The number of employees indicated on the title page of 4-FSS is calculated as an average. The number of average employees is determined from the beginning of the year to the reporting period by dividing the monthly headcount by the number of months. Let's look at current examples of calculations for 2021.

In reporting, the average list indicator is indicated for a quarter, half a year, 9 months, a year, taking into account data from the beginning of the tax period. The indicator is important and is important for determining the form of reporting. Enterprises with more than 25 employees during the reporting period must submit data electronically.

Average headcount calculated by 4-FSS (nuances)

> > > September 25, 2021 Average headcount in FSS-4 - its calculation assumes the participation of quite a large number of indicators. Let's consider the procedure for this calculation step by step.

In form 4-FSS (approved by order of the FSS dated September 26, 2016 No. 381), the average number of employees is indicated in a separate field on the title page. The corresponding indicator is reflected in accordance with the order of the Social Insurance Fund dated 06/07/2017 No. 275 for the period from the beginning of the year. In the previous version of Order No. 381, the average headcount was filled out as of the reporting date. But the fields “Number of working disabled people” and “Number of employees engaged in work with harmful/hazardous production factors” are filled in according to the list number of the corresponding categories of employees as of the reporting date.

Let's look at how the average headcount in the Social Insurance Fund report is calculated in practice. For explanations on filling out the 4-FSS calculation, see

. The calculation of the indicator under consideration for a particular quarter is carried out in 5 stages: 1.

Calculation of the average number of all employees for all days of the month from the beginning of the year, that is, if the report is submitted for the 4th quarter of 2021, then the average number is calculated for January-December 2021. 2. Calculation of the average headcount for part-time employees for all days of the month from the beginning of the year. 3. Calculation of the average number of employees separately for each month.

4. Calculation of the average number of part-time workers for each month. 5. Determination of the average number of specialists for the period from the beginning of the year.

This algorithm corresponds to the procedure for determining the average headcount, which Rosstat recommends using when filling out statistical reporting forms. For use in 2021-2021, this procedure was approved by Rosstat order No. 772 dated November 22, 2017. You can familiarize yourself with the requirements of this order.

This algorithm is used to calculate headcount information submitted annually to the Federal Tax Service.

Accountant's Directory

09/07/2021 Contents In order to reflect reliable data on the average number of employees in the reporting of the Form-4 FSS of the Russian Federation, the State Institution - the Arkhangelsk Regional Branch of the Social Insurance Fund reports. Calculation of the average number of employees must be made in accordance with the Instructions for filling out statistical observation forms: No. P-1

“Information on the production and shipment of goods and services”

, No. P-2 “Information on investments”, No. P-3 “Information on the financial condition of the organization”, No. P-4 “Information on the number, wages and movement of employees”, No. P-5 (M) “Basic information about activities of the organization" (hereinafter referred to as the Directives), approved by the Order of the Federal State Statistics Service of the Ministry of Economic Development of the Russian Federation dated November 12, 2008.

No. 278. The average number of employees is calculated on the basis of daily accounting of the payroll number, which is constantly updated in accordance with the unified forms of primary documentation for labor accounting and remuneration (orders (instructions) on hiring, transfer of an employee to another job, granting leave, termination (termination) ) employment contract (dismissal), time sheets, pay slips). Please note: Numbers are shown in whole units.

The list of employees includes employees who worked under an employment contract and performed permanent, temporary or seasonal work for one day or more, as well as working owners of organizations who received wages in this organization, including: - those who actually showed up for work, including those that did not work due to downtime; - those who were on business trips, if they retain their salary in this organization, including employees who were on short-term business trips abroad; - those who did not report to work due to illness (during the entire period of illness until returning to work in accordance with certificates of incapacity for work or until retirement due to disability);

Average number of employees in FSS-4 (general provisions for 2021)

This paragraph applies to employees, with the exception of those who by law have the right to reduced working hours; Shift workers, that is, those who perform their labor functions outside the main territory of the employer; Employees who are absent from work due to leave (annual, additional or leave at their own expense); At the same time, there is a certain category of workers who should not be taken into account in the headcount calculation. These include external part-time workers, employees brought into the organization by concluding civil contracts, as well as employees who were transferred to other companies if their place in the main organization is not retained. In order to reflect the value of the average headcount indicator in the calculation of contributions from accidents and occupational diseases, it is necessary to follow a certain sequence of actions.

