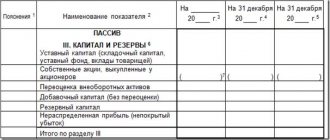

How are net assets related to the company's capital?

Net assets are formed by current assets, which were purchased using own funds or using long-term loans.

With positive dynamics of this indicator over the last reporting periods:

- the company is attractive to investors;

- There is an advantage when applying for loans from banking institutions.

This indicates a high level of solvency and reliability of the enterprise’s financial system.

Low growth rates of working capital - the ratio of net assets and authorized capital with a clear predominance of the latter indicator - signals about the ineffectiveness of the financial strategy. This symptomatology is typical for enterprises in crisis. A negative net asset value means that the solvency of the company and the level of confidence in the company on the part of potential investors are critically low.

Also see “Negative Net Assets: Implications.”

When analyzing operating results, it is necessary to adhere to the rule that net assets must be greater than the authorized capital. Violation of this balance may be a consequence of attracting a large volume of short-term loans.

There are two ways to correct the situation:

- An increase in the value of assets.

- Reducing the amount of capital.

The law does not provide for penalties for violating the optimal balance between assets and the sources of their formation. But still, net assets and authorized capital must be regularly compared in order to promptly identify negative trends.

The manager is interested in quickly eliminating shortcomings in the financial sector in order to avoid undesirable consequences:

- decreased solvency;

- difficulties in attracting new investors;

- refusals of banking structures to provide loans on standard or preferential terms;

- lack of trust on the part of counterparties;

- increasing the risk of forced liquidation by regulatory government agencies.

The last option is possible if net assets are below the authorized capital over the last 2 years. The closure of a business will also be inevitable if it is impossible to revaluate assets or reduce the amount of capital.

Managers and founders must organize internal management accounting to identify negative trends in the enterprise’s economy. Significant assistance can be obtained from auditors who record in their report:

- change in the value of net assets and authorized capital, the ratio of these indicators;

- recommendations for leading a company out of crisis.

Results

If the net assets are less than the authorized capital, and this position is held for 2 years or more, a negative event may occur - the tax authorities may file a lawsuit to liquidate the company. To avoid this, you should either reduce the authorized capital or increase net assets.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of the Russian Federation “On approval of the Procedure for determining the value of net assets” dated August 28, 2014 No. 84n

- Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ

- Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ

- Law “On Tax Authorities” dated March 21, 1991 No. 943-I

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Ways to solve the problem

There may be several options for eliminating the imbalance in the financial sector of a company:

| 1 | Revaluation of enterprise assets | The procedure is carried out in order to increase the value of working capital |

| 2 | Additional cash contribution from the founder | This method can also be used in situations where net assets are equal to equity. In the payment order, in the payment purpose field, you must indicate that the money is intended specifically to increase the value of assets. |

| 3 | Initiating a reduction in the size of the formed and redeemed authorized capital | – |

The option of additional cash injections is possible provided that the founder agrees to invest his own funds to improve the financial stability of the company. And the revaluation method will help to quickly increase the amount of working capital, although it has many costs: net assets will be greater than the authorized capital, but the procedure for changing the estimated value will have to be repeated regularly.

The amount of capital can be reduced if the current value of its valuation is above the minimum threshold.

If the imbalance persists for a long time and the capital amount is minimal, the tax authorities may raise the issue of liquidating the enterprise. The decision is made in court.

The court will decide in favor of the company if, at the time of consideration of the case, the net assets exceed the authorized capital or the business owners are able to propose an effective strategy for getting the company out of the crisis.

Also see “How Founders Can Increase LLC Net Assets.”

