Income tax is an integral part of the burden of every organization. Constant control by tax authorities, a complex system for accounting for profits and losses - all this cannot be avoided. But you can somewhat lighten this mandatory burden by sharing it with your “colleagues in the shop,” that is, with other organizations, creating a consolidated group of taxpayers (CGT).

KGN - Consolidated Group of Taxpayers

Let's consider what the law says about such associations, for which legal entities they are suitable, what are the features and pitfalls of such a union, as well as the specifics of its conclusion.

Advantages for taxpayers when creating a consolidated group

The biggest advantage for members of a consolidated group (hereinafter referred to as the CG) is that the burden of paying income tax is significantly reduced.

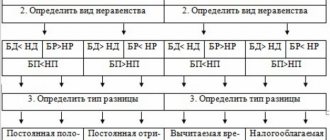

The loss-making and profitability indicators of all CG participants are summed up. The tax base of all companies that are members of the group is added up (consolidated). In this case, transactions carried out between the parties to the agreement on the creation of a corporate group cannot be the object of transfer pricing. The only exceptions are transactions concluded in relation to extracted minerals.

Participating companies merge without creating a legal entity in order to reduce the tax burden on income tax. This tax is calculated as a whole for the CG and is paid on the basis of the norms prescribed in Chapter. 3.1 Tax Code of the Russian Federation.

IMPORTANT! Starting from September 2021, tax authorities no longer register agreements on the creation of corporate groups, and agreements concluded in 2021 are considered unregistered (Law “On Amendments...” dated 03.08.2018 No. 302-FZ). Thus, contracts registered before 2018 are valid until the end of their term, but no later than 01/01/2023.

For more information about which persons are taxpayers for income tax, read our article “Who are payers of income tax?”

ConsultantPlus experts answered the most frequently asked questions from taxpayers about the payment of income tax by corporate group members:

Study the material by getting trial access to the K+ system for free.

Tax payment

Profit and the formula for calculating it into the federal budget are assigned by the responsible participant at his location without distribution among other members of the CTG and their individual divisions.

Payments to the budgets of the constituent entities of the Russian Federation for taxation of profits are calculated at the rates in force in the territory where the members of the group and their individual divisions are located.

To pay the tax, group members transfer money to the responsible member. They should not include amounts of money transferred to the responsible participant for non-operating expenses, and the responsible participant should not include this amount in non-operating income.

Conditions for creating a consolidated group

The main requirement when creating a CG was that the responsible participant in the consolidated group indirectly or directly managed 90% of the shares in the authorized capital (hereinafter referred to as the authorized capital) of each enterprise included in the group. It is important that this requirement is met throughout the entire duration of the contract for the creation of the group.

How to determine the share of participation of one company in another is stated in Art. 105.2 Tax Code of the Russian Federation.

It is also important that each of the enterprises included in the CG has the following indicators for the entire past year:

- The value of net assets, according to information from accounting records, must be greater than the value of the authorized capital (subclause 3, clause 3, article 25.2 of the Tax Code of the Russian Federation).

- The total amount of revenue received by the company from the sale of inventory and materials and the provision of services and other income must be greater than or equal to 100 billion rubles. (Subclause 2, Clause 5, Article 25.2 of the Tax Code of the Russian Federation).

- The total amount of taxes paid (VAT, profit and mineral extraction) and excise taxes must be greater than or equal to 10 billion rubles. (Subclause 1, Clause 5, Article 25.2 of the Tax Code of the Russian Federation).

- The total value of all assets on the balance sheet as of December 31 must be greater than or equal to 300 billion rubles.

Read about the new procedure for calculating assets in our article “A new procedure for calculating net assets has been approved.”

In addition, the enterprises should not have been in the process of liquidation, bankruptcy or reorganization.

The CG must be created for a period of at least 2 years. In this case, options for terminating the effect of CG are possible (we will discuss this below).

Who cannot participate in a consolidated group

Under no circumstances could the companies listed below take part in the CG. It's about:

- about clearing companies;

- insurance organizations;

- residents/participants of special and free economic zones;

- credit consumer cooperatives;

- participants of other CGs;

- microfinance companies;

- companies under special tax regimes;

- organizations exempt from income tax or not recognized as taxpayers;

- educational or medical institutions that apply a zero income tax rate;

- gambling tax payers.

