Payment

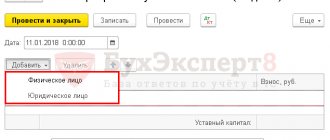

Authorized capital is part of the company’s funds contributed during its creation in the amount established by law.

In 2021, when individual entrepreneurs register, they choose the taxation system that is most suitable for them. Because

Basic concepts A corrective invoice confirms the change for VAT deduction, which was formed due to changes made

Previously, business entities sometimes faced refusal to accept VAT or tax returns

Employer reporting Olga Yakushina Tax expert-journalist Current as of May 29, 2019 Line 130 in

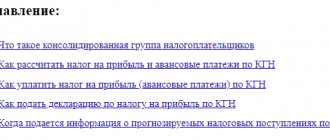

Income tax is an integral part of the burden of every organization. Constant control by tax authorities

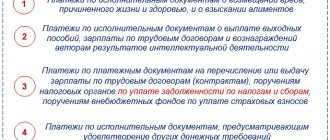

Article 31 of the Federal Law of December 23, 2003 N 186-FZ “On the Federal Budget

UTII is a preferential tax regime for small businesses. A single tax is applied on imputed

Deadlines and procedure for submitting the calculation The calculation is submitted by tax agents (Clause 2 of Article 230 of the Tax Code

A year has passed since control over the payment of insurance premiums was transferred again