Why is KUDiR needed?

A simplified individual entrepreneur does not keep accounting records and does not submit tax reports. But in order to correctly calculate the tax on the simplified tax system, an individual entrepreneur must keep tax records in a special Book of accounting for income and expenses of organizations and individual entrepreneurs using the simplified taxation system (hereinafter referred to as KUDiR).

Also, all organizations using the simplified tax system work with KUDiR.

It is worth downloading that many banks in which individual entrepreneurs or organizations have a current account now provide services that keep a ledger of income and expenses automatically (without user participation). It is very comfortable. But if you want to understand in more detail the formation of KUDiR indicators, you can watch this video:

Form for notification of transition to simplified tax system

To report the choice of a simplified tax regime, a special form is provided in Form 26.2-1. It was published in the Order of the Federal Tax Service of Russia dated November 2, 2012 N ММВ-7-3/ [email protected]

The notification about the transition to the simplified tax system from 2021 refers to recommended, not approved documents. This means that the Federal Tax Service does not impose strict requirements on the procedure for filling it out.

However, when filling out the form, you should still adhere to the standard rules:

- write only printed capital letters;

- use black ink;

- Place dashes in empty cells.

Prepare two copies of the transfer notice, the tax inspector will mark acceptance on one and give it to you. But some of our users report that their inspections require three copies. You can clarify this issue with the inspection in advance or simply print out another sheet.

The notification on the simplified tax system has only one page, you can fill it out without difficulty. Next we will look at the filling order and show what a sample filling looks like.

Cancellation of KUDiR from 2021

Soon, individual entrepreneurs and organizations using the simplified tax system will no longer keep a book of accounts according to the simplified tax system and submit simplified declarations. This was announced by Deputy Head of the Federal Tax Service of Russia Dmitry Satin on the air of the “Taxes” program. Information about this is on the official website of the Federal Tax Service at the link .

As a representative of the Federal Tax Service noted, now individual entrepreneurs and companies using the simplified tax system must keep a book of income and expenses and annually submit simplified declarations. This takes time and knowledge. And the new simplified tax system online mode will allow simplifiers to completely abandon current reporting under the simplified tax system. “STS-online: entrepreneurs in this special mode who use online cash registers will be able to get rid of almost all reporting as early as next year. The tax authority will independently calculate the amount of tax based on the data transmitted by the online cash register and send a notification for payment.”

The new online tax regime of the simplified tax system is planned to be introduced from July 1, 2020. After this date, simplifiers with the “income” object, using online cash registers, will be able to forget about submitting declarations and maintaining KUDiR. But before the introduction of a new special tax regime, the book must be kept.

Also see:

- Cancellation of declarations under the simplified tax system in 2021;

- Changes to the simplified tax system in 2021: table.

Submission of reports compiled in them

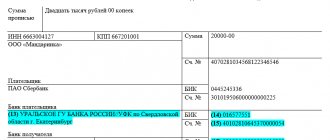

USN IP "Revenue" - calculation and payment of taxes, sample payment form

Three options on how to submit a report filled out in a special computer program to the tax authority in paper form, printing the declaration according to the simplified tax system on a printer and sealing it with a regular signature. Such a report can be:

- send to the Federal Tax Service inspection by Russian Post - necessarily by registered mail with a list of the contents;

- personally take it to the inspection;

It can also be transferred through a representative, having previously issued a power of attorney in his name from a notary:

- In electronic form through an EDI (electronic document management) operator accredited by the Federal Tax Service. The list of operators (Kontur, Elbis, etc.) is posted on the department’s website. Their services are paid, you should choose a service provider by comparing the packages offered. Also, before starting to submit reports online, you must first submit a corresponding application to the tax office.

- Electronically via the Federal Tax Service website. This is free, but involves a lot of time spent manually transferring data.

For both options for submitting reports electronically, the individual entrepreneur must obtain an electronic digital signature in advance - an electronic digital signature.

Form (form) KUDiR in 2021

The form and procedure for filling out the accounting book were approved by Order of the Ministry of Finance dated October 22, 2012 No. 135n. Such a book for recording income and expenses on the simplified tax system is filled out not only by individual entrepreneurs, but also by organizations on the simplified tax system. For the object “income” and “income minus expenses”, the form of the book of income and expenses is the same, only the sections differ.

