The KND code is an indication of the type of tax return according to a special directory. The article describes the functions of the classifier, its structure and provides the main values for the most common reporting.

In accounting documentation, there is often a combination of numbers that means the KND code: the decoding of the abbreviation is quite simple - this is the tax return code. The KNI code can be found in a special reference book approved by the Order of the Federal Tax Service of Russia dated May 28, 2013 (it correlates the values of KNI and BCC). In addition, the structure of the tax document classifier was approved by Order of the Federal Tax Service of Russia dated March 22, 2017 No. ММВ-7-17/ [email protected]

Any document that has a 7-digit codification represents a calculation of a particular tax in written or electronic form, made by the taxpayer himself in order to pay it. For verification and control, the taxpayer also indicates in the form other necessary information: the object of taxation, sources of income, basis for calculation, applied benefits, etc.

Who submits the KND form 1152017

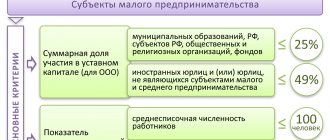

The declaration in the KND form 1152017 is provided for persons using the simplified taxation system - simplified taxation system. The application of the simplified tax system is regulated by Chapter 26.2 of the Tax Code, which states that both organizations and individual entrepreneurs have the right to apply the simplified tax system.

An organization has the right to switch to the simplified tax system after nine months of activity in the year when it decided to switch, provided that the total income for this period did not exceed 112.5 million rubles. Part 3 of Article 346.12 of the Tax Code of the Russian Federation lists the types of organizations and individual entrepreneurs that are not entitled to apply the simplified tax system, including, for example:

- entities with branches;

- banks;

- pension funds;

- investment funds;

- pawnshops.

Organizations and individual entrepreneurs whose activities are not listed in Art. 346.12 and having a fairly small income have the right to switch to the simplified tax system. The declaration in the form KND 1152017 will become mandatory for them.

The simplified tax system provides two taxation options:

- “income”, in which the amount of tax is calculated from the full amount of income of the organization;

- “income minus expenses” is a procedure in which only a person’s profit is subject to taxation.

The tax rate under the “income” system is less than under the “income minus expenses” system; each organization and entrepreneur independently decides which system to prefer.

Tax reporting forms effective in 2021

Organizations and individual entrepreneurs pay taxes and insurance premiums depending on the chosen taxation system and report to the Federal Tax Service and other regulatory authorities using approved forms. Several new reporting forms have come into effect this year.

Income tax

Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] approved a new form of income tax declaration. She received, among other things, Appendix No. 7 to sheet 02 “Calculation of investment deduction.” There are also changes in sheet 02 itself. The payer’s attribute is now reflected in two numbers. New codes have also been introduced: 07 - for participants in regional investment projects, 09 - for educational organizations, 10 - for medical organizations and others.

In addition, the procedure for reflecting the details of the constituent entities of the Russian Federation that have reduced rates has been determined (line 171). And lines 268 and 269 have also been introduced, where the amounts by which advance payments or tax are reduced in connection with the application of the investment deduction are entered. And in Appendix No. 1 to sheet 02, new lines 200-220 serve to highlight the tax base for income from participation in an investment partnership. Sheets 01, 03, 08 have also been updated. Organizations began reporting for 2021 using the new form.

Property tax

Beginning in 2021, taxpayers are not required to submit advance property tax payment estimates. This innovation is reflected in the new tax return form, approved by order dated August 14, 2019 No. SA-7-21 / [email protected] In addition, new tax benefit codes appeared in it for some organizations that own real estate, for example, for high energy facilities efficiency and others. The new form came into effect with reporting for 2021.

Insurance premiums

The sheet on information of individuals not related to entrepreneurs has been excluded from the new form for calculating insurance premiums. It is mandatory to fill out the title page, section 1, subsections 1.1 and 1.2, appendix 1 to section 1, appendix 2 to section 1 and section 3. Other information should be entered as necessary.

New report from SZV-TD

Since the beginning of this year, another monthly report has been submitted to the Pension Fund - SZV-TD. In it, the employer informs about personnel changes among its employees. The SZV-TD form was introduced in connection with the transition to electronic work books.