First, you will need to calculate the value of the population indicator for one calendar day. Table. For example, if the policyholder is registered in the city of Istra, then on the title page of form 4-FSS he should:

- In the “District” field, indicate “Istrinsky”.

- in the “Subject” field indicate “Moscow region”;

Fields “Number” The fields “Number of working disabled people”, “Number of workers engaged in work with harmful and (or) hazardous production factors” are now in section 2 of form 4-FSS.

In June the situation repeated itself again. In such a situation, the total number of hired workers of the company is:

- in the month of April 1 thousand 350 people or person-days (calculated by the formula: 50 * 15 + 40 * 15); in May 1 thousand 390 people (50 * 15 + 40 * 16); in June again 1 thousand 350 people (calculation as in the first case).

When calculating the average number of part-time employees, it is necessary to take into account a small nuance. Working days of employees during illness or maternity leave refer to the working hours of the hours that were worked on the previous day.

Average number of employees in the calculation of 4-FSS (nuances) - all about taxes

Calculating the average headcount is an integral task for all companies and entrepreneurs if they have assumed the responsibilities of employers.

Despite the fact that in 2021 there was a reformation of the previously existing system for paying insurance premiums and new reporting forms appeared, the calculation of 4-FSS is still among the mandatory documents.

However, the structure of this document has changed significantly. Today, when drawing up calculations using Form 4-FSS, it is necessary to take into account only insurance premiums for accidents and occupational diseases.

Let's consider whether the average number of employees should be reflected in the Social Insurance Fund (calculation 4), and also how the value of this indicator will be determined taking into account the requirements of the law. Due to the fact that in 2021 most of the insurance premiums were transferred to the hands of tax inspectors, there was a need to modernize existing reporting forms and develop new documents.

Currently, only contributions from accidents and occupational diseases remain under the control of Social Insurance. To transmit information to the Social Insurance Fund about the payment of insurance premiums on this basis, reporting form 4-FSS is used.

The calculation form in force since 2021 was approved by order of the Social Insurance Fund dated September 26, 2016. No. 381. The report under review is quarterly in terms of submission deadlines to the authorized bodies. Accordingly, this document must be generated and submitted to Social Security at the end of each quarter no later than the 25th day of the month following the end of the quarter.

As for reflecting the value of the average payroll number of personnel in the calculation of 4-FSS, the title section of the document is intended for this. In the report on Form 4-FSS, a separate line is provided on the title page of the document to reflect information about the average headcount of hired personnel. The calculation of contributions for accidents and occupational diseases assumes that to determine the average number of employees, information from documents reflecting the actual presence of employees at their workplaces on a daily basis, namely, time sheets, is used.

Fines for violations when filing 4-FSS

For failure to comply with the deadline for submitting the 4-FSS calculation, the employer is punished with a penalty in the amount of 5% to 30% (but not less than 1,000 rubles) of the amount of insurance contributions accrued for each calendar month in the last quarter of the reporting period. For zero reporting you will be fined at the minimum rate.

If the reporting form for contributions for injuries is not followed (paper and mandatory electronic), a fine of 200 rubles is imposed. The responsible official may be charged from 300 to 500 rubles.

Average number of employees for 4-FSS 2021: how to calculate

Read how to calculate the average number of employees for the 4-FSS report.

We have shown a step-by-step example taking into account the latest changes. And they told us in which case the average number of employees equal to zero would not be an error.

Contents: On the title page of the 4-FSS calculation there are three fields for indicating the number of personnel:

- Number of workers in harmful and dangerous jobs.

- Number of working disabled people,

- Average number of employees,

The procedure for filling out these fields was approved by order of the Social Insurance Fund dated June 7, 2017 No. 275. The average headcount is reflected for the reporting period, that is, from the beginning of the year.

We recommend reading: What benefits are available to a 3rd grade disabled person paying a mortgage?