For you:

- ;

- ;

- .

| simplified tax system “income” - 6 percent | Simplified tax system “income minus expenses” - 25 percent |

If the object of taxation is “income”, then the following sections are maintained:

| If an organization or individual entrepreneur has chosen “income reduced by the amount of expenses” as an object of taxation, then in the KUDiR they will fill out:

|

Popular accounting software for simplified tax system

Individual entrepreneur tax calculator - what is it and how to use it

An accounting program for individual entrepreneurs helps reduce time and costs. Before choosing a specific software name, you should decide what is best for you - a paid Accounting program for individual entrepreneurs or a free program, the functionality of which is sufficient for maintaining KUDiR and preparing all the necessary reports.

Advantages of paid software:

- Higher reliability - there is no risk of unexpected termination of the free license or program support.

- Better support work - the client of the software seller, along with the program, receives responsive online technical support, the developer’s readiness to quickly adapt the functionality to changes in regulations. The developers of free programs do not guarantee this.

- The possibility of further use of the paid program in case of expansion of activities, even if the individual entrepreneur is forced to change the tax regime - for example, becomes a UTII payer. Most free software is created only for individual entrepreneurs.

In turn, the advantages of free software are the absence of acquisition costs and often greater ease of use.

Paid

The most common paid program among Russians is 1C: Accounting. It covers all categories of accounting and meets the needs of representatives of all areas of business - production, trade, service. The product is constantly being improved and adapted to regulatory innovations. The developer guarantees the highest level of technical support; its representatives not only help solve problems when using the product, but also offer installation and configuration of the system on the client’s PC. The downside of 1C is the difficulty in mastering the program.

Among the software products of the developer "1C: Accounting" there is also "1C: Simplified"

The Parus-Enterprise system is easier to learn, but very functional. It also makes it possible to keep records for all categories, including a program for submitting individual entrepreneur reports. Convenient for working on multiple PCs/laptops on a local network.

"Kontur.Elba" is a paid service for recording cash and inventory items, preparing and submitting all reports online. The developer offers a simple interface, 24/7 availability of the service from any device with Internet access, 24-hour support both by phone and through messaging on social networks.

Free

The most popular, well-proven free programs for individual entrepreneurs:

- BukhSoft simplified version - has the functions of automated filling out KUDiR, automatic generation of transactions, automatic reporting. A multi-user mode has been implemented, and there is auto-update in real time. A good accounting program for both simplifiers and individual entrepreneurs with a patent.

- IP USN 2 - tailored for entrepreneurs without employees on the “Income” system (making fiscal payments at a rate of 6%). Does not require installation on a PC, suitable for use on different computers with storage and transfer of all data on a USB drive (flash drive). Equipped with a reference book on accounting and reporting, a reminder mode about the dates of payments and submission of declarations.

- “My Business” is a functional and fast system that can also remind you of the deadline for settlements with the Federal Tax Service or submission of documents, and automatically generates invoices and certificates of work performed.

- “BusinessPack is distinguished by a simple interface and a unique option for exchanging documents with counterparties via Telepack.

A good choice for an entrepreneur without employees using the simplified tax system “Income” - free IP program USN 2

Method of administration

In 2021, KUDiR can be maintained both on paper and electronically. For each new calendar year, a new KUDiR is opened.

The paper KUDiR must be laced and numbered, on the last page the total number of pages contained in it must be indicated and certified with the signature of the head of the organization and seal (if any). The individual entrepreneur certifies the Book with his signature and seal, if the individual entrepreneur has one.

The “electronic” KUDiR must be printed at the end of each quarter. At the end of the year, such KUDiR is also laced, numbered and certified with a signature and seal.

Product name in the return receipt and correction receipt

In connection with the new requirements, the question arises: is it necessary to indicate the name of the product on the return receipt and correction receipt? It all depends on the situation. If an item is returned to you, you must issue a return receipt and indicate on it all returned items (name, quantity and price).

If you issue a correction check, then you do not need to indicate the names of the goods in it. You just need to indicate the amount you want to adjust and wait for the check to arrive to the fiscal data operator (FDO).

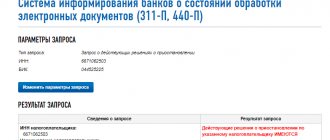

Do KUDiR need to be registered with the Federal Tax Service?

No no need. The law does not impose an obligation on taxpayers to register a book of income and expenses. Article 346.24 of the Tax Code only says that simplified organizations and individual entrepreneurs must keep records of income and expenses in a book, the form and procedure for filling which is approved by the Ministry of Finance.

Error correction

If an error is identified in a laced and numbered book, then you need to correct it like this:

- cross out the erroneous entry;

- make the correct entry indicating “Corrected Believe”;

- indicate the date of correction;

- indicate your last name, initials and signature;

- certify the correction with a seal (if there is one).

