages with explanations if necessary (for example, to clarify the degree of materiality of indicators and other clarifications).

Depending on the type of activity of the organization and the accounting accounts used: if rare accounts are used that are not in the short form of the report, then it is recommended to use the full version. For companies engaged in such common activities as trade, transportation or construction, the lightweight version of the form reflects the results of financial activities quite fully.

Conclusion

Small enterprises, non-profit organizations (except for foreign agents) and Skolkovo residents have the right to keep accounting records in a simplified form. To do this, they must comply with the requirements of the law regarding the composition of the founders, type of activity and scale of business.

The option for organizing simplified accounting depends on the complexity of the business: the number of transactions, the presence of assets, the procedure for settlements with counterparties, etc. In any case, accounting must be kept in such a way that it is possible to objectively assess the financial position and performance of the company.

Individual entrepreneurs have the right not to keep accounting records, but often do so voluntarily. In this case, it is convenient for them to use one of the simplified accounting options recommended for organizations.