Payment

Personal income tax, or personal income tax, is an abbreviated name for the tax withheld from the income of individuals when

When it comes to paying customs duties, it is necessary to indicate the code of the customs authority in the payment

Federal Law No. 402-FZ of December 6, 2011, in Article 9, provides for free

If other inventory documents mainly systematize material assets, then the INV-17 act represents

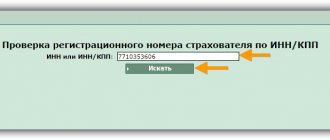

When creating an LLC, the company is registered with the tax office; after the registration process with the tax office, it is necessary

During the inventory carried out in the company, discrepancies in the actual availability of any objects may be identified.

Tax policy is one of the most important attributes of the state and the full functioning of its institutions. Under

Characteristics of account 75 According to the Chart of Accounts, account 75 summarizes data on

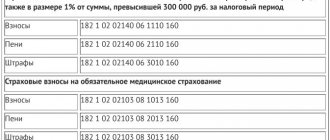

Individual entrepreneurs are required to pay insurance premiums “for themselves.” Even if there is no income, contributions

Depreciation of fixed assets is the inclusion of the cost of fixed assets in the cost of manufactured goods or