Read also

15.08.2019

Transition deadlines

There are two options for submitting an application for the simplified tax system:

- when registering an individual entrepreneur, simultaneously with other papers;

- within 30 days after registration.

Submitting a notification along with registration documents

The advantage of this option is that it saves time on visiting the inspection again to submit a notification. The application is submitted along with other documents, and the individual entrepreneur immediately begins to apply the simplified form after registration.

The downside is the risk of refusal to accept an application to switch to a simplified system in inspections that only deal with the registration of individual entrepreneurs and LLCs. For example, in Moscow, all individual entrepreneurs are registered by only one inspection - Federal Tax Service Inspectorate No. 46, and it does not matter in which district of Moscow the future individual entrepreneur lives.

If this happens, don’t worry, there is a backup option. After registration, but within 30 days, an individual entrepreneur can submit a notification to the tax office at the place of permanent residence.

Recently, the risk of registration inspections refusing to accept a notification on the simplified tax system has decreased to almost zero.

Submission of documents within 30 days after registration

This option is convenient for those individual entrepreneurs who have not fully decided on the taxation system, forgot or were refused to submit a notification at the same time when registering an individual entrepreneur.

Despite the fact that the application is submitted after registration, the individual entrepreneur will be transferred to the simplified tax system from the date of creation. But if the entrepreneur does not meet the 30-day deadline and submits the notification later, he will be placed under the general taxation regime, in which he will have to work until the end of the year. So don't tighten it too much.

Methods for entering items into the cash register

They will depend on the number of goods and services.

Manual method

Suitable for: if you sell a small range of goods or provide a limited selection of services (up to 500 items).

How it works: goods or services are entered manually - either into a smart cash register or into an accounting service.

Where to get the nomenclature from: you can rely on the name of the product on the label, on product reference books, on common sense.

It is important to note: manual work is labor-intensive, so you need to start adding goods in advance.

Uploading files with names to the cash register or accounting system

Suitable for: if you have a large list of products (more than 500 items).

How it works and where to get the items from: you can get a list of goods from an accountant, suppliers, or use the help of a smart service.

It is quite possible that your accountant keeps inventory records and enters the names of goods into the accounting system from receipt documents. It can upload a file with these names. All you have to do is upload it to the cash register or accounting service.

You can also contact suppliers. Ask to send price lists of the goods you are ordering. And then upload these files into the accounting system.

Establishing an item using a smart service

If you use a smart service, for example, Kontur.Market, then all information about the items can be obtained by scanning the product.

How to scan an item into the accounting system

Connect the cash register scanner to the computer or tablet on which you work with Kontur.Market, or use the Kontur.Scanner smartphone application and scan product barcodes with it.

Place products without and with a barcode in the Market and comply with all legal requirements

Uploading a file via Kontur.Market

You can import the file from the accountant and suppliers into Kontur.Market. In addition to product names, the service contains product groups, product barcodes, product units - almost all the data that a supplier or accountant can transmit.

Already, the import of goods in the service is designed in such a way that only barcodes can be loaded into it. That is, a minimum of work is required from the user: scan product barcodes into a notepad or spreadsheet and then upload the file to Kontur.Market.

The service will search for barcodes in the global catalogue, and for each barcode the product name and its group will be found. Products will be entered with appropriate names, groups and barcodes.

Advantages of entering the names of goods and their prices into the accounting system

After entering goods with prices into the service, you will be able to print price tags for these goods . You select the products on which you want to print price tags (this can be a specific product or a group of products), configure the format of the price tags, select in the service the information that you want to show the buyer (composition, article number, etc.), and without any problems receive price tags for all your products.

Fast sale at the checkout. Previously, the cashier had to calculate the amount of the check, and this is a labor-intensive job. After establishing the nomenclature and prices for goods, it will become easier for him to work - he will only need to find the product at the checkout and indicate its quantity. The service performs all other calculations independently.

Work at the checkout without errors. It will be impossible to make a mistake - you will be able to check which goods were sold and which are reflected in the receipt.

Sales analysis . Contour.Market helps you understand which products are selling better, which ones are worse, your revenue for a certain period, how much you earned in cash and non-cash payments, determining peak sales hours, etc.

If, in addition to the names of goods, you enter invoices, write-off statements and other documents into the service, then you will be able to see data such as profitability, business turnover and many other indicators.

You only need to create an item once. New data is entered only when new products appear. At the same time, you save time when working at the checkout, eliminate errors in the work of cashiers, get access to sales analysis and can print price tags.