What is what

Don't know what an off-balance sheet account is in accounting?

In the working charts of accounts used in accounting in both budgetary and commercial and non-profit organizations, main (balance sheet) and off-balance sheet accounts are distinguished. On the main accounts, accountants must conduct transactions related to the movement of cash and other material assets, receipts and disposals, profits and mutual settlements with counterparties; information about various goods and works, as well as advertising and other services are taken into account. Off-balance sheet accounts are used to account for inventory items that are temporarily at the disposal of the organization and do not belong to it as property. Off-balance sheet accounts are also needed to reflect transactions on those obligations that are awaiting fulfillment, and the movement of values not intended for accounting on the main accounting accounts. Such accounts are auxiliary accounting accounts. The balances for them are not included in the balance sheet and are illustrated behind the results of the main balance sheet, that is, behind the balance sheet. They do not affect the financial result and are not reflected in the periodic and final reports of the organization.

Balance sheet accounts are opened by enterprises for the following cases:

- Keeping records of property that either does not belong to him or is written off as expenses.

- Collection of information that must be indicated in the subject of the explanatory note to the balance sheet and final reporting.

Off-balance sheet accounts in budgetary institutions in 2021 are regulated by the Chart of Accounts approved by Order of the Ministry of Finance of the Russian Federation No. 157n dated December 1, 2010 (Instruction No. 157n). The procedure for maintaining balance sheet accounting for non-profit organizations is established by Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000. They are also regulated by 402-FZ “On Accounting” dated December 6, 2011 and the Civil Code of the Russian Federation. Having these legal acts at hand, it is much easier and clearer to conduct accounting for off-balance sheet accounts.

When is it impossible to transfer property from off-balance sheet accounts 03 and 07?

The answer is obvious - when it does not satisfy at least one of the conditions listed above.

Let's take a closer look at examples.

Example 1. In the accounting of the institution, fuel cards are taken into account in off-balance sheet account 03 in accordance with the provisions of the accounting policy. There is no need to transfer them from off-balance sheet account 03 to the balance sheet as part of material inventories. The fact is that fuel cards, as a rule, are the property of the company that issued them. Accordingly, they do not satisfy the concept of an asset.

More on the topic: KOSGU: next changes in expense codes or what will Order of the Ministry of Finance of the Russian Federation No. 69n tell us?

Example 2. In the accounting of the institution on off-balance sheet account 07, certificates acquired in 2014-2015 are taken into account. The institution does not have a warehouse. The certificates are kept by the employees responsible for issuing them. In this case, there is no need to transfer certificates from off-balance sheet account 07 to balance sheet account 105 06.

Features for budgetary institutions

The use of off-balance sheets in the accounting of a budgetary institution is regulated by Instruction 157n (section 7). This section provides a list of assets that should not be included in balance sheet accounts. According to current legislation, institutions have the right to adjust this list and, if necessary, include other inventory items in it.

In accordance with paragraph 373 of Instruction 157n as amended on March 31, 2018, accounting is carried out on off-balance sheet accounts of budgetary institutions:

- valuables located in the organization without the right of operational management (rent, free use, etc.);

- valuables that are taken into account outside balance sheet accounts (fixed assets in the amount of up to 10,000 rubles, strict reporting forms, prizes, vouchers, etc.);

- obligations awaiting fulfillment.

Do you know how many off-balance sheet accounts have existed since 2015? Currently, 31 accounts are used in budget accounting!

You can familiarize yourself with all the accounts that are used when maintaining records in a budgetary institution in the table.

| No. ZSCh | Name |

| 01 | "Property received for use" |

| 02 | “Material assets accepted for storage” |

| 03 | "Strict reporting forms" |

| 04 | "Debt of insolvent debtors" |

| 05 | “Material assets paid for through centralized supply” |

| 06 | “Debt of pupils and students for unreturned material assets” |

| 07 | “Awards, prizes, cups and valuable gifts, souvenirs” |

| 08 | "Vouchers unpaid" |

| 09 | "Spare parts for vehicles" |

| 10 | “Ensuring the fulfillment of obligations” |

| 11 | "State municipal guarantees" |

| 12 | “Special equipment for carrying out research work under contracts by customers” |

| 13 | "Experimental Devices" |

| 14 | "Settlement documents awaiting execution" |

| 15 | “Settlement documents not paid on time due to lack of funds in the account of a state (municipal) institution” |

| 16 | “Overpayments of pensions and benefits due to incorrect application of legislation on pensions and benefits, accounting errors” |

| 17 | "Cash receipts" |

| 18 | "Cash Outflows" |

| 19 | “Unexplained budget revenues from previous years” |

| 20 | "Debt unclaimed by creditors" |

| 21 | “OS worth up to 10,000 rubles inclusive in operation” |

| 22 | “Material assets received through centralized supply” |

| 23 | "Periodicals for use" |

| 24 | “Property transferred into trust management” |

| 25 | “Property transferred for paid use (rent)” |

| 26 | “Property transferred for free use” |

| 27 | “Material assets issued for personal use to employees (employees)” |

| 30 | “Calculations for the fulfillment of monetary obligations through third parties” |

| 31 | "Shares at par value" |

| 40 | "Assets in management companies" |

| 42 | “Budget investments implemented by organizations” |

Here are the ones that are most often used in work:

- Property accounting is carried out using 01, 02, 05, 06, 07, 09, 12, 13, 21, 22, 24, 25, 26, 27 off-balance sheet accounts.

