Author: Cherikov and partners 04/26/2016 Taxes in Kyrgyzstan Leave a comment

In this short article we will try to explain to you in simple language what VAT is and how it is calculated in Kyrgyzstan.

For clarity, let's take an example from life. Two friends (let's call them Azamat and Alexander) decided to start a business selling and servicing office equipment. The guys registered an LLC, rented premises and began calling organizations with offers of cooperation. Since the guys’ prices were much lower than their competitors’, most organizations agreed to work with them. And in just six months, their total revenue reached 9 million soms !

General provisions

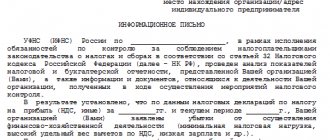

The EAEU today includes 5 countries: Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan. For all transactions that occur within this union, there is a special procedure for paying VAT, as well as a number of other taxes. The rules regarding the payment of taxes when making transactions between these 5 countries were established by the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services (Appendix No. 18 to the Treaty on the Eurasian Economic Union, which was signed in Astana on May 29, 2014).

VAT on imports from Kyrgyzstan: determining the tax base

When paying VAT on imported goods, it is paid not as part of its cost, but separately to the budget of the receiving state. The tax regime and other features of the importer’s tax payment do not in any way affect the rules for paying import VAT. Let's look at the procedure for determining the tax base. The tax is paid at customs in most cases along with customs duties.

- The tax base is determined at the time the product is accepted for accounting and is formed on the basis of their cost. The cost in this case is the amount indicated in the supply contract, or in any other basis for payment for the goods (for example, an invoice).

Attention: an exception when calculating the date of acceptance of a product for accounting is products that were received on the basis of a leasing agreement, moreover, one that provided for the transfer of the right to the product in full to the lessee. In this case, the tax base is determined as many times as lease payments are made.

- If the product was purchased not for rubles, but for another currency, then it is necessary to recalculate the cost of the product at the rate that was set by the Central Bank at the time the product was accepted for accounting.

- The tax base is multiplied by the tax rate, which, as we have already found out, can be either 10% or 18%.

Calculation example: for example, you purchased goods worth 18,650 US dollars from a Kyrgyz supplier, payment was made in dollars. Similar goods in Russia are taxed at a rate of 18%. The dollar to ruble exchange rate on the date the goods were accepted for accounting was 56.14 rubles. So, let's calculate VAT: 18,650 x 56.14 x 0.18 = 188,461.98 rubles.

Promising areas of business in Kyrgyzstan

It’s difficult to say which business is the most profitable. The market conditions are contrasting and changing rapidly. Local experts believe that the most promising option is the production of goods for export (clothing products, meat and dairy industry, dried fruits, nuts and honey). This will create a stable medium-sized business. The trade sector will always remain relevant. But after joining the EAEU, a number of problems arose due to the introduction of customs duties with China. It is advisable to pay attention to the hospitality sector. Recreational resources make it possible to develop any type of tourism - gastronomic, cultural, health, active (hiking, fishing, hunting, outdoor recreation).

- There are all conditions for processing agricultural products and livestock farming. A win-win option is to grow early vegetables and fruits (especially greenhouse ones) and send them for export. In fact, the agricultural industry is currently highly fragmented. Farmers within the same region are not connected to each other in any way. All activities come down to two points - growing and selling. Processing, pre-sale preparation: sizing, packaging, washing, sorting, and logistics are completely undeveloped. And those manufacturers who follow the path of a full production cycle will have significant advantages over their competitors.

The service sector is actively developing - repair of cars, clothing and cell phones. Computer, language and other educational courses and trainings are very popular among the local population. Large investors can turn their attention to small hydroelectric power plants. Previously there were about 1,500 of them, but now there are only a few left. Investments from several hundred to a million dollars will pay off within 2-3 years.

- Construction has ceased to be profitable. The food industry has also become a high-risk business. The mining industry remains the most problematic due to problems with the local population.

To summarize, we can say that Kyrgyzstan is one of the most promising states in the entire post-Soviet space for doing business. The country has one of the most liberal laws in the entire post-Soviet space. Special tax regimes apply in the territories of SEZs and technology parks. In recent years, much has been done for the comprehensive development of small and medium-sized businesses. There is huge potential to create economically favorable soil. Officials intend to promote the “Made in Kyrgyzstan” brand on the international stage.

