According to Russian accounting legislation, primarily Law No. 402-FZ of December 6, 2011, all enterprises are required to ensure reliable accounting in accordance with established standards. The head of the company is recognized as the responsible person for the organization (Article 7 Part 1 No. 402-FZ). When establishing appropriate accounting principles in companies of various industries, one should be guided by guidelines and recommendations for accounting in the Russian Federation.

Simplified accounting methods

Three groups of organizations have the right to use simplified methods of accounting, including simplified accounting (financial) reporting. The first of them includes small businesses. The second group includes organizations that have received the status of participants in the Skolkovo project. And finally, the third group includes non-profit organizations (the accounting statements of non-profit organizations are also described in our other article).

At the same time, simplified methods of accounting may not be used by:

- organizations whose accounting (financial) statements are subject to mandatory audit in accordance with Russian legislation;

- housing and housing construction cooperatives;

- credit consumer cooperatives (including agricultural credit consumer cooperatives);

- microfinance organizations;

- public sector organizations;

- political parties, their regional branches or other structural units;

- bar associations;

- law offices;

- lawyer consulting;

- bar associations;

- notary chambers;

- non-profit organizations included in the register of non-profit organizations performing the functions of a foreign agent as provided for in paragraph 10 of Article 13.1 of the Law of January 12, 1996 No. 7-FZ.

These are the requirements of parts 4 and 5 of Article 6 of the Law of December 6, 2011 No. 402-FZ.

Main differences between financial and management accounting

There are clear distinctive features in the organization of accounting at the financial and managerial levels.

| Financial Accounting | Management Accounting |

| Accurate | Approximate |

| Collection and processing of information for production planning | Collection and processing of information for production management |

| Presented to users within the time limits strictly established by law | Presented only to a certain circle of users within a time frame determined by internal necessity |

| Accounting must be as accurate as possible and organized in accordance with regulations | Responsibility for accounting data lies only with the compiler |

| Accounting is mandatory for everyone | Accounting is not mandatory for everyone, but recommended |

| Accounting summarizing reports of the enterprise as a whole | Accounting containing data on specific types of products, depending on the goals set |

| Financial accounting structure: Assets = liabilities + equity | Management accounting structure: Assets = costs + finished goods |

| Accounting information – regular | Information available upon request |

| Accounting is not a financial secret of an enterprise | Accounting is the financial secret of an enterprise |

| Accounting is used by shareholders, authorities, and all interested parties | Accounting is used by managers, managers, owners |

| Financial accounting principles are generally accepted standards | Principles of management accounting - production necessity in the amounts prescribed by the organization |

Organization of accounting

Accounting and storage of accounting documents is organized by the head of the organization (Part 1, Article 7 of Law No. 402-FZ of December 6, 2011).

He must choose one of the following options and consolidate this in the accounting policy:

- entrust accounting maintenance to the chief accountant or other responsible employee of the organization;

- conclude an agreement on the provision of accounting services with a third-party organization (specialist);

- take charge of accounting (for small and medium-sized businesses, as well as non-profit organizations that have the right to use simplified accounting methods).

This is stated in Part 3 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

Accounting information and its importance in production management

Managers and specialists inside and outside the enterprise use certain information that allows them to assess the organization’s activities, the efficiency of using available resources and development prospects, as well as the receipt of payments.

They receive this information in the process of accounting, and it is called accounting information. Conceptual help!

Accounting is an orderly system for collecting, registering and summarizing information about the state of property and the sources of its formation as of a certain date in monetary terms, through continuous, documentary reflection of all business transactions. Accounting information is quantitative economic information obtained in the accounting process.

Accounting information is the starting point in making decisions of various kinds. Based on accounting data, middle managers analyze and monitor the operating activities of a business entity, and also formulate strategic plans. In addition, accounting information is of interest to the commercial block, in order to compare prices by product, supplier, region, and time period. Senior managers, based on reporting data, make management decisions in the current period and for the future. Investors and lenders, as external users, obtain information from accounting information that allows them to evaluate capital investments and lending opportunities.

In addition to the above users, accounting information is of interest to various regulatory authorities, for example the tax service.

Requirements for the chief accountant of a joint-stock company

Special requirements for the chief accountant are established in the JSC.

The person charged with accounting (for example, the chief accountant) must meet the following requirements:

- have a higher education (and not necessarily by profession);

- have work experience related to accounting, reporting or auditing for at least three years out of the last five calendar years. If there is no higher education in the field of accounting and auditing, then the experience must be at least five years out of the last seven calendar years;

- he should not have an unexpunged or outstanding conviction for crimes in the economic sphere (Section VIII of the Criminal Code of the Russian Federation).

Such rules are established by Part 4 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

If the manager entrusts accounting to a third-party specialist, the latter must also meet the specified requirements. If an agreement for the provision of accounting services is concluded with an organization, it must have at least one employee who meets such requirements.

This is established by part 6 of article 7 of the Law of December 6, 2011 No. 402-FZ.

Federal legislation may establish other additional requirements for the chief accountant (another person entrusted with accounting) (Part 5, Article 7 of the Law of December 6, 2011 No. 402-FZ).

These requirements do not apply if the chief accountant (other person) began his duties before January 1, 2013 (Part 2 of Article 30 of the Law of December 6, 2011 No. 402-FZ).

