Payment

The tax system in Russia involves three levels of taxes: federal, regional and local taxes and

Analysis and sources of increasing the profit of the organization First of all, to maximize the profit of the enterprise first

The authorized capital of a joint-stock company reflects the valuation of shares. For accounting purposes, the most important share is

SZV-STAZH - report on the insurance experience of employees. It has been in use since March 2021. Form

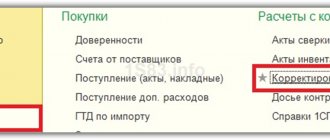

Any business activity is based on close cooperation with counterparties, as a result of which the accounting

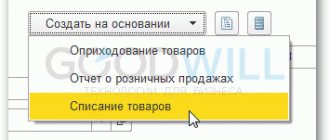

By the way, in older versions of 1C 8.2, inventory takes place according to the same principles, it is different

Why is separate accounting of income and expenses necessary? Clause 8 of Article 346.18 of the Tax Code requires

Personal income tax upon dismissal of an employee is a mandatory operation; the payment is calculated and carried out by the employer. IN

According to Russian legislation on accounting, primarily Law No. 402-FZ of December 6, 2011

Last changes: January 2021 Additional benefits of a one-time and monthly nature - state guarantee for