Payment

What is the difference between standardized and non-standardized advertising expenses Advertising expenses, which are taken into account for tax purposes, are divided

Home / Labor Law / Payment and Benefits / Wages Back Published: 07.17.2020

Many people want to become individual entrepreneurs. But those who already are, advise first

In this material we will learn how to calculate the mineral extraction tax, determine the tax base of the tax, consider the tax

January 4, 2021 Hello, dear readers of the KtoNaNovenkogo.ru blog. To obtain the status of a legal entity, you need

What is OS The concept of OS is disclosed by PBU 6/01 “Accounting for fixed assets” and the Tax Code of the Russian Federation.

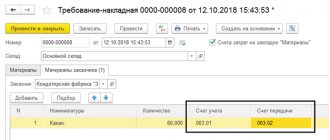

The use of form M-11 or a demand invoice occurs when inventory is transferred within an enterprise from

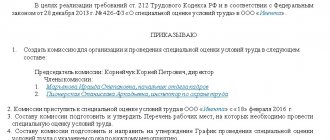

What is the essence of the document? Amendments have been made to some regulatory legal acts of the Ministry of Labor regarding the procedure

Which employees need to be issued PPE, when is it necessary to purchase PPE? The workwear is designed to

The legal status of the company, the rights and obligations of its participants are determined by two main documents. This is Civil