As for banks, non-state pension funds, professional participants in the securities market or insurance companies, their participation in the CG is possible only on the condition that all other participants are also banks, funds, brokers or insurers.

Who is a Responsible Participant?

A responsible member of a consolidated group (RCG) is a company that is a party to the CG agreement. He is entrusted with the responsibility (in accordance with the terms of the agreement) to calculate and pay income tax for the group as a whole.

ConsultantPlus experts explained how to fill out an income tax return for a consolidated group of taxpayers. If you do not have access to the K+ system, get trial online access and switch to the Ready Solution for free.

OUCG has the same rights and obligations to the fiscal authorities as an ordinary income tax payer.

The authority of the OUCG is confirmed by the signed and registered agreement on the creation of the CG by everyone. One of the responsibilities of the OUCG is to register the concluded agreement on the creation of the CG. In the event that the UKG is the largest taxpayer, the agreement must be registered in the tax service where this participant is served.

You will find more information about the OUCG in our article “Tax rate for income tax according to the provisions of Art. 284 of the Tax Code of the Russian Federation."

Main signs of CGN

The specifics of joining a consolidating group provide for a number of features that such a procedure and all its participants must comply with.

- Organizations have a fairly high degree of participation in one another, for example:

- are members of the holding;

- the main community controls the subsidiaries;

- organizations participate in each other's authorized capital.

- The period for creating such a group cannot be less than 2 tax periods.

- The association of all members of the Group of Companies can be considered as a single economic unit.

- Participation in the CGN is secured by the conclusion of a special agreement.

- Income tax is calculated on the basis of the total profit (or loss) of all organizations included in the consolidated tax group.

FOR EXAMPLE: KGN includes three LLCs: Prima, Secunda and Tertsiya. At the end of the year, Prima’s profit amounted to 70 million rubles, Sekunda reported zero profit in the report, and Tertsiya was at a loss of 50 million rubles. If they were not part of the Group of Companies, Prima would have paid income tax on 70 million, and Sekunda and Tertsiya would have paid nothing. Subject to the validity of the agreement on the creation of a consolidated group of taxpayers, the total income of the three participants will be 70 + 0 – 50 = 20 million rubles. Each of the participants will pay tax on this exact amount, which represents a direct benefit for Prima, which is a responsible participant and controls a significant part of the authorized capital of its “sisters” in the tax base.

IMPORTANT! If the total indicator of the tax base turns out to be negative, then there is a loss for the entire consolidating group, and in this case no income tax is paid.

How to conclude an agreement to create a consolidated group

The agreement on the creation of the CG indicated the following important points:

- item;

- list of parties to the agreement and their contact/registration information;

- company name - OUKG;

- information about the responsibilities of each member of the group and separately OUKG (timing and procedure for execution), as well as information about the responsibility that arises due to failure to fulfill the terms of the contract;

- the validity period of the CG, and, accordingly, the contract;

- the amount of information provided by each member to determine the tax base and pay income tax.

You may find the tax information contained in the article “What is the object of taxation for income tax?” useful.

The agreement on the creation of a corporate group was subject to mandatory registration with the tax authority. In order to register it, the OUKG had to collect a complete package of documents. It included:

- the contract itself (in 2 copies);

- statement of establishment signed by all members of the CG;

- documents confirming the powers of the signatories of the agreement;

- accounting and financial documents confirming that all members of the group have the right to create a group of companies (information requiring confirmation is specified in subparagraphs 2–3, 5 of article 25.2 of the Tax Code of the Russian Federation).

The data that needs to be confirmed is certified by the OUKG. This list includes copies of financial statements, payment slips confirming the payment of taxes and excise taxes.

All these documents had to be submitted by October 30, so that starting next year, group members could work and pay taxes within the CG. After submitting documents to the tax authority, a decision was made within a month to register the agreement or refuse it.

If the Federal Tax Service has discovered correctable violations that can be corrected within the allotted month, the OUKG is notified of this and is obliged to eliminate them in a timely manner.

If all formalities regarding compliance by participants with the requirements of Art. 25.2 of the Tax Code of the Russian Federation, and there is also a full package of documents, the agreement on the creation of the CG is registered. Within 5 days, 1 copy of the agreement is issued with a note about the registration.