Previously, this indicator was filled out at the reporting date.

The other two indicators (number of disabled people and hazardous workers) are still filled in as of the reporting date.

Important to know: The methodology for calculating the average headcount is given in Rosstat Order No. 772 dated November 22, 2017.

It is used to calculate the average headcount for the annual report to the Federal Tax Service, filling out statistical reports and for 4-FSS. The algorithm includes five steps:

- For part-time staff: calculate the number of hours worked for each month,

- For the same employees: determine the average number of employees,

- Calculate the final average number of employees for the reporting period.

- For part-time workers: calculate the average number of employees for each month,

- For full-time staff: calculate the total headcount for each month,

Let us show with an example how to calculate the average headcount in the 4-FSS report for the 2nd quarter of 2021.

Step 1. Calculation of the total number of employees Employees working full time are taken into account.

Excluded from the list:

- Those on unpaid study leave,

- Working part time,

- Owners of a company who do not receive a salary

- Part-time workers

- Persons performing work under GPC contracts.

- Lawyers,

- Those on maternity leave or parental leave, including those working part-time or at home while maintaining the right to receive benefits,

Submission of the 4-FSS report

In 2021, legal entities with employees will have to report to the Social Insurance Fund four times - submit report form 4-FSS based on the results of 2021, the first quarter, half a year and nine months.

We recommend reading: Presidential Decree on Russian citizenship 2019 simplified procedure

After proceeding to send the report, select the certificate to sign and click on the “Check Report” button. If errors are found when checking the report, click on the “Open Editor” button, correct the errors and proceed to submit the report again.

How to calculate the average number of employees for 4-FSS

Employers report on insurance contributions imposed on employees' wages by submitting to the Social Security Fund. insurance form 4-FSS. In this article we will learn how to calculate the average headcount indicator for this report. Contents In accordance with Order of the Federal Tax Service of the Russian Federation N 381, the updated form 4-FSS began to be effective in the first quarter of this year.

According to clause 5.15 of this Order, the average headcount is calculated in accordance with the forms approved by Rosstat. Rosstat instructions (Order N 498) state that the average payroll number for 1 month includes the payroll number for each day (30 or 31, and in February - 28 or 29), divided by 12.

Both weekends and holidays are taken into account. Because this report is submitted quarterly, the corresponding figure will be calculated by summing the three-month average headcount divided by three. The calculation of the average headcount for Social Insurance Fund-4 will be illustrated using an example: Staffing of company N.

for the month of January is 15 people, for February - 13, and for March - 12. The average number reflected in the 4-FSS for the first quarter will be equal to (15 + 13 + 12): 3 = 13,333 = 13 people.

The following categories of workers are excluded from the calculation of the headcount:

- Part-time employees (external);

- Employees who are temporarily on unpaid study leave.

- Workers on maternity leave and caring for children under one and a half years old;

- Employees who have entered into GPC agreements with the company (contractors);

A detailed list of employees included in the payroll is contained in clause 79 of the Instructions for filling out form N P-1.

In this case, part-time employees are reflected in proportion to the time worked per month.

- Calculation of the monthly average number of part-time workers.

- Quarterly calculation of the average number of employees by summing clauses 1 and 2

- Finding the monthly average number of full-time employees.

Step 1.

Methods and deadlines for delivery

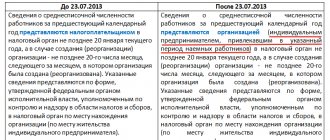

The period for submitting a report in Form 4-FSS directly depends on the method of submitting this report. In this case, the method of submission depends on the average number of individuals in whose favor individual entrepreneurs or companies made contributions for past billing periods (according to paragraph 1, article 24 of Federal Law No. 125):

- if the number of employees is less than 25 people, employers have every right to submit a report on paper;

- If the number of employees exceeds 25 people, employers are given the opportunity to submit a report on Form 4-FSS in electronic form.

Based on this, there are only a few ways to submit a report:

- on paper;

- in electronic form.