Attention: Part 4 of Article 7 of the Law of December 6, 2011 No. 402-FZ refers to the chief accountants of open joint-stock companies (OJSC). However, as of September 1, 2014, such an organizational and legal form does not exist. Now all JSCs that place shares by public subscription are considered public joint-stock companies (PJSC). That is, in essence, the requirements for education and work experience apply specifically to the chief accountant of the PJSC, and officials will make a technical amendment to Part 4 of Article 7 of the Law of December 6, 2011 No. 402-FZ in the near future.

Start of accounting. Who should do the accounting?

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting.

Get free access for 14 days

The obligation to maintain accounting records is dictated by Federal Law No. 402-FZ “On Accounting”. It states that accounting must be maintained by all legal entities, commercial and non-profit organizations, and neither the form of ownership nor the taxation system removes this obligation.

Until 2013, companies using the simplified tax system could not keep accounting records, but in 2013 this right was taken away from them. However, there are concessions especially for small organizations. For example, Federal Law No. 209-FZ allows small businesses to keep accounting records in a simplified form.

The only exception is individual entrepreneurs: they are not yet required to maintain accounting. Lack of accounting records or gross violations of accounting rules are punishable by fines.

Responsibility for violation of accounting rules

For gross violation of accounting rules, the tax inspectorate may fine an organization under Article 120 of the Tax Code of the Russian Federation. Thus, a gross violation of the rules for keeping records of income and expenses is the absence of primary documents, invoices, accounting registers, systematic (twice or more during a calendar year) untimely or incorrect reflection of assets and business transactions in accounting.

If an organization commits such a violation during one tax period, the fine will be 10,000 rubles. And if within several, the fine will increase to 30,000 rubles. If at the same time the organization also underestimated the tax base, then 20 percent of the amount of each unpaid tax, but not less than 40,000 rubles, will have to be paid to the budget.

There are also penalties for officials of the organization. It is prescribed in the Code of the Russian Federation on Administrative Offences. Sanctions are provided for gross violation of accounting requirements, including financial reporting. For such actions, a fine of from 5,000 to 10,000 rubles is provided. Repeated violation faces a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to two years.

The punishment upon application of the tax inspectorate is imposed by the court (Part 1 of Article 23.1, Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

In each specific case, the perpetrator of the offense is identified individually. In this case, the courts proceed from the fact that the manager is responsible for organizing accounting, and the chief accountant is responsible for its correct maintenance and timely preparation of reports (clause 24 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18). Therefore, the chief accountant (an accountant with chief rights) is usually found guilty of a violation. A leader is recognized as such only if:

- the organization did not have a chief accountant at all (resolution of the Supreme Court of the Russian Federation dated June 9, 2005 No. 77-ad06-2);

- accounting and calculation of taxes was carried out by a third-party specialized organization (clause 26 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18);

- the reason for the violation was a written order from the manager, with which the chief accountant did not agree (clause 25 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18).

If the head of the organization has not organized accounting, then the court may recognize such actions as abuse of authority. And if at the same time they prove that he pursued selfish goals, then the court may sentence him to liability under Article 201 of the Criminal Code of the Russian Federation.

How to avoid fines

It is possible to avoid punishment when it comes to distorting accounting data, due to which the organization did not pay additional tax to the budget. Firstly, there will be no fine if you submit an updated tax return (calculation) to the inspectorate, and before that pay off the arrears and pay penalties. Secondly, you can correct errors and submit revised financial statements to the inspectorate. This is stated in paragraph 2 of the note to Article 15.11 of the Code of the Russian Federation on Administrative Offenses.

Advice : if inspectors issued a fine for an accounting error that did not affect the amount of tax in any way, then such a penalty can be challenged.

The most common errors in accounting, which are often considered gross, are presented in the table.

| What do inspectors see as a mistake? | Why is a mistake considered gross? | Is it possible to challenge a fine? |

| Input VAT was deducted based on copies of invoices due to the supplier delaying the originals | Data on accounts 19 and 68 subaccount “VAT calculations” was distorted | The fine can be challenged, since the accountant violated the rules for deducting VAT provided for in Chapter 21 of the Tax Code of the Russian Federation. Accounting legislation does not regulate this issue. Moreover, the data on accounts 19 and 68 comes from tax registers - purchase books and sales books. Important clarification about errors in invoices. If inaccuracies do not prevent inspectors from identifying the buyer, seller, name of goods, works, services, as well as their cost, VAT rate and tax amount, then inspectors do not have the right to refuse a deduction (clause 2 of Article 169 of the Tax Code of the Russian Federation). And then there can be no talk of distortion of data on the accounts. |

| Input VAT was deducted on the basis of invoices containing errors | ||

| Input VAT was deducted in the wrong tax period | Data on account 68 sub-account “Calculations for income tax” was not reflected in a timely manner | |

| Tax expenses were written off based on copies of the original document due to the fact that the supplier delayed the originals | Data on account 68 subaccount “Calculations for income tax” was distorted | The fine can be challenged if we are talking about expenses that the organization recognizes when calculating income tax on the basis of special tax registers. For example, any regulated costs (representation, advertising expenses, interest on loans, compensation for the use of an employee’s personal property in the service, etc.). Organizations, as a rule, take into account such expenses on the basis of certificates or other tax registers. And if so, then we cannot talk about distortion in accounting |