Read also

31.07.2018

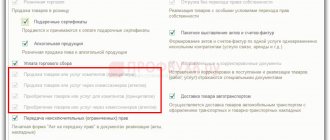

Tax audits

Tax authorities especially carefully check companies whose net asset value is less than their capital, because such a result is possible if the company incurred large losses in previous periods. The company's management will be invited to a special commission at the tax service, where, together with its employees, methods will be thought through to increase the value of the company's net assets. In this case, to implement such an event, the following methods can be used:

- revaluate intangible assets or fixed assets of the enterprise;

- analyze existing accounts payable, which has a direct impact on the cost of the asset. Perhaps some item of debt has expired statute of limitations, and therefore it can be written off;

- take advantage of the help of company participants who will be able to invest any funds in the organization’s activities free of charge.

Calculation of net assets - topic of the video below:

Recommendations for auditors for conducting audits for 2021

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION Department for regulation of accounting, financial reporting and auditing activities. RECOMMENDATIONS to audit organizations, individual auditors, auditors for conducting an audit of the annual financial statements of organizations for 2021 (attachment to the letter dated January 19, 2021

No. 07-04-09/2694) In order to improve the quality of the audit of accounting (financial) statements of organizations, guided by the Federal Law “On Auditing Activities” and the Regulations on the Ministry of Finance of the Russian Federation, approved by the Decree of the Government of the Russian Federation of June 30, 2004.

No. 329, the Department for Regulation of Accounting, Financial Reporting and Auditing, summarized the practice of applying the legislation of the Russian Federation on auditing and accounting and recommends

Calculation value

Net assets are considered not only as an important indicator of the financial position of the enterprise. The higher this parameter, the more attractive the company is to investors, since they are confident that they will not lose their investments. If this parameter is relatively low, then there is a risk of bankruptcy, which does not appeal to anyone. It is important to regularly monitor the status of net assets and prevent them from falling critically.

In general terms, this calculated indicator can be called an indicator of the company’s well-being/failure; on the basis of it, the owner can evaluate how his managers work and make management decisions.

How to increase the authorized capital of a company: 3 ways

There are several techniques to make this amount of resources larger. Generally speaking, for this purpose they use their own or borrowed funds. There are three approaches.

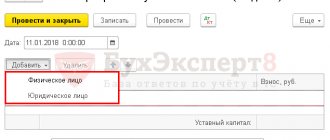

Method No. 1: contribution of additional funds by participants.

- Proportional increase in all contributions.

- Increasing the share at the request of the participant.

The general meeting decides what the amount of additional contributions of all members of the company will be. Next, the owners contribute funds (money or property) in accordance with the size of their share, thereby increasing its nominal value.

One or more participants may decide to increase their own share, then they write a statement with a specific amount. The general meeting makes a decision, the nominal value of the share increases. In addition, the proportional ratio of shares of all business owners changes.

Method No. 2: increasing the authorized capital at the expense of property.

Property owned by the company is converted into a contribution to the authorized capital, making it larger. The percentage of shares does not change, but their nominal value increases.

Method No. 3: contribution of a third party/persons.

The new participant makes his contribution to the authorized funds, receiving the status of a full founder. This fund can be increased by investing money or property. Since the composition of the owners changes, after this procedure their shares in the organization must be reviewed. The nominal value remains unchanged, only the ratio of shares as a percentage is recalculated.

Why do you need a large authorized capital?

Today, enterprises often refuse a large authorized capital, preferring to use a minimal one. This amount does not change over time, since the owners do not see the point in this. After some time, it turns out that a small amount of authorized capital indicates the company as an unattractive business partner.

Why does an LLC need a large authorized capital? There are a number of situations in which it is beneficial for a company to have a large authorized capital:

- Need a loan. The funds in question are a guarantee for the lender, because their volume indicates the financial situation of the borrower. Let us remind you that the company is liable for obligations in the amount of the authorized capital. This means that 10,000 rubles, which today most often serves as the authorized capital, does not give much chance of getting a loan.

- The company attracts serious partners/participates in tenders. Large customers, like lenders, demand reliability from their partners. Therefore, they need to see a large authorized capital, which speaks of financial guarantees and a certain image of the partner.

But it is not necessary to make the authorized capital large for a specific case - this change can be made at any time, as soon as the business owners consider it possible.