On paper

This year, a report on Form 4-FSS must be submitted within the following deadlines:

- for the past year, the deadline is January 20 inclusive of the current year;

- for the first 3 months (quarter) - no later than April 20 (of the same year) inclusive;

- 6 months before July 20 of the current year;

- when submitting a report for 9 months - before October 20 of the current year.

In electronic form

Employers must comply with the following deadlines:

- for last year – until January 25 inclusive;

- for the first 3 months (quarter) – no later than April 25 of the current year inclusive;

- when submitting a report for 6 months - no later than July 25 of the current year inclusive;

- when submitting a report for 9 months - until October 25 of the current year inclusive.

Average number of employees calculated by 4-FSS in 2021: examples

How to reflect the average number of employees in the calculation of 4-FSS in 2021?

Let me explain. On the title page of the 4-FSS in 2021, indicate (clause 5.15 of the Procedure for filling out the 4-FSS):

- in the field “Number of working disabled people” – the list number of disabled people as of 03/31/2019;

- in the “Average number of employees” field – the average number of employees for the 1st quarter of 2021, calculated in the usual manner;

- in the field “Number of employees engaged in work with harmful and (or) hazardous production factors” - the list number of employees in hazardous work as of March 31, 2021.

Let's give an example of calculating the average number of employees for 4-FSS in 2021.

Monthly indicators of the number of employees of the enterprise:

- for March is thirteen.

- for February it is equal to eleven;

- for January is equal to twelve;

The calculation indicator for the 1st quarter of 2021 of the average headcount for FSS-4 in this example will be equal to twelve ((12 + 11 + 13) / 3 = 12). It is this indicator that is to be reflected in the corresponding line of the 4-FSS calculation. The calculation of the number of employees in question is carried out using information from the payroll records for each day.

The daily indicator must be equal to the corresponding indicator reflected in the time sheet maintained by the enterprise.

When calculating the average headcount indicator, in particular, the following are taken into account:

- performing state or public duties outside the place of work;

- those who actually showed up for work, regardless of whether they worked or not due to downtime;

- truants;

- being tested;

- those who worked on business trips;

- persons under investigation, etc.

- disabled people who did not show up for work;

- vacationers (including at their own expense);

An internal part-time worker is included in the calculation at the place of main work.

When in calculation 4 - FSS table 1 “Calculation of the base for calculating insurance

Persons included in the calculation and excluded from the list when counting the number

Persons are included in the calculation of the average number of employees regardless of whether they are in the workplace. Employees may be absent due to illness, vacation, or in connection with the performance of government duties. When including them in the headcount, persons with valid reasons for absence and maintaining the average salary are taken into account. When sampling the number of employed persons at an enterprise, some employees are not subject to inclusion in the average headcount.

| Persons included in the calculation | Persons excluded from the calculation of the average headcount |

| Employees hired for permanent, temporary or seasonal work under an employment contract | Persons employed under GPC agreements |

| Internal part-timers | External part-timers |

| Employees absent due to illness confirmed by a document from a medical institution | Employees on leave for employment and childcare |

| Persons on probation | Potential employees with whom a student agreement has been drawn up with payment for the duration of the training |

| Employees on regular leave | Persons who received leave without pay in connection with admission to an educational institution |

Special rules have been established to reflect the number of part-time workers in the indicator. An employee hired under an internal part-time contract is reflected in the number of 1 staff unit. Temporary employees of other enterprises are not taken into account. In addition to part-time work, combination or replacement of positions due to internal necessity is used. When combining positions, the number does not increase.

Calculation of the average number of employees for FSS-4

» » » Reporting The number of employees of an organization or individual entrepreneur affects the procedure for filling out Form 4 of the Social Insurance Fund. In 2015, companies and individual entrepreneurs must fill out and submit Form 4 of the Social Insurance Fund only electronically if the average number of their employees for 2014 exceeds 25 people.

If the average number of their employees for 2014 does not exceed 25 people, the company and individual entrepreneurs have the right to choose: either report on paper or electronically.

So, in order to decide how to submit the calculation of 4 FSS: on paper or electronically, you first need to count the number of employees for 2014. You can take the number of employees from the form on the average number of employees, which you sent to the tax office in January 2015. Let us tell you in more detail how to calculate the number of employees for 4 Social Insurance Funds.