- Strict reporting forms, prizes, vouchers and periodicals are reflected in accounts 03, 08, 23.

- Accounting for cash and settlement documents is carried out on accounts 14-19, 30.

- Accounts receivable and payable are posted to off-balance sheet accounts 04 and 20, respectively, guarantees are posted to 10 and 11.

- Financial investments are recorded in 31, 40, 42 off-balance sheet accounts.

Requirements for assessing objects

The federal standard did not ignore the assessment of fixed assets. He introduces new terms that distinguish between two types of possible operations on objects:

- Exchange transactions - assets are exchanged for money or other material assets; the cost of work performed, services provided or rights to use the asset can be taken into account towards the cost of the object. This exchange is based on the market value of the property. In exchange transactions, the object is valued based on the amount of actual costs.

- Non-exchange transactions - assets are transferred free of charge or for little money. In this case, the initial cost is determined based on the fair value of the object.

The founder must decide how to value different categories of objects, and the choice must be reflected in the accounting policies of the institution.

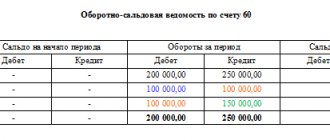

Procedure for maintaining off-balance sheet accounting

Maintaining off-balance sheet accounting ensures control over the use and safety of valuables that are in temporary possession of the institution, as well as timely and correct execution of the relevant accounting documentation and the organization of proper off-balance sheet accounting.

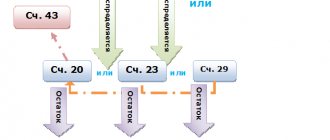

Off-balance sheet accounting is carried out in a simple form, avoiding spam, that is, amounts for transactions with assets taken off-balance sheet are reflected either as a debit or as a credit. There is no correspondence (double entry) regarding them.

Postings are compiled according to the following rule: the required amount is recorded either in Dt or in Ct. The same operation should not be carried out on the debit of one account and on the credit of another. On the off-balance sheet Dt, accounting records are formed for the receipt of property and the issuance of security, on the Kt - the disposal of valuables and the completion of security.

The balance at the beginning of the period (month) indicates the presence of one or another type of value that is accounted for in a certain account. The balance at the end of the month for the client is always in debit.

The debit balance at the end of the period determines the balance of funds formed at the reporting date.

Reflection of transactions in the third group

In these operations, it is necessary to take into account that additional postings to off-balance sheet accounts are generated not only to account 201.11 and 201.34, but also to account 210.03. Transactions on the movement of cash between the cash register and the personal account fall into section 3 “Sources of financing the deficit of the institution’s funds” in lines 710, 720 (as “total turnover” on accounts 201.11 and 210.03) and in lines 731 and 732 (as “internal turnover "between the accounts and the cash register).

Example.

Institution A has withdrawn cash from the personal account.

This operation can be formalized with the document “Cash Request”, “Cash Retirement”. Account records will be generated:

Debit 4.00000000000000000.210.03 – Credit 4.00000000000000000.201.11.610

Credit 4.00000000000000000.17.01.610 (posting to account 201.11, pay attention to KEC 610)

Debit 4.00000000000000000.17.30.510 (posting to account 210.03, pay attention to KEK 510)

Next, the funds go to the institution’s cash desk. The operation must be reflected in the document “Cash receipt order”:

Debit 4.00000000000000000.201.34.510 – Credit 4.00000000000000000.210.03

Credit 4.00000000000000000.17.30.610 (posting to account 210.03, pay attention to KEC 610)

Debit 4.00000000000000000.17.34.510 (posting to account 201.34, pay attention to KEC 510)

Pay attention to the KEC “510 – receipts to budget accounts” and “610 – disposal from budget accounts” used for accounts 17.XX.

Incorrectly specified KEK in postings will affect the internal control ratio f. 0503737.

How to keep accounting records in a government institution in 2021

In 2021, almost all existing budget accounting instructions were adjusted. Officials have published a new procedure for the formation of budget classification codes to reflect income and expenditure transactions - Order No. 132n. The general structure of the KBK has been preserved, but there are changes, and there are quite a lot of them.