| Tax expenses were written off based on the primary report, which contains errors | ||

| Tax expenses were written off based on copies of the original document due to the fact that the supplier delayed the originals | Data on account 68 sub-account “Calculations for income tax” was not reflected in a timely manner | |

| The value of a fixed asset item was understated on account 01 (03) | Property tax is underestimated because the wrong amount is reflected in account 01 (03) | It will not be possible to challenge the fine, since the error is directly related to distortions in accounting. After all, the tax base is the average annual value of property, which the company determines according to accounting data (clause 1 of Article 375 of the Tax Code of the Russian Federation). Please note that since 2014, regional authorities may prescribe in legislation a different procedure for some objects: the cadastral value will become the basis, not the accounting value |

Basic accounting rules

Organizations must maintain accounting records in compliance with the requirements of the Law of December 6, 2011 No. 402-FZ and a number of regulatory documents. So, when doing accounting you need to be guided by:

- federal and industry standards. Before their approval, documents regulating the accounting procedure approved before January 1, 2013 should be applied (Part 1, Article 30 of the Law of December 6, 2011 No. 402-FZ). In this case, these documents are applied to the extent that they do not contradict the Law of December 6, 2011 No. 402-FZ (information of the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012);

- accounting provisions (small businesses, guided by Part 4 of Article 6 of the Law of December 6, 2011 No. 402-FZ, have the right not to follow PBU 18/02, PBU 2/2008, PBU 16/02 and PBU 8/2010, PBU 11/2008);

- recommendations in the field of accounting (for example, letters from the Ministry of Finance of Russia);

- standards of an economic entity (i.e., these are instructions and regulations that the organization itself approved in order to streamline accounting);

- other documents in the field of accounting regulation.

This follows from the provisions of Articles 4 and 21 of the Law of December 6, 2011 No. 402-FZ.

The legislation establishes a number of requirements for accounting:

1. The organization is obliged to keep accounting records in rubles.

2. Accounting statements must be maintained continuously from the date of state registration until the date of termination of activities (as a result of liquidation or reorganization).

3. All accounting objects must be reflected in the accounting registers without omissions or exceptions (that is, each object must be documented and reflected in accounting).

4. Reflection of imaginary and feigned accounting objects in accounting registers is not allowed.

5. Accounting must be done using the double entry method (unless otherwise established by federal standards). In this case, it is not allowed to maintain accounting accounts outside the applicable accounting registers.

Such rules are established by part 3 of article 6, parts 2 and 3 of article 10, part 2 of article 12 of the Law of December 6, 2011 No. 402-FZ.

Micro-enterprises and non-profit organizations have the right to keep accounting using a simple system (without using double entry), having provided for this in their accounting policies (clause 6.1 PBU 1/2008, part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ) .

Fundamental principles of accounting and requirements for it

General requirements are imposed on accounting in all organizations, regardless of organizational and legal form, form of ownership and industry affiliation: 1:

- The organization maintains accounting records of property , liabilities and business transactions (economic facts 1 Federal Law “On Accounting” dated November 21, 1996 No. 129-FZ; Regulations on accounting and financial reporting in the Russian Federation dated August 27, 1998 No. 1598 . activities) by double entry on interrelated accounting accounts included in the working chart of accounts. The working chart of accounts is approved by the organization on the basis of the Chart of Accounts approved by the Ministry of Finance of the Russian Federation.

- Accounting for property , liabilities and business transactions (facts of business activity) is carried out in the currency of the Russian Federation - in rubles. Documentation of property, liabilities and other facts of economic activity, maintenance of accounting registers and financial statements is carried out in Russian. Primary accounting documents compiled in other languages must have a line-by-line translation into Russian.

- To maintain accounting records in an organization, an accounting policy , which presupposes the property isolation and continuity of the organization’s activities, the sequence of application of the accounting policy, as well as the temporal certainty of the factors of economic activity. The organization's accounting policies must meet the requirements of completeness, prudence, priority of content over form, consistency and rationality.

- Completeness – reflection in accounting of all facts of economic activity.

- Timeliness – timely reflection of the facts of economic activity in accounting.

- Prudence is a greater willingness to recognize expenses and liabilities in accounting than possible income and assets, avoiding the creation of hidden reserves.

- The priority of content over form is the reflection in accounting of the facts of economic activity based not so much on their legal form, but on the economic content of the facts and business conditions.

- Consistency is the identity of analytical accounting data with the turnover and balances of synthetic accounting accounts on the next calendar day of each month.

- Rationality – rational accounting, based on the conditions of economic activity and the size of the organization.

- In the accounting of an organization, current costs for production of products, performance of work and provision of services and costs associated with capital and financial investments are taken into account separately.

- The main requirement for accounting in a market economy is the usefulness of its information for decision-making by various user groups. In order for the information to be useful, accounting requirements also include the comparability of planned (forecast) and accounting indicators; reliability of credentials; efficiency of accounting; completeness and simplicity of accounting; cost-effectiveness of accounting.

- Comparability of planned (forecast) and accounting indicators is necessary, first of all, to monitor the implementation of plans, forecasts and orders, for example, in terms of labor productivity, material consumption, product costs, etc.

