Payment

What is an advance under labor legislation? The concept of an advance is not legally established. But in explaining

Let's look at the ratio of own working capital. This ratio is included in the important group “Liquidity” and

Depreciation means transferring the cost of fixed assets (FP) and intangible assets (IA) to the cost of work,

Free legal consultation by phone: 8 This is a document that can confirm that a person has

What are the different taxation systems? — There are five taxation systems: OSNO (traditional, also general),

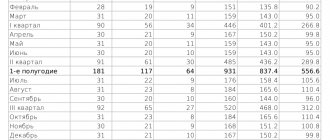

Form P-4 is a form for statistical accounting of enterprises and organizations in which information is entered

When it becomes necessary to adjust Situations in which it is necessary to adjust amounts after delivery, in

Tax period is a code that allows you to quickly and accurately determine the time for which

The Tax Code of the Russian Federation does not contain the concept of “zero reporting”, but most often it means

Excise tax is a special tax that is levied on certain types of goods and transactions with these goods.