What is an income statement

This is a form included in the financial statements along with the balance sheet and its annexes. The report form was approved by Order of the Ministry of Finance dated 07/02/10 No. 66n (hereinafter referred to as Order No. 66n).

IMPORTANT . The income statement format is not recommended. Using it is an obligation, not a right of organizations. But the company can set the level of detail itself. For example, decipher what business expenses consist of and enter an additional line “Including” for this.

By the way, previously this form was called “profit and loss statement” and “form No. 2”. The modern name was introduced more than six years ago, but some accountants, auditors and other specialists still use the old name.

Where are Forms 2 of the financial results statement?

There is a form designed for all organizations (let's call it the general form). It is given in Appendix No. 1 to Order No. 66n. The filling rules given below relate specifically to the general form of the financial results report (on the active link you can use Form 2 of the financial results report).

Small businesses can use a special simplified form. It is given in Appendix No. 5 to Order No. 66n.

Fill out your income statement and other financial statements for free

REFERENCE . The financial results report for 2021 and later periods will need to be submitted using an updated form. Amendments to the current form were made by order of the Ministry of Finance dated April 19, 2019 No. 61n. The changes are related to the new edition of PBU 18/02 (see “Instructions for the new edition of PBU 18/02 “Accounting for corporate income tax calculations”, which must be applied from 2021”). Organizations may wish to apply the updated form earlier.

Prepare, check and submit financial statements to the Federal Tax Service via the Internet Submit for free

Procedure for preparing financial statements

Financial reporting indicators are formed in the accounting system.

The accounting work cycle for any month in the inter-reporting period can be divided into three stages:

- processing of primary documents (registers of primary documents) submitted by financially responsible persons, drawing up cumulative and grouping statements;

- systematization of primary documents in accounting registers;

- generation of information about accounting objects in the General Ledger accounts based on the final data of accounting registers. Indicators of the General Ledger (turnovers in the debit and credit of accounts, balances), and, if necessary, indicators in analytical accounting registers are used to prepare financial statements.

The procedure for preparing financial statements includes:

- checking entries in accounting accounts and correcting errors;

- clarification of the assessment of assets and liabilities reflected in the accounting records;

- reflection of the financial result of the organization’s activities;

- filling out accounting forms.

To check the completeness and correctness of entries in accounting accounts, various techniques are used, which largely depend on the form of accounting used in the organization.

Typically, records in accounting accounts are checked in the following areas:

- compare the turnover for each synthetic account with the results of the documents that served as the basis for the entries;

- compare turnovers and balances of all synthetic accounts (in total);

- They compare the turnover and balances of each synthetic account with the corresponding indicators of analytical accounting.

To compare turnovers and balances for all synthetic accounts, a balance sheet is compiled.

How to fill out an income statement

The purpose of filling out is to show how the totals were calculated:

- Gross profit (loss);

- profit (loss) from sales;

- profit (loss) before tax;

- Net income (loss).

Each final value is obtained by adding or subtracting intermediate values. For example, to find gross profit, you first need to take two intermediate indicators: revenue and cost of sales. Then subtract the second from the first.

IMPORTANT. Intermediate values that participate in calculations with a minus sign (that is, are subtracted) must be indicated in parentheses. Some indicators are always in parentheses: business expenses, interest payable, etc. But there are also those that can be either in brackets or without them. This is a change in deferred tax assets (DTA) and a change in deferred tax liabilities (DTL).

All lines have an “Explanation” column. It contains the number of explanations that disclose information on this line. If, for example, information about revenue is summarized in a certificate with number 15, then before the line “Revenue” you need to put “15”.

ATTENTION. Previously, financial statements could be filled out in both thousands and millions of rubles. But, starting with reporting for 2021, there is only one option left - in thousands of rubles. These amendments to order No. 66n were made by order of the Ministry of Finance dated 04/19/19 No. 61n.

Maintain accounting and tax records for free in the web service

Why do we need interconnection of indicators?

Indicator monitoring is needed in order to control the accuracy and completeness of report data before they are submitted to the tax authorities. There are no clear rules for conducting such an independent check. Enterprises do this on their own. It is also interesting that tax authorities also conduct similar audits. When they discover inconsistencies, they demand explanations.

In some cases, such errors can lead to a desk audit or even an on-site audit. Therefore, it is very important to establish the rule of interconnection in your enterprise in order to save yourself from unnecessary problems in the future.

Example of filling out a financial results report (sample)

In 2021, the trading organization's performance was as follows:

- revenue 12,000,000 rub. (including VAT 20% - RUB 2,000,000);

- purchase price of goods is 6,000,000 rubles. (including VAT 20% - RUB 1,000,000);

- commercial expenses (for warehousing goods and staff salaries) - RUB 1,500,000;

- interest payable (for using a bank loan) - 500,000 rubles;

- current income tax - 600,000 rubles.

The company did not apply PBU 18/02 and did not form ONA, ONO, PNA and PNO.

The accountant found the totals.

Gross profit - 5,000,000 rubles ((12,000,000 - 2,000,000) - (6,000,000 - 1,000,000)).

Profit from sales - 3,500,000 rubles (5,000,000 - 1,500,000).