- The reliability of accounting data is ensured by documenting all business transactions, correct inventory, valuation of property and liabilities.

- The efficiency of accounting consists in the timely provision of information for making management decisions, drawing up and submitting reports.

- The simplicity of accounting lies in the fact that accounting information should be as accessible as possible (presented in the prescribed form) to all users.

- Cost-effectiveness of accounting means that the costs of obtaining accounting information should be recouped by the usefulness of this information in the management system of business processes in order to generate income (profit). Obtaining redundant information violates the integrity of the accounting system and makes it economically unjustified. The usefulness of information also depends on its understandability, relevance and reliability.

- Understandability is the requirement that information be understandable to users who have a certain level of knowledge.

- Relevance. Information is considered relevant or relevant if it influences the economic decisions of users and helps them evaluate economic phenomena, make decisions, etc. The relevance of information is influenced by its content and materiality. Information is considered material if its absence or misjudgment could influence users' decisions.

- Reliability. Information is considered reliable if it is free from material errors or bias and is a true statement of business activities. To be reliable, information must be reliable (true) and stable. The stability of information is achieved by using generally accepted principles and rules of accounting and preparation of accounting (financial) statements.

The effectiveness of the accounting system in organizations is ensured only with consistent use and compliance with all of the listed requirements. In addition, when forming an organization’s accounting policy, optimizing it and putting it into practice, it is necessary to predict and take into account the following possible assumptions (hypotheses) - assumptions: property isolation of the organization; continuity of the organization's activities; temporary certainty of the facts of economic life; sequence of application of the organization's accounting policies.

- The assumption of autonomy (property isolation) means that the assets (property) and liabilities of an organization exist separately from the assets and liabilities of the owners of this organization and the assets and liabilities of other organizations.

- The going concern assumption assumes that the organization will continue to operate for the foreseeable future and has no intention or need to liquidate or significantly reduce its activities and, therefore, liabilities will be settled in the prescribed manner.

- The assumption of temporal certainty of the facts of economic activity assumes that the facts of the organization's economic activity relate to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds associated with these facts.

- The consistency assumption (the sequence of application of accounting policies) assumes that the accounting policies adopted by the organization are applied consistently from one reporting year to another.

The main or initial basis of accounting as a methodological science (accounting) and as a practical activity (accounting) are its fundamental principles. On their basis, each organization develops strategic provisions and determines (selects) rules for maintaining accounting records of property, liabilities and business transactions.

At the same time, there is no consensus among experts on the composition and list of accounting principles. In the economic literature of recent years, domestic authors of works, as well as their foreign colleagues, present various accounting principles. In these works, there are differences not only in the list of principles, but also in the interpretations of this concept. Some authors of the works identify individual assumptions and requirements with accounting principles, others believe that there are a number of similarities between them, but there are also significant differences. There is another opinion, which says that “... the principles of one science, which express its basis and are basic for this science, cannot be “borrowed from the foundations and basic provisions of another science.”

It should be noted that it is inappropriate to identify the concepts of “principles”, “assumptions” and “requirements”. Principle (from the Latin Principium basis, beginning) is the basic, initial position of any theory, teaching, etc. Assumption - assumption, hypothesis.

A requirement is a rule, a condition that must be fulfilled. The assertions that accounting principles should be constant and unchanging over time are also not entirely justified.

Accounting principles , like its functions, are not something given once and for all. On the contrary, they change and develop historically, like science itself. Moreover, the development of principles and functions represents an important aspect (content) of the development of the science of accounting itself.

The modern science of accounting in many respects differs significantly from the science that existed in the Soviet period and before. Its entire appearance and the nature of its relationships with other economic and other sciences have changed. Therefore, new principles and new functions of accounting arise, which is also associated with the openness of this system and its interaction with other organized systems of the economic mechanism and the external environment. Therefore, “... understanding the degree of actual reality of the objects taken into account depends, first of all, on knowledge of the principles with the help of which accountants form this reality.”

Based on the priority areas for the development of accounting in a market economy, as well as taking into account its role and place in the management system of organizations, the fundamental principles of accounting include the following:

1. The principle of a complex organized system means that the accounting system has a holistic, stable structure. The accounting system can be differentiated into interconnected and interacting subsystems of financial and management accounting, which cannot exist one without the other. Based on this principle of consistency, it also follows that, both in theory and in practice, further division, for example, the separation of “tax accounting,” will mean going beyond the possible and necessary, leading to the destruction of system-forming connections and the orderliness of accounting.

2. The principle of integrity - the accounting system must meet the tasks of managing business processes and the information needs of external users of accounting (financial) statements. Understanding this principle also means that all accounting elements that cannot influence the process of making informed decisions, as unnecessary, must be removed from the accounting system.

3. The principle of monetary (cost) measurement is the assessment of all economic activities using a single monetary meter. The unit of measurement is the country's currency (ruble).

4. The principle of duality in the reflection of factors of economic life means that in accounting, any fact (phenomenon) of economic life is reflected: in the accounts by using double entry in digraphic bookkeeping; in registers (books) according to the “expense - income” method in unigraphic accounting.

Did not you find what you were looking for?