Next, the Federal Tax Service that carried out the registration notifies all territorial tax authorities in which the participants of the group are registered about their status. The same notifications are sent to the INFS, where separate divisions of companies that are members of the CG are registered.

If all the described formalities were observed, the CG was recognized as created on January 1 of the year that occurred after the registration of the agreement on the creation of the CG.

Negative aspects of KGN

Like every system, a tax consulting organization has a number of disadvantages. These include:

- The complex process of creating an association , which increases the risk of making erroneous actions.

- Short life span of the group - according to regulatory documents, such an organization can exist for 2 years, which creates certain inconveniences for business entities.

- To leave the group, you must obtain a court decision based on compelling reasons .

- General responsibility for one member for the payment of tax funds to the state treasury (displayed in Article 46, paragraph 7 of the Tax Code of Russia).

- A long period of inspection by visiting fiscal authorities (the period is reflected in Article 89.1 of the Tax Code of Russia).

- Elimination of the possibility of recording losses of a new entity in the CHT before concluding an agreement (Article 283 of the Tax Code of the Russian Federation).

Also a disadvantage in creating such an association is the narrow scope of the legislative framework . If in the agreement for such cooperation the Federal Tax Service finds the slightest deviations from the requirements of the legislative framework, then its registration will be refused. This creates significant difficulties for an inexperienced business entity in resolving this issue.

When is it possible to refuse registration of an agreement?

The tax office could refuse to register the agreement for a number of reasons, the list of which is closed:

- if a member of the CG does not meet the conditions specified in Art. 25.2 Tax Code of the Russian Federation;

- if the agreement on the creation of a corporate group does not contain the mandatory conditions that are listed in paragraph 2 of Art. 25.3 Tax Code of the Russian Federation;

- if the deadlines for submitting documents for registration of the agreement on the creation of a corporate group have been violated or an incomplete package of documents has been submitted, and correctable violations have not been eliminated within a month (clauses 5–7 of Article 25.3 of the Tax Code of the Russian Federation);

- if the documents were signed by persons other than authorized participants.

If the tax authorities refused to register the contract for the creation of a corporate group, this does not deprive the UKCG of the right to re-submit documents for registration.

A copy of the decision containing the refusal is sent by the fiscal service to the OUCG within 5 days and handed to its authorized person.

At the same time, the OUCG may appeal such a refusal within the time limits that apply for appealing acts of tax authorities. If the complaint against the refusal to register is satisfied, then, in the absence of other obstacles, the tax service will have to register the agreement. The CG will be able to function starting from January 1 of the year that occurred after the submission of documents for registration.

Declaration

This document is drawn up by the responsible participant according to the data of the remaining members of the group, submitting the document further to the relevant authorities of the Federal Tax Service. Information about profits is taken from the financial results report in the established form. He is also obliged to submit all necessary documents to the group itself.

A desk audit of the income tax return for the consolidated group of taxpayers is carried out in accordance with the new paragraph 11, which is supplemented by Art. 88 Tax Code of the Russian Federation.

In case of failure to submit a declaration within 10 working days after the expiration of the filing deadline, the tax authorities decide to suspend transactions in the bank accounts of all members of the group.

How to make changes to the agreement on the creation of a consolidated group

Amendments to the contract are mandatory due to one of the following situations:

- one or more participants find themselves in the process of liquidation;

- reorganization of one of the participants is expected in the form of accession, merger, division or spin-off;

- Another company joins KG;

- one of the participants decides to leave the CG, incl. in case of violation of the conditions specified in Art. 25.2 Tax Code of the Russian Federation;

- it is necessary to extend the contract period.

Changes are made to the agreement in the form of a separate agreement, which is signed by all parties to the CG agreement, incl. those who have just joined. This agreement is also submitted to the Federal Tax Service at the registration address of the OUCG to complete the registration procedure.

When submitting an agreement for registration, it is important to comply with the provisions established in paragraph 4 of Art. 25.4 of the Tax Code of the Russian Federation deadlines. This action must be completed no later than one month:

- which remained until the beginning of the new tax period;

- when the concluded agreement on the creation of the CG will end (if a decision has been made to extend the agreement);

- during which reasons arose due to which changes are required (they are listed in clause 1 of Article 25.4 of the Tax Code of the Russian Federation).