Organizational reporting

Reporting forms that are required to be submitted to regulatory authorities of organizations can be divided into:

—

tax reporting in accordance with the selected regime;

—

reporting for employees;

—

financial statements;

—

tax reporting on other taxes;

—

statistical reporting (to Rosstat).

In addition, users of cash register equipment must keep records of cash transactions. Simplified organizations are required to account for income and expenses in KUDiR.

Basic forms of tax reporting

—

KND-1151006 – Tax return for corporate income tax;

—

KND-1151082 – Tax return for corporate income tax when implementing production sharing agreements;

—

KND-1151038 – Tax return for income tax of a foreign organization;

—

KND-1152026 – Tax return for corporate property tax;

—

KND-1152028 – Tax calculation for advance payment of corporate property tax;

—

KND-1151001 – Tax return for value added tax;

—

KND-1151074 – Tax return on excise taxes on tobacco products;

—

KND-1151039 – Tax return on excise taxes on petroleum products;

—

KND-1151090 – Tax return on excise taxes on ethyl alcohol, alcoholic and (or) excisable alcohol-containing products;

—

KND-1151089 – Tax return on excise taxes on motor gasoline, diesel fuel, etc.;

—

KND-1151040 – Tax return for excise duty on excisable mineral raw materials (natural gas);

—

KND-1151088 – Tax declaration on indirect taxes (value added tax and excise taxes) when importing goods into the territory of the Russian Federation from the territory of member states of the customs union;

—

KND-1151054 – Tax return for mineral extraction tax;

—

KND-1152011 – Tax return for gambling business tax;

—

KND-1152004 – Tax return for transport tax;

—

KND-1152027 – Tax calculation for advance payments for transport tax;

—

KND-1153005 – Tax return for land tax;

—

KND-1153003 – Tax calculation of advance payments for land tax;

—

KND-1151072 – Tax return for water tax;

—

KND-1152017 – Tax return for tax paid under the simplified taxation system;

—

KND-1151059 – Tax return for the unified agricultural tax;

—

KND-1151085 – Unified (simplified) tax return;

—

6-NDFL – Calculation of the amounts of personal income tax calculated and withheld by the tax agent;

—

4-NDFL – Tax return for personal income tax (KND-1151021);

—

KND-1151046 – Tax return for the unified social tax;

—

KND-1151063 – Tax return for the unified social tax for individual entrepreneurs, lawyers, notaries engaged in private practice;

—

KND-1110018 – Information on the average number of employees for the previous calendar year;

—

KND-1151065 – Declaration of insurance contributions for compulsory pension insurance;

—

KND-1151058 – Calculation of advance payments for insurance contributions for compulsory pension insurance;

—

KND-1151026 – Calculation of regular payments for the use of subsoil;

—

KND-1151024 – Tax return on income received by a Russian organization from sources outside its borders.

reporting accounting reporting submission of reports

Send

Stammer

Tweet

Share

Share

When to submit a declaration using the KND form 1152017

The deadline for filing a declaration is established by Art. 346.23 Tax Code of the Russian Federation.

| Who reports | Deadline |

| Organizations | No later than March 31 of the year following the reporting year, that is, organizations must submit a declaration for 2021 by March 31, 2020 |

| IP | No later than April 30 of the year following the reporting year |

There are special cases when KND form 1152017 is submitted:

- if a person ceases business activities and notifies the tax office, he submits a declaration by the 25th day of the month following the one in which his activities ceased;

- if a person has lost the right to use the simplified tax system, he must submit a declaration by the 25th day of the month following the quarter in which this loss occurred.

OPTION 1: KND 1166108 – via “Kontur.Extern”

Step one:

- Log in to the Kontur Extern website.

If you do not have Kontur Extern, then use the free “Test Drive” version: 3 months.

- On the main screen of Contour Extern, go to the “FTS” tab, then click on the “Request reconciliation” button.

Step Two:

- On the “Request Reconciliation” tab, select the required document.

Step Three:

- On the request screen for the provision of information services, fill in all the required fields: (Type of request according to the Federal Tax Service, Inspectorate Code, Requested tax according to KBK and OKTMO.)