Teachers rush to help

Diploma

Tests

Coursework

Abstracts

5. The principle of registration means that all facts of the economic life of an organization must be recorded by drawing up primary documents and accounting registers.

6. The principle of frequency – regular, periodic reporting, adherence to the document flow schedule.

7. The principle of confidentiality - data from primary documents and accounting registers of an organization constitute a commercial secret, the disclosure of which is subject to legally established liability. In international accounting and reporting standards, this principle means that the information reflected in the organization’s reporting should not harm its interests.

8. The principle of multiple transformation of information is associated with the fact that information should be useful for management. But this will not happen if it is not understandable and perceived by users. Moreover, information should move from one level of clarity to another (depending on the levels of its generalization and hierarchical levels of use in management). Therefore, to understand information in accounting, procedures such as interpretation are carried out - the initial attribution of meaning and meaning to information; reinterpretation – clarification and change of meaning and significance; convergence - unification, merging of previously separate meaning and significance; divergence – separation of a previously unified meaning into separate sub-meanings; conversion is a qualitative modification of meaning and significance, their radical transformation.

9. The principle of active behavior of the system - plays a significant role in solving the tasks assigned to accounting by influencing the control object through communication processes and influencing the control system. This principle aims the accounting apparatus at increasing the efficiency of information communication, its specialization and participation in the development of management decisions.

10. The principle of adaptability of system behavior is adaptation, adaptation of accounting to changes in the management system, new information needs of its hierarchical structural elements and steps.

11. The principle of the response and effectiveness of the accounting system to changes in the external environment is to provide the necessary information base for the management system in conditions of uncertainty and risk (for example, changes in tax policy, rising inflation, decreasing demand and supply, etc.).

12. The principle of conservatism is caution when choosing rules and forms of accounting, methodological methods for assessing property, as well as when using IFRS rules. In accounting, this principle focuses on maintaining continuity, preserving the progressive provisions of domestic theory, methods and traditions of accounting practice.

13. The principle of determining the elements of accounting (financial) statements. This principle means that the elements of financial statements are: assets (resources that are the result of past events and the source of future economic benefits); liabilities (debts that are the result of past events and a source of future withdrawals of the organization's resources and reductions in economic benefits); capital (the remaining share of the organization's own assets after deducting liabilities); income (this is an increase in the economic benefits of the organization); expenses (reducing the economic benefits of the organization).

These accounting principles can be expanded and supplemented by the principles of relativity of accounting data accuracy, regulation and consistency, etc. Thus, accounting principles underlie the development of theory, the construction of an accounting system and the preparation of accounting (financial) statements.

In addition to principles, assumptions and requirements, the methodological, organizational and practical development of accounting is associated with postulates (axiometric provisions). Hence, the theoretical basis of accounting, as a type of practical activity, can be built in the process of development as a system of interconnected components (blocks):

Principles, assumptions and requirements must underlie the concepts that guide the direction of theory development; postulates – help to understand the content of accounting regulations, rules (standards), which ensures the correct choice of organizational, methodological and technical aspects of accounting and optimization of the organization’s accounting policies in order to implement accounting functions.

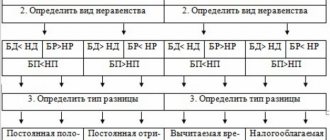

PBU 18/02 from the middle of the year

Situation: how to start using PBU 18/02 if an organization has lost the right not to apply it in the middle of the year (for example, it has lost its status as a small enterprise)?

PBU 18/02 must be applied from the beginning of the calendar year.

This is explained as follows. The income tax that must be paid to the budget is defined as a tax calculated from the organization’s accounting profit, adjusted to the amounts of permanent tax liability, permanent tax asset, deferred tax asset and deferred tax liability (clauses 20, 21 of PBU 18/02).

Income tax is calculated based on the results of the tax period - the year (clause 1 of Article 285, clause 2 of Article 286 of the Tax Code of the Russian Federation). Therefore, in order to do this correctly based on accounting data and their relationship with tax indicators, PBU 18/02 must be applied from the beginning of the calendar year.

In this case, it will be necessary to identify all the differences between accounting and tax accounting that arose from January 1 to the beginning of the quarter in which the organization lost its status as a small business entity. As of this date, permanent and deferred tax liabilities (assets) must be reflected. That is, an organization that has lost the right not to apply PBU 18/02 in the middle of the year must make additions to its accounting, reflecting all the necessary adjustments for the period when this provision was not applied. Do this in the period in which the obligation to apply PBU 18/02 arose.

An example of how to reflect the differences between accounting and tax accounting. The organization has lost its status as a small business entity

Alpha LLC lost its status as a small business entity in September 2021. The accountant reflected the differences according to PBU 18/02 from January 1, 2021. In the organization’s accounting from January 1, 2021, the accountant identified only one difference between accounting and tax accounting: in the residual value of the fixed asset. In tax accounting it amounted to 50,000 rubles, and in accounting – 60,000 rubles. The depreciation rate per month in tax accounting is 1,389 rubles, and in accounting – 1,667 rubles. There are 24 months left until the end of the useful life (both in accounting and tax accounting).