To register an agreement to amend the contract, the OUCG must submit the following documents to the fiscal service:

- a message that changes are being made;

- agreement signed by all participants of the CG, in 2 copies;

- decision to extend the contract term in 2 copies;

- documents confirming the authority of the signatories;

- documents confirming that the participants adhere to all requirements (taking into account changes made to the agreement) specified in Art. 25.2 Tax Code of the Russian Federation.

Registration of changes is made within 10 days after submission of a complete package of documents. As a result of registration actions, the OUKG representative will receive 1 copy of the agreement with a mark of completed registration.

Changes made to the agreement on the creation of a corporate group usually come into force on January 1 of the year following the one in which the package of documents for registration was submitted. This applies to cases where changes were made related to:

- with the addition of new participants;

- withdrawal of one or more participants for various reasons.

In other situations, changes to the agreement come into force on the date approved by the parties, but not earlier than the registration of the agreement on amendments with the tax authorities.

Features of accepting a new member into a consolidated group

The main condition for accepting a new participant into the CG is the compliance of its results and areas of activity with the norms of Art. 25.2 Tax Code of the Russian Federation. The decision to accept a new participant must be signed by all participants, in addition, it will be necessary to make changes to the agreement on the creation of the CG.

This agreement is also signed by all participants of the CG, incl. new member. If the performance indicators of the new company do not correspond to those declared in the Tax Code of the Russian Federation, the tax authorities will refuse to register the agreement to amend the agreement on the creation of a corporate group.

Procedure for a participant to leave the group

When leaving the CG, the participant will have to:

- calculate and pay income tax for the tax period in which the company was no longer a member of the Group;

- change the tax policy for paying income tax from the new reporting date;

- submit tax returns on profits for the period when the company was no longer a member of the Group.

The procedure for filling out tax returns is given in our article “What is the procedure for filling out an income tax return (example)?”

If the OUKG leaves the CG, its responsibilities include:

- making changes to your tax accounting for income tax;

- recalculation of advances on income tax for completed tax periods and submission of clarifications for the tax year.

You will learn about the specifics of filling out clarifications in our article “Clarified declaration: what does an accountant need to know?”

When a company leaves the group, it retains the need to fulfill all obligations assumed during its membership in the group to pay income tax.

You will learn about advance payments from the article “Advance payments for income tax: who pays and how to calculate?”

How to pay income tax (advance payments) according to the consolidated group tax

Profit tax (advance payments) is paid for all group members by the responsible participant (clauses 1, 3, article 25.1, clause 1, article 246, clause 6, article 288 of the Tax Code of the Russian Federation):

to the federal budget at its location without tax distribution among the members of this group and their separate divisions;

to the budgets of the constituent entities of the Russian Federation at the location of each of the KGN participants and each of their separate divisions.

The responsible participant of the consolidated group pays advance payments within the following terms:

Monthly advance payments during the quarter - no later than the 28th day of each month of this quarter (clause 1 of Article 287 of the Tax Code of the Russian Federation).

Quarterly advance payments (clause 2 of article 285, clause 1 of article 287, clause 3 of article 289 of the Tax Code of the Russian Federation):

for the first quarter – no later than April 28;

for six months - no later than July 28;

9 months – no later than October 28.

Monthly advance payments on actual profits - no later than the 28th day of the month that follows the reporting period (clause 1 of Article 287 of the Tax Code of the Russian Federation).

income tax at the end of the year no later than March 28 of the year following the previous one (clause 1 of Article 287, clause 4 of Article 289 of the Tax Code of the Russian Federation).

If the 28th falls on a weekend or holiday, then the payment deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

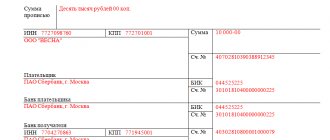

Payment orders for the payment of income tax and advance payments are filled out in the general manner (Appendices No. 1, 2, 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

Particular attention should be paid to filling out the fields “TIN”, “KPP”, “Payer”. In them, reflect the data of the responsible participant of the consolidated group of taxpayers (clause 4 of Appendix No. 1 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

In addition, in field 101, indicate code “21” - the responsible participant of the group of taxpayers (Appendix No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

Responsibility for non-payment (incomplete payment) of tax lies with the responsible participant of the group of taxpayers. It is established by Art. 122 of the Tax Code of the Russian Federation.