- Law No. 402-FZ regarding key issues in the organization of accounting;

- instructions No. 157n and No. 162n regarding the unified chart of accounts and the rules for its application;

- Instruction No. 132n regarding the formation of budget classification codes to reflect transactions in corporate accounting;

- Instruction No. 191n regarding the composition and procedure for generating reports in the CU;

- order No. 209n regarding the formation of KOSGU;

- federal accounting standards regulating industry accounting methods;

- methodological recommendations, letters and explanations from the Ministry of Finance of the Russian Federation and individual departments regarding the settlement of issues related to accounting.

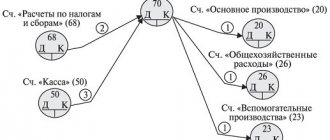

Payroll: invoices and postings

Salaries in government agencies are usually paid twice a month - in the form of an advance and a principal amount. Each payment forms a separate bundle of budgetary and monetary obligations.

CLARIFICATIONS from ConsultantPlus: Starting in 2021, they plan to make changes to KOSGU. In terms of wages, for example, subsection 211 will need to include compensation for unused vacation upon dismissal. And from subsection 2013, benefits that employers currently pay from the Social Insurance Fund will be removed. Read more about the planned innovations in the Review from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Let’s say an employee’s salary is 40,000 rubles, 15,000 is paid in advance.

In the case of an advance, the obligation is formalized by posting:

- Dt 1 502 11 211;

- Kt 1 502 12 211.

This posting reflects the fact that in this case, at first only a monetary obligation arises in the amount of 15,000 rubles in advance. In this case, the budget obligation is formed only at the end of the month, when the entire salary is accrued.

When accruing the entire salary (at the end of the month), the following entries will be applied:

1. Posting reflecting the acceptance of budget obligations within the limit, that is, for the entire amount of 40,000 rubles:

- Dt 1 501 13 211;

- Kt 1 502 11 211.

Account 1 501 13 211 is used by us because it includes codes:

- 501 - reflecting the fact that salaries will be paid at the expense of limits on budgetary obligations;

- 13 - showing that the limits set for the current financial year are used.

2. Posting, which, as in the first case, reflects the institution’s acceptance of a monetary obligation for the remaining salary amount of 25,000 rubles:

- Dt 1 502 11 211;

- Kt 1 502 12 211.

Payment for work and services to third party suppliers: invoices and postings

Suppose a government agency has entered into a contract with an outside firm to provide consulting services.

The fact that the institution has accepted budgetary obligations for the entire amount of the contract with the supplier is reflected in the posting

- Dt 1 501 13 226;

- Kt 1 502 11 226.

Account 1 501 13 226 is used by us because it includes codes:

- 1 - reflecting the fact of accepting obligations at the expense of budgetary funds;

- 501 - showing the acceptance of budget obligations under the limit;

- 13 - reflecting the fact of sanctioning limits in the current year;

- 226 - showing that the institution pays for services (according to KOSGU).

Account 1 502 11 226 is used by us because it includes codes:

- 502 - reflecting, in fact, the fact that the institution has accepted budgetary obligations;

- 11 - showing that the liabilities relate to the current financial year.

The fact that a business entity accepts monetary obligations (their amount is determined by the terms of the agreement and may be less than the amount of budget obligations - for example, if an advance is made as specified in the agreement) is reflected by the posting:

- Dt 1 502 11 226;

- Kt 1 502 12 226.

In turn, the code Kt 1 502 12 226 is used by us because:

- includes a code of type 502, which reflects the fact that the institution has accepted its own financial obligations;

- includes code 12, which indicates that the financial liability relates to the current financial year.

Methodological recommendations of the Ministry of Finance on the application of the new KOSGU procedure

The procedure for applying articles of group 100 “Revenue”, in force since January 1, 2021, retains the procedure for applying KOSGU codes in 2021. The procedure for application has been supplemented with certain features related to the implementation of new terminology and the application of federal standards by institutions, including the Federal Budgetary Accounting Standards Income.

In accordance with the application of subarticle 223 “Utilities”, expenses for the purchase of bottled drinking water are excluded from the list of transactions if the organization does not have a centralized drinking water supply system or the sanitary and epidemiological supervision authority issued a conclusion recognizing the water as not meeting sanitary standards. These expenses in 2021 are subject to reflection under subarticle 349 “Increase in the cost of other disposable inventories.”

Secondment of workers in 2021: what innovations to consider

Please note that an employer can send only persons associated with him through labor relations (permanent employees and part-time workers) on a business trip. This is stated in paragraph 2 of Regulation No. 749 [1], which guides all employers, without exception, when sending their employees both within the country and abroad. Persons involved in work under a civil contract cannot be seconded. Guarantees and compensations provided for by labor legislation, including those related to business trips, do not apply to them (Article 11 of the Labor Code of the Russian Federation).

In this article, we will recall the basic rules for sending employees on business trips, talk about the guarantees and compensation that are provided in this case, and also consider the procedure for reflecting travel expenses in the accounting of state (municipal) institutions, based on the changes that occurred from 01/01/2019 in the order of application KOSGU