Knowing the number of employees, you can easily fill out the number of employees in Form 4 of the Social Insurance Fund. You can calculate the average number of employees by following the Guidelines approved by Rosstat Order No. 428 dated October 28, 2013. To determine the average number of employees for the year, use the formula: Average number of employees for the year = Average number of employees for January + Average number of employees for February + ... + Average number of employees number of employees for December: 12 In cases where the company operated for less than a full year (for example, it was registered in the summer), this indicator must be calculated in a similar way.

That is, the sum of the average headcount for all months must still be divided by 12.

In turn, to calculate the average number of employees for the month, use the formula: Average number of employees for the month = Average number of employees who worked full-time + Average number of employees who worked part-time The average number of employees working full-time is calculated as follows: Average number employees who worked full working days = List number of employees for the 1st day of the month

Minakova Yulia

The calculation of the average number of employees is carried out in accordance with the Instructions of Rosstat, approved by Order No. 428 dated October 28, 2013. This document presents a list of employees who must be included in the number of employees indicated in the reporting form. There is also a list of persons who are not taken into account in the calculation.

The need to submit a report gives rise to another question: how to calculate the SCH when opening an LLC, and who should be included in this document? Calculations must be made in accordance with the instructions given by Rosstat. They are displayed in letter No. 428 dated October 28, 2017.

Average headcount in FSS-4: calculation

→ → Update: March 23, 2021

To calculate insurance premiums to the Social Insurance Fund, an indicator such as the average number of employees is used, among other things. It is contained in the FSS-4 report.

We will consider the calculation of this indicator below.

It is important to note that the 4-FSS report forms for 2021 and for 2021 are different.

At the same time, the indicator considered in this article remained unchanged.

The procedures for filling out the Order dated February 26, 2015 and contain the same information that this indicator is calculated on the basis of forms approved by Rosstat. In the 4-FSS report, the average number of employees is reflected on the first page. The calculation procedure for statistics is contained in, approved by Rosstat on October 26, 2015.

From the Instructions, in particular, it follows that the monthly indicator is calculated by adding the number of workers on the payroll for each calendar day and dividing this amount by the number of all days of the month. The calculation includes absolutely all days of the month, regardless of whether they are working days, weekends or holidays. In order to obtain the corresponding quarterly headcount indicator in the 4-FSS report, you should add up the three monthly indicators calculated by the above method and divide them by the number of months in the quarter.

Let's give an example. Monthly indicators of the number of employees of the enterprise:

- for January is equal to twelve;

- for February it is equal to eleven;

- for March is thirteen.

The quarterly indicator for calculating the average headcount for FSS-4 in this example will be equal to twelve ((12 + 11 + 13) / 3 = 12).

It is this indicator that is to be reflected in the corresponding line of the 4-FSS calculation.

The calculation of the number of employees in question is carried out using information from the payroll records for each day. The daily indicator must be equal to the corresponding indicator reflected in the time sheet maintained by the enterprise. When calculating the average headcount indicator, in particular,

Average headcount in FSS-4 (calculation in 2021)

Author of the article Victoria Ananyina 4 minutes to read 3,217 views Contents The number of employees indicated on the title page of 4-FSS is calculated as an average.

The number of average employees is determined from the beginning of the year to the reporting period by dividing the monthly headcount by the number of months.

Let's look at current examples of calculations for 2021. In reporting, the average indicator is indicated for a quarter, half a year, 9 months, and a year, taking into account data from the beginning of the tax period. The indicator is important and is important for determining the form of reporting. Enterprises with more than 25 employees during the reporting period must submit data electronically. The average number of employees is not identical to the number of employees approved by the staffing table.

The procedure for determining the average headcount (AS) is established by Rosstat in order No. 428 dated October 26, 2015, as amended, adopted on February 6, 2017. When calculating the average headcount, the following principles are used:

- The number of employees on a non-working day is determined by the previous working day. Similarly, the number of persons is taken into account when several non-working days occur.