The accountant of Alpha LLC made the following entries in 2021:

Debit 68 subaccount “Calculations for income tax” Credit 77 – 2000 rubles. ((RUB 60,000 – RUB 50,000) × 20%) – deferred tax liability is reflected;

Debit 44 subaccount Credit 02 – 1667 rub. – depreciation has been calculated;

Debit 77 Credit 68 subaccount “Calculations for income tax” – 56 rubles. ((RUB 1,667 – RUB 1,389) × 20%) – reflects the decrease in deferred tax liability.

Over the course of 24 months, the accountant will charge depreciation and write off the deferred tax liability.

Make additional entries based on supporting documents (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011). For example, these could be:

- primary documents indicating the emergence of differences between accounting and tax accounting;

- accounting certificate justifying the entries made.

If necessary, make a change to the organization's accounting policy for the current year: specify the obligation to use PBU 18/02 and the procedure for its application (clause 10 of PBU 1/2008).

List of current IFRS standards:

- International Accounting Standards (IAS)

- International Financial Reporting Standards (IFRS)

- Standing interpretations Committee

- International Financial Reporting Interpretations Committee (IFRIC)

International Accounting Standards (IAS) – (translated from English - international accounting standards)

These standards were adopted by the International Accounting Standards Committee (IASB). In 1973, organizations in a number of countries in the field of accounting and auditing created this committee and from that time the IFRS system began to develop. The work of the IASB was carried out until it was transformed into the IASB. The standards developed between 1973 and 2001 by the IASB are called IAS.

International Accounting Standards (IAS)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| IAS 1 | "Presentation of Financial Statements" | valid from January 1, 1975 – present |

| IAS 2 | "Stocks" | valid from January 1, 1976 – present |

| IAS 7 | "Cash Flow Statements" | valid from January 1, 1979 – present |

| IAS 8 | "Accounting Policies, Changes in Accounting Estimates and Errors" | valid from January 1, 1979 – present |

| IAS 10 | "Events after the end of the reporting period" | valid from January 1, 1980 to present |

| IAS 12 | "Income taxes" | valid from January 1, 1981 – present |

| IAS 16 | "Fixed assets" | valid from January 1, 1983 – present |

| IAS 17 | "Rent" | valid from January 1, 1984 until January 1, 2021 |

| IAS 19 | "Employee Benefits" | valid from January 1, 1985 – present |

| IAS 20 | “Accounting for government subsidies and disclosing information on government assistance” | valid from January 1, 1984 – present |

| IAS 21 | "The Impact of Changes in Currency Exchange Rates" | valid from January 1, 1985 – present |

| IAS 23 | "Borrowing Costs" | valid from January 1, 1986 to present |

| IAS 24 | "Related Party Disclosure" | valid from January 1, 1986 to present |

| IAS 26 | “Accounting and reporting for pension plans” | valid from January 1, 1988 to present |

| IAS 27 | "Consolidated and Separate Financial Statements" | valid from January 1, 1990 to present |

| IAS 28 | "Investments in associated enterprises" | valid from January 1, 1990 to present |

| IAS 29 | "Financial reporting in a hyperinflationary economy" | valid from January 1, 1990 to present |

| IAS 32 | "Financial instruments: presentation of information" | valid from January 1, 1996 to present |

| IAS 33 | "Earnings per share" | valid from January 1, 1999 to present |

| IAS 34 | "Interim financial reporting" | valid from January 1, 1999 to present |

| IAS 36 | "Asset Impairment" | valid from July 1, 1999 – present |

| IAS 37 | "Reserves, contingent liabilities and contingent assets" | valid from July 1, 1999 – present |

| IAS 38 | "Intangible assets" | valid from July 1, 1999 – present |

| IAS 39 | "Financial instruments: recognition and evaluation" | valid from January 1, 2001 to present |

| IAS 40 | "Investment property" | valid from January 1, 2001 to present |

| IAS 41 | "Agriculture" | valid from January 1, 2003 to present |

International Financial Reporting Standards (IFRS) - (translated from English - international financial reporting standards).

IFRS standards were developed by the International Accounting Standards Board (IASB). This is an independent organization created in 2001. Board members are responsible for developing and publishing IFRSs, as well as approving their interpretations. Transformed by the IASB from the International Financial Reporting Standards Board (IASC). Geographically, the council is located in the capital of Great Britain, London. From 2001 to the present, standards have been developed by the IASB and are called IFRS.

International Financial Reporting Standards (IFRS)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| IFRS 1 | "First application of international standards" | valid from January 1, 2004 to present |

| IFRS 2 | "Share-based payment" | valid from January 1, 2005 to present |

| IFRS 3 | "Business Combinations" | valid from April 1, 2004 – present |

| IFRS 4 | "Insurance contracts" | valid from January 1, 2005 until January 1, 2021 |

| IFRS 5 | "Non-current assets held for sale and discontinued operations" | valid from January 1, 2005 to present |

| IFRS 6 | "Exploration and assessment of mineral reserves" | valid from January 1, 2006 to present |

| IFRS 7 | "Financial instruments: information disclosure" | valid from January 1, 2007 to present |

| IFRS 8 | "Operating Segments" | valid from January 1, 2009 to present |

| IFRS 9 | "Financial instruments" | valid from January 1, 2015 to present |

| IFRS 10 | "Consolidated financial statements" | valid from January 1, 2013 to present |

| IFRS 11 | "Cooperative activity" | valid from January 1, 2013 to present |

| IFRS 12 | “Disclosure of information about participation in other enterprises” | valid from January 1, 2013 to present |

| IFRS 13 | "Fair value measurement" | valid from January 1, 2013 to present |

| IFRS 14 | “Deferred Tariff Difference Accounts” | valid from January 1, 2021 – present |

| IFRS 15 | “Revenue from contracts with customers” | valid from January 1, 2021 – present |

| IFRS 16 | "Rent" | will come into force on January 1, 2021 |

| IFRS 17 | "Insurance contracts" | will come into force on January 1, 2021 |

In addition to international standards, there are interpretations to them.