We declare and pay tax

Payment of import tax is very strictly regulated. Thus, VAT must be paid by the 20th day of the month following the day when the product was accepted for accounting. Also, before the 20th day of the next month, you must submit a declaration to the Federal Tax Service. The declaration is submitted in the old form and can be found in the appendix to Order No. 69 of the Ministry of Finance of the Russian Federation dated July 7, 2010.

You should be careful when filling out and submitting the declaration, because unlike the usual one, the import VAT declaration must be submitted not for the quarter, but for the month. If you receive goods regularly, you will have to submit a declaration every month.

Who is required to pay import VAT?

Based on legislative acts related to the EAEU, it is possible to distinguish categories of citizens and legal entities who are required to pay import VAT when working with counterparties from Kyrgyzstan.

| Pay tax | Don't pay tax |

| All companies and individual entrepreneurs that import products from the EAEU. This applies even to those persons who, according to the Tax Code of the Russian Federation, are exempt from paying regular VAT. | Persons who have imported the product for their own use and who do not intend to sell it or conduct any business activity involving it. |

Some products are not subject to tax:

- products that were imported under the customs zone regime under the “free” sign;

- companies that are exempt from paying fees in accordance with Art. 150 Tax Code of the Russian Federation;

- when transferring products from one department of the organization to another (for example, if one division is located in Kyrgyzstan and the second in Russia.

Important: if you are not sure whether you will need to pay VAT or not, you can consult Art. 150 of the Tax Code of the Russian Federation - other legislative acts are built around it.

There are different ways to pay VAT. The most common is payment through the Federal Tax Service. However, you can only pay through the inspection the VAT that was received only on goods that were manufactured in the EAEU member countries, as well as those that, although they were manufactured in other countries, were officially released into free trade in the territory of the entire so-called Customs union.

Buy a ready-made business

There are several ways to become the owner of an operating enterprise in Kyrgyzstan:

- discover something new;

- buy ready-made;

- open a branch or representative office;

- make investments;

- participate in the privatization of state facilities. But for this it is imperative to provide a detailed business plan for the further development of the company. The list of objects can be found on the website of the Ministry of Justice. The privatization program for 2015-2017 included BTA-Bank CJSC, Alfa Telecom CJSC, and Kyrgyzstan Airline OJSC.

The simplest way is to purchase an existing business. The largest and most serious platform is kg.bizmast.ru. On it you can sell, buy, evaluate a business, conduct an audit and receive legal support. On multidisciplinary resources (flagma-kg.com, bazarmazar.kg, stroga.kg) there are many offers (from websites and patents to large operating businesses). Ready-made companies or trademarks are sold on desko.kg. The profile portal lalafo.kg contains many advertisements, including for large investors. On business-asset.com, in addition to business, you can become the owner of equipment, commercial real estate, a franchise, and even select highly qualified specialists.

In their activities, foreigners doing business in the Kyrgyz Republic must rely on the Tax, Civil, Land and Customs Codes of the Kyrgyz Republic. The following laws are fundamental:

- “On state registration of legal entities”;

- “On free economic zones in the Kyrgyz Republic”;

- “On licensing”;

- “On investments in the Kyrgyz Republic”;

- “On public-private partnership”;

- “On joint stock companies”;

- “On business partnerships and societies”;

- “On securities”;

- “About the subsoil”;

- “On the protection of the rights of entrepreneurs.”

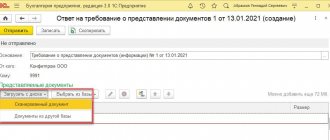

Required documents

Along with the tax return, you also need to provide a number of documents:

- A statement that you have imported a certain product;

- Documents confirming the fact of tax payment (for example, a bank statement);

- Accompanying documents (waybill);

- If the product was purchased through the services of intermediaries, then you must provide an agreement between your organization and the intermediary;

- The basis for payment and import of goods into the territory of the Russian Federation (for example, an agreement or invoice).

Please note: you can submit your application either electronically or in printed form.

You can submit documents electronically through the State Services website, as well as through the Tax Service website. The document must be signed with an electronic signature. If you submitted an application electronically, there is no need to submit it again in paper form. Also, if you submit an application in printed form, there must be 4 copies, as well as 1 more copy in electronic form on removable media.

You may not provide a bank statement to confirm the fact of payment of VAT when your organization has overpaid taxes and fees that go to the federal budget, because in this case the Federal Tax Service may decide to offset import VAT against the invoice overpayments.

Accompanying documents (in particular, the waybill) may also not be able to be submitted to the Federal Tax Service due to the fact that, according to the legislation of Kyrgyzstan, suppliers have the right not to issue such a document. The same applies to other accounting documents, such as invoices.