- The number is set in whole units, rounded up or down depending on the size of the fractional indicator.

- A person who has a day off in accordance with the schedule for performing duties is included in the calculation based on the data of the previous day.

- Persons are counted for the month on every calendar day, including weekends or holidays.

- The indicator is displayed based on the results of the month. Based on each month's data, an indicator is displayed for any period from the beginning of the year.

We recommend reading: How to calculate sick leave for pregnancy and childbirth in 2021 for a part-time worker

The basis for obtaining data on the number of employees is information from time sheets and personnel orders for the enterprise. The responsible employee must have information about persons who are assigned to part-time work.

Based on data on the average number

Average headcount for 2021: features of accounting for part-time workers and performers according to the GPA

Accounting for certain categories of personnel is carried out in a special manner. External part-time workers are not taken into account on a general basis: only internal ones are included in the average number. Each internal part-time worker is accepted as one unit and only for the main position. And “externals” are subject to separate accounting, as are performers under civil contracts, services, and so on.

The calculation of the average number in this case is carried out by analogy with the determination of the average number of employees, while external part-time workers are taken into account in proportion to the time worked, and performers according to the GAP - as whole units. Therefore, for “external workers”, the total number of man-days worked is first calculated using the standard formula:

And only then, based on the result obtained, the average number is determined:

But with persons working under civil contracts, everything is much simpler:

The timing of remuneration payment does not affect accounting. Each calendar day is taken into account throughout the entire contract period. All performers are taken into account, with the exception of individual entrepreneurs and full-time employees with whom the employer has concluded a GPA, as well as persons with whom copyright agreements have been concluded for the transfer of property rights.

Advice from the editor. Do not forget to annually submit reports on the number of employees to Rosstat. Even if a company has been declared bankrupt this year and is preparing for liquidation or has suspended operations but produced goods and services during the reporting period, it will still have to submit a report. Only small enterprises with no more than 15 employees per year are exempt from this obligation; all others fill out form No. 1-T or No. P-4 for statistical authorities. How to prepare a report and check the correctness of the entered data, read in the electronic magazine “Personnel Affairs”.

In the FSS report, how to calculate the number of employees

Contents The average number of employees (ASN) is the average number of employees who worked for you during the quarter or year. SSC are indicated in the reporting for employees to the Social Insurance Fund and once a year they submit a separate report on it to the tax office.

The average headcount includes employees under employment contracts.

The calculation does not include:

- external part-time workers, non-working employees on maternity leave, employees on study leave.

The average number is wider than the average number. It includes both employees under employment contracts, and external part-time workers and employees under a GPC agreement. In reporting, the average headcount is most often used.

The principle is this: count the number of employees for each month of the year and divide by 12.

For example, if 6 people worked for you for six months, and 4 for the remaining six months, the average number of employees for the year is 5 employees.

If nothing changed during the calculation period - the employees did not quit or come back, they worked full time, just count them on their heads. There are more complicated situations. New employees appear and old ones leave, some take maternity leave, and some work part-time.

To calculate everything correctly, use step-by-step instructions. Add up the employees for each day of the month—even those who were sick or on vacation—and divide by the total number of days in the month. In the same way, count employees for the remaining months.

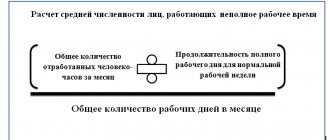

If you don't have part-time employees, move on to the next step. First, calculate how many hours all part-time employees worked each month. Divide the hours worked by employees by the daily working hours multiplied by the number of working days in the month.

Add up the NAV of full-time and part-time employees for each month.

Round the result to a whole number.

Divide the number of full-time and part-time employees by the number of months in the period.

Round again to a whole number.

Results

In order to calculate the average number of employees of an organization in order to fill out Form 4-FSS, you need to know the following indicators: the length of a full-time working day in a company, the number of hours worked by part-time employees, the number of days in a month, as well as the number of employment contracts for full and part-time.

Using them in a certain sequence, you can make the necessary calculations using the above method. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Average headcount calculated by 4-FSS for the year

> > > December 5, 2021 4-FSS for the year - the average headcount in this report, generated on an accrual basis, is also calculated for the year.