Standing interpretations Committee - standing committee on interpretations.

SICs are clarifications to standards issued by the IASB prior to 2001. The publication of these standards was carried out by the Standing Committee on Interpretations.

Standing interpretations Committee (SIC)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| SIC 7 | "Introduction of the Euro" | valid from June 1, 1998 – present |

| SIC 10 | “Government assistance: lack of specific connection with operational activities” | valid from August 1, 1998 to present |

| SIC 15 | "Operating lease - incentives" | valid from January 1, 1999 – until January 1, 2021 |

| SIC 25 | “Income taxes - changes in the tax status of an enterprise or its shareholders” | valid from July 15, 2000 – present |

| SIC 27 | “Assessment of the essence of transactions clothed in the legal form of lease” | valid from January 1, 2002 – until January 1, 2021 |

| SIC 29 | “Concession agreements for the provision of services: Information disclosure” | valid from January 1, 2002 to present |

| SIC 31 | “Revenue-barter transactions involving advertising services” | valid from January 1, 2002 to present |

| SIC 32 | “Intangible assets: costs for the Internet site” | valid from March 25, 2002 – present |

International Financial Reporting Interpretations Committee (IFRIC) - (translated from English - international committee on the interpretation of financial statements).

IFRICs are clarifications and interpretations of international standards published after 2001. These interpretations were issued by the International Financial Reporting Interpretations Committee.

International Financial Reporting Interpretations Committee (IFRIC)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| IFRIC 1 | “Changes to existing obligations for decommissioning, natural resource restoration and other similar obligations” | valid from September 1, 2004 to present |

| IFRIC 2 | “Shares in cooperatives and similar financial instruments” | valid from January 1, 2005 to present |

| IFRIC 4 | “Determining whether the agreement contains signs of a lease agreement” | valid from January 1, 2006 – until July 1, 2021 |

| IFRIC 5 | “Rights associated with participation in funds for financing the decommissioning of facilities, environmental restoration and environmental rehabilitation” | valid from January 1, 2006 to present |

| IFRIC 6 | Liabilities arising from activities in a specific market - waste electrical and electronic equipment | valid from December 1, 2005 to present |

| IFRIC 7 | “Applying an approach requiring restatement of financial statements in accordance with IAS 29 Financial reporting in hyperinflationary conditions” | valid from March 1, 2006 – present |

| IFRIC 9 | "Re-analysis of embedded manufacturing tools" | valid from June 1, 2006 to present |

| IFRIC 10 | "Interim financial reporting and impairment" | valid from November 1, 2006 to present |

| IFRIC 12 | “Concession agreements for the provision of services” | valid from January 1, 2008 to present |

| IFRIC 13 | "Customer Loyalty Programs" | valid from July 1, 2008 – present |

| IFRIC 14 | "AS 19 - Defined benefit plan asset limits, minimum funding requirements and their relationship" | valid from January 1, 2008 to present |

| IFRIC 15 | "Contracts for real estate construction" | valid from January 1, 2009 to present |

| IFRIC 16 | “Hedging a Net Investment in a Foreign Operation” | valid from October 1, 2008 – present |

| IFRIC 17 | “Non-cash distributions to shareholders” | valid from July 1, 2009 – present |

| IFRIC 18 | "Transfer of assets from clients" | valid from July 1, 2009 – present |

| IFRIC 19 | “Settlement of financial obligations with equity instruments” | valid from July 1, 2010 – present |

| IFRIC 20 | “Costs of stripping operations at the stage of operation of an open-pit mine” | valid from January 1, 2013 to present |

| IFRIC 21 | "Obligatory payments" | valid from January 1, 2014 to present |

In the Russian Federation, the basic rules for maintaining accounting records are enshrined in the accounting regulations (PBU).

Accounting Regulations (PBU)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| Regulations on accounting and financial reporting in the Russian Federation | Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n | |

| PBU 1/2008 | Accounting policy of the organization | Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n |

| PBU 2/2008 | Accounting for construction contracts | Order of the Ministry of Finance of Russia dated October 24, 2008 N 116n |

| PBU 3/2006 | Accounting for assets and liabilities, the value of which is expressed in foreign currency | Order of the Ministry of Finance of Russia dated November 27, 2006 N 154n |

| PBU 4/99 | Organizational financial statements | Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n |

| PBU 5/01 | Accounting for inventories | Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n |

| PBU 6/01 | Fixed Asset Accounting | Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n |

| PBU 7/98 | Events after the reporting date | Order of the Ministry of Finance of Russia dated November 25, 1998 N 56n |

