Payment

Trade organizations regularly face the need to write off goods that have become unusable. First of all, this

It is necessary to generate an FPR (financial performance report) for 2021 on an updated form

Before answering the question of what is not subject to depreciation, let us explain this accounting term. All

Who applies Companies that are payers of income tax (except for credit organizations, as well as

The assets and liabilities of an enterprise are important economic concepts that allow you to evaluate the efficiency and

For a detailed step-by-step calculation of advance payments and simplified tax system, you can use this free

Who submits the declaration Order of the Russian Ministry of Natural Resources No. 1043 dated December 10, 2020 amended the current

The useful life of a vehicle is the period during which the vehicle generates economic value.

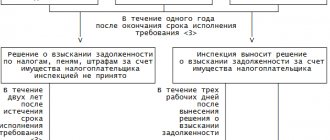

Each tax must be paid by the organization on time. This rule applies not only to

Why is the program needed? The head of an enterprise or organization is obliged to create an optimal and safe production