- In the “Response format” field, enter: “XML”.

- Next we move on to sending.

Step Four:

- Wait for the results of document processing by the tax authority (usually this operation takes a few minutes, but delays may occur.)

- Go to the “Documents”, “ION Requests” section and download the finished act.

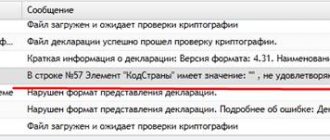

How to fill out KND form 1152017

Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] approved the procedure for filling out KND 1152017, which describes in detail how to fill out each section of the document.

The declaration consists of a title page and three sections; the first and second sections contain subsections intended for different taxation systems. The logic for filling out a document is unusual: first the title page is filled out, then the second section, then the first. Finally, if necessary, a third one.

All monetary values in the declaration are entered in rubles in whole numbers, kopecks are rounded: 50 kopecks or more - to the full ruble, 49 kopecks or less - to zero.

Legal side

So, in order to study the structure of the ND, you need to familiarize yourself with a number of regulations governing the rules for its submission and completion:

- Tax code . The general structure is reflected in Article 80.

- Departmental orders . All changes that relate to the ND submission form are formalized by issuing them. In addition, orders of the Federal Tax Service regulate the specific form, structure, and sequence of completion for each type of declaration.

What is the procedure for preparing tax returns? ND composition: 7 sheets, as well as five appendices. The ND must have a title page. Line numbering is done using three digits. For example, the first line of the ND will look like this - 001, the second - 002 and so on.

The ND, regardless of its type, must necessarily contain certain information. In our material we will try to clearly explain the content and purpose of each section.

You can learn more about the legal norms and other aspects of the declaration in this article, and read about how to properly submit a declaration here.

Method and form of document submission

Declaration 1152017 is submitted:

- On paper:

- personally by the taxpayer;

- his representative;

- by mail.

- Electronic.

IMPORTANT!

The Federal Tax Service does not have the right to require an electronic declaration. Taxpayers with a staff of 100 or more employees are required to report in electronic format. And for the transition to the simplified tax system, the following condition applies: the staff cannot exceed 100 employees. At the same time, the electronic delivery method eliminates a large number of errors and omissions when filling out.

OPTION 2: Request List of KND 1166108 on the tax website

Step one:

This method will require registering in the “Personal Account of a Legal Entity” on the website of the Federal Tax Service. And receive an Electronic Signature (KSKPEP) of a Legal Entity.

- Log in to the website nalog.ru in your personal account of a legal entity.

Step Two:

- Select the “document request” tab in your personal account.

Step Three:

- Select “List of tax returns (calculations) and financial statements” and set the desired response method.

Reporting deadlines

A single (simplified) declaration is submitted both on paper and electronically (with an average number of more than 100 people).

The declaration is submitted quarterly.

for 2021 - until 01/20/2021 inclusive;

for the 1st quarter of 2021 - until 04/20/2021 inclusive;

for the six months - until July 20, 2021 inclusive;

9 months before 10/20/2021 inclusive.

Try submitting your reports through the Kontur.Extern system. 3 months free use all features!

Try it

Tax return for UTII

UTII is a single tax on imputed income, a tax that is introduced at the municipal level and applies to certain areas of activity.

List of objects subject to UTII:

- domestic services;

- veterinary;

- maintenance; transport services, storage and washing;

- retail;

- public catering;

- outdoor advertising, including in vehicles;

- provision of housing for rent, hotel services;

- provision of land plots and places for trade for rent

The tax rate is about 15%.

Updated tax return

What is this type of reporting? All goods that were imported during the reporting period. Unlike the general VAT return, the taxpayer fills out the form without a cumulative total. That is, only monthly data is taken into account.

In this regard, it is not always possible to correct inaccuracies in the tax return for the reporting periods following the current one. In order to correct incorrect information provided by the taxpayer, an amended tax return must be submitted within the time limits specified by the regulations of the Tax Code of the Russian Federation. For these purposes, there are special lines “Change in the tax base for previously imported goods.”