Read about where it should be shown, its role and calculation rules in our material. 4-FSS is a form intended for the Social Insurance Fund and dedicated to calculations of contributions for accident insurance, control over which the FSS retained after the transfer of other insurance contributions to the tax service in 2021.

It must be submitted to social insurance quarterly (Clause 1, Article 24 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ), generating incremental data throughout the year in each subsequent report, i.e., covering the period , counted from the beginning of the current year (pp.

1, 2 tbsp. 22.1 of Law No. 125-FZ). The need for accrual accounting also applies to information about the average headcount (hereinafter referred to as SSC) (clause 5.15 of Appendix No. 2 to Order No. 381 of the FSS of the Russian Federation dated September 26, 2016, as amended by Order No. 275 of the FSS of the Russian Federation dated June 7, 2017).

Form 4-FSS, as well as the rules for filling out this form, were approved by Order No. 381 of the FSS of the Russian Federation. To indicate the SSC, a special field is allocated on the title page under the basic information about the payer of contributions.

Entering this information is mandatory. What is the reason for the obligation to include data on the SSC in the report? The value of this indicator determines the acceptable method of its presentation in the Social Insurance Fund.

In this regard, the figure for the average number of employees in 4-FSS for the year is no exception. The limit value for the SSC is the number 25 (p.

1 tbsp. 24 of Law No. 125-FZ): policyholders for whom it turns out to be greater than this value are required to submit a report electronically, but can do this later (including the 25th day of the month in which the report must be submitted); policyholders with a staff number not exceeding the limit value have the right to choose the method of submitting the report (on paper or electronically), but must remember:

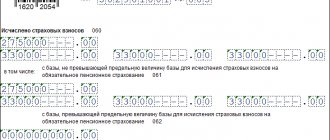

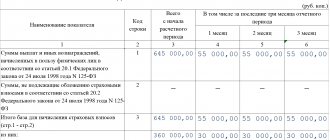

Table 1. Calculation of the base for calculating insurance premiums

The indicators in the table are reflected as follows:

- in column 3 - on a cumulative basis from the beginning of the billing period;

- in columns 4-6 - for the last three months of the reporting period.

In line 1, the total amount of payments and other remunerations subject to insurance premiums is automatically calculated:

page 1 = page 2 + page 3

Line 2 indicates payments that are not subject to insurance premiums (if any). In this case, the value in column 3 is calculated automatically as follows:

page 2 gr. 3 (for 1 quarter of the billing period) = (column 4 + group 5 + group 6) page 2

page 2 gr. 3 (for other reporting periods) = page 2 gr. 3 calculations for the previous reporting period + (column 4 + group 5 + group 6) page 2 calculations for the current reporting period

Line 3 reflects the base for calculating insurance premiums. In this case, the value in column 3 is calculated automatically as follows:

page 3 gr. 3 (for 1 quarter of the billing period) = (column 4 + group 5 + group 6) page 3

page 3 gr. 3 (for other reporting periods) = line 3 gr. 3 calculations for the previous reporting period + (column 4 + group 5 + group 6) page 3 calculations for the current reporting period

Attention! When filling out line 3 , you should pay attention to the fact that the following equality must be satisfied:

page 3 = page 1 – page 2

Line 4 indicates payments made in favor of disabled people. In this case, the value in column 3 is calculated automatically as follows:

page 4 gr. 3 (for 1 quarter of the billing period) = (column 4 + group 5 + group 6) page 4

page 4 gr. 3 (for other reporting periods) = page 4 gr. 3 calculations for the previous reporting period + (column 4 + group 5 + group 6) page 4 calculations for the current reporting period

Line 5 indicates the size of the tariff that is established for the organization or its separate division.

Attention! Line 5 is filled out on the basis of a notice of the amount of insurance contributions for compulsory social insurance against accidents at work and occupational diseases, which is issued to the policyholder by the branch of the Federal Social Insurance Fund of Russia.