Profit before tax - 3,000,000 rubles (3,500,000 - 500,000).

Net profit - 2,400,000 rubles (3,000,000 - 600,000).

The accountant filled out the financial results report as shown in Table 2.

table 2

Report on financial results of a trading company for 2019 (thousand rubles)

| Explanations | Indicator name | For 2021 |

| Revenue | 10 000 | |

| Cost of sales | (5 000) | |

| Gross profit (loss) | 5 000 | |

| Business expenses | (1 500) | |

| Administrative expenses | ||

| Profit (loss) from sales | 3 500 | |

| Income from participation in other organizations | ||

| Interest receivable | ||

| Percentage to be paid | (500) | |

| Other income | ||

| other expenses | ||

| Profit (loss) before tax | 3 000 | |

| Current income tax | (600) | |

| incl. permanent tax liabilities (assets) | ||

| Change in deferred tax liabilities | ||

| Change in deferred tax assets | ||

| Other | ||

| Net income (loss) | 2 400 |

Table 3

The relationship between the balance sheet and the income statement

| Balance indicator | Income statement indicator | Note |

| Line “Retained earnings (uncovered loss) (1370) The difference between the column “As of December 31 of the previous year” and the column “At the end of the reporting period” | Line “Net profit (loss)” (2400) Value at the end of the reporting period | Equal if there were no turnovers on account 84 in the reporting period (not counting balance sheet reformation) |

| Line “Deferred tax assets” (1180) The difference between the column “As of December 31 of the previous year” and the column “At the end of the reporting period” | Line “Change in deferred tax assets” (2450) Value at the end of the reporting period | Equal if SHE and IT are shown expanded in the balance sheet |

| Line “Deferred tax liabilities” (1420) The difference between the column “As of December 31 of the previous year” and the column “At the end of the reporting period” | Line “Change in deferred tax liabilities” (2430) Value at the end of the reporting period | Equal if SHE and IT are shown expanded in the balance sheet |

Fill out and print your balance sheet using the current form for free

Example

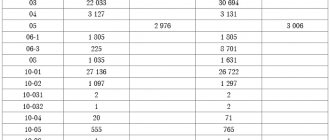

| date | Equity | Assets | CA |

| 31.12.2017 | 1640 | 4600 | 0,36 |

| 31.12.2018 | 2024 | 4610 | 0,44 |

| 31.12.2019 | 2480 | 4500 | 0,55 |

The table shows that CA is growing steadily and reaching the average standard value as of the last reporting date.

- Solvency. The main indicator that characterizes a company's ability to pay off its obligations is the total liquidity ratio. It is equal to the ratio of current assets to short-term liabilities

Klo = OA / KP

Current assets are the sum of inventories, accounts receivable and cash.

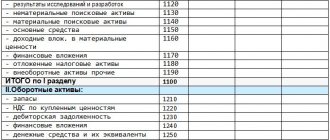

OA = page 1210 + page 1230 + page 1250

Short-term liabilities are the sum of all short-term debts of the enterprise.

KP = page 1510 + 1520 + page 1550

The Klo standard can vary from 1 to 2.5. Those. Even in the most extreme case, debts with short maturities should be fully covered by liquid assets.

And here, too, a lot depends on the direction of the company. Trading firms can allow a reduction in KLo to values slightly exceeding 1, because their inventory is usually easy to sell if necessary.

It is usually more difficult for manufacturing enterprises to sell stock balances in warehouses, therefore KLo for them should be higher, approximately in the range of 1.5 - 2.5. But there is no need to increase this coefficient too much either, because while resources are in reserves.

How to present

Until recently, companies could choose in what form to submit their financial statements: on paper or via the Internet.

But as of reporting for 2021, there is only one way left - to submit the balance sheet and other forms via the Internet (via telecommunication channels through an electronic document management operator).

An exception is made only for small businesses. At the end of 2021, they can submit reports, including financial results, on paper. But based on the results of 2020 and later periods, general rules will apply to them. Such changes were made to the Accounting Law by Federal Law No. 444-FZ dated November 28, 2018.

Additional Information

Is it necessary to look for a logical connection between accounting and tax reporting? It is impossible to find a direct relationship between these documents. This is due to the fact that when drawing up different areas of reporting, different principles are applied. That is, different rules for generating documents are used. Therefore, there are no direct connections between the documents.

Who exactly should carry out the interconnection? Any legal entity, regardless of its size, should search for logical connections between reports. That is, interconnection is also sought by small business accountants. Moreover, for small companies the procedure will be simpler. This is due to the small number of documents and data. Searching for connections allows you not only to detect errors, but also to see the real financial results of the company’s activities.

Which specialist should look for logical connections? Essentially, this is the job of the chief accountant. However, it can be delegated to any representative of the financial or accounting department. If the company does not have competent employees, you can resort to the services of third-party specialists. Finding connections is a fairly simple job if you have the appropriate information.

However, if someone without proper financial knowledge undertakes this, inconsistencies may be missed.

Is it necessary to somehow record the implementation of interconnection? It is necessary, but the problem is that the law does not stipulate the appropriate forms of supporting documents. They need to be developed independently and reflected in the accounting policies. It is also advisable for the manager to establish the timing and procedure for carrying out the procedure.