The supplier may be required to send a letter on official letterhead stating where the product came from. Such a letter may not be provided to the Federal Tax Service when all this data is indicated in other documents provided, for example, in a contract.

Do not forget that if you work under a contract with intermediaries, then you must submit documents such as an agency agreement, or a commission or assignment agreement to the Federal Tax Service.

Customs clearance of goods transported between EAEU countries

Filling out declarations for goods in the usual manner for goods transported between the states of the EAEU has been abolished; accounting is carried out through the submission of a statistical declaration form (statistical form) to the customs office of the state of export. Submission of statistical forms is carried out in order to record the movement of goods during foreign trade of the Russian Federation with member countries of the Eurasian Economic Union. The statistical form is drawn up by the person who made the transaction, or on whose instructions this transaction was made, or who is vested with the right to own and use goods.

The statistical form is submitted to the customs authorities no later than the 8th working day of the month following the month in which the goods were shipped.

Important! For failure to comply with the deadlines for submitting a statistical form for recording exports to Kyrgyzstan, a fine is provided for officials under Article 19.7.13 of the Code of Administrative Offenses of the Russian Federation in the amount of ten thousand to fifteen thousand rubles; for legal entities - from twenty thousand to fifty thousand rubles.

The statistical accounting form on paper can be sent using the Personal Account of a Foreign Trade Participant service on the Customs website as follows:

- It is necessary to fill out the statistical form electronically;

- Make sure that the document is filled out correctly and completely;

- Request a system number and save the form;

- Certify the received document with the signature and seal of the applicant;

- Send the received document in paper form in person or by post with acknowledgment of receipt to the customs office at the place of registration of the exporter;

- The customs inspector, having received the statistical form on paper, will download it from the customs system using the system number, verify the information and record it, assigning an official registration number;

Who takes into account import VAT and how?

There is a difference between including VAT on the cost of goods and accounting for VAT on expenses. Let's figure it out.

| Taken into account in the cost of goods | Taken into account in expenses |

| 1. Companies that operate under the general tax regime, or that use UTII; 2. Companies that, according to Art. 145 Tax Codes of the Russian Federation were exempt from taxation; 3. VAT payers if the products purchased from a member country of the EAEU were purchased in order to carry out activities to which payment of VAT does not apply, or for activities that cannot be carried out on the territory of the Russian Federation. | 1. Companies that use the “simplified” system of “income minus expenses”; 2. Companies that operate under the single agricultural tax system; |

We subtract import VAT

You can deduct VAT if you apply the normal tax regime and are not exempt from paying VAT. Deduction of import VAT is possible only after you have paid it and you have all the documents to confirm this. There are no other official conditions for tax deduction; however, tax authorities often also require you to provide a statement that you imported the goods and paid tax on them. However, this is not a mandatory condition, and you have every right to refuse to comply with it.

An organization can submit documents for deduction only when several conditions are met. Product was purchased:

- In order to use it only on the territory of the Russian Federation, either for temporary transport, or for its processing;

- The product was purchased for an activity that is subject to value added tax;

- The product has been accepted for accounting.

Attention: if at least one condition is not met, then you do not have the right to apply for a deduction.

Accounting entries

Let's look at the accounting entries when working with import VAT:

| Operation | Debit | Credit |

| We reflect the price of the product | 60 | 51 |

| We pay for the goods | 60 | 51 |

| We charge VAT for payment to the Federal Tax Service | 19 | 68 (sub-account “VAT calculations”) |

| Paid VAT | 68 | 51 |

In order to consider in more detail the process of accounting entries, as well as everything related to the import of VAT from Kyrgyzstan, one of the EAEU member countries, you can use the Treaty on the EAEU and Appendix %18 to it. Also on the official website of the tax service there is a section “Customs Union”, where other application documentation is located.

OUR ADVANTAGES

COMFORTABLE

Your personal account makes it possible to carry out the vast majority of procedures electronically, from uploading documents and information to tracking the status of customs clearance. The declaration is sent to the customs authority via a secure channel using Electronic Declaration technology (ED-2).

FAST

Thanks to the accumulated experience of interaction with the customs service, we have developed clearly defined rules of interaction that allow us to complete the customs clearance procedure quickly enough.

PROFITABLE

Our customers receive a Declaration of Goods (DT), and a set of documents for crossing the border at the established rate specified in the Agreement, additional costs.