However, if the responsible group member has not paid (has not fully paid) the tax due to the communication of false data by a group member, then the latter will be held liable for taxation in the form of a fine (Clause 4 of Article 122, Article 122.1 of the Tax Code of the Russian Federation).

For late payment of the advance payment, you will not be fined, but you may be charged a fine (clause 3 of Article 58, Article 75 of the Tax Code of the Russian Federation, clause 16 of the Information Letter of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 N 71).

Rights and responsibilities of group members

The rights of OUKG KG include:

- submission to the tax authorities of explanations related to the calculation and payment of income tax according to the CG;

- the opportunity to attend all on-site tax audits;

Read about the timing of such tax audits in our article “What is the deadline for conducting an on-site tax audit?”

Our article “Procedure for conducting an on-site tax audit (nuances)” will help you understand the procedure for conducting such an audit.

- receiving inspection reports, decisions and other documents on the business activities of the Group from the Federal Tax Service;

- participation in the consideration of tax audit materials;

- receiving from the fiscal service information constituting a tax secret about the participants of the group;

- appealing against inspection reports and actions of tax officials related to the performance of their duties to collect profit tax;

- filing an application for a credit for income taxes paid in excess of the required amount.

The responsibilities of the OUKG include:

- maintaining tax records, calculating and paying income tax based on the results of CG activities;

You can learn more about paying income tax on behalf of a group of companies from our articles:

- “We correctly indicate the status in payment orders in 2020”

- “Indicate the originator’s status in the payment order”

- “How to fill out a payment order in 2021 - sample?”

- “Main payer statuses in a payment order”

- submission to the tax office for registration of an agreement on the creation of a group of companies or an agreement to amend the agreement, a decision to terminate the group’s economic activities;

- filing an income tax report, as well as submitting documents that were received from the participants of the Group;

Use the advice from ConsultantPlus and check whether you are filling out income tax payments correctly. Get trial access to the system and go to the Tax Guide for free.

Read about the specifics of disclosure of CG information in our article “The procedure for disclosing information in consolidated statements has been clarified.”

- upon leaving the group or terminating the activities of the group, transferring to the group information on the calculation and payment of income tax and other information;

- payment of penalties imposed in connection with non-compliance with tax legislation;

- bringing to the attention of participants within 5 days information about the receipt of demands for tax payment;

- requesting primary / tax accounting registers as part of tax control;

- submission of primary tax records/registers to the Federal Tax Service upon request.

CG participants have the right:

- appeal to a higher authority or court acts of fiscal officials or certain actions of their officials;

- receive from OUKG copies of all documents from the tax office;

- fulfill voluntarily the assumed obligations of the OUCG;

- participate in tax audits at home, as well as be present when reviewing the materials of such audits.

The responsibilities of the CG include:

- presentation of calculations of the tax base for income tax, data from registers and other documents of the OUCG;

- submission to the Federal Tax Service of documents and information that fiscal officials need to carry out tax control;

- fulfillment of obligations to pay taxes, penalties in the event of failure by the participant responsible for the activities of the corporate group to fulfill his obligations to the tax authorities;

- immediate notification of the OUKG about all cases that may lead to a violation of those specified in Art. 25.2 NC conditions;

- maintaining tax records for income tax.

Consolidation of taxpayers in Russian style

Source: corporate publication for clients of the IRBiS Group of Companies “System of Success”

On January 1, 2012, Federal Law No. 321-FZ of November 16, 2011 “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the creation of a consolidated group of taxpayers” (hereinafter referred to as Law No. 321-FZ) came into force. , which supplemented the Tax Code of the Russian Federation with a new chapter 3.1 “Consolidated group of taxpayers”.

These amendments provide taxpayers – Russian organizations – with the opportunity to unite for the purpose of calculating and paying income tax into so-called “consolidated groups of taxpayers”. Only Russian organizations can be members of the group, that is, legal entities created in accordance with the legislation of the Russian Federation and not having separate divisions outside the Russian Federation. The main benefit for members of a consolidated group of taxpayers (hereinafter referred to as the group) is the ability to summarize the profits and losses of various group members. This procedure for calculating income tax is due to the fact that interdependent persons act with the aim of obtaining the total income of a group of companies, and it is possible that not all members of the group of companies will always make a profit.