| PBU 8/2010 | Provisions, contingent liabilities and contingent assets | Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n |

| PBU 9/99 | Income of the organization | Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n |

| PBU 10/99 | Organization expenses | Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n |

| PBU 11/2008 | Related Party Information | Order of the Ministry of Finance of Russia dated April 29, 2008 N 48n |

| PBU 12/2010 | Segment Information | Order of the Ministry of Finance of Russia dated November 8, 2010 N 143n |

| PBU 13/2000 | Accounting for state aid | Order of the Ministry of Finance of Russia dated October 16, 2000 N 92n |

| PBU 14/2007 | Accounting for intangible assets | Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n |

| PBU 15/2008 | Accounting for expenses on loans and credits | Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n |

| PBU 16/02 | Information on discontinued activities | Order of the Ministry of Finance of Russia dated July 2, 2002 N 66n |

| PBU 17/02 | Accounting for expenses for research, development and technological work | Order of the Ministry of Finance of Russia dated November 19, 2002 N 115n |

| PBU 18/02 | Accounting for corporate income tax calculations | Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n |

| PBU 19/02 | Accounting for financial investments | Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n |

| PBU 20/03 | Information on participation in joint activities | Order of the Ministry of Finance of Russia dated November 24, 2003 N 105n |

| PBU 21/2008 | Changes in estimates | Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n |

| PBU 22/2010 | Correcting errors in accounting and reporting | Order of the Ministry of Finance of Russia dated June 28, 2010 N 63n |

| PBU 23/2011 | Cash flow statement | Order of the Ministry of Finance of Russia dated 02.02.2011 N 11n |

| PBU 24/2011 | Accounting for the costs of natural resource development | Order of the Ministry of Finance of Russia dated October 6, 2011 N 125n |

| Regulations on accounting for long-term investments | Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160 |

All PBUs regulate the procedure for organizing accounting as a whole for all enterprises, organizations, and institutions of the national economy of the Russian Federation.

Working chart of accounts

The obligation to approve the working chart of accounts is established in paragraph 4 of PBU 1/2008. When developing a chart of accounts, it is necessary to rely on accounting policies for accounting purposes. At the same time, the working chart of accounts must take into account the specifics of the organization’s activities. This can be achieved if synthetic and analytical accounting is optimally constructed.

The work plan should include only those synthetic accounts that the organization will use in practice. Please note that new synthetic accounts (not provided for in the chart of accounts) can be added to the work plan only with the approval of the Russian Ministry of Finance. This is stated in paragraphs 4 and 6 of the Instructions for the chart of accounts.

An organization can determine the structure of analytical accounting (types of subaccounts, depth of analytics, etc.) independently. In this case, analytical accounting data must correspond to the turnover and balances of synthetic accounting accounts.

In the Instructions for the chart of accounts, after the characteristics of each synthetic account, a typical scheme of its correspondence with other synthetic accounts is given. If facts of economic activity arise, correspondence for which is not provided for in the standard scheme, the organization can supplement it, observing the uniform approaches established by the Instructions (letter of the Ministry of Finance of Russia dated March 24, 2009 No. 07-02-06/90).

Disagreements between the chief accountant and the director

Situation: what should the chief accountant do if disagreements arise between him and the head of the organization regarding the reflection of a particular transaction in accounting?

The chief accountant needs to request a written order from the manager to formalize the controversial transaction.

It is with the written order of the head of the organization that one can reflect or not reflect accounting objects and take into account (or not) the data of primary documents in a situation where there is a disagreement on this issue between the director and the one who is responsible for accounting. In this case, the manager is solely responsible for the accuracy of the reflection of the financial position, financial result, cash flow and other information.

This conclusion follows from Part 8 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

Without a written order from the manager, dubious documents should not be accepted for execution.

Situation: how to transfer affairs when changing the chief accountant?

If the chief accountant resigns, he is obliged to transfer to his successor all documents and material assets for which the accounting department is responsible. In practice, they usually draw up an act of acceptance and transfer of documents or a special inventory. At the same time, keep in mind that accounting documents, in particular primary reports, registers, accounting policies, audit reports, etc., must be stored for at least five years (Article 29 of the Law of December 6, 2011 No. 402-FZ). That is, all such documents for such a period must be included in the inventory or in the act.

Internal control

The organization is obliged to organize and carry out internal control of the facts of economic life (Part 1, Article 19 of the Law of December 6, 2011 No. 402-FZ). How exactly it is necessary to organize such control is not explained in the legislation. In practice, for this purpose, an internal control service of the organization is usually created or a responsible employee is appointed. Specify the functions and tasks in the job descriptions of employees who are responsible for internal control and in the Regulations on Internal Control.

How to write an organization's accounting policy?

An accounting policy is an internal document of a company that defines the principles and options for accounting. The accounting policy must be drawn up and approved within 90 days from the date of state registration of the legal entity.

In small companies where accounting is not rich in features, accounting policies are often adopted once for the entire life of the enterprise. However, if necessary, changes are made to the academic policy, for example: due to the emergence of a new area of activity of the organization or changes in legislation.

If an audit comes to you, be prepared to present your accounting policy: this will be the first thing they ask for. To ensure that inspectors do not have the opportunity to interpret the ambiguities of the law not in your favor, describe in your accounting policy the features of accounting in your business.