In what cases is an updated tax return provided?:

- If an error (error) is detected in the application of the VAT rate.

- If an error (error) is detected in determining the tax base, provided that the data for calculating VAT were known on the date of submission of the declaration.

- When exporting goods intended for sale from the territory of the Russian Federation within one month, with subsequent return.

If you provide an updated tax return, you must write a statement about the import/export of goods in which indirect taxes were paid.

It should be taken into account that when returning goods to the Russian Federation, the payer has every right not to provide an updated declaration, accepting the entire amount of tax paid as a deduction. However, an updated declaration must be provided in the event of returning goods, if the initial declaration has not yet been submitted to the Tax Inspectorate.

An updated tax return is not provided:

- If, after calculating VAT for a certain period of time on goods exported from the territory of the Russian Federation, expenses are known that increase the tax base for these items.

- In case imported goods from Russia are returned to the seller within the same month.

- In case of a change in the tax base due to fluctuations in exchange rates at the time of receipt of the goods before the payment deadline.

Tax return for property deduction

This type of deduction includes three components:

- In relation to the costs of building a new house or purchasing real estate on the territory of the Russian Federation (in any region), including land plots for development.

- In relation to the costs of repaying existing interest on target loans. It is worth considering that loans can be issued exclusively by Russian financial institutions, as well as individual entrepreneurs. These funds must be spent for their intended purpose - construction or purchase of housing.

- Expenses to repay existing interest on loans (loans) received for the purpose of refinancing for the purchase of housing (apartment, house) or land for development. Including the construction of a residential building. On-lending can be carried out exclusively by Russian financial institutions.

How can I get a property deduction? In case of acquisition or construction of a residential house (cottage), apartment or room, share, land plot for construction. The deduction is made solely in the amount of expenses that were incurred. However, it is worth considering that the amount should not exceed two million Russian rubles, not taking into account previously paid interest on current loans.

When a taxpayer can submit a single simplified return: examples

For a clearer explanation of who submits a single simplified tax return, let’s look at a few illustrative examples:

Example 1

Let’s say that Ogonyok LLC, located at OSNO, did not provide services in 2021, and no funds were received into the company’s current account or cash desk. Ogonyok LLC has no assets on its balance sheet. However, during the reporting period, it paid utility bills from its current account, and wages were also accrued and paid to its only employee - the manager. In this case, Ogonyok LLC does not have the right to file a single simplified tax return due to the fact that the movement of funds in the current account occurred despite the fact that there was no income in this period.

Example 2

Borisov A.I. was registered as an individual entrepreneur from 08/01/2020, and he chose the simplified tax system as the taxation system. However, due to unforeseen circumstances, Borisov A.I. did not provide a single service for the entire 2021. He did not open a current account, there was no receipts at the cash desk. In this case, Borisov A.I. has the right to submit a single simplified tax return for 2021 no later than 01/20/2021.

Confirmation of the above example is contained in the letter of the Federal Tax Service dated 08.08.2011 No. AS-4-3/ [email protected]

Example 3

Temp LLC is located on OSNO. In 2021, no funds were received into the current account or cash register, and no payments were made; Temp LLC is not a payer for property, transport and land taxes due to the lack of taxable items. In this case, the organization has the right to file a single simplified tax return, which will include income tax and value added tax.

Single simplified declaration - sample filling

The unified simplified tax return form can be downloaded for free on our website using the link below:

However, it may also be useful to become familiar with a sample of filling out a single simplified tax return. Especially in light of the question of whether it is possible to have a sample for filling out a zero unified simplified tax return. The Unified Simplified Declaration was initially created as a zero declaration (i.e., without digital indicators characterizing the taxpayer’s conduct of activities), so it does not even contain fields for putting dashes in it for data missing to be filled out. In addition, it reflects information about the absence of grounds for paying several taxes at once. The usual zero declaration is drawn up on the form of a specific tax, used to enter into it the initial information for calculating the base for this tax, which, in the absence of this information, is replaced with dashes.

You can also download a completed sample of a single simplified tax return for the 4th quarter of 2021 for an organization in ConsultantPlus, having received trial demo access to the K+ system. It's free.