If the organization has the right to a discount on the insurance rate, then it is reflected in line 6 . The percentage of discount to the insurance rate is set by the territorial body of the Social Insurance Fund for the current calendar year and depends on the state of labor protection (including the results of a special assessment of working conditions, as well as mandatory medical examinations) and the cost of insurance coverage.

If the organization uses a premium to the contribution rate, then line 8 reflects the date of the order of the territorial branch of the Social Insurance Fund to establish the premium, and line 7 indicates the percentage of the premium. The percentage of the premium to the insurance tariff is set by the territorial body of the Social Insurance Fund for the current calendar year.

The maximum discount (surcharge) cannot exceed 40% of the approved insurance rate.

In line 9, the final rate of insurance premiums is automatically calculated taking into account the discount or surcharge using the following formulas:

- if the payer of insurance premiums does not have discounts (surcharges) to the insurance rate:

page 9 = page 5

- if the payer of insurance premiums has a discount on the insurance rate:

page 9 = page 5 – page 5 * page 6 / 100

- if the payer of insurance premiums is given a premium to the insurance tariff:

page 9 = page 5 + page 5 * page 7 / 100

The procedure for calculating the average number of employees

In order to reflect reliable data on the average number of employees in the reporting of the Thomas-4 FSS of the Russian Federation, the State Institution - the Arkhangelsk Regional Branch of the Social Insurance Fund reports. Calculation of the average number of employees must be made in accordance with the Instructions for filling out statistical observation forms: No. P-1

“Information on the production and shipment of goods and services”

, No. P-2 “Information on investments”, No. P-3 “Information on the financial condition of the organization”, No. P-4 “Information on the number, wages and movement of employees”, No. P-5 (M) “Basic information about activities of the organization" (hereinafter referred to as the Directives), approved by the Order of the Federal State Statistics Service of the Ministry of Economic Development of the Russian Federation dated November 12, 2008.

No. 278. The average number of employees is calculated on the basis of daily accounting of the payroll number, which is constantly updated in accordance with the unified forms of primary documentation for labor accounting and remuneration (orders (instructions) on hiring, transfer of an employee to another job, granting leave, termination (termination) ) employment contract (dismissal), time sheets, pay slips). Please note: Numbers are shown in whole units. The list of employees includes employees who worked under an employment contract and performed permanent, temporary or seasonal work for one day or more, as well as working owners of organizations who received wages in this organization, including: - those who actually showed up for work, including those that did not work due to downtime; - those who were on business trips, if they retain their salary in this organization, including employees who were on short-term business trips abroad; - those who did not report to work due to illness (during the entire period of illness until returning to work in accordance with certificates of incapacity for work or until retirement due to disability)

Average headcount calculated by 4-FSS (nuances)

The average headcount in FSS-4 - its calculation assumes the participation of a fairly large number of indicators.

Let's consider the procedure for this calculation. In Form 4-FSS (approved by Order of the FSS dated September 26, 2016 No. 381), the average number of employees is indicated in a separate field on the title page. The corresponding indicator is reflected in accordance with the order of the Social Insurance Fund dated 06/07/2017 No. 275 for the period from the beginning of the year.

In the previous version of Order No. 381, the average number of employees was filled out as of the reporting date. But the fields “Number of working disabled people” and “Number of employees engaged in work with harmful/hazardous production factors” are filled in according to the list number of the corresponding categories of employees as of the reporting date. Let's consider how the average headcount in the Social Insurance Fund report is calculated in practice. Read more about all aspects of filling out the 4-FSS calculation. The calculation of the indicator in question for a given quarter is carried out in 5 stages: 1.

Calculation of the average number of all employees for all days of the month from the beginning of the year, that is, if the report is submitted for the 2nd quarter of 2021, then the average number is calculated for January-June 2021.2. Calculation of the average headcount for part-time employees for all days of the month from the beginning of the year.3.

Calculation of the average number of employees separately for each month.4. Calculation of the average number of employees with part-time employment for each month.5. Determination of the average number of specialists for the period from the beginning of the year. This algorithm corresponds to the procedure for determining the average number of specialists, which Rosstat recommends using when filling out statistical reporting forms.